Summary:

- Nvidia Corporation’s earnings show strong growth, with Q3 revenue up 94% YoY and data center sales driving impressive performance, despite recent share price declines.

- Elevated forward valuation metrics suggest a need for targeted pullbacks; Nvidia’s forward P/E ratio is 46.33x, higher than most MAG-7 peers.

- Recent share price declines to mid-130s might offer a buying opportunity; support near the 50-day EMA suggests upside potential outweighs downside risks.

- I am raising my outlook to a “strong buy” and targeting new all-time highs before the end of 2024, given the current market conditions.

Robert Way

When I last covered NVIDIA Corporation (NASDAQ:NVDA) on October 1st, 2024, with my article “Nvidia: Bull Flag Aftermath,” the stock was in the process of consolidating at lower levels after posting what were (at the time) record highs of $140.76 on June 20th, 2024. In the article, I lowered my outlook to a “buy” rating. I argued that my strongly bullish expectations had come to fruition, and that the stock would likely need to trade in a sideways fashion long enough to form a new base before another bull rally might be possible. Now that we have received a major earnings update from the company and the stock has experienced substantial short-term declines following this release, I am ready to raise my outlook for this stock to a “strong buy” rating. This is based on my belief that Nvidia’s earnings figures continue to show incredible strength, and the recent declines in share prices suggest that upside potential might outweigh downside risks by a fairly wide margin.

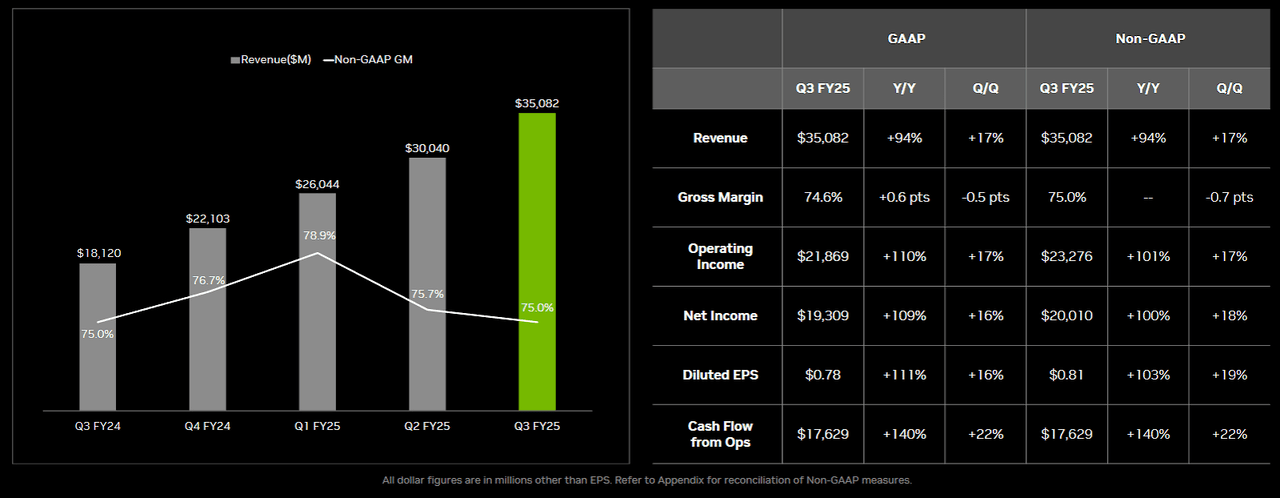

Nvidia: Q3 2024 Earnings Figures (Nvidia: Q3 2024 Earnings Presentation)

