Summary:

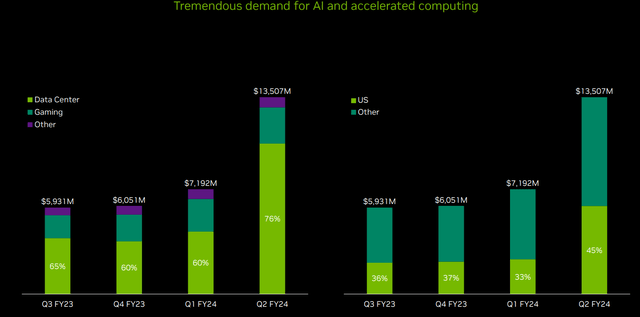

- Nvidia Corporation has had two prolific earnings beats this year and expectations are high, but I believe the white-hot demand for its products will remain intact.

- When a stock is as much of a favorite of the crowd as Nvidia, many of the tools stock analysts use to ascertain value lose utility.

- In the case of Nvidia, the huge premium is justified by the breakneck pace of the company’s revenue and earnings growth.

- Similar to big wave surfing, the rules of investing in stocks with excessive valuation are different than normal investing.

- A focus on management and track record shows that Nvidia has earned the benefit of the doubt from shareholders.

rhyman007/E+ via Getty Images

“It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.

John Maynard Keynes, General Theory of Employment, Interest and Money, 1936.

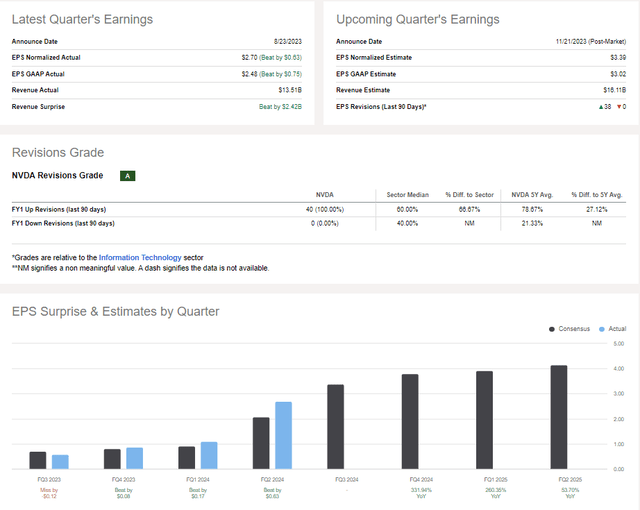

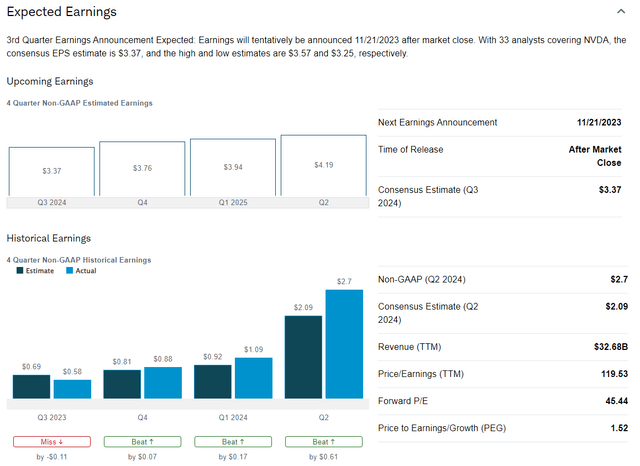

Look at that madman. That is a terrifying wall of water for most people. For him, it was something that needed to be ridden. Who can deny that his achievement of surfing this wave is not somewhat unlike Nvidia Corporation (NASDAQ:NVDA) CEO Jensen Huang’s consistent ability to beat consensus expectations? The last two earnings reports were massive beats, and the consensus got swept under a massive wave of wildfire-in-a-whirlwind-paced growth. As you can see below, analysts are tripping over themselves to revise estimates upward, and 100% of revisions have been positive.

This earnings report will be a significant juncture and will help to show just how big the earnings wave Nvidia is riding could get. If analysts have caught up or exceeded the company’s pace of earnings, then investors will be disappointed. Like big wave surfing, the trillion-dollar club often sees fundamentals thrown out the window. For big waves, you have to be towed in, and unlike normal surfing, you have foot stirrups because a leash could cause you to drown. In normal surfing, the leash is your saving grace.

