Summary:

- Nvidia’s Q1 revenues exceeded analysts’ expectations by 10%, reaching $7.2 billion, and its net income increased by 26% YoY. The company’s Q2 revenues are expected to be around $11 billion, a 64% gain YoY.

- The company’s growth is largely attributed to its AI chips.

- Despite optimistic future expectations, Nvidia’s current stock price is overvalued.

Justin Sullivan

Investment Thesis

Hold on ex-crypto gurus now turn into AI fanboys, before starting complaining about the sell rating on your beloved Nvidia (NASDAQ:NVDA), let me clarify one thing.

This won’t be an in-depth analysis of how AI technology is about to change the world we live in, I will value Nvidia on the basis of a broader analysis of the semiconductor industry assessing how big its market share will be, taking into account the positive effect of AI on the company financial performances.

And spoiler, Nvidia will have a big role, but not big enough to justify the current prices.

Recent Developments

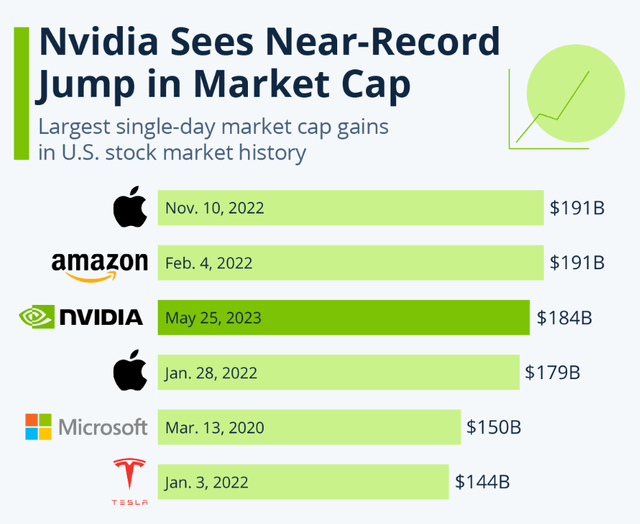

On the 25th of May, Nvidia’s market capitalization increased by almost $200 billion – reaching $940 billion – placing third in the list of biggest single-day gains ever happened in the US market history.

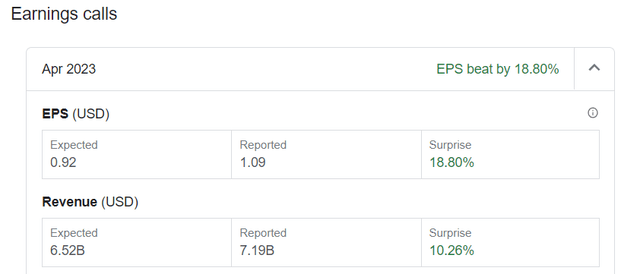

It was the result of an unexpected extremely positive earnings call that flabbergasted the entire Wall Street. Q1 revenues beat analysts’ expectations by 10%, sitting at $7.2 billion, but more importantly, EPS beat consensus by nearly 19% from a forecasted $0.92 per share to $1.09.

YoY, despite revenues were down 13%, the net income increased by 26%, but that’s just the beginning.

What really shocked the street was the Q2 guidance and its implication for the remaining half of the year. In Q2 the management expects revenues to be in the range of $11 billion, a whopping 64% gain YoY, and despite they didn’t give full-year guidance, in the Q&A session an analyst asked the following:

Colette, just wanted to clarify, does visibility mean data centre sales can continue to grow sequentially in Q3 and Q4? Or do they sustain at Q2 level? So I just wanted to clarify that.

Who replied with:

We believe that the supply that we will have for the second half of the year will be substantially larger than H1. So, we are expecting not only the demand that we just saw in this last quarter, the demand that we have in Q2 for our forecast but also planning on seeing something in the second half of the year. We just have to be careful here, but we’re not here to guide on the second half. But yes, we do plan a substantial increase in the second half compared to the first half.

