Summary:

- Nvidia Corporation reported strong Q3 ’25 earnings with 94% revenue growth, driven by a 112% increase in Data Center sales, despite a modest Q4 ’25 outlook for 7% sequential growth.

- Blackwell GPUs showed significant performance improvements and strong interest among major tech firms, contributing to NVDA’s robust growth in AI and data center segments.

- Risks include high valuation, potential electricity constraints for data center growth, and a forecasted sequential growth slowdown in Q4 ’25.

Alexander Sikov/iStock via Getty Images

Nvidia Q3 Earnings

Nvidia Corporation (NASDAQ:NVDA) reported a strong Q3 ’25 earnings release that beat analysts’ estimates and was met with marginal trading activity. Top-line revenue grew by 94% and was driven by strong Data Center segment sales, up 112% on a year-over-year basis.

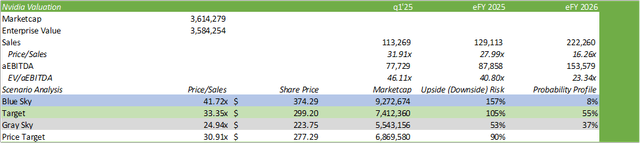

Despite the strong performance, the eq4’25 outlook provided little confidence for shareholders, forecasting 7% sequential top-line growth. One factor that investors must consider is Taiwan Semiconductor aka TSMC (TSM) expanding its CoWoS production, expecting to double its capacity for CY25. Given the strong production outlook for eFY26 and the durable demand from hyperscalers and enterprises, I am reiterating my BUY rating with a price target of $277/share at 30.91x eFY26 price/sales.

You can read my previous coverage of Nvidia here: Nvidia Will Likely Continue Its Bull Run Post-Earnings (Earnings Preview).

As a result of Nvidia’s robust growth trajectory and investor sentiment, I have raised my price target from $165/share to $277/share.

Nvidia Operations

Though Nvidia’s Data Center segment is the largest catalyst for the firm, driving 112% top-line growth in Q3 ’25, all segments performed exceptionally well in the quarter. There was strong growth in both Gaming & Professional Visualization and an acceleration in growth for the Automotive & OEM segments.

Going into Q3 ’25 earnings, analysts’ biggest concern appeared to be related to the new Blackwell release. Seeking Alpha reported on November 17, 2024, that the new Blackwell GPUs were experiencing issues with overheating. Despite the concern, Mr. Jensen Huang, CEO of Nvidia, suggested that the platform is in great shape.

In Q3 ’25, management noted that Blackwell is in full production. Running up to production levels, Nvidia shipped 13,000 GPU samples to customers with the first Blackwell DGX engineering samples to OpenAI. Blackwell also underwent MLPerf Training, providing results suggesting that the Blackwell GPU delivered a 2.2x performance improvement when compared to the Hopper architecture.

Microsoft (MSFT), Dell Technologies (DELL), CoreWeave, Oracle Corp. (ORCL), and Alphabet (GOOG) (GOOGL) have each stood up Blackwell systems in Q3 ’25.

Oracle issued a press release on September 11, 2024, announcing the first zettascale cloud computing clusters accelerated by the Blackwell, delivering up to 131,072 Nvidia GPUs to build, train, and inference AI at scale. The largest OCI Supercluster offered has more than 3x as many GPUs as the Frontier supercomputer, and more than 6x when compared to other hyperscalers.

Microsoft announced on November 19, 2024, that the firm will be launching the first cloud private preview of the Azure ND GB200 V6 VM series, offering customers supercomputing capabilities for training and inferencing models. The tech stack offered will include a GB200 Superchip, connecting two Blackwell GPUs and a Grace CPU via the NVLink C2C interface, and the ability to scale up to 18 compute servers for 72 Blackwell GPUs.

Google also announced that it will be making available to its Google Cloud the Nvidia HGX B200 and the GB200 NVL72 in early 2025.

Dell Technologies will be offering its Dell PowerEdge XE9680L server, offering direct liquid cooling and 8 Nvidia Blackwell Tensor Core GPUs. Dell is also offering its Dell NativeEdge orchestration platform that will automate the delivery of Nvidia AI Enterprise software, including Nvidia NIM. The tech stack will also include Nvidia’s Spectrum-X Ethernet networking fabric and its Bluefield DPUs.

Despite Blackwell being the focus of the Q&A, Nvidia Hopper remains in strong demand as the hyperscalers continue to build out their clusters. I’m forecasting Alphabet to invest $54b in eFY24, Amazon $75b in eFY24, and Microsoft $62b in eFY25 towards scaling out their data centers and AI infrastructure to service the heightened level of compute demand. This is because management at these firms have made it clear their intentions to increase capital spend going forward.

Management at Nvidia announced that H200 sales have increased to double-digit billions of dollars in Q3 ’25 and is the fastest product ramp-up in the company’s history. Cloud service providers [CSPs] accounted for half of Nvidia’s data center sales in the quarter.

On the networking front, management anticipates Q4 ’25 to realize sequential growth, driven by strong interest in InfiniBand and Ethernet switches, SmartNICs, and BlueField DPUs. Accordingly, CSPs are adopting the InfiniBand platform to power their H200 clusters. CSPs are also planning to deploy Spectrum-X Ethernet on large clusters.