There are a lot of metaphors used for the stock market, but surfing isn’t often one of them. One might call the culture of Wall Street and the surfing culture opposed; in some sense, this is undoubtedly correct. In other senses, the task of surfing giant walls of water is somewhat like what we do as investors: we surf the fickle and forceful whims of the crowd with the often elusive goal of buying low and selling high. Like those big wave surfers, it could be the end of us if we get pulled under and freak out during drawdowns. Or our portfolio’s relative performance anyway.

John Maynard Keynes had an incredible insight about the price of stocks when observing a newspaper contest where the contestants were supposed to pick the six women that the rest of the crowd would find the prettiest. Not that you yourself would find the prettiest. Therefore, the crowd’s opinions and faculties should be just as much an object of analysis as the faces of the contestants themselves. Let’s be honest: most people investing in Nvidia have no idea how to evaluate the capital projects related to its ultra-complicated chips properly. But as stock analysts, we have the tools to evaluate intrinsic and relative valuation.

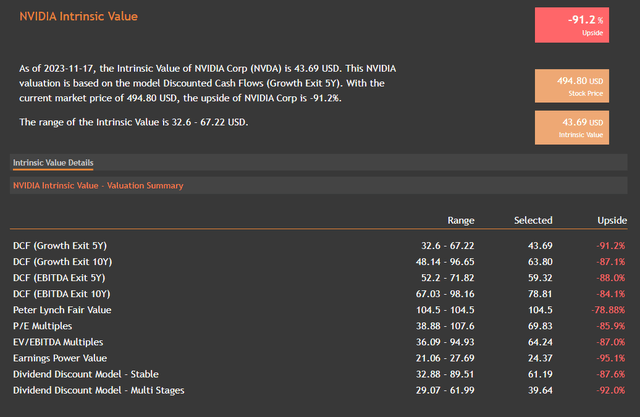

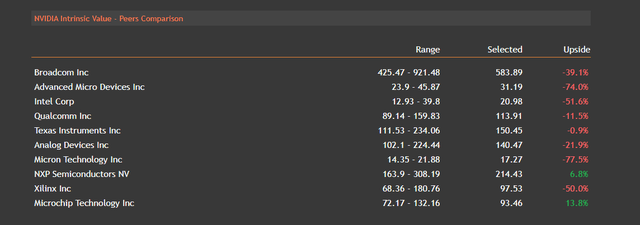

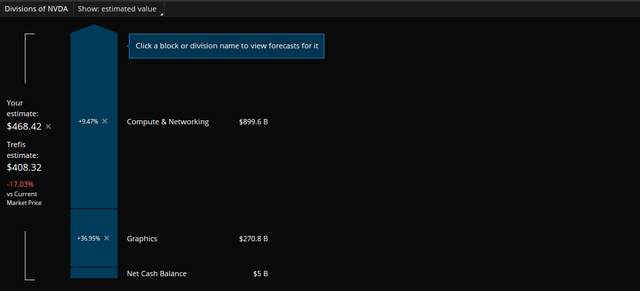

On both counts, Nvidia basically gets straight Fs across the board. The stock is dramatically overvalued in every intrinsic value measure with credibility available. As you can see below, although the entire sector is pretty overvalued, Nvidia still takes the cake as the most overvalued among its peers.

So, the question becomes, if all the primary valuation tools tell you that Nvidia is overvalued, then why would you buy it? There’s no doubt it’s risky. And like that giant wall of water in the picture, it’s an intimidating stock to buy, especially when it’s had such a phenomenal runup. However, you’ve got to analyze the crowd and its whims like a set of waves coming in, and you have to time your buys correctly. I wrote a pre-earnings report about this stock last quarter, and I was correct that the company had earnings fireworks in store.

But the crowd is fickle, and their speed and mass can be terrifying, like an oncoming wave. But if you played it right and bought this stock on the decline after a prolific earnings blow, guess what? You’re not one of the people griping about how overvalued Nvidia is. You’re one of the people getting rich from how overvalued it is.

