Summary:

- For the first time in NVIDIA’s upcycle, there are broad downward revisions in expected capex from key customers. This, along with emerging in-sourcing trends are brewing headwinds.

- The impact of insourcing on pricing and a margin dip as Blackwell production ramps up may dampen margins for at least a year, and likely more.

- Valuations are more appealing now at a 1-yr fwd PE level of 36.0x. NVDA stock is still seeing strong fundamental earnings growth.

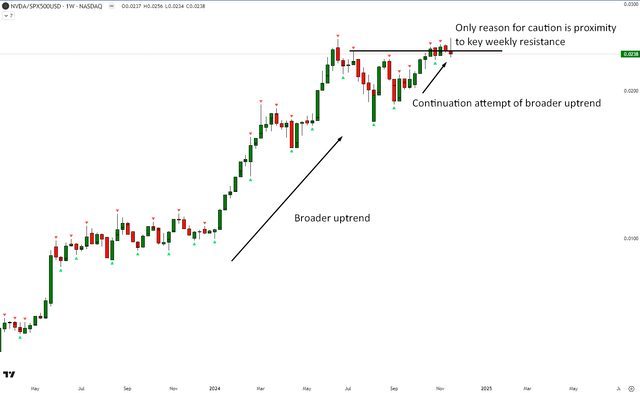

- Relative technicals vs the S&P500 remain in bullish flow but new buy entries may be riskier as the ratio prices are currently at a key weekly resistance level.

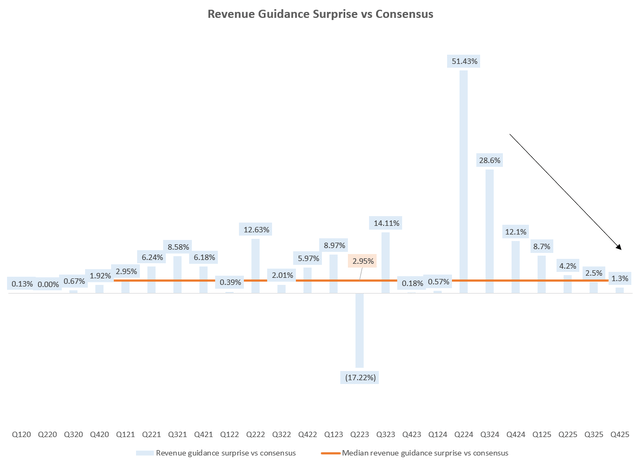

- The extent of revenue guidance beats vs consensus has been falling over the past 6 quarters, indicating that NVDA stock is increasingly getting more ‘priced in’.

tap10

Performance Assessment

By having a ‘Neutral/Hold’ stance, I’ve missed some upside on NVIDIA (NASDAQ:NVDA) since my last update on the stock:

Performance since author’s last article on NVIDIA (Seeking Alpha, Author’s last article on NVIDIA)

Thesis

Q3 FY25’s earnings resulted in a yet another beat on revenues by 5.9% over consensus estimates. And management’s commentary continues to talk about demand greatly exceeding supply as they are “on track to exceed… previous Blackwell revenue estimate[s]”.

However, I still hesitate to rate the stock a buy:

- Downward expected capex revisions from key customers indicate potential headwinds

- Blackwell ramp may drag gross margins for longer

- Valuations are more appealing as the stock is driven by earnings growth

- Relative technicals remain in bullish flow but is currently at a key weekly resistance level

- Revenue guidance beat vs consensus is a key monitorable to gauge downside risks

Downward expected capex revisions from key customers indicate potential headwinds

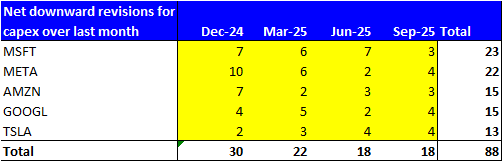

In my previous coverage, I have noted how hyperscalers such as Microsoft (MSFT), Meta (META), Amazon (AMZN) and Google (GOOGL) (GOOG) make up a majority (just shy of 40% based on the Q3 FY25 latest customer concentration disclosures) of NVIDIA’s revenues. I have also tracked Tesla (TSLA) as it is another known major customer.

Tracking Wall St’s capex revisions for NVIDIA’s key customers is one of my techniques to evaluate the extent to which NVIDIA’s growth potential may be ‘priced in’. Now, for the first time since I started keeping tabs on this metric, we now see broad-based downward revisions on capex spending by NVIDIA’s major customers:

Net downward revisions in capex from NVIDIA’s major customers over the last month (Capital IQ, Author’s Analysis)

I believe this flashes some warning signs for headwinds in NVIDIA’s revenue delivery vs expectations going forward. I would like to emphasize that I still expect NVIDIA to grow handsomely. Rather, my point here is that the growth may fall short of what the market may be pricing in.

Now what may be driving these revised capex expectations downwards?

I think a key fundamental development that is starting to emerge is the fact that customers are starting to explore in-sourcing alternatives for custom AI chips. For example, via its Israeli semiconductor chips start-up Annapurna Labs, Amazon is on track to reduce dependency on NVIDIA through the development of its own line of AI chips called Trainium 2. These chips, which are suited for large AI models training at up to 40% of the cost of NVIDIA’s chips, is expected to be showcased next month. Indeed, as one of Amazon’s AWS leader noted:

We want to be absolutely the best place to run Nvidia… But at the same time we think it’s healthy to have an alternative.

– Dave Brown, VP of Compute and Networking Services at Amazon’s AWS

I expect these incentives to in-source to ramp up among NVIDIA’s major customers, resulting in some incremental headwinds.

