Summary:

- Recent inventory data shows a buildup for key rivals such as AMD.

- In contrast, NVDA sits on record low inventory.

- Together with its higher unit price, this serves as a clear sign for robust volume and superior pricing power for NVDA.

- I further project demand from training/deploying Large Language Models to continue.

- These catalysts all point to another quarter of outsized growth for NVDA.

Antonio Bordunovi

NVDA stock: the evolving competitive landscape

I last covered Nvidia Corporation (NASDAQ:NVDA) about a little more than a month ago. As you can see from the screenshot below, the article was titled “Nvidia’s Blackwell Finally Addresses An AI Bottleneck” and published by Seeking Alpha on June 24, 2024. More specifically, that article explained why:

I view Nvidia Corporation’s Blackwell as a game changer for the deployment of AI chips (my first time using this term in my SA articles). With a 25-fold reduction in energy consumption, I expect Blackwell to fundamentally change the budget allocation of end users. Performance improvement and other ripple effects (such as cooling demand) can further amplify the impacts.

That article was mainly written for readers with an interest in technical specs and intentionally placed a focus on the energy efficiency of NVDA’s new Blackwell chip. In this article, I want to examine the stock from the business perspective to incorporate the new developments since my last writing. The most important developments in my view are twofold. First, its key competitor, Advanced Micro Devices (AMD), has recently released its 2024 Q2 earnings report (ER). The updates in AMD’s ER, especially the inventory data, provide key insights into the ongoing competitive landscape in my view. Second, the demand for AI training and application has kept increasing since my last writing. In the remainder of this article, I will argue why these factors point to another monstrous quarter for NVDA ahead.

NVDA stock: What does AMD inventory data tell us

I do not want to make this article an earnings review for AMD. So I will just take the risk of oversimplifying things here and only point out the parts that are mostly relevant to the analysis in this article. Overall, AMD reported a strong quarter in my view. Topline growth from the Data Center Segment (115% increase YOY) is especially noteworthy, and I will revise this point later.

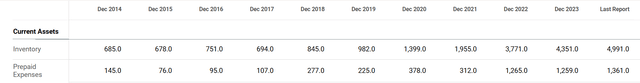

In its Q2 report, AMD also reported an inventory level of almost $5B ($4.99B to be exact, as shown in the next chart). To wit, AMD’s inventory surged sharply in 2021, rising from less than $2B in 2021 to over $3.7B in 2022. It has kept rising at a rapid pace since then, and the current inventory of $5B is a record level thus far.

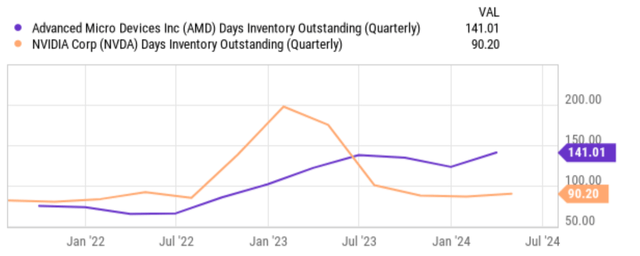

Of course, there is nothing wrong if the company’s sales grow at a corresponding pace. But unfortunately, it is not the case here, as you can see from the next chart. AMD’s inventory not only hovers around a record level in dollar amount but also in terms of days of inventory outstanding (DOIO). While in contrast, NVDA’s DOIO data sits near the lowest level in multi-years, suggesting to me that it can sell its chips as fast as it makes them.

The signal is even louder and clearer in my mind when the pricing of NVDA chips is taken into account. According to the following data provided by Toms Hardware,

According to Citi’s price projections for AMD’s MI300 AI accelerators, Nvidia currently charges up to four times more for its competing H100 GPUs, highlighting its incredible pricing power as a shortage of H100 GPUs continues. Nvidia’s H100 AI GPUs cost up to four times more than AMD’s competing MI300X. AMD’s chips cost $10 to $15K apiece, while Nvidia’s H100 has peaked beyond $40,000.

I believe such a combination of low inventory and high unit pricing will be translated into another quarter of outsized growth and be reflected in its Q2 financials.

