Summary:

- Nvidia Corporation’s strong financial performance in 2023 is attributed to the growing demand for AI technologies and the company’s dominant position in the GPU market.

- Despite entering the overbought phase, NVDA stock price is expected to continue its upward trajectory due to optimistic projections of future growth and the rapid expansion of the AI industry.

- The significant volatility observed for May and June 2023 suggests heightened market uncertainty, which further bolsters the potential for a bullish trend in the Nvidia market.

Justin Sullivan

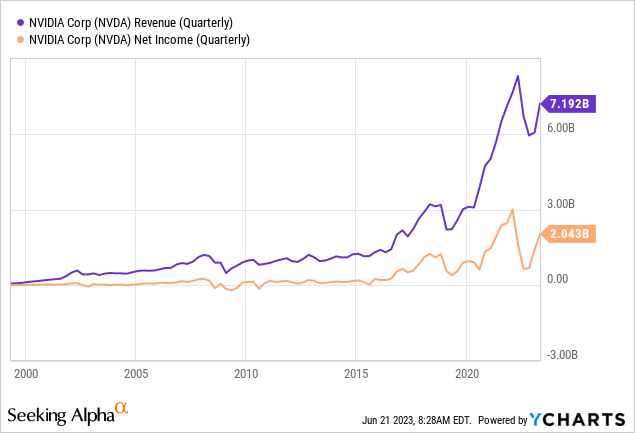

In 2023, Nvidia Corporation (NASDAQ:NVDA) demonstrated strong financial performance, underscored by substantial increases in quarterly revenue, which peaked at $7.192 billion, and net income, which skyrocketed to $2.043 billion. This outstanding performance further reinforces Nvidia’s standing as a leading entity in the semiconductor industry.

This article follows up on a previous one that provided a technical analysis of Nvidia, by offering a more in-depth examination of technical charts and exploring the future path of the stock. The analysis reveals that, although the stock has entered the overbought zone, the price is still expected to ascend, owing to the manifestation of resilient price trends.

Financial Performance of Nvidia

Nvidia’s financial performance has showcased robust growth in 2023, as evidenced by its quarterly revenue and net income data. The company’s revenue surged significantly, reaching $7.192 billion in the latest quarterly earnings, underscoring a prosperous upward trend for the year. Additionally, Nvidia experienced a considerable uptick in net income, which stood at $2.043 billion for the same quarter as shown in the chart below. This sharp increase in revenue and net income is attributed due to the industry transitions.

The computer industry is undergoing two major transitions, according to Nvidia CEO Jensen Huang. These are a shift towards accelerated computing and the adoption of generative Artificial Intelligence (AI). This implies that companies are seeking more powerful and efficient computing solutions, and Nvidia’s products are well positioned to meet this demand.

Moreover, Nvidia’s comprehensive suite of data center products, including the H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand, and BlueField-3 DPU, are all in production. This wide range of products allows Nvidia to cater to a diverse set of customer needs. Nvidia is also ramping up its supply to meet the increasing demand for its data center products. This surge in demand likely contributes to the company’s growing revenue and net income.

The company’s strong financial performance allows it to return cash to shareholders in the form of dividends. In Q1 2024, Nvidia returned $99 million in cash dividends to shareholders. This not only enhances shareholder value but also signals the company’s confidence in its financial health and growth prospects.

Nvidia’s share value has surged by more than 100% in 2023, driven by the growing interest and investments in AI and related technologies. Despite trading at a high 213 times trailing earnings and 39 times sales, Nvidia’s prospects for growth are promising.

A key factor driving Nvidia’s potential for continued growth is its foothold in the AI sector. In the fiscal 2024 first-quarter results, the company projected a 64% year-over-year increase in revenue in the current quarter, marking a solid acceleration of growth. Moreover, the reported shortage of Nvidia’s AI-capable GPUs, commanding a premium of up to 40% in some markets, illustrates the company’s impressive pricing power and dominant market position. With control over 95% of the GPU market for machine learning in data centers, Nvidia is set to capitalize on the exponential growth expected in the AI sector.

