Summary:

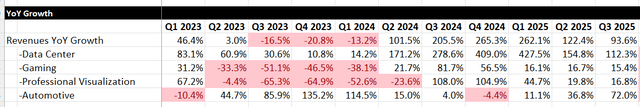

- Nvidia Corporation reported 93.6% revenue growth and 101.4% year-over-year growth in adjusted operating profits, driven by strong data center demand and AI computing.

- The H200 sales reached double-digit billions, marking the fastest product ramp in Nvidia’s history, with strong partnerships in the AI ecosystem.

- Nvidia is guiding for $37.5 billion revenue for Q4, with an anticipated 111% revenue growth in FY25, driven by data center and automotive segments.

- Despite potential competition from OpenAI’s custom AI chips, I reiterate a “Strong Buy” rating for Nvidia with a one-year target price of $184 per share.

In my previous “Strong Buy” thesis published in August 2024, I highlighted Nvidia Corporation’s (NASDAQ:NVDA) strong networking growth and Blackwell ramp-up. Nvidia delivered a strong Q3 result, with 93.6% growth in revenue and 101.4% year-over-year growth in adjusted operating profits. I reiterate a “Strong Buy” rating with a one-year target price of $184 per share.

Key Takeaways From Q3

Nvidia released its Q3 FY25 result on November 20th, reporting 93.6% growth in revenue and 101.4% year-over-year growth in adjusted operating profits. Notably, the data center business revenue grew by 112.3% year-over-year, demonstrating continued robust demand driven by AI computing.

My key takeaways from the quarter can be summarized as follows:

- Nvidia H200 sales reached double-digit billions, marking the fastest product ramp in the company’s history, as noted during the earnings call. I think Nvidia has established strong partnerships with hyperscalers, software and platform providers and AI model companies. The H200 is available on Amazon (AMZN) AWS, CoreWeave, and Microsoft (MSFT) Azure, and Google (GOOGL) Cloud.

- In September 2024, Oracle (ORCL) announced that their Cloud Infrastructure will offer Nvidia HGX H200 this year, which can connect eight Nvidia H200 Tensor core GPUs in a single bare-metal instance via NVLink and NVLink Switch. In addition, Oracle Cloud Infrastructure introduced the first zettascale OCI Supercluster powered by Nvidia Blackwell platform. I believe Nvidia will continue to gain growth momentum in the AI era.

- The management noted that the next wave of AI will be Enterprise AI and Industrial AI. To capture the future growth, the company launched Nvidia AI Enterprise, offering NIM microservices through a UI-based portal and prototype with NVIDIA-managed endpoints. Enterprises are increasingly adopting Nvidia AI Enterprise to build Co-Pilots and agents, as indicated in the earnings call. In addition, Nvidia is investing in the Omniverse, supporting developers in building robotics applications.

- Lastly, Blackwell is ramping up effectively, with management anticipating increased chip shipments next quarter. The management emphasized that Nvidia has built a strong partnership with key industry partners, including connectors, AI servers, and HBM providers. The robust ecosystem will enable Blackwell to ramp up rapidly, contributing to Nvidia’s revenue growth in the near term, in my opinion.

Outlook and Valuation

Nvidia is guiding for around $37.5 billion revenue for Q4, indicating 69.7% year-over-year growth. Given the strong product ramp-up and end-market demands, I don’t expect the Q4 result will substantially deviate from their guidance. As such, I anticipate Nvidia’s revenue will grow by 111% in FY25.

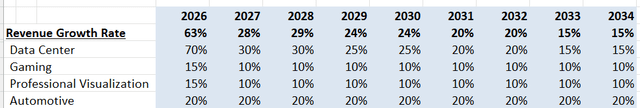

For FY26 onwards, I am considering the following factors:

- Data Center: With the ramp-up of H200 and Blackwell, I anticipate Nvidia will continue dominating the AI GPU market, achieving 70% revenue growth in FY26. The strong growth is supported by the massive investments from cloud infrastructure providers and rapid adoption of AI training and inference technology. From FY27 to FY28, I anticipate the data center business will grow by 30%, as the early investments from hyperscalers approach completion, and AI computing will shift from AI training to AI inference, in my view. I project the growth will decelerate to 25% from FY29 to FY30, 20% from FY31 to FY32, and 15% from FY33 to FY34, as AI computing and machine learning enter a maturity phase.

