Summary:

- Recency bias affects investment decisions.

- We examine one big bank’s downside case for Mag 7 play, Nvidia Corporation.

- We look at why past cycles offer clues for this one.

jetcityimage

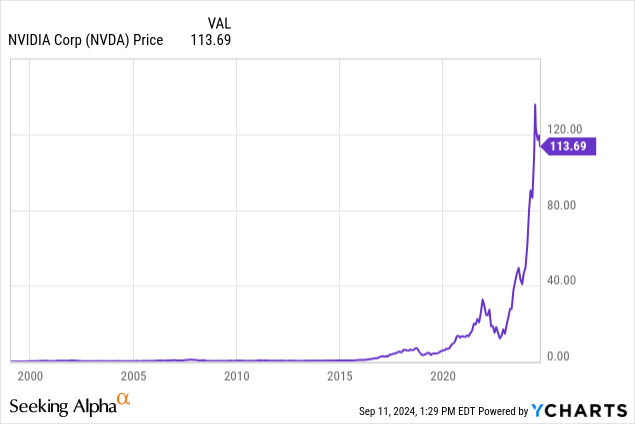

Recency bias. We all have it to an extent. The way it plays into the stock market is that you see the most recent price and compare it to where it was a few weeks back. So “cheap” or “expensive” becomes a relative concept to where prices were. It unhinges from valuation. To be fair, nothing has remotely been about valuation in the past 18 months. But we are going to look at one bank’s attempt to put a fair value on a stock.

Nvidia Corporation (NASDAQ:NVDA)

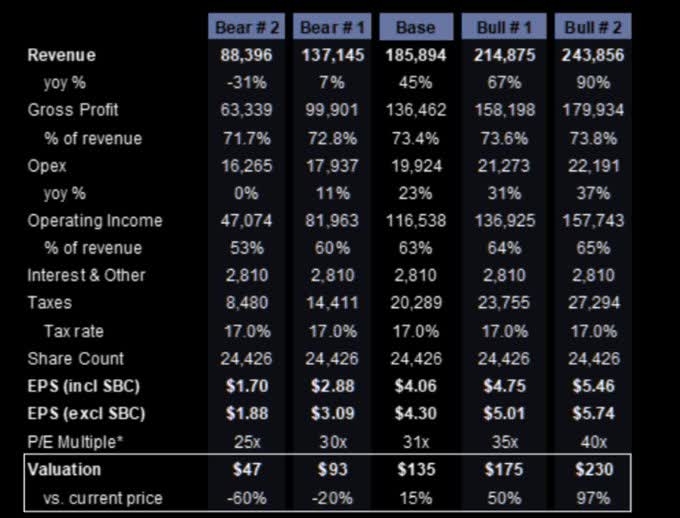

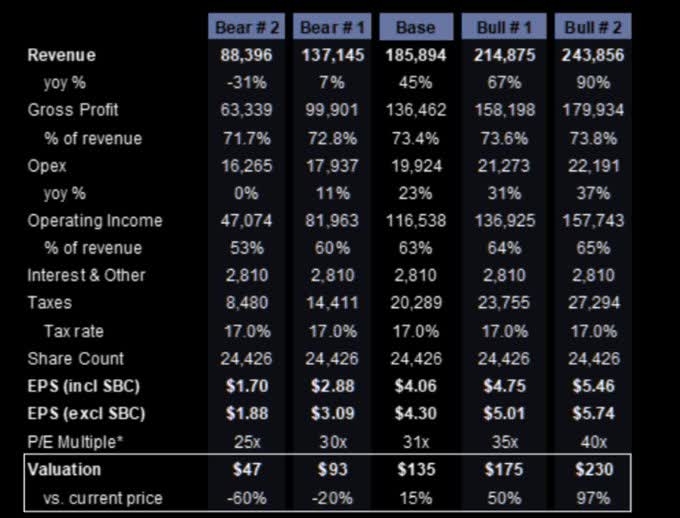

We are not going to give you the background on the company or what it does. If you need that, you have come to the wrong place. Instead, we are going to just focus on a tiny little concept called margins. Goldman Sachs (GS) recently came out with their valuation model on NVDA and said it would be fairly valued in a range of $47-$230, depending on how things play out. The company (NVDA, not GS) has about 25 billion shares outstanding. So GS, in essence, is saying fair value could be off by about $4.5 trillion between the two extremes, give or take.

