Summary:

- Nvidia is on track to become a $1 trillion company.

- This indicates that the market’s obsession with AI is far from over yet.

- This article offers a fresh look at various growth catalysts that could help Nvidia to continue to exceed expectations.

- It also highlights the potential risks that could kill the company’s momentum.

Justin Sullivan

I was wrong back in March when I stated that it would be hard for Nvidia’s (NASDAQ:NVDA) shares to continue to retain their momentum on AI hype alone. While there are still some risks to Nvidia, the upbeat guidance that the company’s management revealed last week indicates that the market’s obsession with AI is far from over yet. Considering that in a matter of days, Nvidia’s market cap has increased by over $200 billion and now its business is about to enter an elite club of companies that have a market cap of over $1 trillion, it makes sense to take another look at the opportunities that the AI industry offers and re-evaluate my position. Therefore, this article offers a fresh look at various growth catalysts that could help Nvidia to continue to exceed expectations and at the same time highlights the potential risks that could kill the company’s momentum and result in the depreciation of the business’s shares in the near-term.

AI Hype Train Accelerates

Last week, Nvidia reported its Q1 earnings results that were not that impressive. Even though the company’s data center business managed to generate a record $4.28 billion in revenues, Nvidia’s total revenues for the period were still down 13.3% Y/Y to $7.19 billion.

Despite this, the company’s stock managed to skyrocket to new all-time highs and add over $200 billion in market capitalization in a matter of days thanks to the management’s upbeat guidance for Q2. While the consensus on the street was that Nvidia will generate around $7.11 billion in revenues, the company’s management announced that they expect to have around $11 billion in sales during the second quarter. The business is expected to achieve such a target thanks to the expected surge in demand for Nvidia’s products as a result of the increase in popularity of AI tools and applications that require the company’s GPUs in order to properly function.

Performance of Nvidia’s Stock Price (Seeking Alpha)

Considering such an upbeat guidance, it’s safe to say that the generative AI boom which is mostly responsible for the surge in popularity of AI-related applications is not over yet. Even though there are still disagreements about the TAM for AI applications as some analysts believe that the generative AI market alone could be worth over $100 billion while others think that the broader AI industry is likely to be worth ~$1.85 trillion by 2030, it’s nevertheless safe to assume that Nvidia would benefit the most from this AI boom.

This is because in addition to its advanced H100 and A100 GPUs, Nvidia also offers a full stack offering for consumer companies, cloud service providers, and other enterprises that help them fully benefit from the ongoing AI boom. That’s why there are already rumors that even the CEO of Tesla (TSLA) Elon Musk has been purchasing thousands of Nvidia GPUs for his AI project at Twitter, while recent reports indicate that Nvidia has been placing additional wafer supply orders at TSMC (TSM) to meet the surging demand for its advanced chips.

On top of that, during the latest earnings call, Nvidia’s management stated that they believe that the entire data center industry that’s entirely run by CPUs today will begin their transition to more effective and energy-efficient GPU-accelerated computing as generative AI will become their primary workload. The transition itself could take 10 years, which creates significant opportunities for Nvidia to benefit the most from this transition as data center sales are expected to increase the most in the following quarters.

At the same time, Nvidia’s advanced GPUs could also be used in the chip manufacturing process thanks to their ability to significantly reduce cost and power for chip makers who are heavily CPU dependent. Nvidia’s CEO Jensen Huang recently pitched this idea at a major semiconductor industry event, which indicates that the company has lots of different opportunities for growth as the AI hype train continues to accelerate.

What’s Next For Nvidia’s Share Price?

Despite the upbeat guidance and various growth opportunities, the real question now is whether Nvidia’s stock has even more room for growth or are its shares trade close to their peak. After all, we shouldn’t forget that after the recent appreciation, Nvidia is now worth close to $1 trillion simply due to the fact that the market became excited that the company will generate $11 billion in sales in Q2. Add to all of this the fact that the business’s revenue has even declined in Q1 while gross margins barely ticked up and it becomes obvious that if Nvidia fails to deliver on its promises in Q2 then its shares would experience a major depreciation in such a scenario.

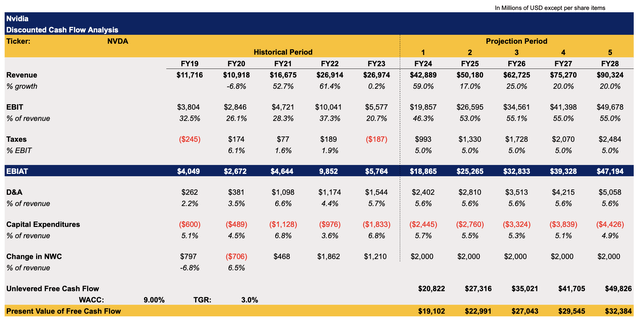

That’s why to figure out whether there is more upside to Nvidia’s shares, I’ve updated my DCF model which previously showed that the company’s fair value is $172.68 per share and didn’t include the latest upbeat guidance and a major growth in sales in FY24 and beyond since it was made before the release of the latest earnings results.

