Nvidia: Intrinsic Valuation Is Spicy With AI Hype

Summary:

- Nvidia’s data center GPUs (H100 and A100) are effectively the building blocks for the most powerful AI supercomputers in the world, including those from Microsoft and Meta Platforms.

- Nvidia reported a top and bottom line beat on its financial results for Q4,22, but its revenue is still down 21% year over year.

- My discounted cash flow valuation model indicates the stock is ~24% overvalued at the time of writing.

- The technical charts indicate Nvidia’s share price is approaching at resistance level of $269 per share, which could mean a pullback is due.

Sundry Photography

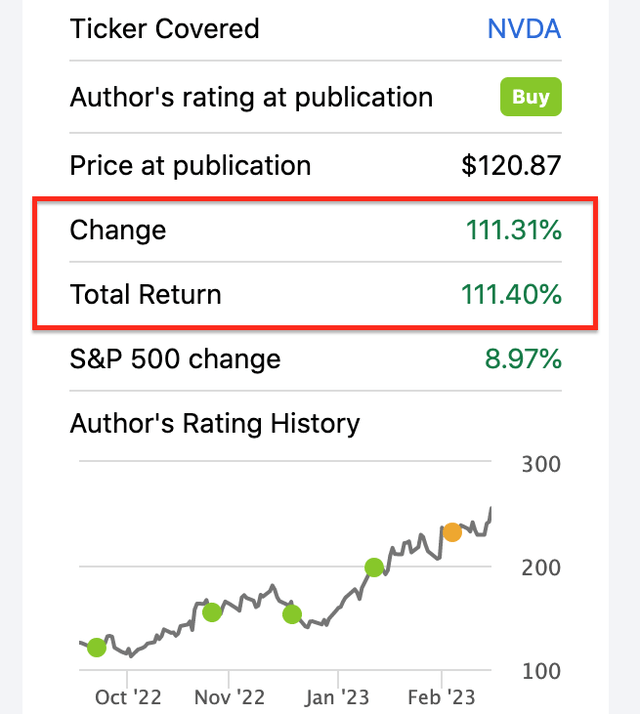

Nvidia (NASDAQ:NVDA) is well known for its high-performance graphical processing Units (GPUs) for both PCs and data centers. In a previous post on Nvidia, I stated the company is poised to become the “backbone of the AI industry” due to its state-of-the-art GPUs (A100 and H100). Since that post and my post in September 2022, its stock price has increased by 111.4%, which is substantial, and no doubt many investors will be in huge profits right now. Now the question is has the rally gone too far? Is this exuberance justified and what is the intrinsic valuation? In this post I’m going to answer those questions as well as break down the technical charts for the stock.

Nvidia stock price increase over 100% (Deep Tech Insights Post)

The Backbone of the AI Industry

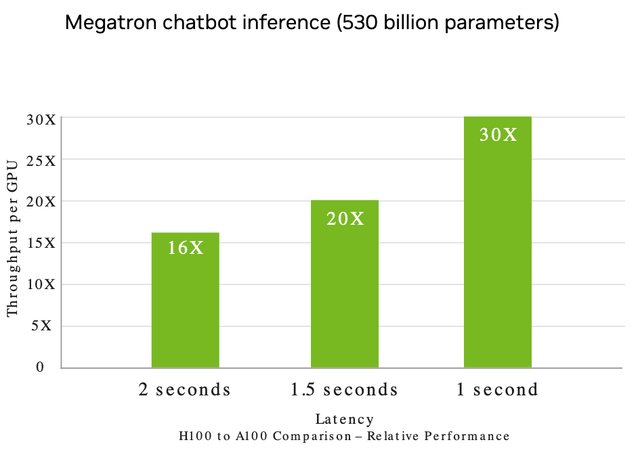

Let’s recap on why Nvidia is the “backbone of the AI industry,” in my opinion, and also discuss some new information that I haven’t discussed in prior posts. Firstly Nvidia’s A100 and latest H100 data center GPUs are effectively the building blocks of AI supercomputers and for good reason. Its newest H100 GPU is an order magnitude greater than its A100, with up to 30 times better performance for large language transformer models. This model type includes Nvidia’s Megatron Chatbot and the widely popular ChatGPT or GPT-3 model by Open AI.

As I’m sure you may be aware Microsoft (MSFT) invested $10 billion in Open AI (which created ChatGPT) and the company has announced integrations into its Bing search engine. In November, Microsoft also announced plans to build one of the most powerful AI-focused supercomputers in the world, from Nvidia H100 and A100 GPUs. More recently (March 13, 2023), Microsoft has announced it’s offering AI as a service through its Azure Cloud infrastructure and Nvidia-based virtual machines. This product called the ND H100 V5 VM (Virtual Machine) basically enables startups or any other organization to leverage the power of Nvidia H100 GPUs directly through Azure. These are all connected via Nvidia Quantum 2 Infiniband which is Nvidia’s state-of-the-art networking solution. This huge deal with Microsoft basically acts as a solid endorsement of its networking technology, which effectively means Nvidia could surpass legacy networking players such as Cisco.