Goldman Sachs

Sounds legit.

But the picture above is very instructive, as despite knowing the obvious pitfalls of assigning a multiple on a single year’s earnings, GS is going all in on its valuation based on that. In its base case, GS assigns a 31X multiple, and in its Ultra-Bear case, it runs with a 25X multiple.

What’s Wrong With This Picture?

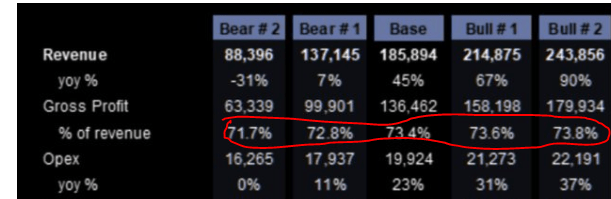

Well, everything is wrong, but we are going to focus on margins. In one of the funniest takes we have seen since Safehold (SAFE) was valued at 200X cash flow, GS moves gross margins in a two percentage range. Between sales of $244 billion annually and $88 billion annually, the gross margin changes only from 73.8% to 71.7%.

Goldman Sachs

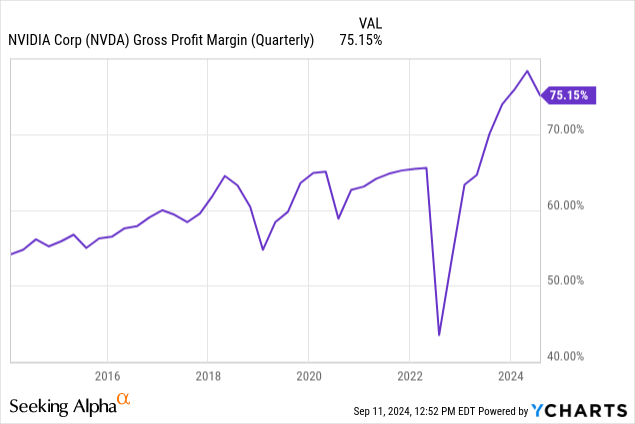

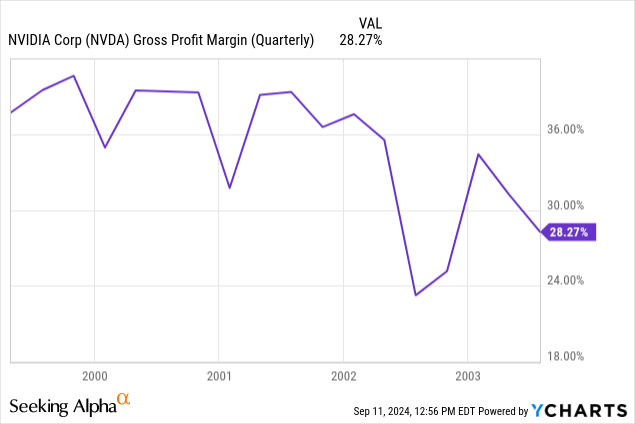

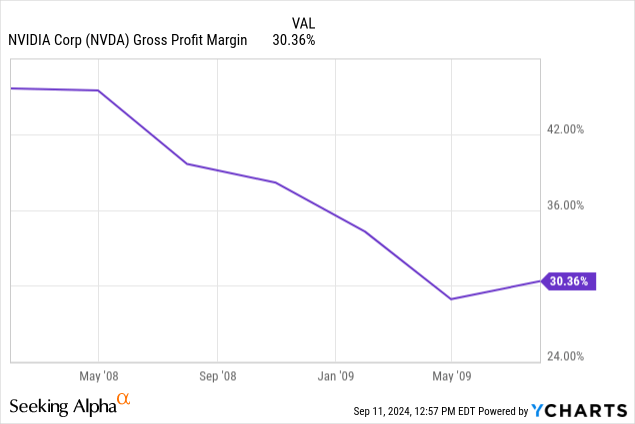

Even in monopolies, this would be unheard of. If revenues are declining by 31% year over year, you can bet margins will take a vertical plunge. This is hardly a unique concept, and it is certainly something the darling of bubble-land is quite familiar with. In fact, the 71.7% number was first breached on the upside about a year back. Before that, NVDA did not in its entire history come close to that number in its peak quarters.