The new model below assumes that Nvidia’s top-line growth rate in FY24 will increase by 59% Y/Y after which the growth rate will subside but remain in the double-digits. Such assumptions are mostly in-line with street expectations. The same is true for the earnings for the next few years. All the other assumptions mostly remain the same while the WACC has been increased from 8% to 9% to better reflect the new macroeconomic reality.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

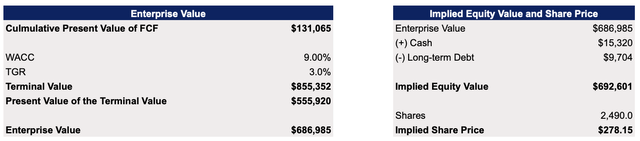

The updated model shows that Nvidia’s fair value is $278.15 per share, which is significantly above the previous calculations but also already below the current market price. However, there are some important things that are needed to be considered.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

First of all, it would be safe to say that this is a conservative scenario as there’s a decent probability that Nvidia’s Y/Y top-line growth rate could be much higher beyond 2024 if data centers and other businesses accelerate the process of replacing their CPUs with Nvidia’s GPUs. At the same time, the improvement of the overall macroeconomic environment along with potential rate cuts by the Federal Reserve next year would decrease the cost of capital for the company. With a WACC of 8%, which was used in the previous model, Nvidia’s fair value would’ve been over $330 per share.

Therefore, as long as Nvidia manages to retain its momentum and exceeds expectations while the overall economy improves, then the assumptions in the model above would be revised and result in a greater fair value for the whole business. Considering that the consensus on the street currently is that Nvidia’s shares still have an upside, it would be safe to say that the assumptions in my model could be too conservative.

Nvidia’s Consensus Price Target (Seeking Alpha)

However, it’s still hard to justify Nvidia’s nearly $1 trillion valuation at this time since the company first needs to deliver on its promises and at least generate the forecasted $11 billion in sales in Q2 before we realistically begin to talk about annual double-digit revenue growth rates. Let’s not ignore the fact that Nvidia’s business barely showed any growth last year while the overall sales of the data center industry even contracted in 2022 despite the fact that generative AI has already started to gain traction at that time. Add to this the fact that the company’s overall revenues decreased Y/Y in Q1, and execution risk could become Nvidia’s biggest nightmare, especially if the Federal Reserve continues to hike rates and crashes the economy.

In addition to that, let’s not forget that Nvidia barely pays any taxes thanks to establishing its business in various offshore jurisdictions that allow it to avoid paying the standard U.S. corporate tax rate of 21%. However, there’s an indication that in the following years, the minimum global tax rate for corporations of 15% is about to be implemented around the globe, which could pressure Nvidia’s bottom-line performance and negatively affect its valuation.

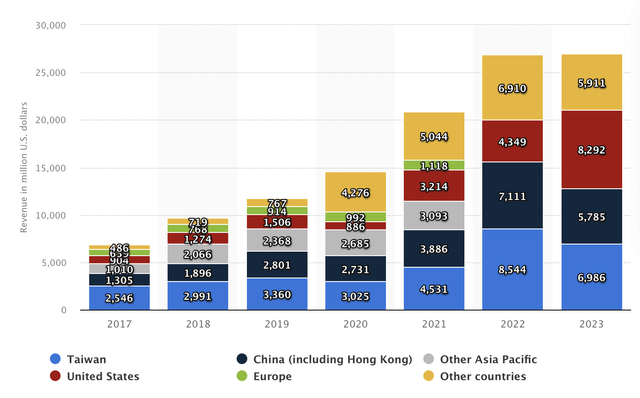

On top of this, we shouldn’t forget that Nvidia along with other chip designers is heavily reliant on TSMC to produce its chips. Since there’s an indication that Beijing aims to be capable of invading Taiwan by 2027, there’s a risk that Nvidia’s capacity to produce its most advanced chips would be limited in case of a war even if TSMC shifts some of the production to its newly built fab in Arizona in the future. Add to this the fact that the ongoing Sino-American trade war has already negatively affected Nvidia’s sales in China, which declined last year, and it becomes obvious that the chip designer is risking losing some of its major markets in case of a further confrontation by the end of the decade.

Nvidia’s Sales By Region (Statista)

Even though the company managed to mitigate some of the risks and adapt to new export restriction rules by selling downgraded versions of its most advanced chips to China, the potential retaliation of Washington against Beijing along with the implementation of new outbound investment rules could nevertheless hinder Nvidia’s efforts to fully distance itself from geopolitical risks. Therefore, a further confrontation between the big powers could make it harder for Nvidia to reach its sales targets and would diminish any potential upside of its shares.

The Bottom Line

Even though there are risks that could kill Nvidia’s momentum and diminish its growth potential, there’s nevertheless a case to be made that the market would continue to justify the company’s current aggressive valuation as long as it manages to deliver on its promises and fully capitalizes on the growth opportunities that were highlighted in this article.

While there’s going to be a time when the share price retracts after the recent explosive growth, I won’t be even trying to forecast when that moment might arrive as the market has been proven to be far too irrational for far too often in recent years. That’s why I’m only following Nvidia’s price action for now and have neither a long nor a short position in the company at this stage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!