Summary:

- Nvidia has a strong track record of delivering exceptional growth while maintaining very high profit margins.

- Both sales and earnings per share are expected to continue to grow impressively, increasing almost fivefold over the next ten years.

- Despite strong financials and a positive outlook combined with experienced management, the results of the valuation analysis suggest that the recent increase is not consistent with the underlying fundamentals.

Antonio Bordunovi/iStock Editorial via Getty Images

Investment thesis

NVIDIA (NASDAQ:NVDA) stock is up more than 60% year-to-date, largely due to the market rewarding Nvidia for its involvement in the land rush fever in the artificial intelligence [AI] industry, particularly ChatGPT and the like. I agree that Nvidia is firmly positioned to benefit from this secular shifts in computing industry, the company has strong history of delivering topline growth together with exceptional margins.

But, at the moment, valuation analysis suggests the stock is significantly overvalued.

Company information

Headquartered in Santa Clara, California, NVIDIA was incorporated in California in April 1993. The company specializes in designing and manufacturing advanced graphics processing units (GPUs), which are used in a variety of industries, including gaming, artificial intelligence, data centers, and the automotive industry.

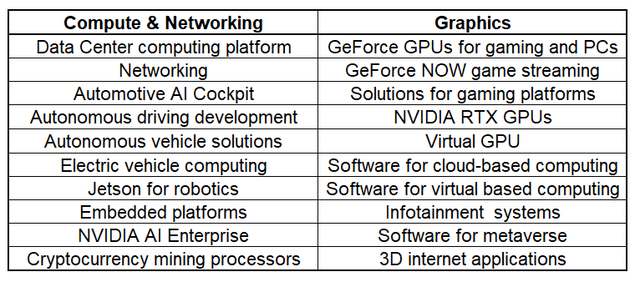

The company reports its financials in two segments: Compute & Networking and Graphics. To get better understanding of what comprises these two segments please refer to the table below.

Based on Nvidia 10-K report

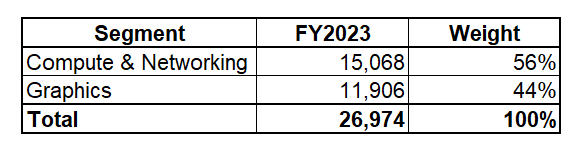

The company’s financial year ends on January 31. This means that the Company’s fiscal year runs from February 1 of one year to January 31 of the following year. In FY2023, which ended on January 29, 2023, Compute & Networking segment was leading company’s sales with revenue representing 56% of the total amount.

Author’s calculations

Financials

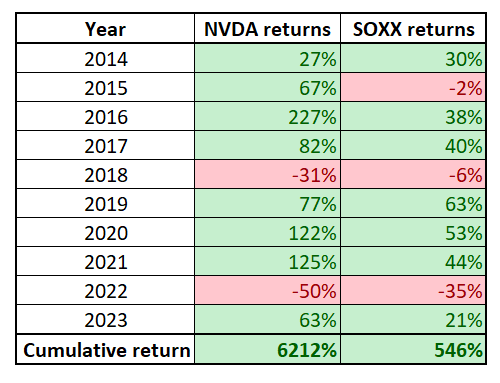

In last 10 years Nvidia has consistently delivered strong financial results, with revenue and profit growth that is among the best in the industry. Stellar financials enabled the company’s market cap to outpace its peers in the semiconductor industry. In the table below I compare returns of NVDA stock during last 10 years with iShares Semiconductor ETF (SOXX). The row “2023” stands for year-to-date returns.

Author’s calculations

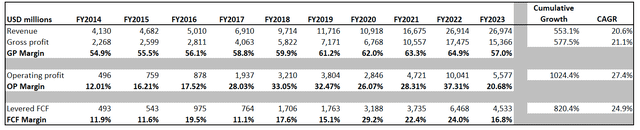

If we look at the company’s financial performance 10 years back, there was a topline growth with a 20.6% CAGR and gross margins within the 55-65% range. The company’s operating profit together with levered free cash flow [FCF] grew even faster with CAGR of 27.4% and 24.9%, respectively.