You can see above the peaks for margins were in the mid-60s. What is also observable here is that the drops are fairly steep. The 2018 crypto cycle peaking threw margins down 10 percentage points. The 2022 oversupply on data center chips dropped them by 20 percentage points. NVDA was a baby in 2000 during the dot-com era by we can still see the near one-third contraction in gross margins.

2008-2009 again saw a one-third contraction.

So every bit of history tells you that whatever your start point, once revenues contract even marginally, your gross profit margins do a deep dive. Yet, we are seeing valuations being based on those margins holding higher than what we have ever seen before. Why is that? The answer lies in the picture itself.

Goldman Sachs

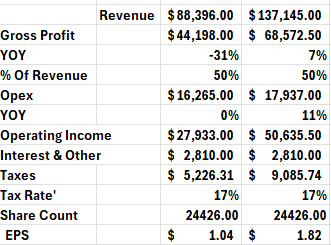

Putting in anything reasonable in either the gross margins or P/E multiples creates a terrible downside scenario. For example, in the two bear cases shown above, if we input 50% gross margins, our earnings (including stock-based compensation) drop is fairly steep.

Author’s Estimates

50% gross margins may sound really low, but once everyone has their chips, will they be buying a second one? Revenue rates for AI are running at a fraction of the capex rate. By our estimate, revenues need to increase 100-200 fold to justify what has already been invested. We have not even accounted for Alphabet Inc. (GOOG), Intel Inc (INTC) or Advanced Micro Devices, Inc. (AMD), making a successful competing chip.

Valuation & Verdict

It is fairly obvious that NVDA’s EPS growth rate has peaked. The revenue growth rate has also peaked. What we are saying now is that there is no “cycle” anymore, and we will all be eating AI chips for breakfast, independent of anything else.

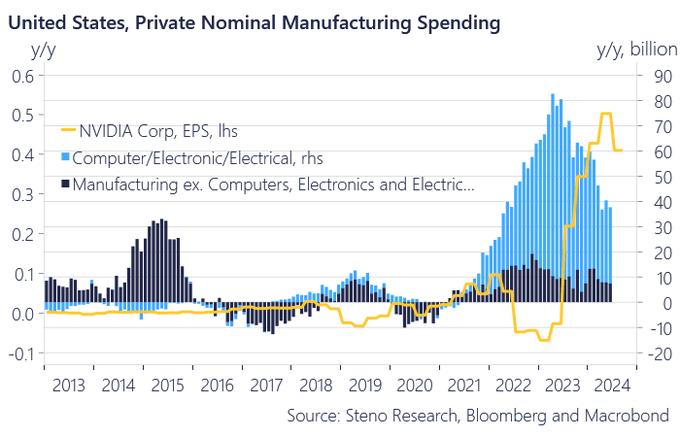

Steno Research As Shared On X

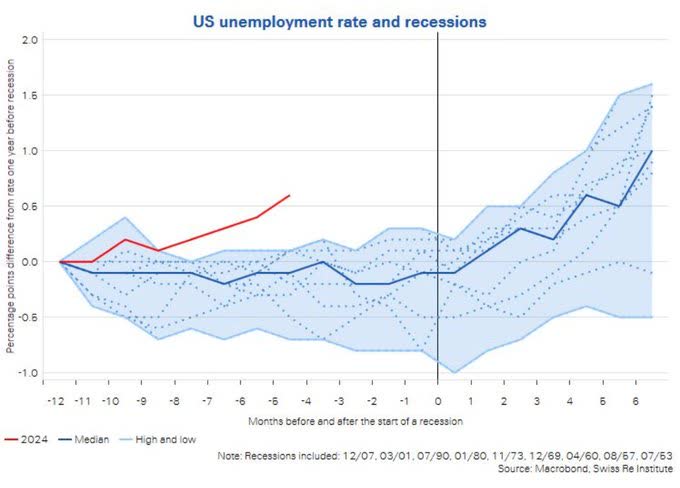

Remember that in every past downturn, NVDA’s sales and gross margins eventually cracked. It also did not have 3 out of 5 top customers, trying to create competing chips back then. Will we have a recession? Certainly. The data is lining up for it.

