Summary:

- Nvidia Corporation’s forward EPS estimates are one of the most uncertain among the Magnificent 7 stocks and among other chip stocks.

- The highest EPS estimate for the fiscal year ending Jan 2027 is $7.29 which is 4 times the lowest EPS estimate of $1.81.

- Other big tech stocks have a variation of 20% to 60% between low and high EPS estimates.

- This shows the uncertainty regarding future market share and margins for Nvidia as AMD, Intel, and other tech players launch their own AI chips.

- The recent bull run has made NVDA stock expensive while the forward earnings are uncertain, which can cause a major correction in the stock.

JHVEPhoto

Nvidia Corporation (NASDAQ:NVDA) stock has been one of the best performers over the last two years since the first major large language models, or LLMs, came to the market and launched a major AI-driven bull run. However, there is a major red flag in Nvidia due to uncertainty in forward earnings. There is a very high variation between the bull and bear cases for the stock. Most of this variation comes due to uncertainty in future market share and the ability of Nvidia to retain its juicy margins. The company has been able to report over 70% gross margins for the past few quarters. In the previous article, it was mentioned that the demand side for AI chips can face challenges as hyperscalers optimize their AI investments.

Competitors like Advanced Micro Devices (AMD) and Intel (INTC) are putting their best efforts into launching better AI chips. Being the underdog in this segment, they would be ready to earn lower margins, making the overall segment more competitive. Other big tech companies have been working on their own AI chips, and they have the talent and resources to deliver some excellent products. Nvidia’s CUDA moat is still strong, but the uncertainty in forward earnings should be a warning for investors. At the same time, the stock is trading at close to 30 times the consensus EPS estimate for the fiscal year ending January 2027, which is one of the highest within the tech sector. According to this metric, Nvidia is 75% pricier than Alphabet (GOOGL) (GOOG), which can cause a short-term correction in Nvidia stock.

Uncertain forward earnings are a big red flag

Nvidia’s has delivered great results over the last few quarters, which has helped the stock deliver over 130% price growth in YTD. However, future earnings are becoming more uncertain as different analysts have very different forward outlooks for the company. We might disagree over the views of some analysts, but the huge variation in future EPS estimates is a clear warning sign for investors. As shown below, none of the other big tech stocks have anything close to Nvidia’s forward earnings uncertainty.

Nvidia’s EPS estimate

Seeking Alpha

Figure: Nvidia’s forward earnings estimate. Source: Seeking Alpha

A total of 28 analysts have given their estimates for Nvidia’s EPS for the fiscal year ending Jan 2027. The lowest EPS estimate is $1.81 while the highest estimate is $7.29. Hence, the highest forward EPS estimate is 4X that of the low estimate. All the analysts have done a very in-depth analysis of the company, and yet, we see a massive variation in future earnings estimates. For most of the other tech stocks, the variation in low and high estimates is only 20%-60%. Higher forward EPS uncertainty should make the stock cheaper, but on the contrary, Nvidia is trading at one of the highest forward P/E ratios.

AMD’s EPS estimate

Seeking Alpha

Figure: AMD’s forward EPS estimate. Source: Seeking Alpha.

AMD’s EPS estimate for fiscal year ending Dec 2026 shows the high EPS estimate is 60% more than low estimate.

Google’s EPS estimate

Seeking Alpha

Figure: Google forward EPS estimate. Source: Seeking Alpha.

Alphabet’s EPS estimate for fiscal year ending Dec 2026 shows the high EPS estimate is only 23% more than low estimate. This clearly shows the certainty in forward earnings for Alphabet.

Higher uncertainty is a sign that analysts are not sure about the ability of Nvidia to retain its current margins as competitive pressure increases over the coming years.

Do not underestimate AMD and other competitors

In the recent earnings call, AMD increased its 2024 revenue forecast for AI chips to $5 billion from a previous forecast of $4.5 billion. Over this year, AMD’s estimate for AI chip revenue has steadily increased. Back in late 2023, AMD forecasted that it could deliver $2 billion in revenue for AI chips in 2024. It is highly likely that AMD could deliver over $10-$12 billion in total AI revenue for 2025. At this scale, it could be close to 10% of Nvidia’s revenue base from its Data Center segment. New products and aggressive pricing can certainly increase the attraction of AMD’s AI chips.

Intel is facing an existential crisis as it continues to face headwinds in its foundry business and more questions from investors. The company is leaning on its Gaudi 3 AI chips to improve the sentiment towards the stock. Being an underdog in this segment, Intel could undersell Nvidia by a significant amount.

Big tech cloud companies like Amazon have been building their own AI chips and have reported that the price/performance metric is 50% cheaper than Nvidia. AI chips are one of the biggest expenses for hyperscalers and if they can reduce the cost of this item, it will help in improving their competitive position and boosting their own margins. It should be noted that Nvidia had earlier mentioned that it receives close to 40%-45% of total Data Center revenue from these hyperscalers.