Author’s calculations

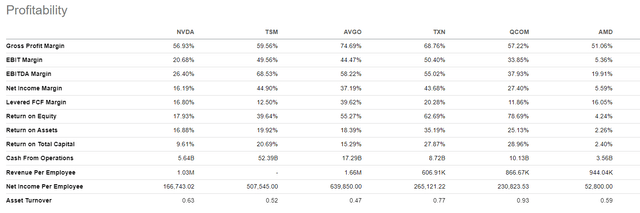

Here I would like to add context to figures presented above, because I believe it is crucial. Many investors explain Nvidia stock phenomenon by the stellar pace of topline growth and the company’s high profitability. But, If we refer to peer comparison, Nvidia’s margins are not by far higher than other semiconductor companies demonstrate. More to say, across some of profitability metrics, NVDA is not best-in-class.

Seeking Alpha

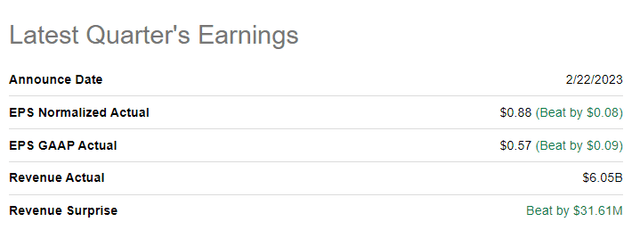

On February 22, the company announced it’s 4Q and full FY2023 results. Nvidia slightly topped consensus estimates both in terms of quarterly revenue and EPS.

Seeking Alpha

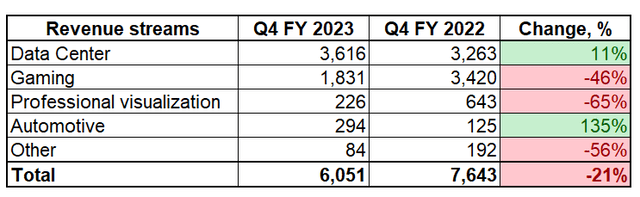

Quarterly revenue was $6.05 billion which is 21% lower on a year-over-year [YoY] basis and up 2% sequentially. Decrease in quarterly revenue YoY mainly comprised a 46% drop from gaming with other revenue streams offsetting each other almost evenly.

Author’s calculations

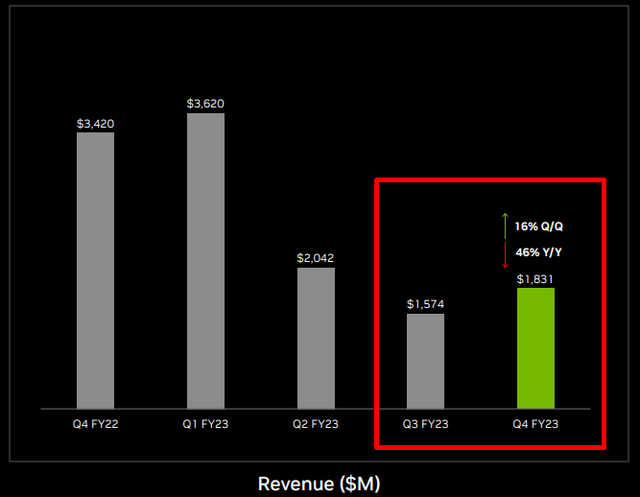

It is important to mention that a sharp drop in Gaming reflects the effects of the correction of channel stocks which seems to be behind being bottomed in Q3 of FY 2023.

Nvidia

Professional visualisation also demonstrated significant drop YoY with the same problem as Gaming which related to the channel inventory correction. Management expects this problem’s effect to end in the first half of FY 2024.

Full year revenue was $27 billion, which was flat from the prior FY with margins and EPS shrinking.

For Q1 FY 2024 outlook, management expects revenue at approximately $6.5 billion, which is higher sequentially but almost 22% lower than the company reported for Q1 FY 2023 and gross margin is expected to shrink about 150 basis points YoY.

Earnings call on results of Q1 FY 2024 is scheduled for May 24.