Translating in more straightforward terms, in Q3 and Q4, we can expect Nvidia to deliver revenues at least on par with its $11 billion expected in Q2. If that is the case, revenues for FY 2024 will be no less than $40 billion, a nearly 50% increase compared to the $26.9 billion registered in FY 2023.

Nvidia is everything but a young small-cap company, so how exactly it managed to achieve such growth rates? Well, the short answer is AI chips.

AI Boost

Before late 2022, when generative AI like ChatGPT wasn’t even a thing for the masses, Nvidia was known for its GPUs widely used by gamers and crypto miners. However, two quarters ago, wasn’t exactly a great time, both gaming and crypto were – and still are – facing a severe downturn cycle after the tremendous growth boosted by the Covid pandemic.

Differently from traditional CPUs – which run processes serially and excel at performing one big task at a time – Graphic Processing Units, or GPUs, run processes in parallel and give their best when performing several small tasks simultaneously.

GPUs are perfect for graphic needs – especially to improve the gaming experience – and with the crypto mining boom, GPUs were discovered very useful to handle the verification of several transactions on a blockchain network to earn cryptocurrency.

But luckily for Nvidia, GPUs usage didn’t stop there.

GPUs’ multitasking capabilities are also perfect for advanced computing needs – like Deep Learning applications and data centres – and paired with a CPU, help the latter overcome performance struggles when it comes to handling huge amounts of data. With AI technologies – based on Deep Learning – and data centres emerging in recent times, whoever needed high-performance computing capabilities fell back on GPUs to assure having enough power.

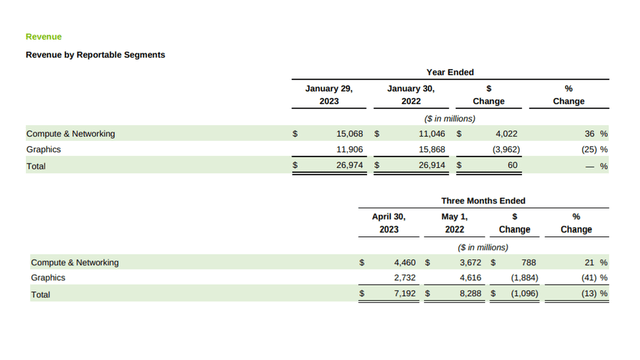

Nvidia’s business model is divided into two segments: Computers & Networking and Graphics.

At the end of FY 2023, the Graphics’ revenues were down 25% YoY, and declines perpetrated in Q1 of FY 2024, being down 41% YoY. Computers & Networking instead – amid a structural slowdown of the semiconductor industry – were up 26% last year, and in Q1 kept delivering strong performance growing 21% YoY.

Combine strong growth in a recessionary period with the booming popularity of AI technology, and you obtain a deadly mix which would let your company gain $200 billion in market capitalization in just one day.

However, it wasn’t just luck, Nvidia truly believed in its chips and their application, investing heavily to support its growth, and now is reaping the benefits.

Industry Overview

But let’s look at the broader picture for a moment. I recently analysed the entire semiconductor industry – which I suggest checking to have a better understanding – and quickly realized how the industry heavily relies on continuous reinvestments.

By their nature semiconductors evolve at an incredible speed – Gordon Moore’s law of miniaturization states that the number of transistors on chips doubles every two years – which means chip companies, whether they are Fabless, Fabs, or IDMs must keep pouring billions into R&D to stay ahead of the competition.

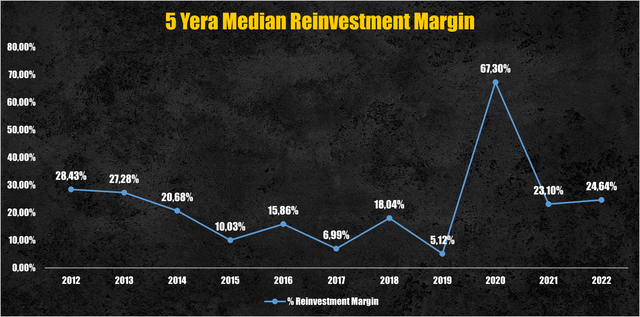

Collectively, over the last decade semiconductor companies have reinvested around 22% of their revenues in growth initiatives, and Nvidia was not an exception, having a median reinvestment margin of 20.6%.

