Summary:

- Nvidia Corporation’s management gave Q2 guidance for quarter-over-quarter revenue growth rate of roughly 50%.

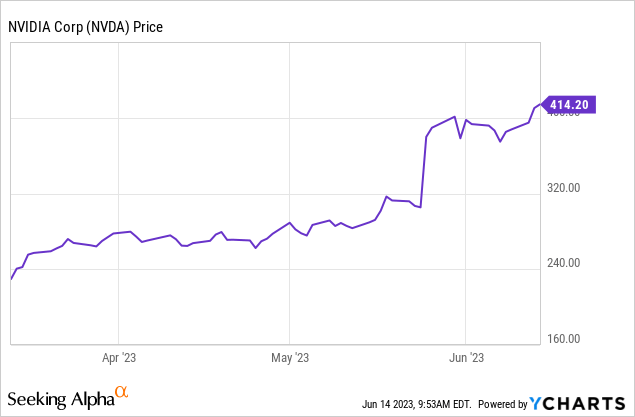

- This optimistic guidance propelled Nvidia stock into a strong rally.

- Even when considering these optimistic growth numbers, Nvidia Corporation seems to be overvalued.

Justin Sullivan

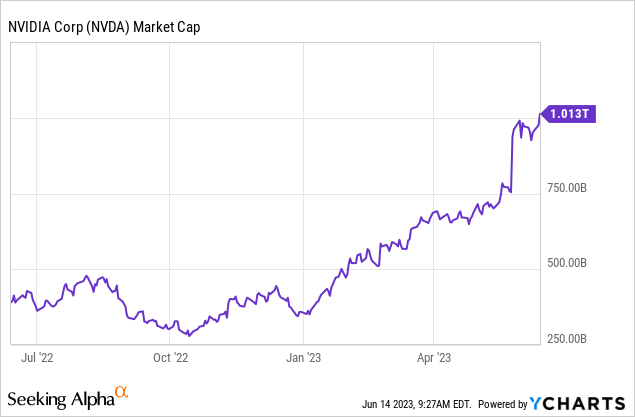

After witnessing Nvidia Corporation’s (NASDAQ:NVDA) rise into the top ranks of the almighty $1 trillion market capitalization club, I believe the time has come to conduct an in-depth analysis of its present valuation. The primary focus of this discussion will be to explore and comprehend the consequences of the current bull run on the company’s position and prognosis.

While I won’t be diving into the company’s business model in this article, I will be examining what the current valuation actually means and what this implies for the expected growth rate of Nvidia.

For those interested in a more in-depth understanding of Nvidia’s operations and their current competitive advantage, I highly recommend Ash Anderson’s article. It provides useful insights into the dynamics of NVDA’s business as well as the elements that make it unique in the highly competitive tech market.

Valuation

We’ll start things off with the Outlook for 2023, to get an understanding what the management of Nvidia is planning for this year.

Outlook for 2023

What really set off NVIDIA’s stock price explosion is the guidance they gave in their latest quarterly report in late May.

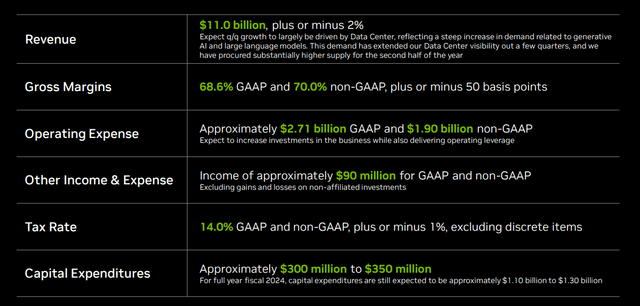

For Q2 2023 (Nvidia’s Q2 2024), management expects revenue to be at $11.0 billion. The data center industry is likely to be the key driver of this quarter-on-quarter rise, owing to a significant surge in demand related to generative AI and massive language models. This increased demand has helped Nvidia data center operation’s visibility into future quarters and, according to management, they have significantly boosted its supply for the second half of the year to accommodate this demand.

Furthermore, the company forecasts that gross margins will be around 70.0%. Operating expenses are expected to be around $2.71 billion GAAP and $1.90 billion non-GAAP, as the company aims to increase investments in the business while achieving operating leverage. Other Income and Expense is expected to generate around $90 million in both GAAP and non-GAAP terms, excluding gains and losses from non-affiliated investments. The tax rate, excluding discrete items, is estimated to be 14.0%. Capital expenditures are expected to range between $300 and $350 million.

For the full fiscal year of 2023, the capital expenditures are expected to range between $1.10 billion and $1.30 billion.