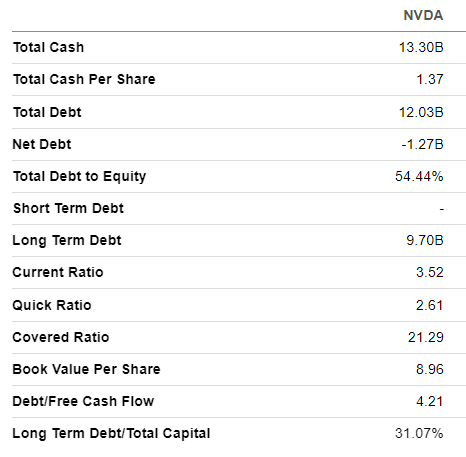

As of the latest fiscal year-end, the company’s balance sheet is strong with good liquidity and leverage ratios. During FY 2023 the company repurchased 63 million shares for $10.04 billion. As of the latest reporting date, Nvidia is authorized, subject to certain specifications, to repurchase shares of common stock up to $7.23 billion through December 2023.

Seeking Alpha

Consensus estimates forecast that the company will hit a $100 billion in annual sales by FY2033, demonstrating consecutive topline double digit percentage growth, except for FY2029. EPS is expected to follow this pace by increasing almost fivefold compared to FY2023.

Valuation gone ridiculous this year

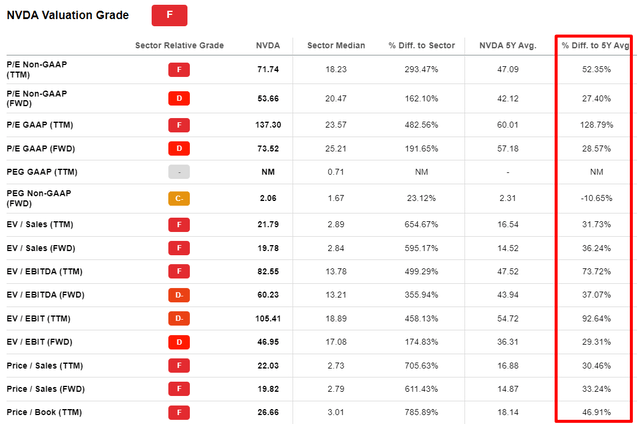

Since the beginning of current year, Nvidia stock had a massive rally of over 60% YTD which by far outpaced other semiconductor companies’ shares.

Seeking Alpha

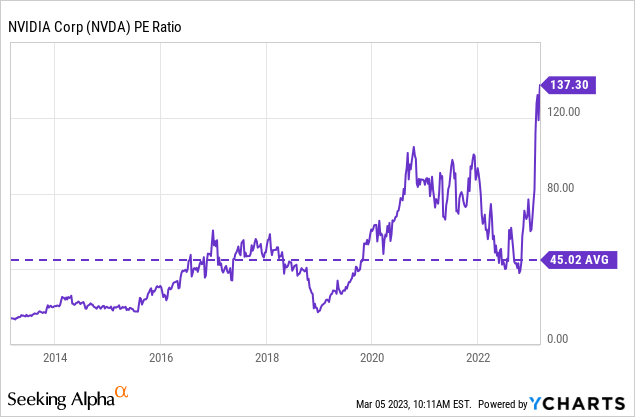

Nvidia’s valuation multiples were high in last 10 years with P/E ratio averaging at 45.02 for the period. Current P/E multiple [GAAP TTM] is at 137.30, which is by far higher than 10 year average.

The company has delivered stellar growth in the last decade together with very wide margins; therefore it is not surprising that Nvidia’s valuation multiples are much higher than sector median. But, from the screenshot below, we should pay attention that current multiples are also much higher than Nvidia’s 5 year averages, which indicates that the stock is too pricy now.

Seeking Alpha

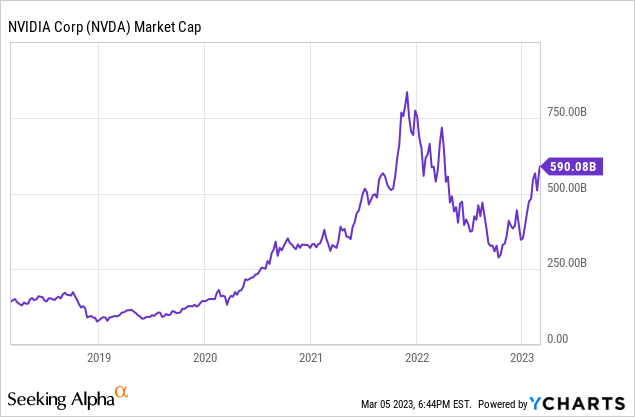

In my opinion, it is also critical to emphasize that the company’s current level of market capitalization of around $590 billion is at late 2021 level. Let me remind you that late 2021 was the period of lowest possible Federal funds interest rates, inflation was considered “transitory”, and no quantitative tightening plan was discussed. A lot is being told about current unfavorable macroenvironment, so just let me briefly remind you that currently Fed rates are at 4.75% which is highest level since the Global Financial Crisis and some of Fed officials believe that more rate hikes are needed to tame inflation, which in reality appeared to be sticky, not transitory.