In 2022, the industry generated $672 billion in revenues, reinvesting nearly $100 billion.

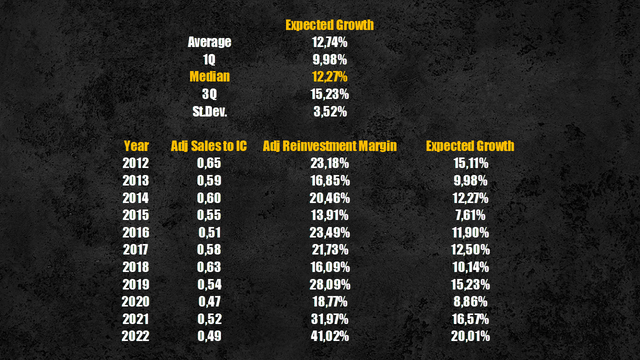

Future growth can be determined by looking at how much and how well it has been reinvested for growth. I calculated the expected revenue growth rate by taking the median value of what resulted by multiplying the reinvestment margin and the sales to invested capital – a ratio telling how much revenues are generated by each dollar reinvested – over the last decade.

It resulted that the expected growth rate for the semiconductor industry is 12.27%.

Semiconductor industry expected growth rate (Personal Data)

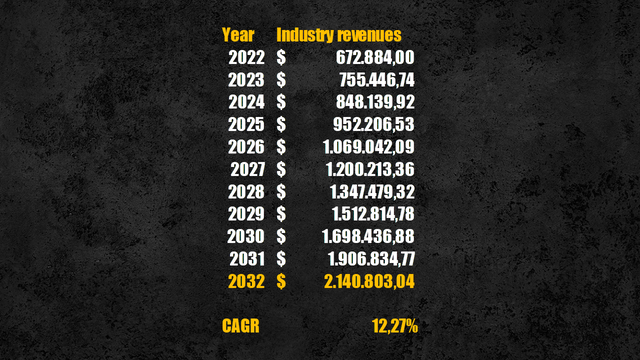

I used the obtained rate as the CAGR at which I let revenues grow for the next ten years, resulting in total semiconductor revenues expected to triple, reaching $2.1 trillion by 2032.

Semiconductor industry revenues projection (Personal Data)

Revenues Projection

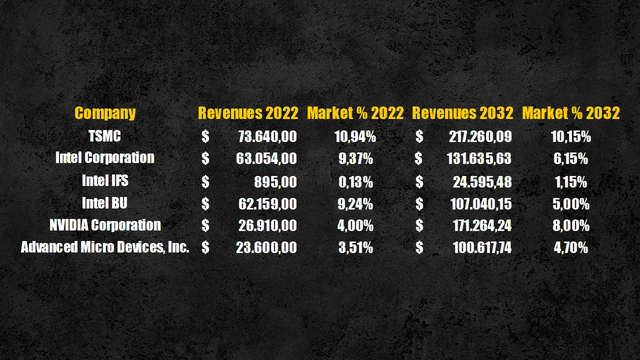

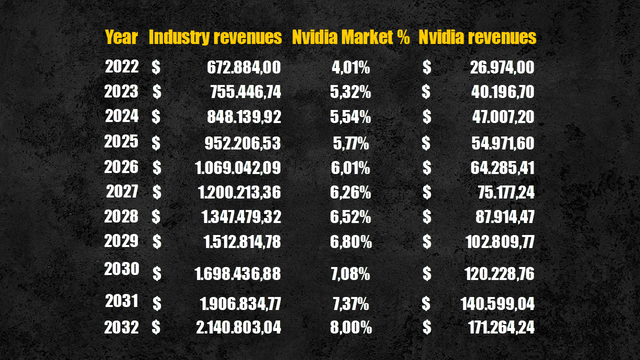

With revenues of $26.9 billion, Nvidia accounted for 4% of the total industry, while the $40 billion expected for FY 2024 would increase its market share to 5.3%.