How To Evaluate Nvidia Without a PhD

I’m no slouch, but I’m certainly not as qualified as a sell-side analyst steeped in the traditions and jargon of the semiconductor industry. And if you look above, the main tools I have as a stock analyst tell me that I should avoid this stock because it’s overvalued. But wait, then why are the only people who will get good bonuses on Wall Street this year the people who bought Nvidia’s stock? In Nvidia’s case, the extreme valuation is daunting, like a huge wave, but that doesn’t mean it can’t be one of the most rewarding stocks in your portfolio. I am going to break down the bull case as simply as I can from several vantage points:

- Nvidia’s advanced chips enable a parallel computing process that enables users to get much more computing power out of their machines.

- The firm currently enjoys a significant competitive advantage and R&D lead over peers.

- The chips the firm produces are essential to the high-intensity computing at the heart of artificial intelligence models, specifically the large language models that have made such a splash.

- Nvidia gets a return on invested capital far higher than most peers. It produces approximately 30 cents of FCF for every dollar invested.

- The company’s financial condition is pristine. It has less than a 1% chance of bankruptcy. The Advanced Micro Devices, Inc. (AMD) chance of bankruptcy is 18%, for perspective.

- Nvidia has ample opportunities for growth and the ability to expand margins by decreasing R&D intensity over the coming years, a significant advantage of the fabless model it pioneered.

- The firm is exposed to major future growth trends. Aside from AI, its technology is essential for autonomous driving and virtual reality/metaverse, to name just two trends. It is thematically diversified.

This would even be true for a relatively simple industry like retail. When you’re talking about the sophisticated dance of some of the world’s best talent required to do what this company does, we have to rely on heuristics to some degree. However, as a stock analyst, there’s a lot I can tell you about this stock and the way it has performed. The incredible premium it trades at is because of incredible feats. Nvidia has tripled its market cap this year and has exceeded earnings expectations by grand-slam double-digit levels.

It’s important to remember that instead of being angry and upset at Nvidia’s unprecedented growth and detached fundamentals, this company has produced extraordinary results, which is why the crowd is willing to pay an extraordinary premium for it. I think the evidence points to the white-hot demand for its revolutionary products not subsiding, and I think this earnings report on Tuesday will be another significant beat.

However, any small ripple could cause the crowd to shun the stock, like after the last prolific earnings beat. In that case, hold your breath on the way down and keep buying. This stock’s prodigious competitive advantage will keep building like a wave; its dramatic stock performance attracts the best talent in a virtuous cycle that I suspect has only just begun.

Risks and Where I Could Be Wrong

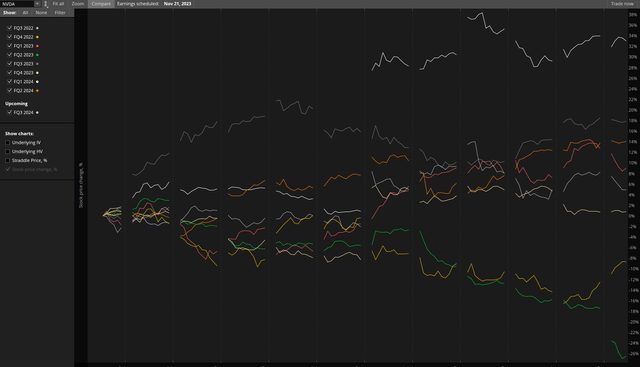

Well, the prom queen of the stock market is going to report after the bell on Tuesday, November 21st, and if the firm’s reports earlier this year are any indication, there could be some major fireworks. Nvidia had an incredible run in 2023, and its spectacular Q1 earnings kicked off a wave of optimism related to artificial intelligence that still hasn’t subsided. The firm has experienced pretty significant price movement in the wake of the last eight earnings reports.

But this optimism in itself is a curse. The expectations for the stock are sky-high. General David Petraeus once said, “The higher you get up the flagpole, the more your rear end shows.” In big wave surfing, a tiny nick in one of the fins can cause uncontrollable vibration that will cause a surfer to wipe out, given the speeds involved. I think this is analogous to the situation Nvidia is in. We saw this weakness in play earlier in the month, when Nvidia had a significant drop on a Chinese ban that shouldn’t have a near-term effect on earnings.

