Summary:

- Nvidia Corporation’s stock price has gained 124% since July 2023, driven by strong growth opportunities in the data center segment and AI computing.

- The company’s Q1 FY25 earnings showed explosive revenue and profit growth, with expectations of demand surpassing supply for their H200 and Blackwell products.

- Nvidia is expected to continue dominating the GPU market, with competitors like Intel and AMD lagging in terms of technology and product offerings.

Antonio Bordunovi

I recommended buying shares of NVIDIA Corporation (NASDAQ:NVDA) in my initiation report published in July 2023, and since then, the stock price has gained 124%. I highlighted their strong growth opportunities in the data center segment, driven by AI computing. The company released its Q1 FY25 result on May 22 with explosive revenue and profit growth driven by data center GPUs. The company expects the demand for H200 and Blackwell will exceed supply in 2025. I now upgrade Nvidia to a “Strong Buy” rating with a one-year target price of $1,310 per share.

Dominating GPU Market Continues with Demands Surpassing Supplies

In Q1 FY25, Nvidia data center revenue grew by 427% year-over-year. The key takeaway from the earnings is the current explosive growth comes from their H100 products, and the next wave of growth will be driven by H200, Blackwell and their InfiniBand and Ethernet.

As indicated over the earnings call, Nvidia started sampling H200 in Q1 and expects shipments to begin from Q2 FY25. Notably, H200 nearly doubles the inference performance of H100. As AI growth will eventually shift from AI training to the inference stage, the inference performance will be key to the future success of the AI world. Superior performance in inference could potentially lower the total cost of AI deployments for enterprise customers.

Additionally, Nvidia is targeting to deliver their Blackwell products to their customers later this year, and they expect demand will surpass supply for both H200 and Blackwell products in the near future.

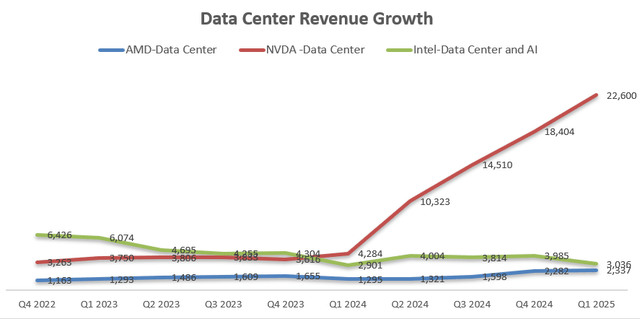

As depicted in the chart below, Nvidia’s data center business has been growing much faster than Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC) over the past five quarters.

Nvidia, AMD and Intel Quarterly Earnings

I think Nvidia will continue to dominate the GPU market, and it will take a long time for its competitors to catch up. Key reasons are:

- -As discussed in my initiation report, Nvidia’s CUDA toolkit is one of their key competitive advantages. Nvidia continues to enhance the CUDA algorithm, which could further accelerate AI computing capabilities. The software layer enables engineers to fully leverage the GPU’s computing power to accelerate applications. Once these applications have been built on CUDA, it becomes difficult for customers to switch to another platform.

- -While Intel recently launched the Gaudi 3 GPU accelerator, which uses the same process node as Nvidia’s H100, Intel is late to the game. During the recent earnings call, Intel projected over $500 million in revenue from this product in the second half of FY24. Currently, Nvidia has already started the production process for their Blackwell products, the next generation of accelerators. As such, Intel is at least one node generation behind Nvidia.

- -AMD expects their MI300 and other accelerators to generate $4 billion in revenue in FY24. AMD is set to launch their RDNA 4 GPUs later this year, and there are not many details available about the upcoming product launch. Even if AMD launches RDNA 4 later this year, they will be at least 6-month behind Nvidia. As mentioned during the earnings call, Nvidia’s Blackwell architecture delivers up to 4x faster training and 30x inference than the H100 accelerator. Nvidia’s technology is significantly ahead of its competitors.

FY25 Outlook

I consider the following growth drivers for Nvidia in FY25:

-The majority of data center growth will come from H100 in FY25. H200 is expected to start contributing growth in the second half of this year, as Nvidia aims to begin deliveries from Q2 FY25. It is worth noting that Nvidia’s data center business started to accelerate from Q2 FY24; therefore, investors should not assume a similar growth rate will continue in the coming quarters.

I think the best way to forecast Nvidia’s data center business is to estimate the growth of AI parameter size. For example, ChatGPT-2 used 1.5 billion parameters, and ChatGPT-3 utilized 175 billion parameters. Although the exact size of ChatGPT-4 is unknown, it is rumored to have 1.76 trillion parameters, which is 10 times larger than ChatGPT-3. As Blackwell architecture could deliver up to 4x faster training than H100, the growth in AI parameters could potentially expand the GPU market to 2.5x its current size. Nvidia generated $47 billion in revenue from its data center in FY24, as such it would be quite reasonable for the company to achieve more than $110 billion in annual data center revenue in the near term.

