Summary:

- Nvidia’s strong financial results are driven by growing demand for data center equipment, with supply expected to remain tight.

- Gaming segment shows robust demand despite market weaknesses, outperforming competitor AMD, prompting an upward revision of revenue forecasts for 2025 and 2026.

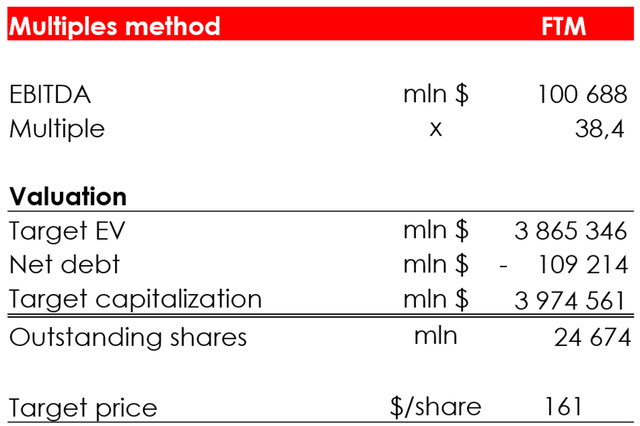

- Increased EBITDA forecasts for Data Center, Gaming, and Automotive Solutions segments lead to a revised target price of $161 and a buy rating.

- Antitrust investigation by the U.S. Justice Department poses a moderate risk, but Nvidia’s market dominance is attributed to superior product quality.

JasonDoiy

Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) continues to deliver strong financial results as demand for Nvidia data center equipment continues to grow. Large consumer Internet companies and cloud service providers (CSPs) are increasing orders for Hopper series chips while preparing for the introduction of Blackwell. Nvidia continues to see demand outstripping supply (for both the Hopper and Blackwell series) and expects this to continue into next year.

Of the company’s other segments, gaming is noteworthy because, despite the weakness in the console market and the nascent recovery in the PC market, Nvidia management continues to see strong demand for its gaming products. This, by the way, coincides with the declining gaming results of its closest competitor, Advanced Micro Devices, Inc. (AMD).

We have covered the stock before and, based on our reassessment, we have revised upwards our target price from $136 to $161 due to an increase in our 2026 EBITDA outlook. We assign a BUY rating to the stock.

Data Centers: Growing as Planned

Revenue in the data centers segment totaled $26.3 bln (+154% y/y and +16% q/q) in 2Q FY 2025, which made up 87.5% of Nvidia’s total revenue.

Demand for Nvidia’s data center hardware continues to rise. Large consumer Internet companies and cloud service providers (CSPs) are increasing their orders of Hopper series chips while preparing to adopt Blackwell.

In addition to demand from Nvidia’s typical customers, the management reported increasing demand for AI from government agencies, raising the FY 2025 revenue guidance for this customer group from $7-$9 bln to $10-$12 bln. Beyond FY 2025, we expect government spending on AI to climb at a pace that, as a minimum, will keep up with the general growth in demand for data centers.

In 2Q of calendar year 2024, the company began volume production of H200 chips as planned, while continuing to ship large quantities of the H100. So, due to the expected ramp-up in H200 shipments and consistently strong demand for the H100, revenue from the Hopper series will continue to expand in 2H FY 2025.

As for the next generation, Blackwell, the company is still doing sampling shipments for now and plans to begin ramping up production in 4Q CY 2024, despite recent reports of delays.

In early August 2024, the Information reported that Nvidia’s Blackwell chip exhibited unexpected design flaws. The problem, discovered by contract manufacturer TSMC (TSM), was caused by an issue with the processor die that connects the two GPU dies in the Blackwell GB200 chip. The design fix and testing would reportedly require a minimum of three additional months, which would consequently force the company to inform its customers that the production ramp-up would be delayed from 4Q CY 2024 to 1Q 2025. Such a serious delay would affect the plans of Nvidia’s customers, including Google (GOOG), Meta Platforms (META), and Microsoft (MSFT), who pre-ordered hundreds of thousands of chips of the series, according to the report. The news upset Nvidia’s investors and delighted investors of competing companies, but the setback took much less time to resolve, and everything is already back on track. During a 2Q FY 2025 earnings conference call, Nvidia announced that Blackwell shipments in 4Q FY 2025 will generate “several billion dollars” for the company.

Nvidia again reported that demand outstrips supply (for both the Hopper and Blackwell series) and expects this situation to continue into next year.

