Summary:

- Nvidia Corporation’s Q3 earnings exceeded expectations, driven by strong Data Center growth.

- Free cash flow grew 138% Y/Y, outpacing revenue growth, signaling Nvidia’s scalability and strong financial health.

- Nvidia’s Q4 revenue guidance is robust, with Blackwell GPU shipments expected to further accelerate growth next year.

- Risks include potential demand moderation and growing competition, but Nvidia’s consistent performance and market dominance support a strong buy rating.

- Nvidia is currently valued at a FY 2026 P/E ratio of 35X. However, with consistent EPS growth, Nvidia could be valued at more than $300 per-share by the end of the decade.

BING-JHEN HONG

Nvidia Corporation (NASDAQ:NVDA) just released third fiscal quarter earnings that were better than expected on both the bottom and the top line. Nvidia’s Data Center segment remained on fire in the quarter ending on October 27, 2024. With the Blackwell GPUs starting to ship soon, the semiconductor firm is set for a massive ramp in Data Center-related revenues. Nvidia also gained in terms of free cash flow — which grew 1.5X as fast as the firm’s top line — and the company saw a sequential free cash flow margin expansion of 3 PP.

In the long term, Nvidia could be set to see a dramatic increase in revenues and with free cash flows growing even more quickly. I believe the risk profile still benefits long-term investors here.

Previous rating

I rated shares of Nvidia a strong buy in my last work on the semiconductor company — Blackwell Is Set To Crush Expectations — because I believe that the market drastically underestimates Nvidia’s potential for its latest AI GPU. I also believe that Nvidia could see a quadrupling of its market cap until the end of the decade, assuming that revenues in the crucial Data Center segment continue to grow. With free cash flow and earnings also ramping up nicely, I believe Nvidia could be a very profitable investment until the end of the decade.

Nvidia beat Q3 ’25 estimates, FCF growing 1.5X faster than revenue, strong Q4 outlook

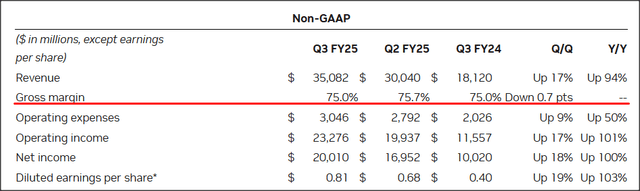

The semiconductor company earned $0.81 per-share in the third fiscal quarter and beat the consensus prediction by $0.06 per-share. Nvidia’s revenue came in at $35.1B, beating the average estimate for its top-line figure by a decent $1.95B.

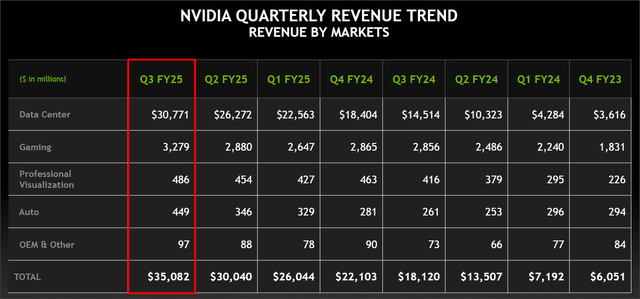

Nvidia was obviously headed for a strong earnings release, as the chipmaker is seeing record demand for its AI GPUs. In the third fiscal quarter, Nvidia had a top line of $35.1B (+94% Y/Y) mainly due to the company’s growth in the Data Center business. In fact, out of the $17.0B Y/Y increase in consolidated revenues, $16.3B (96%) came exclusively from the Data Center segment.

Total Data Center revenues were $30.8B, showing 112% year-over-year growth. The revenue figure exceeded the average prediction by approximately $2.0B. In the previous quarter, Nvidia generated 154% top-line growth, so the chipmaker is seeing a bit of a growth deceleration in its biggest and by far most significant operating segment in terms of revenue contribution. Data Center revenues increased 17% Q/Q compared to 16% in the previous quarter, so on a sequential basis, Nvidia actually saw a 1 PP revenue growth acceleration.

Nvidia’s other segments contributed a cumulative $4.3B to the company’s third fiscal quarter revenues, representing a revenue share of only 12%. Going forward, Nvidia is likely going to build on the momentum in its Data Center business, as the firm is getting ready to start shipping new AI chips.

Nvidia has said that it is going to ship its GB200 server chips to companies in December, which creates a new revenue catalyst for Nvidia. The company’s new Blackwell GPU is in such high demand that wait times can exceed one year, which obviously bodes well for pricing. As I indicated in my last work on Nvidia, the chipmaker could benefit here from higher average selling prices, which in turn could be a major boost for Nvidia’s revenue growth. The real impact of the Blackwell shipment start will likely be felt in Q1 ’25 or later.