Q2 FY2024 Outlook (nvidia.com)

Discounted Cash Flow Analysis

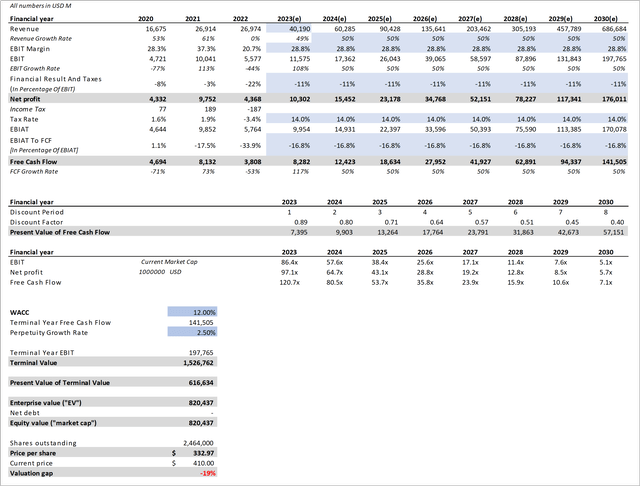

To valuate NVDA, I conducted a discounted cash flow (DCF) analysis to properly predict a suitable share price for the company. The metrics stated below are relatively aggressive and thus pretty much, in my opinion, represent the current bull case from the current shareholders’ point of view. The blue cells in my DCF represent assumptions I made.

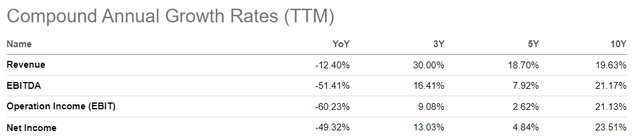

- Revenue: I predicted that the $11.0 billion in sales expected for the second quarter of 2023 will be replicated in both the third and fourth quarters. The corporation recorded $7.2 billion in revenue for the first quarter. When the predicted revenues for all four quarters are added together, the overall revenue for FY23 is likely to be around $40 billion. This is a year-on-year growth rate of 49%. From there on, I estimated a very optimistic growth rate of 50% for the following years. Keep in mind that the historic ten-year growth rate sits at around 20%:

CAGRs of Nvidia (seekingalpha.com)

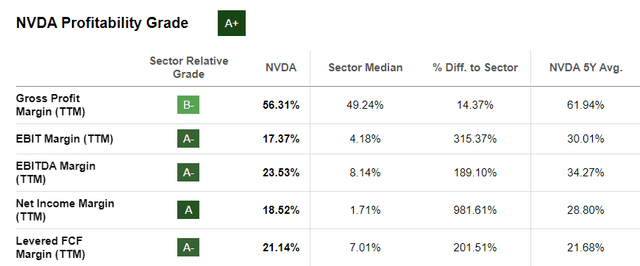

- EBIT Margin: For the EBIT margin, I used the average of the last 3 years and anticipated that it will stay flat at 28.8% for the next 8 years. This is also pretty much in line with Nvidia’s 5y average:

Profitability of Nvidia (seekingalpha.com)

- Financial Result And Taxes: I averaged the values of the last three years and therefore used -11% to calculate the Net Profit for the years 2023 to 2030.

- Tax Rate: The tax rate used for this DCF is 14%, right at management’s guidance for Q2 2023.

- Free Cash Flow: I calculated the EBIAT using the aforementioned tax rate and then attempted to estimate an appropriate EBIAT to FCF ratio. To be aggressive again, I averaged out the last 3 years, even though there is a clear development to an increasingly worse EBIAT to FCF ratio visible – from 1.1% down to -33.9% over three years. We, therefore, arrived at a ratio of -16.8%.

- WACC: I used the medium of NVDA’s current WACC of 12%.

- Perpetuity Growth Rate: The perpetuity growth rate assumed for the analysis is 2.5%.

DCF of Nvidia (nvidia.com; seekingalpha.com)

This analysis gives us a target share price of $332.97. When considering this and assuming NVDA’s business will develop like we predicted, there is currently a potential downside of ~19%.

To be honest, when I started this DCF analysis, I expect the valuation to be a lot worse and the stock to be far more overvalued. But one has to keep in mind that in this DCF really a lot of very optimistic assumptions were made:

- The Q2 revenue guidance is met and Q3 and Q4 perform equally as good.

- Revenue CAGR of 50% for the next 8 years even when the Nvidia’s ten-year average growth rate was at ~20%.

- EBIAT to Free Cash Flow metric is the average of the last three years, even though the metric constantly declined over the last years.

Conclusion

Based on our very optimistic discounted cash flow analysis, which pretty much, in my opinion, is the “Bull Case” for Nvidia Corporation stock right now, we arrive at a price target of $333.00. This currently represents a downside of around 20%.

At first look, a 20% drop may not appear to be cause for concern. However, keep in mind that this analysis is based on an extremely favorable outlook and solid growth projections, leaving little tolerance for unanticipated contingencies or underperformance.

Given these considerations, I currently rate Nvidia Corporation stock a “Strong Sell” and I just recently liquidated my Nvidia position, locking in a solid return of roughly 150%.

We’ll see if this was the right decision.

However, if we see another downturn in the stock, I will not hesitate to re-establish my investment. Nvidia Corporation continues to be a high-quality corporation, and a reduced price point may give an appealing re-entry opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.