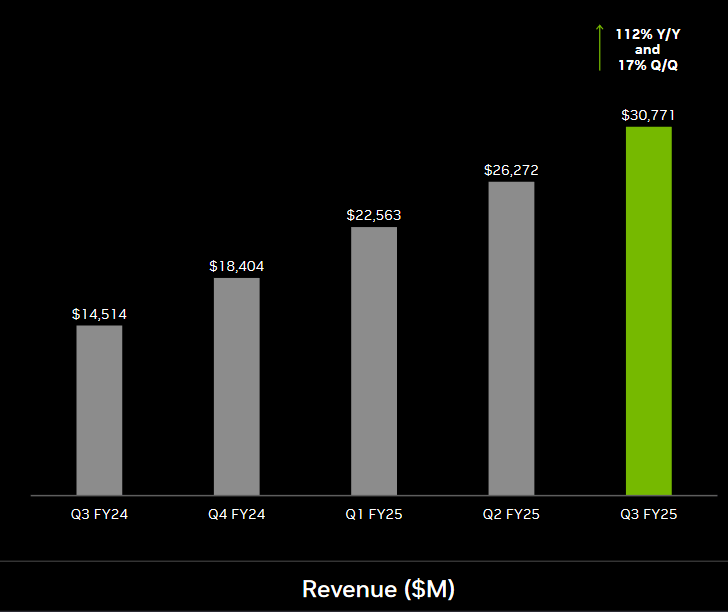

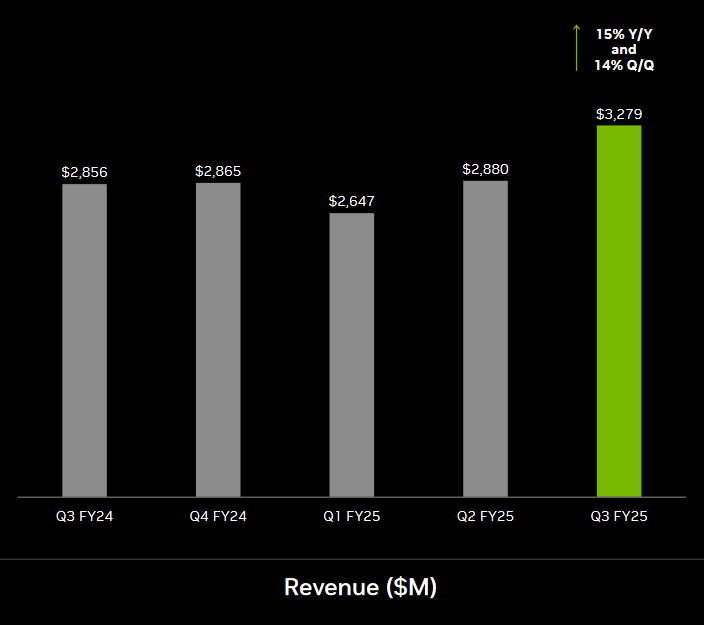

For the third quarter period, Nvidia had very little difficulty in beating consensus estimates on essentially every important metric. On an annualized basis, the company posted revenue growth of 94% (at $35.1 billion) and this also marks gains of 17% relative to the already impressive performances that were seen in Q2 2024. The vast majority of this revenue figure stems from its data center sales, making it apparent that Nvidia has profited from the global shift toward artificial intelligence applications at levels that surpass every other company in the world. For the quarter, Nvidia’s data center segment generated revenues of $30.8 billion, and this equates to annualized growth rates of 112%. Smaller segments also posted gains, with gaming revenues coming in at $3.28 billion (14% growth YoY) and the automotive segment posting just $449 million in revenue (however, this translates to annualized segment growth rates of 72%).

Nvidia: Q3 2024 Data Center Revenues (Nvidia: Q3 2024 Earnings Presentation)

On the earnings side of the equation, results were even more surprising with annual growth rates of 111% (at $0.78 per share), and net income figures increased from $9.24 billion to $19.3 billion. Looking ahead, guidance figures suggest that Nvidia will generate current-quarter revenues of $35.5-39.5 billion, which easily surpassed prior consensus estimates (at the midpoint). If realized, this revenue performance would indicate very respectable gains of 70% (YoY). However, it should also be noted that this would mark a more disappointing headline figure when compared to the 265% YoY revenue gain that was posted during Q4 2023.

Nvidia: Q3 2024 Gaming Revenues (Nvidia: Q3 2024 Earnings Presentation)

Looking at the negative aspects of these results, we can see that the Q3 annualized revenue growth rate figure was weaker than the figures that were generated during the three prior quarterly periods (122% in Q2 2024, 262% in Q1 2024, and 265% in Q4 2023). Overall, this suggests that it is becoming more and more difficult for the company to build on its prior performances and surprise markets in quarterly earnings reports. Additionally, Nvidia’s operating expenses increased by 44% on an annualized basis during the quarter. Finally, the company’s gross margin figure declined by -0.5% (at 74.6%). However, classifying this final metric as a “negative” does seem a bit ridiculous to me because it should be quite that the vast majority of all businesses would be more than happy with a quarterly gross margin figure above 70%.