Nvidia’s gross margins unfortunately declined quarter-over-quarter, by 0.7 PP to 75%, but it still indicates strong pricing power for the company’s core Data Center AI chips. For comparison, Advanced Micro Devices (AMD) non-GAAP gross margin in its third fiscal quarter was just 54%, so Nvidia has a 20 PP+ gross margin advantage here compared to its closest rival.

Nvidia generated $16.8B in free cash flow in the third fiscal quarter, which calculates to a massive 138% year-over-year growth rate. Interestingly, Nvidia’s free cash flow is growing significantly faster than the company’s top line — by a factor of 1.5X — indicating that the company has reached a scale that allows for a higher retention of free cash flow. Nvidia’s free cash flow margin in the September quarter was 48%, showing an expansion of 9 PP year-over-year and 3 PP quarter-over-quarter.

|

in $M |

FQ3’24 |

FQ4’24 |

FQ1’25 |

FQ2’25 |

FQ3’25 |

Growth Y/Y |

|

Net Revenue |

$18,120 |

$22,103 |

$26,044 |

$30,040 |

$35,082 |

94% |

|

Operating Cash Flow |

$7,333 |

$11,499 |

$15,345 |

$14,489 |

$17,629 |

140% |

|

Capital Expenditures |

($291) |

($282) |

($409) |

($1,006) |

($842) |

189% |

|

Free Cash Flow |

$7,042 |

$11,217 |

$14,936 |

$13,483 |

$16,787 |

138% |

|

FCF Margin |

39% |

51% |

57% |

45% |

48% |

+9 PP |

(Source: Author)

Revenue outlook for Q1’25

Nvidia submitted very decent revenue guidance for the fourth fiscal quarter: the chipmaker projects $37.5B +/- 2% in revenue for FQ4 ’24 which implies Q/Q revenue growth of 7% and Y/Y growth of 70% Y/Y, so Nvidia expects a revenue deceleration here. The company also sees a non-GAAP gross margin of 73.5% +/- 0.5 PP, which implies a sequential margin drop of 1.5 PP.

Despite a high 35X P/E, Nvidia is still cheap…

In my last work, I highlighted why I believe that the market fundamentally underestimates Nvidia’s Blackwell potential. The main argument here was that Nvidia’s Blackwell supply was already sold out for the next year or so, which was set to create positive tailwinds effects for average selling prices. AMD, in my opinion, was going to be a big winner of this expected supply shortage as well as the firm ramps up shipments of its Data Center chips, called the MI300X accelerators.

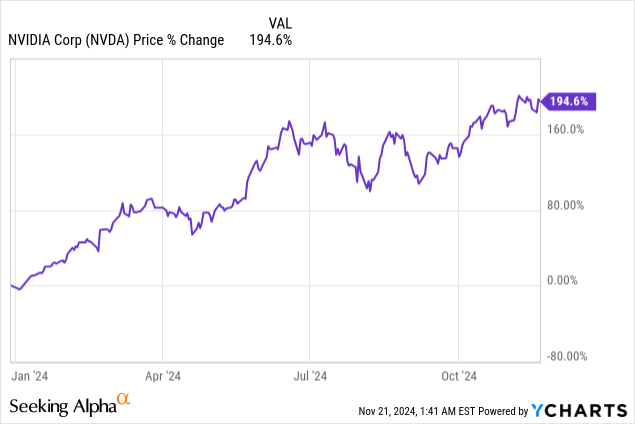

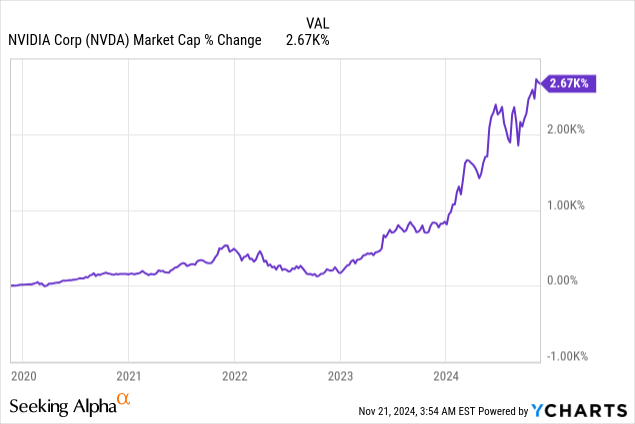

Nvidia has seen explosive market cap growth in the last several years, but the company is clearly not stopping to grow. Currently, Nvidia has a market cap of $3.58T.

Nvidia is expected to grow its top line at an average rate of 15% in the next five years, and I believe investors may still underestimate the need for AI GPUs. One of the reasons why both Nvidia and AMD are moving to yearly product release cycles regarding their AI GPUs is that they want their Data Center customers to participate in technological advancement. This could also force these customers to upgrade their GPUs more frequently.