NVDA Stock and LLM Demand

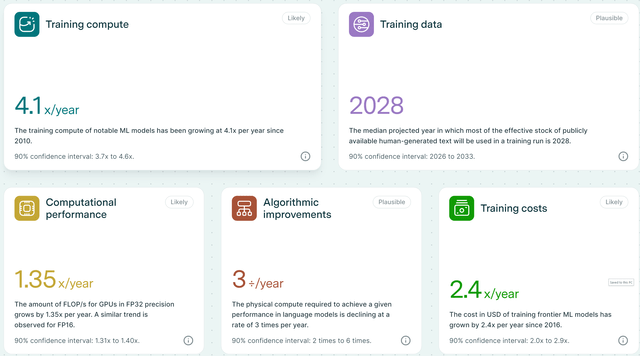

Another catalyst that has been accelerating is the demand for training/deploying LLMs (large language models). The precise measure of model size and computing requirements are beyond the scope of this article. And there are various angles to dissect the numbers, as you can see from the following statistics provided by EpochAI. To quote a few numbers, their data show that the training computing requirements of notable ML (machine learning) models have been growing at 4.1x per year since 2010. The dollar cost to train these models has grown by 2.4x per year since 2016.

LLMs are the cornerstone for generative AI applications. So far, the trend is that larger models with more parameters can lead to improved accuracy and a wider range of applications. Current models feature parameters on the order of ~2 trillion. My own rule of thumb based on recent data is that the LLM model sizes and the corresponding training requirements have been doubling about every 6 months. Doubling a number as large as 2 trillion every 6 months sounds very impressive (or even mind-boggling) and, of course, cannot go on indefinitely. However, I expect the trend to keep going for a few more years at least, considering. As a reference point, the human brain has over 100 trillion synaptic connections, and it will take a few more doublings before we can get our AI algorithms to remotely resemble true intelligence.

All of these point to a continued up-cycle for NVDA’s leading AI chips. Of course, a rising tide lifts all boats. In AMD’s recent Q2 earnings report, its data center segment reported a 115% YOY topline growth as aforementioned. I believe a large driver for such growth is the acceleration of the AI-related business. Judging by the analysis presented in the previous section regarding inventory and pricing, I believe NVDA will benefit even more than what AMD has just reported.

Other risks and final thoughts

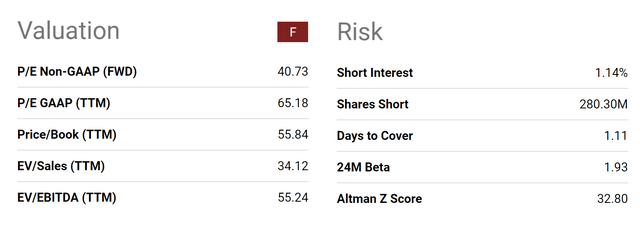

The stock entails considerable downside risks at the same time and certainly is not for more conservative investors. It is a rare case you can experience a 10% daily price swing for a multi-trillion dollar company (e.g., it went up 10.9% during intraday trading when I am typing these lines). I expect such extreme volatiles to persist for a few reasons. First and foremost, the valuation is quite extreme here, as you can see from the chart below. The P/E ratios (on both GAAP and non-GAAP bases) are at very elevated levels (in a range of 40x to 65x). With such a premium P/E, any sign of a setback, even temporary, could trigger large price corrections. Overall, the stock’s beta is 1.93 in the past 24 months, meaning that NVDA’s stock price is more volatile than the overall market by almost a factor of 2x.

To add to the volatility, advanced chips are also in the crossfire of the ongoing geopolitical tension, especially between the U.S. and China. China is a key market for NVDA (and other chip companies too). The U.S. government has imposed various export restrictions in the past 1~2 years on AI chips and also other related equipment/technologies to Chinese companies. A most recent example is quoted below.

NEW YORK, July 31 (Reuters) – President Joe Biden’s administration plans to unveil a new rule next month that will expand U.S. powers to stop exports of semiconductor manufacturing equipment from some foreign countries to Chinese chipmakers, two sources familiar with the rule said. But shipments from allies that export key chipmaking equipment – including Japan, the Netherlands, and South Korea – will be excluded, limiting the impact of the rule, said the sources who were not authorized to speak to media and declined to be identified.

All told, for investors who can look past these near-term volatilities, I see an outsized potential in the stock. To recap, the key factors analyzed in this article are twofold. First, I see both robust demand for its chips and superior pricing power over key competitors such as AMD, judging by the inventory data. Second, I anticipate the demand from training/deploying LLM to continue for a few more years (say about 3 years) judging by the recent trend and the current status of our LLM. Such an upcycle certainly will not only serve as a profit driver for NVDA, but I see it best positioned to capitalize here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.