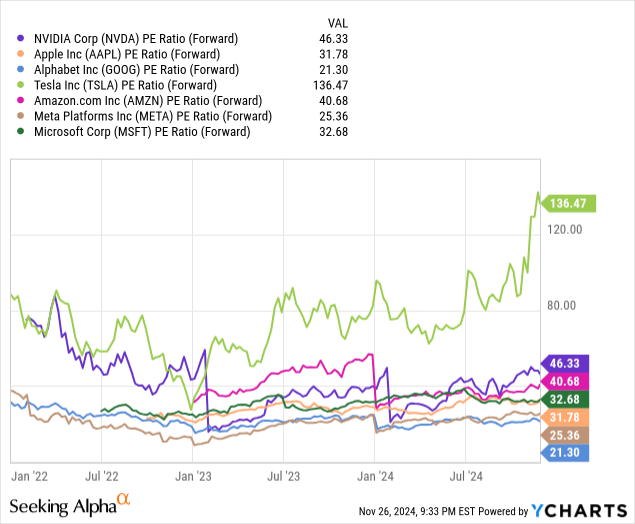

Nvidia: Comparative Forward Price to Earnings Valuations (YCharts)

Data by YCharts.

Since classifying some of these figures as “negatives” seems a bit unfair (at least, on a relative basis), I think it is better to highlight potential risks from NVDA investments through the lens of the stock’s forward valuation metrics. Here, the potential for a downside in share prices seems more plausible because there is only one MAG-7 that trades with a more expensive forward price-earnings ratio. Currently, Nvidia’s forward price-earnings metric stands at 46.33x and the only MAG-7 offering trading at higher levels would be Tesla, Inc. (TSLA) at 136.47x. By contrast, Amazon.com, Inc. (AMZN) trades at 40.68x, while Microsoft Corporation (MSFT) trades at 32.68x and Apple Inc. (AAPL) is seen at 31.78x. Currently, much cheaper options can still be found in Meta Platforms, Inc. (META) at 25.36x and Alphabet, Inc. (GOOG) (GOOGL) at 21.3x. Since the beginning of 2022, Nvidia’s forward price-earnings ratio has been improving, but this longer-term trend has been showing some evidence of reversal if we assess the company’s valuations from the start of 2024.

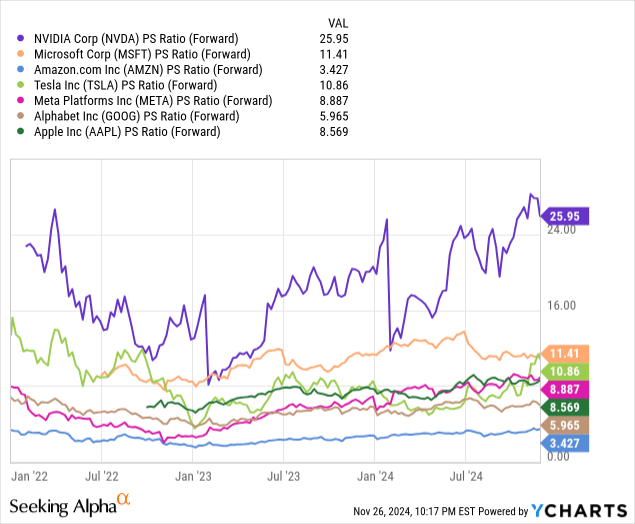

Nvidia: Comparative Forward Price to Sales Valuations (YCharts)

Data by YCharts

Unfortunately, changing this perspective to the forward price-sales metric for this grouping of stocks, the situation actually looks a bit worse. In this case, Nvidia is trading with an elevated forward price-sales ratio of 25.95x and the next companies in line would be found in Microsoft (which is now seen with a much lower forward price-sales valuation of 11.41x) and Tesla at 10.86x. Slightly cheaper ratios can be found in Meta Platforms (which is trading at 8.887x forward sales figures) while Apple is currently trading with a somewhat similar valuation of 8.569x. However, from there we see a fairly substantial drop-off with Alphabet trading at 5.965x and Amazon trading at just 3.427x. Using this metric, we can see that Nvidia has been trading with an increasingly elevated forward price-sales ratio since roughly the beginning of 2023. When we consider the company’s guidance figures for the current quarter period, it looks as though this is a trend that might continue trending in this same direction into the end of 2024.