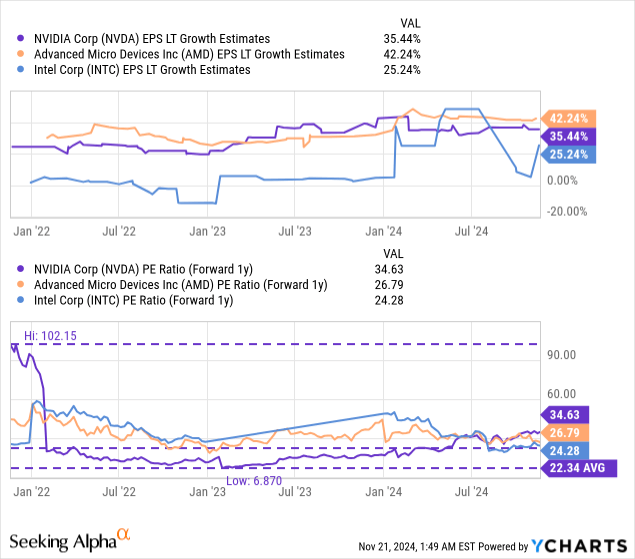

Nvidia is currently valued at a high price-to-earnings ratio of 34.6X, which is significantly above the company’s historical valuation average P/E ratio of 22.3X. The increase in the valuation multiplier is almost solely due to the ramp in Data Center revenues and expectations of a strong launch performance of the Blackwell GPU… Nvidia’s latest flagship chip, targeted at compute-intensive AI applications run by large Data Centers. However, if Nvidia keeps growing at its current pace, shares still have considerable revaluation potential in the long term.

For comparison, AMD is valued at a price-to-earnings ratio of 26.8X. I covered AMD after the company submitted its third-quarter earnings sheet — which showed a significant acceleration in Data Center revenues — but the chip company is still lagging Nvidia in terms of profitability (gross margins and free cash flow) as well as top-line growth. As an example, AMD had a free cash flow margin of only 7% in the most recent quarter compared to a 48% margin for Nvidia, reflecting a 41 PP FCF margin advantage. However, as AMD is just ramping up its MI300X shipments and Data Center sales, I believe the chipmaker has considerable “catch-up” potential: Why I Am Aggressively Loading Up The Truck.

Intel, on the other hand, is a pure restructuring play at this point and I recently explained why I believe the chipmaker could be set for a rebound. The low forward FY 2025 P/E ratio of 24X reflects the company’s restructuring setup, however.

If Nvidia grows its yearly EPS at an average rate of 25% in the next five years, which I consider to be a more realistic assumption than what the consensus estimates imply (15%) — given the Blackwell launch and stronger free cash flow growth — Nvidia could be set to earn $9-10 per-share annually by the end of the decade. If Nvidia is valued at the same forward P/E ratio of ~35X, Nvidia could be fair valued in a range between $315 and $350 per-share, implying up to 141% upside revaluation potential.

In my opinion, Nvidia will continue to grow all its key metrics and expand its market cap until 2030. While a 35X P/E ratio may seem high to some investors today, Nvidia has the growth to back up this valuation and even without multiplier expansion, Nvidia could easily grow into a $300+ per-share valuation by the end of the decade. Assuming that AI spending is secular, and not cyclical, I would also bet that investors in 2030 would fall over themselves to buy into Nvidia at a 2024 valuation. So while a 35X P/E ratio sounds high to today’s investor, from the vantage point of an investor in 2030, Nvidia is likely going to be considered cheap at ~$145.

Risks with Nvidia

Nvidia is currently in a strong position: the Blackwell GPU is sold out before the chip even hit the market, indicating red-hot demand for Data Center GPUs. If this demand were to moderate or other companies were to launch similar AI GPUs that stole market share away from the chipmaker, then Nvidia could be seeing a stronger revenue deceleration. Since Nvidia owns more than 90% of the Data Center GPU market, I am not worried about Nvidia’s growth setup. What would change my mind about Nvidia is if the semiconductor firm were to see an erosion of its gross margin profile or a slowdown of its free cash flow growth.

Final thoughts

Nvidia once again did not disappoint: the semiconductor company beat the top line and the bottom-line estimates easily and confirmed yet again why investors would want to own a part of Nvidia’s business: revenues are still surging, and gross margins remain high in the 70 percent range. The outlook for Q4 ’25, into which the start of Blackwell GPU shipments falls, is also positive. The biggest take-away for me was that Nvidia’s free cash flows are growing significantly faster than its revenues.

I believe Nvidia has considerable potential to expand its valuation on the back of higher average selling prices as well as accelerating volume shipments regarding Blackwell. While Nvidia looks expensive now, investors should realize that the semiconductor firm has consistently been “expensive” in the last several years and almost always beaten investor expectations. Nvidia is executing well in the Data Center segment. I believe that with the current trend of growth in its core business being intact, the semiconductor firm could be on track to a stock price exceeding $300 by the end of the decade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.