Blackwell ramp may drag gross margins for longer

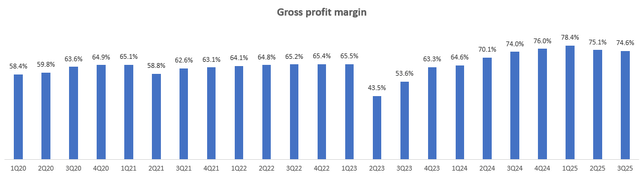

NVIDIA has been stabilizing at a gross profit margin level in the mid 70’s percentage levels:

Gross profit margins (Company Filings, Author’s Analysis)

This is of course extremely impressive for a hardware company. However, what matters for the stock is the incremental deltas (positive or negative) from current levels. And on this front, management has admitted that NVIDIA’s ramp of Blackwell chips is likely to drag down the overall margin profile slightly but temporarily:

As Blackwell ramps, we expect gross margins to moderate to the low-70s. When fully ramped, we expect Blackwell margins to be in the mid-70s.

– CFO Colette Kress in the Q3 FY25 earnings call

Currently, I expect Blackwell to fully ramp up by H2 CY25 at the earliest. However, I think the margin recovery back to the mid-70s levels may take a bit longer if NVIDIA chooses to adjust pricing to combat customers’ insourcing efforts.

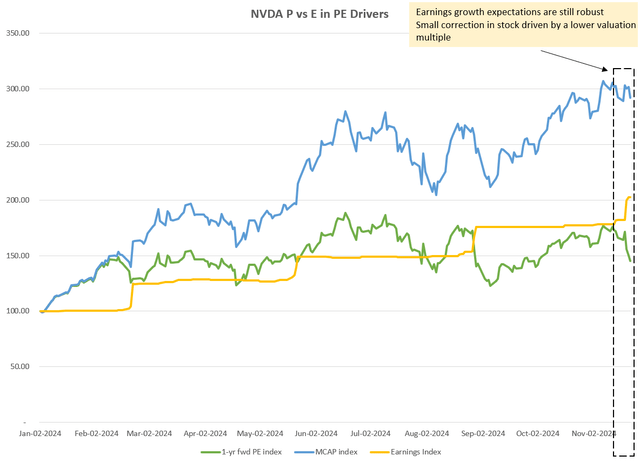

Valuations are more appealing as the stock is driven by earnings growth

A look at the drivers of NVIDIA’s market capitalization shows that the small correction/consolidation in the stock is due to a lower 1-yr fwd valuation multiple (36.0x currently) despite an upgrade in earnings expectations:

NVDA P vs E in PE Drivers (Capital IQ, Author’s Analysis)

I interpret this positively; valuations are more appealing now, having dropped from mid-40x 1-yr fwd PE levels it was at before. At the same time, the earnings growth trajectory has only improved.

Relative technicals remain in bullish flow but is currently at a key weekly resistance level

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of NVDA vs SPX500

NVDA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P500 (SPY) (SPX) (IVV) (VOO), NVDA stock remains in a broad uptrend, which seems to be continuing. However, I identify one key reason for caution; the ratio prices are at a key weekly resistance level. If this level holds, then it increases the chances of NVDA underperforming the S&P500 over the next months.

Revenue guidance beat vs consensus is a key monitorable to gauge downside risks

Over the last 3 years in particular, NVIDIA has deservedly earnt a reputation for almost always beating expectations. However, I notice that the extent of its revenue guidance beats vs consensus levels has been steadily declining for the past 6 quarters now:

Revenue guidance surprise vs consensus (Capital IQ, Author’s Analysis)

The Q4 FY25 revenue guidance of $37.5 billion only beat consensus estimates by +1.3%; lower than the median beat levels of +2.95%. I posit that gradually, this data shows that NVIDIA’s perceived growth potential is getting more and more ‘priced in’ by the market. Hence, one risk I believe may materialize is a revenue guidance miss vs expectations over the next quarter or two.

Another key monitorable I had mentioned in my last update was the trends in China’s self-reliance of chips. With Donald Trump’s victory in the US election, I believe it is reasonable to expect more protectionist policies from 2025 onwards. This is likely to provide a further boost to China’s domestic chip technology development as part of the broader Xìnchuàng initiatives. However, I still view this as a longer term risk to NVIDIA’s global market positioning for now as China is still 2-3 years behind NVIDIA’s latest product cycles.

Takeaway & Positioning

Overall, I am getting some mixed signals on NVIDIA. Whilst the company’s results is still beating estimates and there is a favorable fundamental backdrop with demand outpacing supply for the upcoming Blackwell GPU chips in 2025, I believe the Street’s downward capex revisions among NVIDIA’s key customers flash signs of caution. There are also signs of insourcing efforts, which I believe may be a headwind for either future demand or pricing, or both. Combined with some temporary margin gross margin pressures as the Blackwell series ramps up production, I believe the next year (and likely a bit more thereafter) for NVIDIA is likely to see a dip in the margin profile of the business (although it would still remain remarkably high for a hardware chips company).

On the positive side, I believe valuations are more compelling now at 36.0x 1-yr fwd PE levels, down from the mid-40x range it was earlier. At the same time, the earnings growth trajectory is still very healthy and seeing upgrades. From a relative technical analysis perspective vs the S&P500, the stock remains in a bullish trend but I don’t think it is ideal for fresh buys right now as it is right at a key weekly resistance area.

Rating: ‘Neutral/Hold’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to more than a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.