Summary:

- I am initiating coverage on Nvidia with a Strong Buy rating due to robust demand for AI accelerators and the upcoming Blackwell Superchips, driving significant growth.

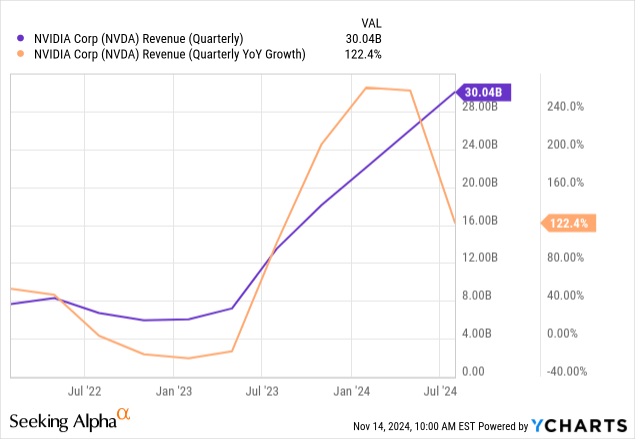

- Nvidia’s Q2 FY2025 results shattered records with $30.04 billion in revenue, a 122% YoY growth, driven by the Data Center segment’s 154% YoY growth.

- Foxconn’s massive manufacturing scale-up and recent Nvidia’s $50 billion share repurchase program signal strong confidence in sustained long-term demand for Blackwell chips.

- Nvidia’s full-stack AI solutions and extensive software ecosystem create a competitive moat, positioning it to capture substantial market share in enterprise AI.

JHVEPhoto

Written by Mark Daniels

I am initiating coverage of NVIDIA (NASDAQ:NVDA) with a Strong Buy rating ahead of the Q3 FY2025 earnings due to robust demand for AI accelerators and Nvidia’s Blackwell Superchips. Nvidia is experiencing a perfect storm of positive catalysts. The company’s Q2 FY2025 results shattered previous records with revenue reaching $30.04 billion, representing a staggering 122% YoY growth. What’s particularly compelling is that this growth is accelerating rather than plateauing – quarterly growth came in at 15% sequentially, demonstrating continued momentum even at this massive scale.

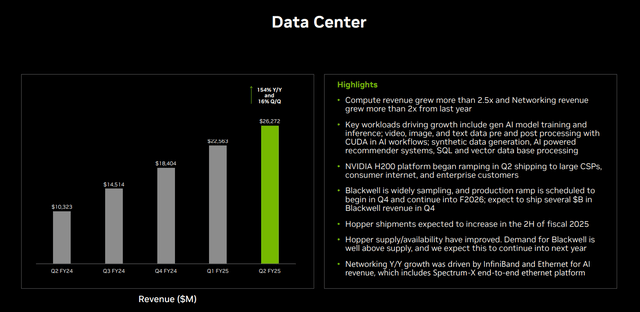

Data Center segment, posted revenue of $26.3 billion in Q2 growing 154% YoY and 16% QoQ. The segment now represents approximately 88% of total revenue, and I believe it’s still in the early stages of its growth trajectory. Based on my research, this explosive growth is being driven by two simultaneous platform transitions: the shift from general purpose to accelerated computing, and the emergence of generative AI as a fundamental new computing paradigm.

My main reason for initiating a Strong Buy rating for Nvidia is its near-term outlook and the unprecedented demand for its upcoming Blackwell platform. According to Morgan Stanley’s recent analysis after meetings with Nvidia management, Blackwell chips are already fully booked for the next 12 months, even before volume production begins. The company expects to recognize several billion dollars in Blackwell revenue in Q4 FY2025 alone, which, I believe, could drive significant upside to current consensus estimates.

There are two most important and recent developments that I want to highlight that demonstrate both the scale of demand for Blackwell and management’s confidence in the company’s trajectory. First, Foxconn has announced it is building what it describes as “the world’s largest GB200 production facility” specifically to manufacture Nvidia’s Blackwell chips, calling the demand “awfully huge.” This huge manufacturing scale-up suggests the company’s supply chain partners see sustainable long-term demand rather than a temporary surge.