Paraphrasing Microsoft’s head of product for Azure, you can’t just “buy a whole bunch of GPUs, hook them together and they start working.” There’s a huge amount of “system level optimization” required to “get the best performance” and that “comes with a lot of experience over many generations.”

This “experience” is basically what Nvidia has gathered from building its own large language model (Megatron) and from co-developing solutions with the major AI cloud infrastructure providers. I mentioned Microsoft Azure prior, which is the second largest cloud infrastructure provider in the world. In addition, Nvidia has previously announced Meta Platforms was building an AI supercomputer with over 6,000 Nvidia GPUs. I couldn’t find a massive amount of information regarding AWS (the largest cloud infrastructure provider) using Nvidia GPUs for its own AI supercomputer. However, I did discover one post which referenced AWS using GPU-based instances, with Nvidia’s A100 hardware. Thus even though Microsoft and Amazon are considered to be competitors, I can’t see why Nvidia couldn’t provide the hardware to both parties for AI supercomputers.

Alphabet (GOOGL) (GOOG), or Google, the third largest cloud provider, hasn’t disclosed whether its humongous LaMDA AI model, used Nvidia GPUs for its hardware. However, we do know that Google has used Nvidia GPUs for many deep learning models, such as its image recognition system, its BERT natural language model, its own “GPT-3,” Tensor Flow, and many more. Oracle has also partnered with Nvidia in a software partnership to provide AI to enterprises.

Intrinsic Valuation Update and Forecasts

In my previous post on Nvidia, I covered its financials for the fourth quarter of the fiscal year 2023. Here’s a quick recap with my forecasts embedded into my updated valuation model. Nvidia reported revenue of $6.05 billion, which rose by just 2% quarter over quarter but was still down ~21% year over year. Its data center revenue was the growth driver (as expected) increasing by 11% year over year to $3.62 billion. However, its gaming segment revenue was still down an eye-watering 46% year over year to $1.83 billion. A positive is sequentially gaming revenue did increase by 16% year over year. This could be a sign of a recovery in the gaming industry, which is cyclical by nature and had a major boom in 2020.

In February 2023, Microsoft announced an “expansive” Xbox gaming deal with Nvidia which was a positive sign. I have forecast 16% revenue growth for “next year” or the next four quarters in my model. This is 1% higher than my prior estimates and driven by further information regarding Microsoft’s AI partnership and other cloud providers. In years 2 to 5, I have increased my growth rate estimate from 30% to 31% per year. I forecast this to be driven by a rebound in the cyclical gaming market, as well as continued growth in the Cloud industry, which is forecast to be worth $1.7 trillion by 2029. I also forecast continued growth in Nvidia’s automotive segment, which increased its revenue by a blistering 135% year over year to $294 million in Q4,FY23.

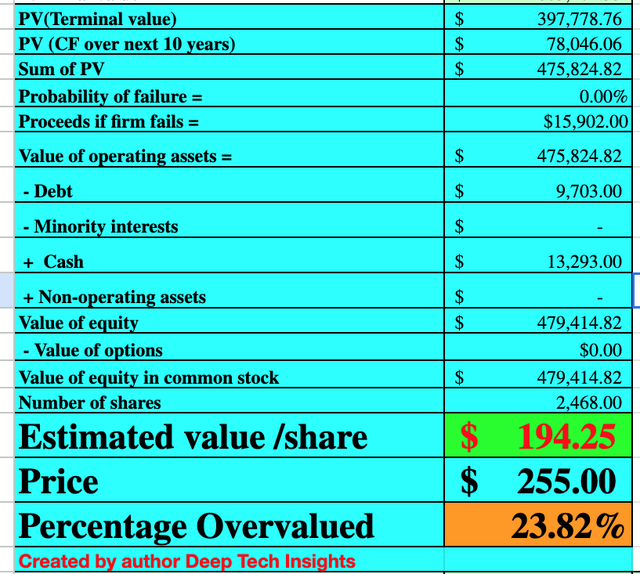

Nvidia stock valuation 1 (Created by author Deep Tech Insights)

Moving onto margins, Nvidia reported operating income of $5.58 billion for Q4, FY23 which declined by 44.46% year over year. This was driven by slow top-line growth, while its operating expenses rose by 21% year over year. The only silver lining is much of this expense growth was related to investments into its infrastructure. Therefore as the company begins to grow revenue again, it should benefit from operating leverage long term. I have capitalized Nvidia’s R&D expenses to boost its operating margin. I have forecast an operating margin of 41% over the next eight years. This is fairly optimistic as its highest operating margin ever reported was 38.8% in the quarter ending May 2022. Therefore I have forecast Nvidia can return to this past margin, as the gaming industry rebounds. Then this can be enhanced by sales of its high-margin GeForce NOW cloud gaming and visualization services which are poised to benefit from the rebound in gaming and the forecasted growth in the Metaverse industry.