- Gaming and Professional Visualization: I anticipate Nvidia will grow both segments by 15% in FY26 and 10% from FY27 onwards, aligned with the historical averages.

- Automotive: As analyzed in my previous article, I anticipate Nvidia achieving rapid growth in automotive chips, driven by electrification and autonomous driving technology. The Nvidia Drive AGX platform includes all the software and hardware to develop autonomous driving features. I forecast Nvidia will grow the segment by 20% in the near future, aligned with the EV market growth.

The segment growth projections are as follows:

Nvidia Segment Growth Forecast

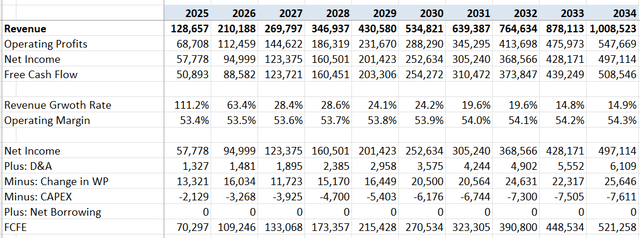

I model 10bps annual margin expansion driven by operating leverage in SG&A expenses. It’s worth noting that the product margins are closely tied to the ramp-up of H200 and Blackwell. During the earnings call, during the Blackwell ramp up period, the gross margin is anticipated to be low-70s. Once the ramp-up is complete, Blackwell margins are anticipated to improve to the mid-70s.

The cost of equity is calculated to be 16.7%, assuming: risk-free rate 3.6%; beta 1.88; equity risk premium 7%.

I calculate the free cash flow from equity (FCFE) as follows:

Discounting all the future FCFE to the year of FY26, the one-year target price is calculated to be $184 per share, as per my estimates.

Key Risk

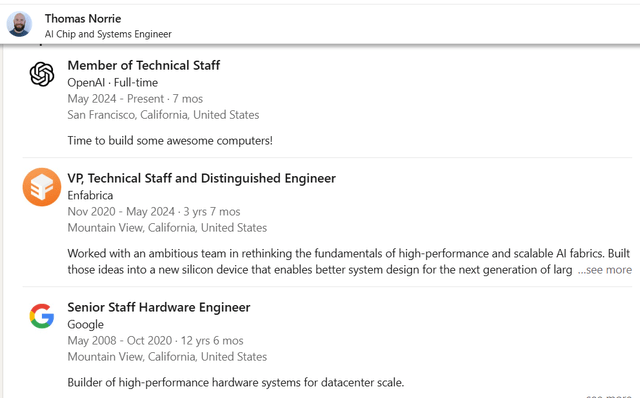

As reported by the media in October 2024, OpenAI is designing its first AI chip in collaboration with Broadcom (AVGO) and TSMC (TSM). OpenAI has assembled a dedicated chip team of near 20 people. Thomas Norrie, a former Google TPU engineer, joined OpenAI in May 2024. Similarly, Richard Ho, another former Google TPU engineer, joined OpenAI in November 2023 to lead the hardware and chip product development efforts.

In my opinion, it makes sense for OpenAI to develop their own GPU chips, as the company needs a huge number of GPU chips to support its future AI machine learning initiatives. According to reports, OpenAI has secured manufacturing capacity with TSMC, targeting a 2026 timeline for its first custom-designed chip.

End Note

I think Blackwell is well positioned to drive Nvidia’s future growth, and Nvidia will continue to benefit from the rapid expansion of the data center market. I reiterate a “Strong Buy” rating with a one-year target price of $184 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.