Second, Nvidia’s board has authorized a massive $50 billion share repurchase program. This comes on top of $7.4 billion in share repurchases executed in Q2 and signals that management sees significant value in the stock even at current levels. With $14.5 billion in operating cash flow generated in Q2 alone, the company has ample resources to return capital while still investing aggressively in growth.

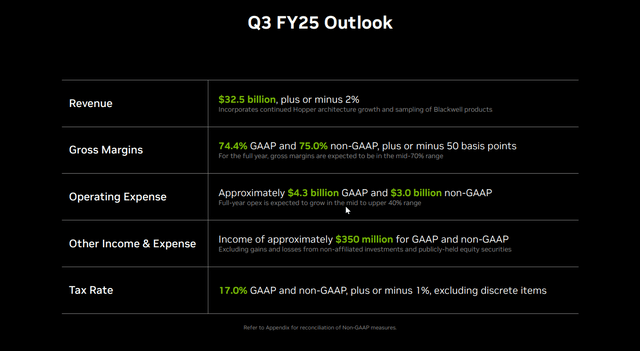

Looking ahead, I see multiple catalysts that could drive Nvidia’s performance above current market expectations. The company has guided for Q3 revenue of $32.5 billion (±2%) which would represent another quarter of robust growth. However, I believe the bigger story is the convergence of Blackwell’s production ramp, accelerating enterprise AI adoption and expanding sovereign AI opportunities that could drive sustained growth well beyond current forecasts.

Robust Blackwell Demand

According to Morgan Stanley’s recent analysis following meetings with Nvidia management, Blackwell chips are already fully sold out for the next 12 months before volume production even begins. The company expects to recognize “several billion dollars” in Blackwell revenue in Q4 FY2025 alone, suggesting an extraordinarily steep production ramp.

The technical specifications of Blackwell explain this unprecedented demand. The platform represents what Nvidia CEO Jensen Huang describes as a “step-function leap” over the current Hopper architecture. Built on TSMC’s (TSM) advanced 4NP process, Blackwell incorporates 208 billion transistors more than 2.5 times Hopper’s 80 billion. This massive increase in transistor density enables 3-5 times more AI throughput in power limited data centers along with advanced features like 4-bit floating-point AI inference capabilities that dramatically improve efficiency for large language model deployment.

Nvidia has also demonstrated impressive engineering flexibility by developing multiple system configurations to address diverse customer needs. The GB200 NVL72 system enables up to 72 GPUs to be connected via NVLink acting as a single GPU with aggregate bandwidth of 259 terabytes per second – approximately 10 times higher than Hopper. The platform will be available in both air-cooled and liquid-cooled variants, with liquid cooling enabling 3-5 times higher AI throughput in power-constrained environments. This configuration versatility allows Nvidia to target everything from traditional data centers to next-generation AI factories.

Microsoft (MSFT) has already announced it is the first cloud provider to deploy GB200 servers, optimizing them with Infiniband networking and innovative closed-loop liquid cooling. Other major customers including Google (GOOGL) (GOOG), Meta (META), and CoreWeave have placed substantial orders for Blackwell chips, demonstrating broad demand across the AI ecosystem. Based on current visibility, I expect the Blackwell cycle to drive significant growth through fiscal 2025 and 2026.

Why NVIDIA Is A Strong Buy

Based on Nvidia’s market position, financial performance and growth trajectory, my Strong Buy is underpinned by several powerful catalysts that, I believe, will drive significant value creation in the coming quarters and years.

The Blackwell ramp beginning in Q4 FY2025 is an immediate and substantial catalyst. Foxconn’s commitment to building the world’s largest GB200 production facility underscores the magnitude of expected demand, with their senior executives describing it as “awfully huge.”

In 2024, AI SaaS startups have raised $49.2 billion across various funding rounds including Series A, B, C, and other types of investments. Enterprise AI adoption is accelerating at a pace that, I believe, would exceed current market expectations. The data center modernization cycle represents a massive secular growth driver that, I believe, will sustain Nvidia’s momentum well beyond the current AI infrastructure buildout. As Jensen Huang has articulated, the world is experiencing two simultaneous platform transitions: the shift from general purpose to accelerated computing, and the evolution from human engineered to AI-generated software. With CPU scaling effectively at an end, Nvidia’s accelerated computing solutions offer the only viable path forward for enterprises facing growing computational demands. The addressable market here is substantial, the company estimates over $1 trillion in existing data center infrastructure will need to be modernized.