Nvidia stock valuation 2 (created by author Deep Tech Insights)

Given these forecasts and financials, I get a fair value of $194 per share, the stock is trading at $255 per share and thus it’s ~24% overvalued. This “overvaluation” is partially justified by the tailwinds in the AI industry and Nvidia’s solid position as the “backbone of the industry.” The market is currently pricing a 20% growth rate for “next year,” above my 16% estimate. In addition, to a 36% growth rate in years 2 to 5, up from my forecast of 31%. These aren’t impossible numbers by any means but given the uncertain macroeconomic environment, there is some AI exuberance baked into the stock price.

Technical Analysis

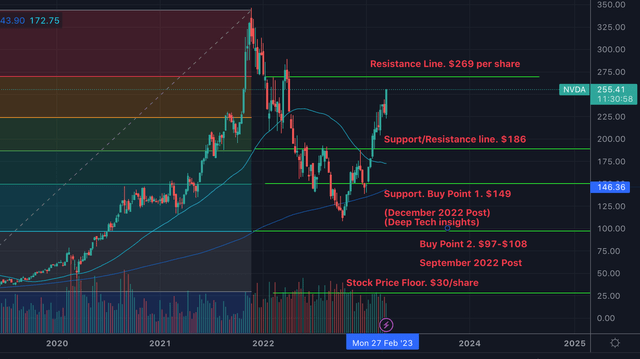

Generally, I’m an investor who uses fundamental analysis such as analyzing revenue, earnings etc. However, I believe it can sometimes help to combine this with technical analysis, in order to help identify “buy” and “sell” points. In this case, my previous fundamental and technical analysis has played out exactly as forecast. Starting at the bottom right of the chart below, I identified “Buy Point 2” at between $97 and $108 per share, which was in line with my September 2022 post on the stock. Since that point, the stock price has “ripped” higher and broken through the “buy point 1” level and the “resistance line” at $186 per share.

Nvidia technical analysis (created by author Deep Tech Insights)

We’re now approaching a new resistance level of $269 per share. In a prudent scenario, the stock is likely to “bounce” off this resistance and it may correct back down to the $186 level. This is because Nvidia is trading substantially above its 50-day and 200-day moving average, therefore “reversion to the mean” is likely. This also could be driven by the “hype” around AI, dying down for the time being until Nvidia’s financials have caught up, with regard to a gaming market that hasn’t fully recovered.

In another scenario, Nvidia’s stock price could “breakthrough” the resistance line at $269 per share, and once a clean break is made (past $287), it could go higher to $341 per share, the stock price peak in November 2021. An upcoming catalyst for a move higher would be the Nvidia Technology Conference [GTC] on March 20 to the 23. This will include talks by the co-founder of Open AI and Microsoft even plans to showcase its “purpose-built” AI infrastructure. I imagine the stock price will rise during this event, but after the “hype” will likely die down for the time being, until the gaming market recovers and Nvidia’s expenses growth starts to slow down.

Therefore, the question is what should you do? I’m not in the business of giving specific financial advice (as it depends upon your investment value, trade size, and financial position, etc). I will give you the risk/reward scenario. In the first scenario, Nvidia has a 5% upside to the ($269 per share resistance) and a 27% downside if it falls back to the prior support line at $186 per share, therefore in this scenario, it would make sense to cash out a portion of the profits (if you invested during my early posts and your position is now up by over 113% like myself). However, in the second (best case) scenario Nvidia could rise by a further 33.7% to $341 per share (the prior peak). I will bring everything together in my “final thoughts” section next.

Final Thoughts

Nvidia is an innovative technology company that’s the market leader in high-performance GPUs, with over an 80% market share (discrete type). The company is poised to benefit from the growth in the AI industry and its latest H100 is effectively the building block of the latest AI supercomputers. However, its stock price has gone on a blistering bull run and increased by over 100%. My intrinsic valuation model now indicates the stock is close to 24% overvalued at the time of writing. My personal rule with long-term investments is I don’t sell when slightly overvalued but only when “egregiously” overvalued, this philosophy also is popular with many successful hedge funds which I have studied. In this case, 24% overvalued is high but not too crazy just yet. However, given Nvidia is also approaching a technical resistance level, I will label the stock as a “hold” overall. For me personally, I will likely be cashing out a portion of my profits from the ~100% gain but then will likely “hold” a portion of the stock for the long term. Then if Nvidia dips in price, I will likely buy back again if or when it drops below my intrinsic valuation.

Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.