Looking at its direct competitors, AMD (AMD) was close behind with a market share of 3.51%, while Intel (INTC) – despite its numerous problems – maintained the lead with a market share of 9.37% and $63 billion in revenues.

Projecting Nvidia’s future market share, in my narrative, I wanted to factor in the positive effects that AI technology – or more generally high-performance computing dedicated chips – will have on the company’s ability to attract customers and increase its market relevance.

Currently, Nvidia has the leadership in AI chips, and considering the benefits of using GPUs – or the more advanced Data Processing Units, or DPUs, another Nvidia product – instead of traditional CPUs for high-performance computing, I can see the company growing its market dominance at the expenses of its peers, especially Intel, as the latter will have to focus on its foundry business to succeed with its turnaround strategy – as I underlined in my recent analysis of the company.

With these assumptions, I assumed Nvidia to double its market share, from 4% to 8% by 2032, while Intel’s Business Unit and AMD will account for 6.15% and 4.7% respectively.

Chip companies’ market share (Personal Data)

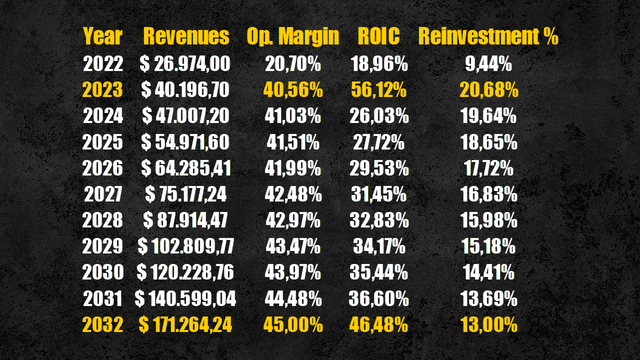

With an 8% market share by 2032, Nvidia’s revenues are expected to reach $171 billion, achieving a six-bagger in 10 years.

Nvidia revenue projection (Personal Data)

Efficiency & Profitability

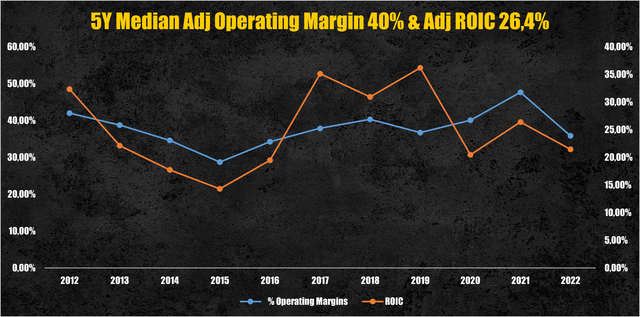

Moving on to efficiency and profitability, adjusting for R&D expenses, Nvidia has a 5-year median operating margin of 40% and a median return on invested capital (ROIC) of 26.41%.

Nvidia operating margin & ROIC (Personal Data)

As seen before, the median reinvestment margin – accounting for R&D, capital expenditure, and acquisitions – is equal to 20.6%.

Nvidia reinvestment margin (Personal Data)

In my narrative, I see Nvidia maintaining top-tier profitability, thanks to its growing market dominance, improving its adjusted operating margin to 45% by 2032. However, to stay ahead of the competition, Nvidia will have to keep reinvesting in new cutting-edge technologies. I assumed the reinvestment margin to remain in the double-digit territory, slowly decreasing to 13% by the time the company reach a steady state.

With these assumptions, Nvidia should achieve a ROIC of around 46% by 2032.