NVDA Q2 2025 Presentation Deck

Nvidia’s software segment represents a particularly underappreciated value driver. Beyond the approaching $2 billion revenue run rate the software ecosystem creates powerful network effects that strengthen Nvidia’s competitive moat. The company’s CUDA platform domain-specific libraries like cuDNN for neural networks and cuQuantum for quantum simulation, and enterprise tools create high switching costs and sustained competitive advantages. The recent introduction of NIM inference services and microservices further expands this software footprint.

Looking at current valuation levels, Nvidia trades at approximately forward P/E Ratio 53.3, which I believe undervalues the company’s growth potential and competitive position. The magnitude of Blackwell demand alone, with the next 12 months of production already sold out suggests potential for substantial revenue upside. The enterprise AI opportunity is just beginning to unfold with Nvidia’s full-stack approach and extensive software ecosystem positioning it to capture a substantial share of this emerging market.

I believe we’re witnessing the early stages of what could be an even larger opportunity than the initial AI infrastructure build-out of the enterprise AI wave. The company is already working with the majority of Fortune 100 companies, but what’s particularly compelling is the acceleration in enterprise adoption I’m seeing across multiple verticals and use cases.

Customer success stories are particularly compelling. Amdocs has reduced customer service costs by 30% using Nvidia’s generative AI, while Wistron has achieved a 50% reduction in factory cycle times through Nvidia AI Omniverse implementation. ServiceNow’s integration of Nvidia technology has become their fastest growing new product ever, demonstrating the transformative impact of these solutions.

Recent customer wins demonstrate the breadth and depth of enterprise adoption. ServiceNow’s implementation of Nvidia technology in their Now Assist offering has become the fastest-growing new product in the company’s history. SAP is leveraging Nvidia to build dual Co-pilots, while Snowflake, which processes over 3 billion queries daily for more than 10,000 enterprise customers, is working with Nvidia to develop their own Co-pilots.

Recent Performance And Outlook: No Sign Of Slowing Down

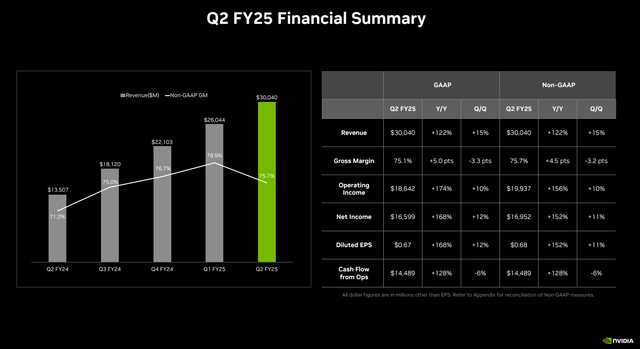

In Q2 FY2025, the company achieved record quarterly revenue of $30.04 billion, representing not just a remarkable 122% YoY growth but more importantly a 15% sequential increase from Q1. This acceleration at such a massive revenue base defies typical scaling limitations and suggests the AI computing demand curve is still in its early stages.

Operating income surged to $18.64 billion growing even faster than revenue at 174% YoY. This translated to an impressive operating income margin of 61.87% nearly doubling from the year-ago period. The company maintained industry leading gross margins of 75.1% GAAP and 75.7% non-GAAP even as it ramps production of new products.

NVDA Q2 2025 Presentation Deck

The data center segment is the primary engine of Nvidia’s growth, and this trend is accelerating. With Q2 data center revenue reached $26.3 billion representing a staggering 154% YoY growth and 16% sequential growth. This segment now accounts for approximately 88% of total revenue, with a remarkably diverse customer base, about 45% from cloud service providers and over 50% from consumer internet and enterprise companies. I find it particularly noteworthy that compute revenue grew more than 2.5 times while networking revenue doubled YoY indicating strong adoption across Nvidia’s full technology stack.