Industry experts predict Nvidia’s growth trajectory will be maintained in the coming years, primarily powered by the ever-expanding AI industry. Vivek Arya, a global research analyst at Bank of America, estimates Nvidia’s revenue to grow at an annual rate of 25% through 2027 due to the increased adoption of generative AI services. Considering the company’s expected fiscal 2024 revenue of around $40 billion, Nvidia’s top line could potentially reach nearly $100 billion by 2027. Hence, Nvidia’s current market cap could see a boost of 80%, further reinforcing the promise of substantial upside potential. Therefore, Nvidia’s high stock price should not deter investors eyeing exposure to the thriving AI industry; instead, it signals an opportunity for long-term growth.

Decoding the High Volatility Surge After a Breakout Event

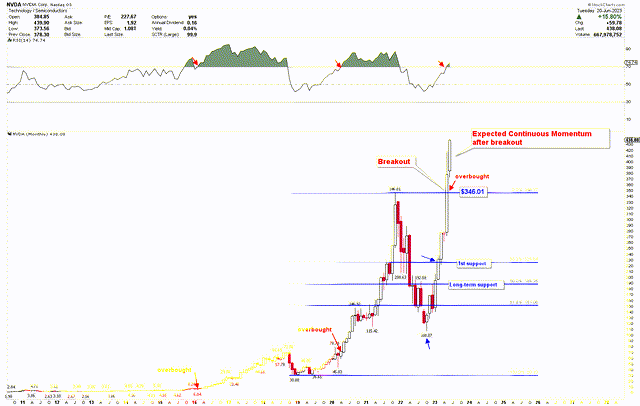

In an earlier piece, Nvidia’s promising future was discussed, forecasting the likelihood of an upward trajectory for the company in the forthcoming months. As per the latest monthly chart, Nvidia’s stock price has surpassed its previous all-time high of $346.01, showing a steep upward trajectory. This break past the $346.01 mark also disrupted the bullish pattern, suggesting greater market volatility. However, the ongoing momentum, post-breakout, implies more growth in the market.

Despite the current high prices, it could be advantageous for investors to keep buying Nvidia. Interestingly, the Relative Strength Index (RSI) shows Nvidia entering an overbought phase, usually indicating an imminent market correction. However, historical trends from the first quarter of 2016 and the second quarter of 2020 show that significant growth in Nvidia’s stock price typically commences upon entering the overbought phase.

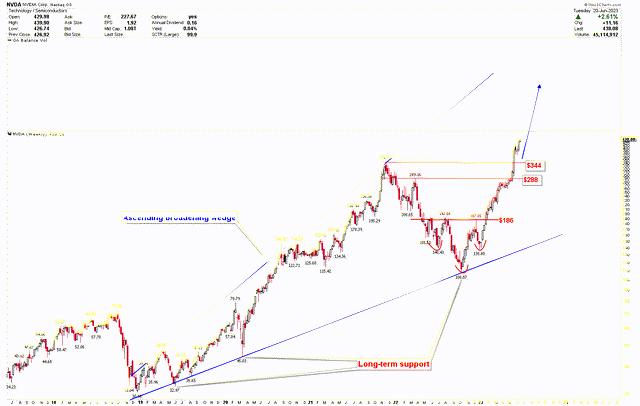

Nvidia Monthly Chart (stockcharts.com)

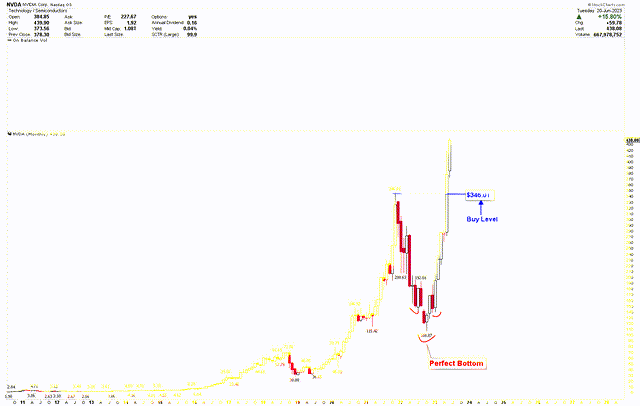

Another monthly chart further substantiates Nvidia’s bullish trend, as the stock breaks through the solid $346.01 threshold. This level now serves as a critical pivot point for investors seeking to increase their long positions. Despite the current surge, the market trajectory suggests further growth, possibly leaving late entrants missing out on lower buy-in levels. The swift recovery from 2022’s low of $108.07 also revealed an inverted head and shoulders pattern, predicting an acceleration in stock price from the current breakout point.