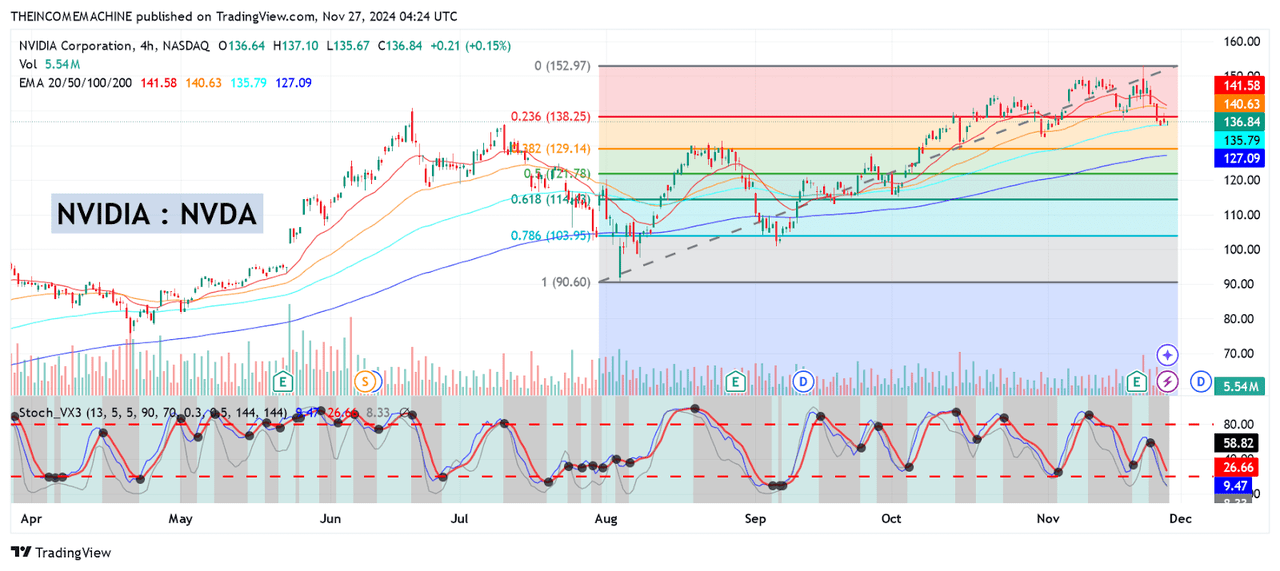

NVDA: Critical Support and Resistance Levels (Income Generator via TradingView)

Given the fact that we are currently seeing elevated forward valuation metrics, it is important for investors to wait for targeted pullbacks before entering into new long positions for this stock. After posting what I would consider to be incredibly strong quarterly earnings figures, NVDA shares encountered a brief spike above the $150 level – only to later see a volatile and erratic reversal in the downward direction. However, now that the stock has fallen back into the mid-130s, I think the stock is worth another look. After falling from the November 21st, 2024 highs of $152.89, NVDA has seen near-term lows of $135.82 on November 25th. Currently, the stock is finding support near its 50-day exponential moving average, and this suggests that downside risk might be outweighed by upside potential at current levels. For me to change my outlook, I would need to see share prices break below the October 31st, 2024 lows of $132.11. If this occurs, I would expect to see a period of sideways consolidation that could extend until the final weeks of the year.

As long as this key support zone remains intact, I will be raising my outlook to a “strong buy” rating because I think that the latest share price declines seem over-extended and a prolonged downtrend seems unlikely to me at this stage. For all of these reasons, I have added to my long positions near the mid-130s, and I am targeting new all-time highs for this stock before the end of 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.