NVDA Q2 2025 Presentation Deck

Looking ahead to the Q3 of fiscal 2025 Nvidia has guided for revenue of $32.5 billion (±2%), which I view as potentially conservative given the company’s recent history of exceeding expectations. The gross margin guidance of approximately 75% non-GAAP demonstrates Nvidia’s continued pricing power and operational efficiency even as it ramps production of new products like Blackwell. While operating expenses are expected to grow around $4.3 billion and $3.0 billion, I believe this investment is necessary and prudent to capture the massive market opportunity ahead.

The long-term growth drivers and sustained momentum is well beyond the current fiscal year. The company is addressing what I estimate to be a trillion-dollar-plus total addressable market in data center modernization, as enterprises transition from general purpose to accelerated computing infrastructure. This shift is fundamental and secular, driven by the end of Moore’s Law scaling in traditional CPU architectures and the growing demands of AI workloads.

Sovereign AI initiatives represent another substantial growth vector, with Nvidia projecting low double-digit billions in revenue this year alone.

We believe sovereign AI revenue will reach low-double-digit billions this year. – NVIDIA Q2 2025 Earning Call Transcript

The company’s recent win with Japan’s National Institute of Advanced Industrial Science and Technology for their AI bridging cloud infrastructure 3.0 supercomputer exemplifies this opportunity. Additionally, I see significant potential in emerging markets like automotive, where Nvidia’s technology is being used by every major automaker developing autonomous vehicle technology and healthcare, which management believes is on track to become a multi-billion dollar business.

Moreover, Nvidia’s competitive position in high-end AI chips remains remarkably strong, with limited competition in the highest performance segments of the market. The company’s software ecosystem including CUDA and various domain-specific libraries creates powerful network effects that make it increasingly difficult for competitors to displace Nvidia in enterprise environments. This combination of financial strength, market leadership and sustainable competitive advantages leads me to believe that the current valuation, while premium, still underestimates Nvidia’s long-term potential.

Hurdles Ahead

Overall, I remain strongly bullish, I believe it’s crucial to discuss the risks that could impact the company’s growth trajectory.

The first significant challenge comes from intensifying competition in the AI acceleration market. Several of Nvidia’s biggest customers, including Microsoft, Amazon, Alphabet, and Meta (which currently around 46% of its data center revenue), are actively working to design their own AI chips as alternatives to Nvidia’s offerings. Tesla, for instance, has announced plans to “double down” on its in-house Dojo semiconductors citing difficulties in securing Nvidia hardware due to high demand. Apple has begun using Google chips for some AI workloads instead of Nvidia’s solutions.

However, I believe Nvidia’s competitive moat is stronger than many appreciate. The company’s full-stack approach involves seven different types of chips working in concert to create its AI infrastructure. The Blackwell platform, for example, integrates the Grace CPU, dual GPU, ConnectX DPU, BlueField DPU, NVLink switch and networking chips all optimized through Nvidia’s extensive software stack. This level of vertical integration and optimization is extremely difficult to replicate.

Nvidia relies heavily on TSMC’s advanced manufacturing capabilities, particularly its CoWoS (Chip-on-Wafer-on-Substrate) packaging technology, which is crucial for products like Blackwell. While TSMC has “scaled up CoWoS capacity tremendously” according to Nvidia’s CFO, with plans for further expansion through 2024 and 2025, this geographic and technological concentration creates potential vulnerabilities.

we’ve scaled up CoWoS capacity tremendously, and we’re going to have to scale it up even more next year and scale up even more the year after that. – Goldman Sachs Communacopia + Technology Conference (Transcript)

Recent U.S. export controls have already impacted Nvidia’s ability to sell its most advanced chips to China, which remains a significant contributor to data center revenue despite running below pre-restriction levels. The company has responded by developing market-specific products like the H20 China chip, which is expected to generate at least $12 billion in sales from over one million units in the coming months, according to industry analysts. However, the potential for further restrictions or geopolitical tensions remains a concern.

To Sum Up

Nvidia represents the best opportunity to invest in the company leading the AI revolution, even at this price point. While the stock has had an impressive run, I believe we’re still in the early innings of the AI compute transformation. The combination of Unprecedented product demand, expanding markets and Strong execution makes Nvidia one of the most compelling investment opportunities I see in the market today. The upcoming Blackwell cycle and enterprise AI wave should drive continued outperformance in coming quarters.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.