Spectrum-X is being leveraged by xAI’s Colossus, Elon Musk’s AI development company, on its 100,000 Hopper Supercomputer and has experienced zero application latency degradation with 95% data throughput, well above traditional Ethernet’s 60% throughput.

Gaming experienced both sequential and year-over-year growth, driven by strong back-to-school sales of GeForce RTX GPUs to power gaming, creative, and AI applications. Nvidia began shipping the new GeForce RTX AI PCs with OEMs such as ASUS and Microsoft.

Management is anticipating that Nvidia AI Enterprise will realize a 2x year-over-year growth rate as the firm builds out its pipeline. Major consulting firms such as Accenture & Deloitte are both leveraging Nvidia’s agentic AI internally but are also staffing up and training for enterprise deployment. Other consulting firms, such as Infosys, TSE, and Wipro are upskilling their developers and consultants to help customers build and run AI agents on Nvidia’s platform.

Nvidia Financial Position

Nvidia reported strong revenue growth of $35b in Q3 ’25, up 94% on a year-over-year basis, well above management’s guidance of $32.5b. One factor that may bring some concern isn’t necessarily that growth is tapering off, but rather, that Nvidia’s growth is peaking in terms of capacity. Management’s revenue guidance for Q4 ’25 came out to be $37.5b +/- 2%. This comes out to 7% growth sequentially and 70% on a year-over-year basis.

Margins compressed sequentially as a result of mix shift from the H100 systems to more complex, higher-cost systems within the Data Center segment. Management suggested in the Q3 ’25 earnings call that Blackwell revenue is expected to exceed its previous estimate as visibility to supply continues to improve. Management is forecasting another sequential decline for gross margin in Q4 ’25 as the firm ramps up Blackwell production. Beyond Q4 ’25, management anticipates that gross margins will moderate to the low-70%s and reach the mid-70%s when Blackwell is fully ramped up.

For eFY25, I’m forecasting Nvidia to report $129b in net revenue with an adjusted EPS of $2.95/share driven by moderating growth and a slight gross margin compression as management guided in their Q3 ’25 earnings call. Looking out to eFY26, I’m forecasting significant growth as Taiwan Semiconductor (TSM) expands and ramps up its CoWoS production, allowing for GPU manufacturing to further scale for the year. In addition to this, the hyperscalers are showing no signs of slowing down their capital spending towards infrastructure. This leads me to believe that the slowdown in growth in Q4 ’25 is not a function of demand, but rather, a function of manufacturing capacity limitations. I’m forecasting revenue to grow to $222b for eFY26, with an adjusted EPS of $5.49/share. I’m forecasting significant margin improvement in the eFY26 as production scales, allowing for Nvidia to further realize economies of scale. Despite TSM doubling its CoWoS capacity, I do not anticipate this to 100% translate to 2x the manufacturing capacity for Nvidia.

We are putting a lot of effort to increase the capacity of the CoWoS. Our customers’ demand far exceeds our ability to supply. So even we work very hard and increase the capacity by about more than twice, more than two times as this year compared with last year, and probably double again, but still not enough.

Risks Related To Nvidia

Bull Case

Nvidia remains at the forefront of AI development with its Grace Hopper solution realizing strong, durable sales growth paired with positive demand for the Grace Blackwell architecture. Given the growing capital investments by the hyperscalers, as outlined above, I have no doubts that investments for Nvidia’s accelerators and software will slow in the near-term. In addition to infrastructure sales, networking will likely ramp up as customer seek to optimize compute performance.

Bear Case

Despite Nvidia’s strong Q3 ’25 performance, shares sold off in the after-hours market as growth is anticipated to near its peak at 7% sequential growth. NVDA shares also trade at an exceptionally high premium at 46x EV/aEBITDA, adding substantial scrutiny to earnings performance. Though revenue is expected to taper in Q4 ’25, I suspect growth will reaccelerate in eFY26 as TSM ramps up its CoWoS capacity at the end of CY24.

One major challenge as it relates to CSP growth is the growing electricity constraint, potentially posing a roadblock as the grid reaches capacity for additional data center capacity. Adding salt to the wound, FERC is seeking more information relating to utility/hyperscaler co-location baseload capacity, potentially leading to additional hurdles for data centers having dedicated power sources through utilities. This may create some headwinds later in the decade if additional data center cannot ramp up as forecast.

NVDA Stock Valuation & Shareholder Value

NVDA shares sold off by -2.5% in the after-hours market post-earnings release. Though the Q3 ’25 results were above management’s outlook, I believe the Q4 ’25 forecast may be suggestive of manufacturing nearing its capacity, limiting growth potential for the next fiscal year.

NVDA’s valuation remains at a heightened level, trading just shy of 32x price/sales on a trailing twelve-month basis. Though this is significantly higher than its peer cohort chip designers, I believe NVDA’s valuation is justified by its significant growth and strong operating margins.

Valuing NVDA shares using an internal valuation model based on my revenue growth and the firm’s historical trading premiums, I believe NVDA shares have significantly more growth ahead of them. At 30.91x eFY26 price/sales, I value NVDA shares at $277/share and reiterate my BUY rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.