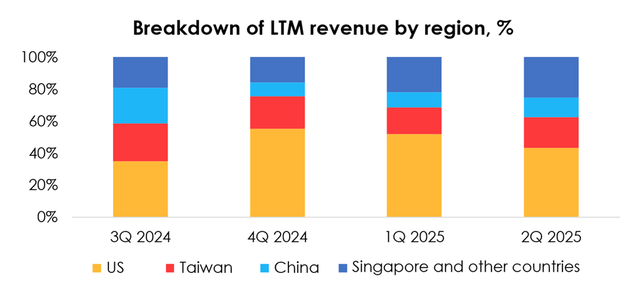

Looking at the company’s revenue by region, it’s clear that since the release of “exportable” chips, Nvidia’s revenue from sales in China has been gradually increasing. However, it now takes up a much smaller share of the company’s revenue structure than it used to.

Even as competition from Chinese manufacturers is intensifying (primarily from Huawei), alternative chips so far:

A) Do not meet the high standards set by Nvidia.

B) Are not produced in sufficient quantity.

Firstly, Huawei customers complain about software bugs that cause performance degradation, frequent chip failures that further reduce performance, and much more. It has also been reported that up to 80% of Ascend 910B chips were released with defects (probably, most of them are not critical for operation, and the chips can still be used with some cores disabled or at lower clocks).

Secondly, Huawei is facing significant difficulties in expanding the production of the Ascend 910B due to insufficient yields at the SMIC plant. Consequently, in response to the news that the first shipments of the next-gen AI chip, the Ascend 910C, which is touted as an answer to Nvidia’s H100, are scheduled for October 2024, the logical question is “How?” Furthermore, Huawei’s customers are concerned that the Netherlands plans to limit ASML’s ability to service the advanced installed wafer fabrication tools in China. This could cause SMIC to lose some or all of its capacity to produce 7nm and 5nm chips as early as next year.

So, the demand for Nvidia’s “exportable” chips, which are more stable compared with the Ascend, is gradually going up. If customers are not satisfied with either of these options, they find ways to get around US export curbs to get the Nvidia H100, and the smuggling of Nvidia AI chips is gaining momentum.

Company data, Invest Heroes calculations

Nvidia’s Financial Results

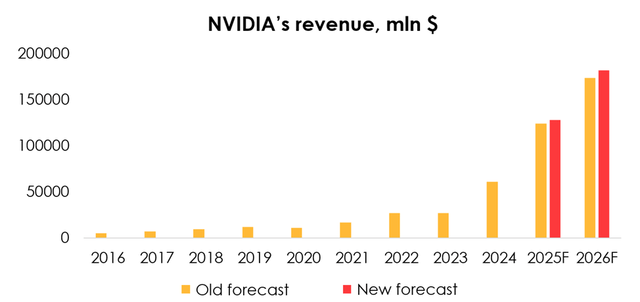

As such, we are raising the forecast for revenue in the Data Center segment from $109.3 bln (+130% y/y) to $112.3 bln (+136% y/y) for 2025, and from $155.6 bln (+42% y/y) to $161.8 bln (+44% y/y) for 2026 on the back of Nvidia’s increased guidance for revenue from government agencies. We expect the Data Center segment’s revenue to total $29.8 bln in 3Q 2025.

In 2Q FY 2025, revenue in Nvidia’s gaming segment totaled $2.9 bln (+16% y/y and +9% q/q), up from our forecast of $2.6 bln. Despite the weakness in the console market and the just-beginning recovery in the PC market, Nvidia’s management noted that demand for its gaming products had been consistently strong. For the record, this is happening as earnings from the segment at the chipmaker’s closest competitor, AMD, are declining. Given the higher-than-expected revenue in Nvidia’s gaming segment in 2Q 2025 and as the forecast for its further growth has been left unchanged, we are raising the forecast for the gaming segment’s revenue. It goes from $11.1 bln (+7% y/y) to $12 bln (+14% y/y) for 2025, and from $14.5 bln (+30% y/y) to $15.9 bln (+33% y/y) for 2026. We expect the segment’s revenue to total $3.1 bln in 3Q 2025.