NVDA Monthly Chart (stockcharts.com)

The updated chart presents a fulfilled buying opportunity as previously discussed, with Nvidia’s stock price exceeding expected levels and showing promise for further growth. The emergence of an ascending broadening wedge pattern signals significant market volatility in the coming months. As the highlighted price levels at $288 and $344 are breached, the stock’s upward acceleration is likely to increase. The aim of this move is the upper trend line of the ascending broadening wedge. Given its considerable distance from the current price, further growth can be expected for Nvidia’s stock to reach this target.

NVDA Weekly Chart (stockcharts.com)

Market Risk

Nvidia’s exceptional growth in recent years is primarily due to the surge in demand for AI technologies. However, any slowdown in the AI industry could significantly impact Nvidia’s revenues and earnings growth. If the AI industry fails to maintain its expected growth trajectory, it could hurt Nvidia’s performance. On the other hand, global economic downturns, trade disputes, geopolitical instability, or pandemics could negatively affect Nvidia’s overall business performance. This could potentially cause a decline in consumer and business spending, including expenditure on high-end GPUs. Moreover, Nvidia’s competitors may introduce new products or technologies that could disrupt the market or erode Nvidia’s market share. Companies like Advanced Micro Devices, Inc. (AMD), Intel Corporation (INTC), and others are continuously investing in research and development, and any breakthrough could change the competitive landscape.

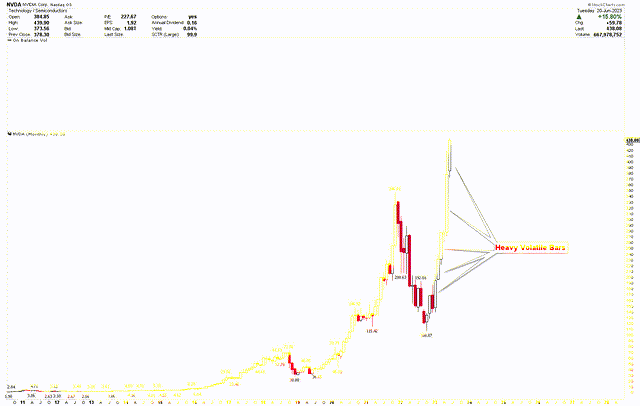

In technical terms, the ongoing bullish trend of Nvidia’s stock could result in overheating, rendering it susceptible to a significant pullback. The RSI indicating Nvidia’s entrance into an overbought stage could be signaling an impending market correction. The chart below depicts substantial volatile bars for the months of May and June 2023. This sudden and steep rise in Nvidia’s market within a short span of two months suggests substantial market turbulence, which may precipitate a sharp correction. These sizable volatility bars typically lead to a sharp correction in the stock’s value.

NVDA Monthly Chart (stockcharts.com)

Final Thoughts

In conclusion, Nvidia’s impressive financial performance in 2023, reflected in robust increases in quarterly revenue and net income, underscores its dominance in the semiconductor industry. Despite potential overheating, as the stock enters the overbought phase, Nvidia’s robust foothold in the AI sector, coupled with optimistic projections of future growth, suggests a promising investment opportunity for long-term investors. The AI industry’s rapid expansion and Nvidia’s control over a substantial portion of the GPU market for machine learning in data centers are expected to fuel its growth trajectory. The stock price has surpassed previous records and heightened volatility points to a further escalation in the stock value. Nevertheless, following this ascent, it’s probable that the price will adjust downwards.

Investors might contemplate acquiring Nvidia Corporation stock at the existing rates, expecting an enduring uptrend. Alternatively, should a correction occur, the $346 mark remains a solid investment threshold for those considering long-term investments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.