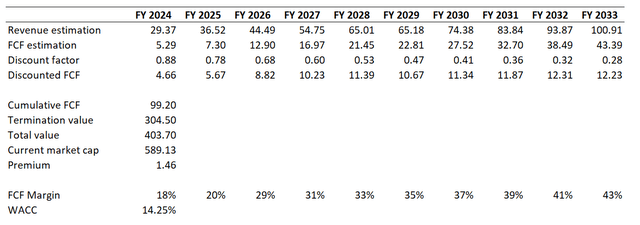

To challenge my multiples and historical analysis, I also performed a discounted cash flow [DCF] simulation to understand whether the company’s future cash flow is worth its current market valuation. For discounting I use WACC of 14.25%, which is a Gurufocus’ estimation. For free cash flows I use the company’s consensus revenue estimates up to FY 2033 and multiply them by FCF margin I consider fair based on the company’ historical FCF metrics. Incorporating all assumptions together, I arrived at a fair market cap of $403 billion, which is by far lower than the actual market cap.

Author’s calculations

To understand how massively Nvidia stock is overvalued let me demonstrate some of the sensitivity exercises that I have simulated.

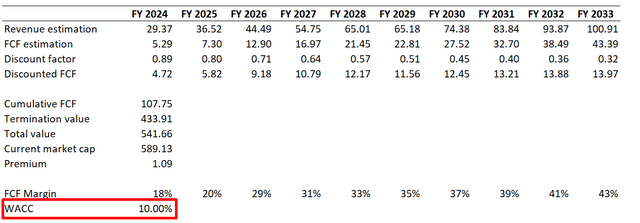

First, if we simulate the scenario of interest rates falling sharply and Nvidia’s WACC to crash closer to 10%, cumulative discounted cash flows still demonstrate lower value than the current market cap. This simulation indicates that current market cap is 9% higher than the higher value.

Author’s calculations

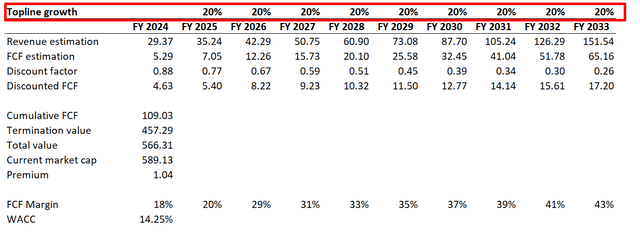

For the second sensitivity check, I have implemented an actual WACC of 14.25%. But here I implement a massive topline growth at a 20% CAGR meaning that Nvidia will exceed $150 billion revenue in FY2033, which is 50% higher than consensus estimates. Even with this highly unlikely pace of revenue growth, DCF indicates that the stock is still slightly overvalued.

Author’s calculations

To sum up, multiples analysis together with DCF model outcomes suggest that the stock is massively overvalued at the moment.

Risks to consider

Aside from the stretched valuation, investing in Nvidia stock carries other significant risks that should be discussed.

Although the company has a history of strong financial results and consensus estimates for future earnings are also very positive, Nvidia’s future success depends on several factors. First, Nvidia’s revenues are highly dependent on the overall health of the global economy. The company’s financial results may be negatively impacted if demand for graphics processors or other hardware components declines due to an economic downturn. Second, Nvidia operates in a highly competitive industry where there is a high risk of technology obsolescence. Competitors could undermine Nvidia’s market share by bringing competing products to market at similar or lower prices. The third risk, which is very important these days, is political risk. The company operates all over the world and is subject to different political and legal environments. Changes in regulations could have an impact on the company’s operations and profitability.

Bottom line

In summary, notwithstanding Nvidia’s impressive financial performance over the past decade and positive growth prospects going forward, my valuation analysis suggests that the current market value appears to be inappropriate relative to the underlying fundamentals. I strongly believe that the stock is a sell at the current price level, which is confirmed by my valuation analysis.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.