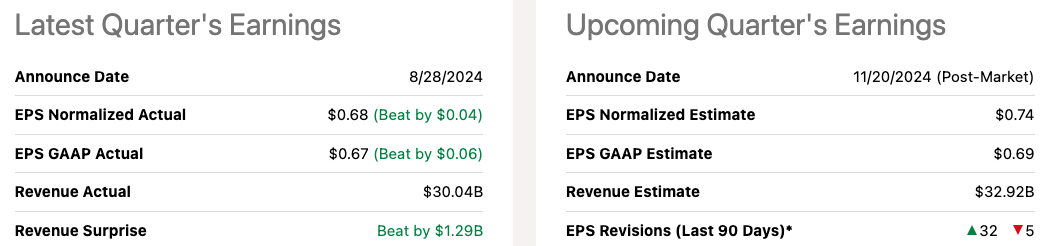

Beating expectations is not enough

Nvidia stock hit close to $140 in June 2024. Since then, the stock has seen big swings with 30% correction and has now returned to earlier peak. This is even though the company has been able to easily beat the earnings estimate for the past two quarters.

Seeking Alpha

Figure: Nvidia’s earnings estimate in the upcoming quarter. Source: Seeking Alpha.

Even a very good earnings result does not guarantee bullish sentiment for the stock because of the current price. Nvidia would need to present a strong argument to sustain the bullish momentum. As mentioned above, there is already a massive variation in the forward earnings estimate for the company. The bear case could easily take over if the company does not meet the earnings expectations or does not beat the expectations by a big enough margin.

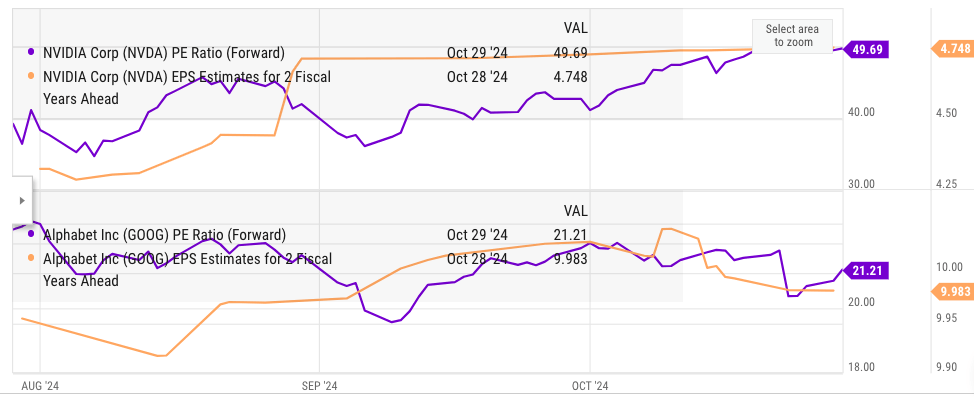

Nvidia stock is pricier than other stocks

The huge variation in forward earnings is already a big red flag for the stock. But even the most bullish EPS estimate for Nvidia will continue to give a pricey valuation multiple for the company. The highest EPS estimate for Nvidia for the fiscal year ending Jan 2027 is $7.2 which gives the forward P/E multiple of close to 20. On the other hand, the lowest EPS estimate for Alphabet for the fiscal year ending Dec 2026 is $9.05 giving the stock a forward P/E multiple of less than 19. Hence, even the most bullish case for Nvidia makes the stock pricier than Alphabet’s lowest EPS estimate for 2 fiscal years ahead. A lot can change in the next 2 years, and I believe Nvidia stock does not offer a sufficient margin of safety.

YCharts

Figure: Comparison of Nvidia and Alphabet’s EPS and forward P/E. Source: YCharts.

There are other options within the AI industry, and Nvidia is expensive at the current price. Investors looking for a more certain forward earnings trend could look at Alphabet, TSMC, and other alternatives.

Investor Takeaway

Nvidia’s forward earnings projections have the highest variation among the big tech stocks. The EPS projection for fiscal year ending Jan 2027 varies from $1.8 to $7.2. Hence, the high case is 4X the low estimate. For most of the other tech companies, the high case is 20% to 50% higher than the low case. Higher variation shows the uncertainty in future earnings as the company faces intense competition from AMD, Intel, and other big tech companies.

It is highly likely that Nvidia’s market share will contract over the coming quarters, which will also squeeze the margins. The forward P/E multiple for 2 fiscal years ahead for Nvidia is 75% higher than Alphabet. The stock is quite expensive, and even an earnings beat might not be enough to deliver a further bullish run.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.