Summary:

- Nvidia Corporation has smashed expectations again, thanks to its promising forward guidance, highly profitable margins, and raised consensus estimates through FY2026.

- Assuming that it continues to command the lion’s share in the discrete GPU and AI chips, we believe that Nvidia stock’s premium growth valuations and subsequent rallies are well deserved.

- With the latest clarification from the chief of the US Department of Commerce, we believe that Nvidia’s superior offerings will remain popular in China, once the export limitations are finalized.

- Assuming that the tailwinds persist, there is still a great upside potential of +87.6% from current levels to our long-term price target of $939.60, based on the consensus FY2026 adj EPS estimates of $23.64.

- While we may rate Nvidia as a Buy, investors must also size their portfolios according to their risk appetite, with the Extreme Greed Index triggering inflated market sentiments.

DNY59

We previously covered Nvidia Corporation (NASDAQ:NVDA) in August 2023, discussing its mixed near-term prospects, with demand notably gated by supply from Taiwan Semiconductor (TSM).

On the one hand, we had remained optimistic about its long-term prospects, with the semiconductor company likely to grab significant market share during the generative AI boom, further aided by the timely Data Center replacement cycle after the pandemic boom.

On the other hand, we reiterated our Hold rating then, since much of the stock’s upside potential had already pulled forward, offering investors with a minimal margin of safety.

In this article, we shall discuss why we have raised our long-term price target for the NVDA stock, thanks to its profitable growth trend, (likely to be) lifted trade restrictions to China, and raised consensus forward estimates over the next few years.

Combined with Fed Chair Powell’s dovish stance in the FOMC meeting and the increased likelihood of a pivot in 2024, we believe the lifted market sentiments may contribute to the accelerated corporate demand for generative AI services, and consequently, NVDA’s growing AI chip sales/ market share.

The NVDA Investment Thesis Remains Robust, For So Long As The High Growth Trend Persists

For now, NVDA has smashed expectations indeed, with FQ3’24 revenues of $18.12B (+34.2% QoQ/ +205.5% YoY) and adj EPS of $4.02 (+48.8% QoQ/ +793.1% YoY), well exceeding its own revenue guidance of $16B offered in the FQ2 ’24 earnings call.

Most of its tailwinds are attributed to the Generative AI demand, with the company reporting impressive Data Center revenues of $14.51B (+40.6% QoQ/ +278.8% YoY), partly aided by the recovering gaming demand with revenues of $2.86B (+15.3% QoQ/ +82.1% YoY).

Investors must also note the impact of cryptocurrency mining on its GPU demand, with Bitcoin (BTC-USD) already recovering to $42.73K by the time of writing (+12.8% MoM/ +146.2% YoY).

Furthermore, the NVDA management has offered another promising FQ4’24 revenue guidance of $20B (+10.3% QoQ/ +230.5% YoY) and GAAP gross margin guidance of 74.5% (+0.5 points QoQ/ +11.2 YoY).

The insatiable demand for its offerings is highly evident indeed, attributed to the robust pricing power, compared to FY2020 (CY2019) gross margins of 62% (+0.8 points YoY).

The same is reflected in the growing remaining performance obligations for contracted license, development arrangements, and support for hardware/ software, at $896M (+24.9% QoQ/ +31.5% YoY) by the latest quarter.

These have contributed to NVDA’s improving balance sheet, with growing cash/ short-term investments of $18.28B (+14.1% QoQ/ +39.1% YoY) and moderating long-term debts of $8.45B (inline QoQ/ -12.8% YoY).

While much of the tailwinds have yet to be translated to shareholder returns, with minimal shares retired and dividends paid out, we already rejoice at the immense rally the stock has enjoyed thus far.

The Consensus Forward Estimates

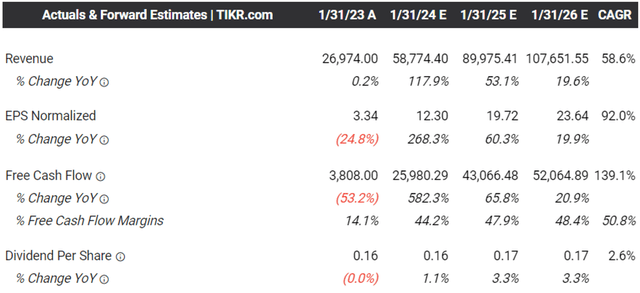

For now, the consensus has also priced in an impressive top and bottom line growth at a CAGR of +58.6% and +92% through FY2026, accelerated compared to NVDA’s historical CAGR of +25.5% and +27.8% between FY2017 and FY2023, respectively.

Most importantly, its semiconductor peers are expected to report underwhelming top/ bottom line estimates, including Intel (INTC) at +1.8%/ +13.5% and Advanced Micro Devices (AMD) at +9.3%/ +13.1% over the same time, respectively.

Assuming so, it appears that NVDA may very well continue commanding the lion’s share in the discrete GPU market, as similarly reported at 87% in Q2’23 (-1 points QoQ/ +7 YoY), with Q3’23 data yet to be released.

The New York Times has also previously estimated that the company accounts for over 70% of AI chip sales by mid-2023, with even more used for the training of generative AI models.

NVDA Valuations

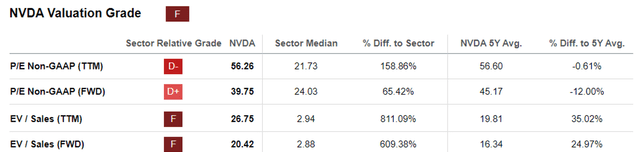

Assuming that NVDA continues to command the lion’s share in the discrete GPU and AI chip markets, we believe that the stock’s premium growth valuations and subsequent rally are well deserved indeed.