In 2Q 2025, revenue in Nvidia’s other segments – professional design visualization solutions, automotive solutions, OEM collaborations – collectively made up 3% of the company’s total revenue. This was slightly above our expectations, driven primarily by the performance of the automotive segment, or as the company’s CFO called it, the automotive and robotics segment. Despite the observed stagnation of the automotive industry in the world’s major markets, there is a rising share of electric vehicles in the total volume of autos sold. Apparently, along with robotics, this appears to be helping push revenue growth in this segment higher than we expected. Considering the stronger 2Q 2025 results, we are raising our revenue estimate for the automotive solutions segment over the forecast period.

Therefore, we are raising the forecast for the company’s revenue. It goes from $123.7 bln (+103% y/y) to $127.8 bln (+110% y/y) for 2025, and from $173.7 bln (+40% y/y) to $181.6 bln (+42% y/y) for 2026 on the back of a better outlook for revenue in the Data Center, Gaming and Automotive Solutions segments in 2025 and 2026.

Company data, Invest Heroes calculations

The company’s cost of sales reached 24.9% of revenue (+3.2 pp q/q) in 2Q 2025, up from our expectations of 21%. The costs were driven up by an increased proportion of new products of the Data Center segment in the sales structure, and the need to make additional preparations for ramping up production of the Blackwell series.

Nvidia guided for a gross margin of 74.4% +/- 50 bps in 3Q 2025, and ~75% for the full fiscal year 2025. That means the increased cost of sales in 2Q 2025 was not a one-off spike, and Nvidia doesn’t expect the cost of sales to decline until 4Q 2025 at the earliest. In line with the Nvidia management’s expectations, we are adjusting our projections for the company’s cost of sales, raising the forecast from 21% of revenue to 24% for 2025 and from 20% of revenue to 22% for 2026.

The company’s 2Q 2025 operating expenses reached 13.1% of revenue (-0.3 pp q/q), compared with our expectation of 13.4%. The management guided for higher operating expenses this year in an updated guidance: They now expect operating expenses to jump by 45%-49% y/y in 2025, while the previous guidance was for a surge of 40$-44% y/y.

Given the lower-than-expected operating costs in 2Q 2025, we are lowering the forecast for the expenses from 13.4% of revenue to 13.2% for 2025, and to 13.1% for 2026. This forecast means operating expenses are projected to shoot up by 48% y/y in 2025.

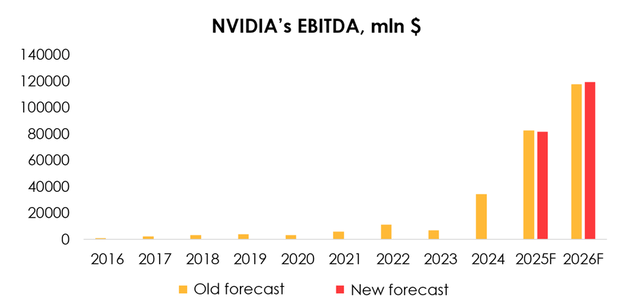

Therefore, we are lowering the EBITDA forecast from $82.6 bln (+140% y/y) to $81.7 bln (+137% y/y) for 2025 and raising it from $117.6 bln (+42% y/y) to $119.5 bln (+46% y/y) for 2026 due to a combination of the following reasons:

- The forecasts for the company’s revenue were raised, and operating costs lowered for 2025 and 2026, but the increased forecasts for the cost of sales outweighed that in the 2025 outlook, and partially offset that in the 2026 outlook.

Company data, Invest Heroes calculations

Valuation

We are raising the target price of the company’s shares from $136 to $161 due to:

- The increased EBITDA forecast for 2026.

- Changes in how we compute the target price. We dropped the method where we computed the target price for 2026 based on that year’s financial results, projected using the EV/EBITDA and FCF Yield methods, and then discounted to the FTM price at the rate of 13% per annum. Instead, we shift to an EBITDA-based FTM valuation.

Given the new input data, we are assigning a buy rating to the stock.

Escalating Antitrust Probe

It was reported on September 3 of calendar year 2024 that the U.S. Justice Department sent subpoenas to Nvidia and other companies as it seeks evidence that the chipmaker violated antitrust laws. In response to questions about the investigation, Nvidia said that its market dominance stems from the quality of its products, while customers can freely choose any other provider of advanced chips.

This new phase in the antitrust investigation is moderately negative news for Nvidia, as many big-tech companies are currently exposed to the risk of such investigations.

Conclusion

Nvidia is one of the most prominent participants in the emerging market of artificial intelligence, having become a one-stop developer of everything it needs. The company generates most of its revenue in the Data Center segment, which brought in 87.5% of its total revenue in 2Q 2025.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.