Macrobond

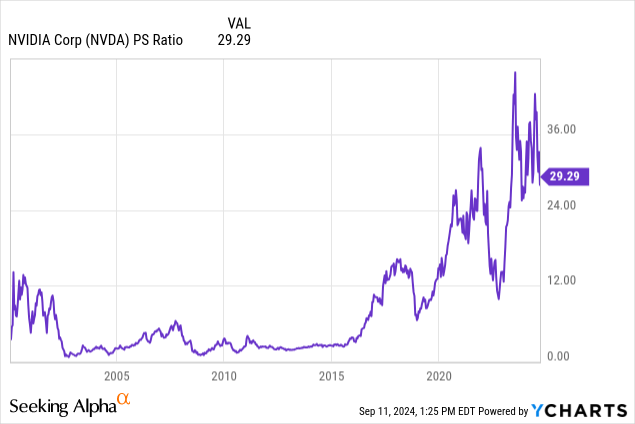

And when that does and sales do start declining and profits start evaporating, where will you value this? Definitely not at 30X sales.

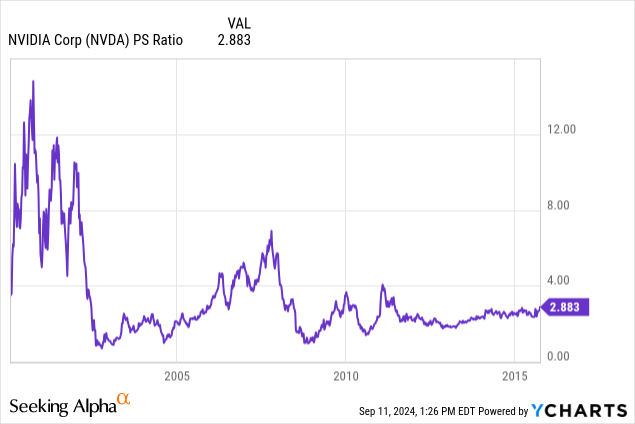

In fact, NVDA’s trough multiples have been at, 2X sales.

It is fairly difficult to see on that chart because the scaling of the right-hand side destroys your visuals. Let’s run the same chart just until 2015 so we get a glimpse of how this might play out.

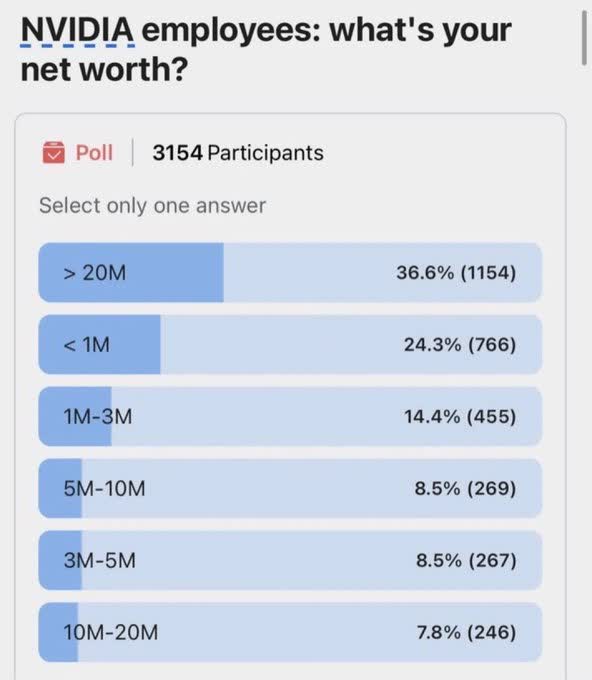

Of course, 2X sales would imply some rather unfathomable downside levels, even if NVDA grows its sales. Some may argue that the cash made during the boom years will help the company. It certainly may provide some buffer, but so far NVDA is spending on buying back its stock at extremely bad valuations. The only people who likely make it rich, even at the end of this cycle, are the NVDA employees. Assuming they cash out the stock options.