Nvidia future efficiency & profitability (Personal Data)

Cash Flows Projection

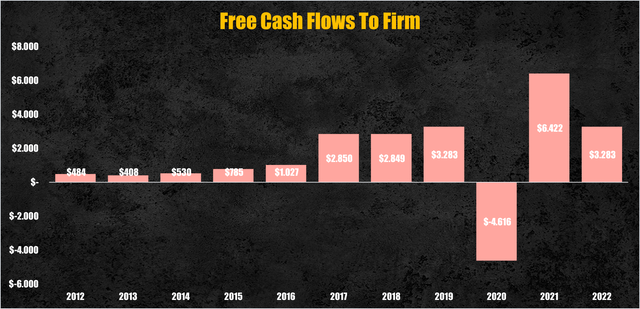

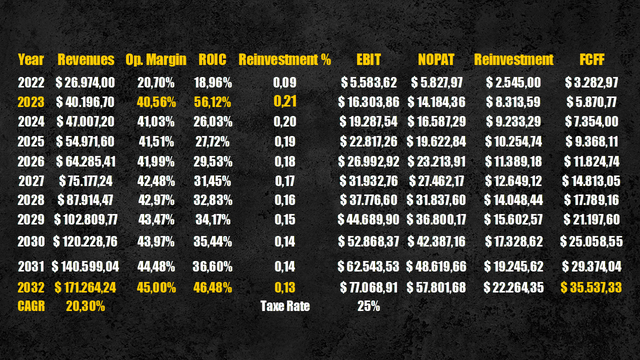

Despite having reinvested a great portion of its revenues, Nvidia was still able to deliver solid free cash flows to the firm (FCFF) to its shareholders.

In the coming years – positively influenced by the increasing adoption of high-performance computing chips for AI and data centre purposes – we can expect the company to keep generating big and consistent FCFF which will sit around $35 billion by 2032, a ten-bagger from the $3.2 billion of FY 2023.

Nvidia FCFF projection (Personal Data)

Valuation

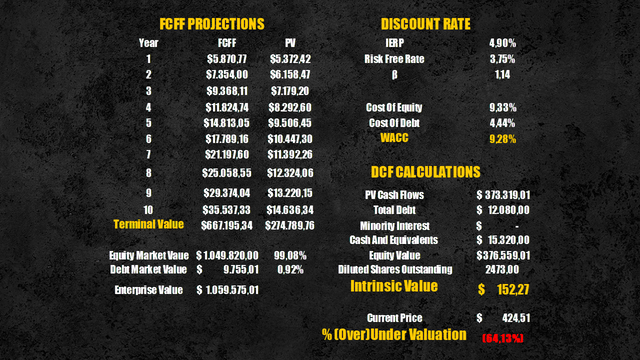

Applying a discount rate of 9.28%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $376 billion or $152 per share.

Compared to the current prices, Nvidia’s stocks result overvalued by 64%.

Nvidia intrinsic value (Personal Data)

Conclusion

Despite optimistic expectations for the future – assuming Nvidia will take the lead in the logic chip industry – the current price cannot be justified, and clearly, the market has overreacted seeing the recent performance and the rapid developments of AI technologies.

Other than temporary euphoria, investing in Nvidia involves some risks. While US Fabless stocks like Nvidia and AMD have skyrocketed in prices, their counterparts Fabs – which manufacture all of their chips – like TSMC (TSM) have remained quite calm and are still undervalued as I underlined in my recent analysis.

The primary reason for such depressed stock prices is the geopolitical risks involved with Taiwan. Nvidia, despite being a US-based company, has very close relationships with Taiwan for its chip supply, and any negative development there could have terrible repercussions on the company’s bottom line.

To conclude, Nvidia is certainly a great company, but at the current prices, it does not represent the best investment opportunity.

If you’re looking for an in-depth analysis of stocks and detailed industry reports, follow me and turn on the notification button to avoid missing any new updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.