-Gaming and Professional Visualization: While these markets are not growing as fast as data center, gaming, and visualization require accelerators. Grand View Research predicts that the gaming market will grow at a CAGR of 13.4% from 2023 to 2030. Therefore, I expect the business will grow by 15% in the near term, and then decelerate to 10% later.

-Automotive chips: It is a tiny business segment for Nvidia, with only $1.1 billion in revenue in FY24. I forecast their automotive business to grow by 10%-15% annually, in line with the overall market growth.

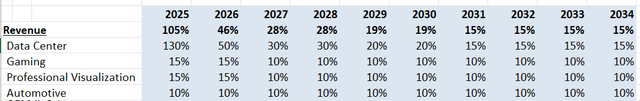

As shown in the table below, I forecast Nvidia will deliver 105% revenue growth in FY25, then start to decelerate to 15% in the future.

Nvidia Growth Forecast – Author’s Calculations

Valuation Revision

I estimate Nvidia’s primary margin expansion will come from operating leverage and business mix shift. As their data center business is expected to grow much faster than other business segments, the higher revenue mix toward the data center could potentially expand the company’s gross margin and net income margin. As AI demands high-end GPU accelerators, the data center business tends to generate better margins.

Additionally, I think Nvidia’s R&D and SG&A will benefit from operating leverage, and I estimate the fast revenue growth could contribute approximately 20bps of operating leverage for their R&D and SG&A.

Lastly, Nvidia’s stock-based compensation (SBC) as a percentage of total revenue has declined over the past two years, dropping from 10% in FY23 to 5.8% in FY24. I expect the trend will persist in the future, contributing to margin expansion on a reported basis.

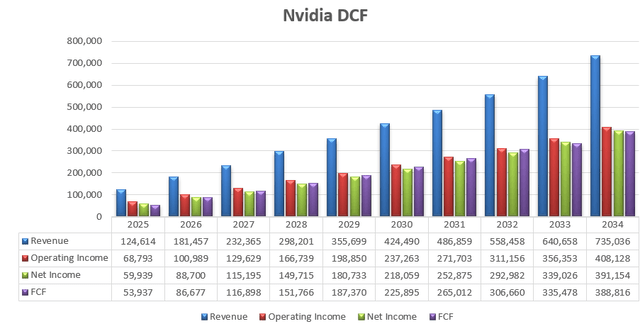

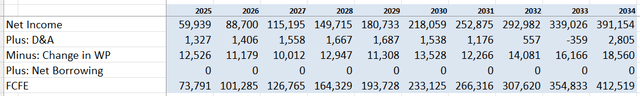

With these assumptions, the summary of Nvidia’s discounted cash flow, or DCF, can be found below:

Nvidia DCF- Author’s Calculations

I calculate the free cash flow from equity by adjusting net income with depreciation/amortization, change in working capital, and net borrowing amounts.

Nvidia DCF- Author’s Calculations

The cost of equity is calculated to be 17% with the following assumptions: the risk-free rate 4.5% ((US 10Y treasury yield)); beta 1.88 (SA); equity risk premium 7%. Discounting all the future FCFE, the one-year price target is calculated to be $1,310 per share.

Key Risks

Nvidia is ramping up a customized product for the Chinese market to avoid the need for an export license. Nvidia’s data center business in China dropped significantly in the quarter due to the export restrictions. The management expects the weakness will continue throughout the year. It is unknown when Nvidia will complete their H20 product. Until then, China is not expected to contribute any growth for Nvidia.

Nvidia started shipping their new Spectrum-X Ethernet networking solution in the quarter. Spectrum-X Ethernet is specifically designed for AI networks, connecting multiple GPU accelerators. Nvidia anticipates Spectrum-X Ethernet will drive notable growth in the future. However, Arista Networks, Inc. (ANET) poses a strong competitive presence in the Ethernet market, and I suspect Nvidia can gain a tremendous competitive advantage over Arista in the near future. Nvidia is partnering with Dell Technologies Inc. (DELL) to bring Spectrum-X to the market. It is worth monitoring the trajectory of Spectrum-X’s growth in the future.

Conclusion

I am confident that Nvidia will maintain their leadership position in the GPU market, driven by innovations such as H200, Blackwell as well as their unique CUDA software platform. H200 and Blackwell could potentially become the primary growth driver for Nvidia in the next fiscal year. I have upgraded Nvidia Corporation shares to a “Strong Buy” rating with a one-year target price of $1,310 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.