Of course, like the prom queen in high school, Nvidia can draw the crowd’s ire. Particularly if you’re steeped in Ben Graham’s ways and highly focused on intrinsic value, then there’s not much to like about Nvidia. Looking at the stock from an intrinsic value standpoint, it ultimately fails on almost every metric. Nvidia is facing renewed competition from formidable competitors. Still, I think its holistic strength, bolstered by the CUDA software network, is a strong enough moat that even Big Tech will have trouble assailing it.

Nvidia has faced a few headwinds since my last report on the firm—namely, enhanced chip bans against China. Still, the impressive demand for the company’s underlying H100 GPU chip likely hasn’t changed since the last report. And like the last two reports, I suspect Wall Street analysts will still be behind the curve in terms of predicting the firm’s sales to increasingly voracious consumers bent on using the superior Nvidia chips over any other. The firm will be susceptible to any significant market-wide risks becoming problematic.

- Escalation of geopolitical risks in China, Ukraine, or the Middle East.

- Fed policy error.

- The banking crisis worsens.

- Return of inflation.

- CRE meltdown.

- Write-downs of private assets.

I think it’s a little early to start pricing in competitors eroding market share, but even if they eventually do, that doesn’t mean the firm can’t maintain the rocket-fuel growth it is known for.

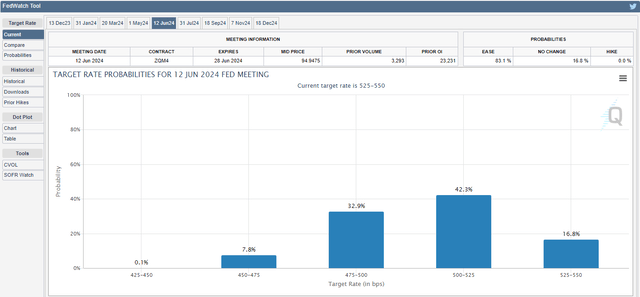

Given the sky-high valuation, it is obviously susceptible to rates, and given the high-beta nature, it is particularly susceptible to steep drops. There is a risk that Chinese bans will continue to affect the company. Still, I think it’s more likely we’ve seen the beginning of a U.S.-China detente that will benefit the entire chip sector despite being in disagreement with Michael Burry. Furthermore, Nvidia is already working to ensure the bans will have a minimal effect on future earnings. Their chips are so essential that some vital Chinese clients had already stockpiled enough for the foreseeable future, an expensive pre-emptive move given their hefty price tag. This also speaks to the company’s pricing power.

Conclusion: Jensen Huang “Shreds the Gnar” on Wave After Wave of Tech

When you can’t rely on fundamentals the way you can with less prominent stocks in the crowd’s consciousness, one of the main things you should rely on is something straightforward. It can be broken down into a question. Who has my money, and can they be trusted to steward my financial interests? You won’t find a better man than Jensen Huang on this question.

Competition surfing is not just about catching the big waves; it’s about catching waves consistently. And when you’re in the trillion-dollar club, the CEO needs to command the hearts and minds of the crowd. The company will shred earnings expectations this quarter as they did the last two.

Jensen has guided the company from waves of enthusiasm on crypto to autonomous driving, and now he’s proven that his company is one of the most essential for the prosperous age of artificial intelligence that awaits. I think the crest of this wave is at least a few quarters in the future, and managers who have been destroyed by the synchronicity of bonds and stocks this year will be piling into the magnificent seven. This means Nvidia’s price performance for the year could exceed what many think is possible. It’s good to be the prom queen.

Jensen’s prescience in capital allocation, his steady hand in messaging and management, and the multi-faceted exposure to the most exciting technological trends of our time justify Nvidia’s premium. Let’s remember that Polaroid once traded at twice the P/E ratio that Nvidia currently has. So, in some senses, given the technological dominance and proven capability of delivering historic returns to shareholders, I’d say it’s worth it to put up with the risks and high volatility. Over time, this firm has proven it can deliver and successfully surf the crowd’s whims and any modern company.

The last CPI report seems to have changed the market’s reaction function with regard to the Fed. Now, increasingly, the market is focused on cuts. Nvidia’s performance has been incredible in recent history’s most robust tightening cycle. How do you think it will be when rates start coming down? This is why I would be a buyer of Nvidia even in the event of an earnings miss.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.