NVDA Poll

We will have to see how this plays out. In general, whenever the parabola breaks, the stock is usually done. It looks like it broke.

Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

Source: Bob Farrell.

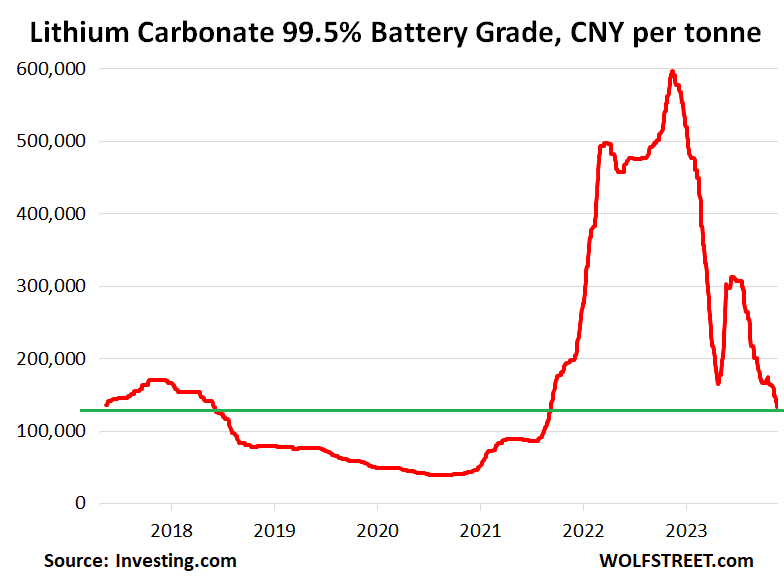

Take a look at the lithium chart below.

Wolf Street

Keep in mind this headline at the exact peak of lithium prices.

The world could face lithium shortages by 2025, the International Energy Agency (IEA) says, while Credit Suisse thinks demand could treble between 2020 and 2025, meaning “supply would be stretched.”

Source: We Forum.

Yes, it will happen here as well.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

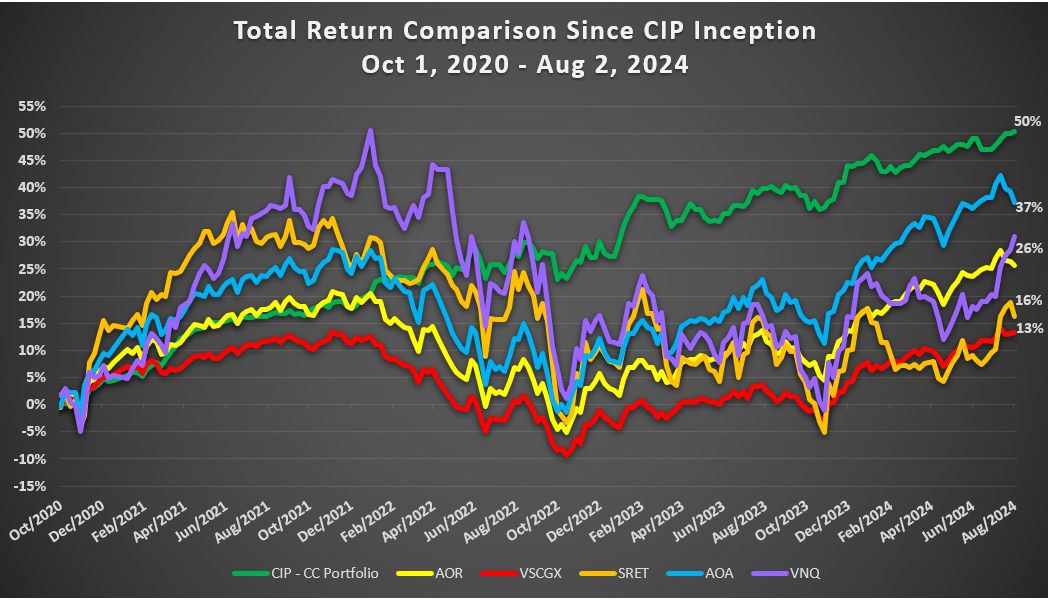

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.