Interestingly, NVDA stock also trades at a somewhat reasonable FWD P/E valuation of 39.75x, compared to its 1Y mean of 44.55x, 3Y pre-pandemic mean of 33.56x, INTC at 48.40x, and AMD at 52.37x. This is especially since the former’s profitable growth trend, FQ4’24 guidance, and consensus forward estimates well exceed those of its peers.

We believe that there are two ways to look at this situation for now.

One, as a long-term NVDA shareholder, we are very happy with its success in generative AI indeed, as it demonstrates CEO Jensen Huang’s visionary approach since the strategic gift of a DGX-1 supercomputer to OpenAI back in 2016 and thus, nurturing a “large community of AI programmers who consistently invent using the company’s technology.”

This is also the reason why NVDA’s proprietary CUDA software is increasingly popular for Machine Learning/ AI applications, attributed to its capability to facilitate the necessary parallel computing of large scale models on GPUs at a much higher efficiency and performance, against the traditional CPUs.

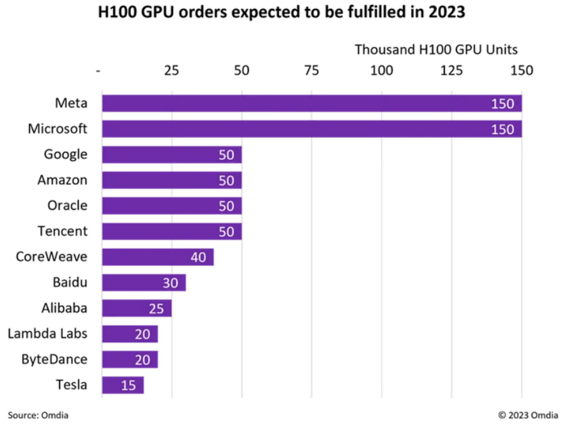

NVDA’s 2023 GPU Orders

AI Business

Therefore, while other companies may also offer AI chips/ software, it is understandable why NVDA’s offering remains the preferred choice for many Big Tech companies, including those in China.

Most importantly, with the latest clarification from the chief of the U.S. Department of Commerce, we believe that its superior offerings will remain popular in China, once the export limitations are finalized and the company designs trade compliant products.

On the other hand, it is “almost” foolish to expect NVDA to continuously record exponential QoQ growth in sales, with any market share losses and/ or missed earnings/ guidance likely to trigger drastic volatility in its stock prices.

While Jensen Huang may lead a highly successful company with sticky offerings, the AI market competition has been intensifying after all, with many other Big Tech companies creating their own in-house chips.

This is on top of AMD’s official launch of MI300 Accelerators and INTC’s recent unveiling of the Gaudi 3 accelerator, with both supposedly matching NVDA’s H100 offering in some form or another.

As a result, while NVDA may have been the market leader in a growing AI accelerator market size of $400B by 2027, raised from the previous estimate of $150B, we maintain our belief that there will be multiple winners in this space.

So, Is NVDA Stock A Buy, Sell, or Hold?

NVDA’s Buy/ Hold/ Sell Recommendation

Well, that is a difficult question to answer indeed, as market sentiments appear to be mixed surrounding NVDA’s prospects, with most of the Wall Street rating it as a Strong Buy with the Seeking Alpha analysts being more well-balanced.

Based on the management’s FQ4’24 guidance, we are looking at approximately $10.14B in net income (+9.7% QoQ/ +619.1% YoY) and approximately $4.07 in EPS (+1.2% QoQ/ +362.5% YoY), based on the FQ3’24 share count of 2.49B.

Combined with NVDA’s YTD EPS of $7.81 and the stock’s FWD P/E valuation of 39.75x, it appears that the stock is trading slightly higher than its fair value of $472.20, implying a minimal +6% premium.

Most of the premium is likely attributed to the optimistic market sentiments, thanks to Powell’s dovish stance in the FOMC meeting, with discussions of a potential 2024 pivot already underway.

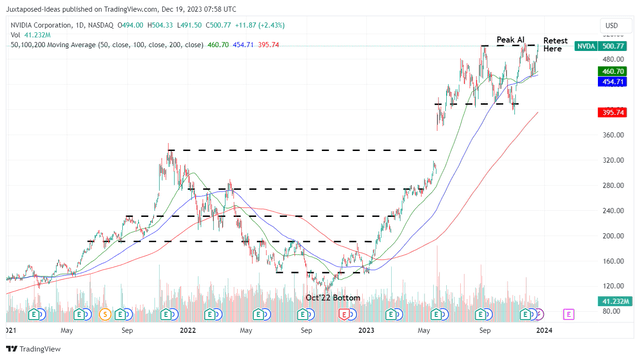

NVDA 3Y Stock Price

Moving forward, it seems that there is still a great upside potential of +87.6% from current levels to our long-term price target of $939.60, based on the consensus FY2026 adj EPS estimates of $23.64. This is despite the impressive +332.20% rally since the October 2022 bottom.

For now, we are carefully rerating the NVDA stock as a Buy, though with no specific entry point since it depends on individual investors’ dollar cost averages and portfolio allocation.

For context, we will not be adding anytime soon, attributed to our relatively low dollar cost averages, thanks to our previous load up point in September 2022 and January 2023.

With the NVDA stock currently retesting its peak resistance levels, investors may want to wait for moderate pullback for an improved margin of safety, preferably at its previous support level of $450s.

Lastly, investors must also size their portfolios according to their risk appetite, especially given the Extreme Greed Index in the stock market, with it likely to trigger the semiconductor stocks’ bloated share prices/ valuations accordingly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.