Summary:

- NVIDIA continues to dominate the AI revolution, providing state-of-the-art hardware for AI tools, reflected in its strong Q3 FY 2025 earnings.

- Despite beating revenue expectations with $35.08B, NVIDIA’s stock fell post-market, leaving investors wondering whether NVIDIA has lost its magic.

- However, NVIDIA’s already outstanding growth hasn’t even accounted for the Blackwell environment, which is booked for several quarters ahead and is set to drive results in FY 2026.

- The question remains – will NVDA keep on growing into its valuation by dynamically increasing its financial scale? I believe it will, and as long as it does, I’m buying.

BING-JHEN HONG

As a long-term owner of NVIDIA (NASDAQ:NVDA), I enjoyed watching and even covering its outstanding growth and emergence as an undisputable leader of the ongoing AI revolution. Whenever (which has been ‘daily’ for quite some time) major tech players wish to dig for the holy grail (developing AI tools), NVIDIA is there to provide shovels (state-of-the-art hardware) perfectly suited for complex training of large language models that are the backbone of the most prominent solutions that quickly became another day-to-day tool for most people (e.g. ChatGPT).

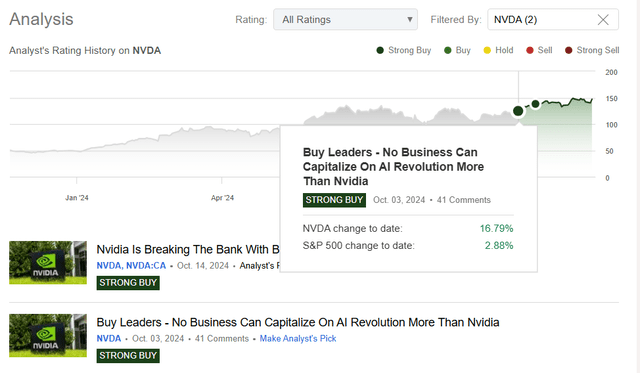

Since I first covered NVDA in early October, its stock price has increased by over 16%. Today, the company released its Q3 earnings for FY 2025, providing another solid quarter-to-quarter and y/o/y performance. However, its stock price has fallen (as of the time of writing this article) by 2-3% post-market.

Seeking Alpha

Seeking Alpha

Is Beating Expectations Not Enough?

NVDA

NVDA

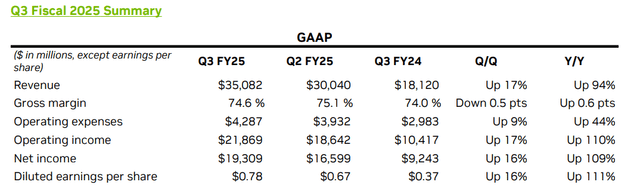

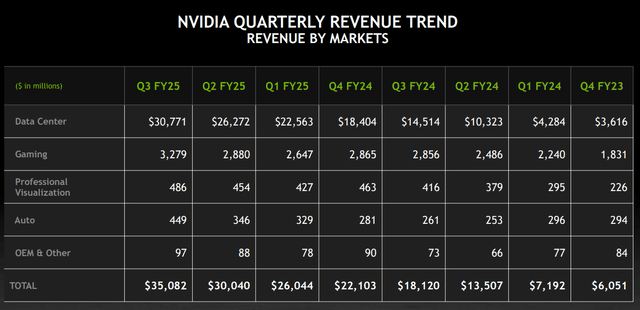

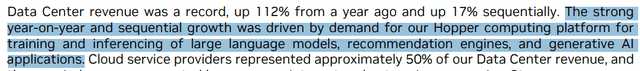

Another amazing quarter from NVDA resulted in total revenue of $35.08B, beating expectations by as much as $1.95B. NVIDIA set another quarterly Data Center revenue record, exceeding $30.77B, growing 17% q/o/q and 112% y/o/y.

Despite impressively dynamic revenue increases, NVIDIA keeps its cost structure in check, upholding strong profitability with a gross margin as high as 74.6% and an operating income margin as high as 62.3% during the quarter (almost 485 bps higher than during Q3 of FY 2024).

Arriving at the bottom line, NVDA’s diluted earnings per share grew 16% q/o/q and 111% y/o/y, greatly summarizing its quarterly performance.

NVIDIA Brought More Good News To The Table

Investors have to keep in mind that NVDA’s Data Center segment has much more to offer in the years to come, as its already outstanding performance was driven by its previous architecture from the Hopper computing platform for LLM training (large language models).

NVDA

Revenue growth was driven mainly through increasing demand for H200. Where’s the good news? Much has changed recently, as the company has introduced far more advanced architecture – Blackwell, which is set to outperform its previous (highly successful) Hopper environment greatly. NVDA’s latest architecture was announced in early 2024 for those unacquainted with the’ Blackwell’ term. Its GB200 NVL72 features 4x as fast training model speed, 30x as much real-time throughput, and 25x higher energy efficiency when compared with H100.

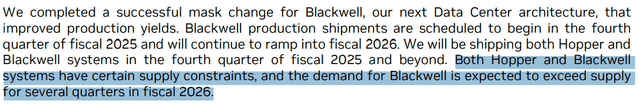

As we can read in NVDA’s CFO’s Commentary, the company will ship both Blackwell and Hopper products until the end of FY 2025 and further. As I’ve mentioned in my previous article on NVDA, the company has already broken the bank with Blackwell and sold out its systems for 12 months ahead, which has been confirmed once again.

NVDA

With such a positive quarter in terms of both financial and business developments, NVDA provided yet another treat for its shareholders, topping its consensus Q4 FY 2025 revenue of $37.04B. NVDA expects to reach as high as $37.5B of revenue, constituting a ~70% increase y/o/y.

Long-Term-Oriented Investing Is Different Than Trading

During each earnings season, especially regarding companies as popular and engaging as NVIDIA, I like to remind myself of one of the brightest metaphors regarding the stock market I’ve ever encountered – Benjamin Graham’s Mr. Market metaphor. According to his thesis, the market is often irrational and highly susceptible to mood swings depending on short-term events that fail to constitute any meaningful impact in the long term.

That may very well be happening to NVDA for several days/weeks from now, as many investors and analysts will wonder whether the company has beaten the expectations by enough magnitude.

Maybe it should have delivered 115% Data Center revenue growth y/o/y? Or declared an expected 75% increase in revenue in the upcoming quarter? Or Blackwell’s demand should exceed supply for full FY 2026 not just several quarters?

While some investors will wonder about such matters (and more power to them if that works), I shy away from such divagations. I don’t have a crystal ball and can’t predict NVDA’s revenue level or profit margin with 100% accuracy for several quarters to come. Still, I can quickly arrive at pretty simple yet reassuring conclusions, such as:

- NVDA holds a gigantic technological edge over its peers and sets the stage for the AI revolution.

- Its highly effective business model is reflected in growing revenues and upholding profitability, which is crucial from a Shareholder’s perspective.

- NVDA will continue to beat expectations and grow at a highly dynamic pace. Recent growth didn’t even account for its most innovative Blackwell solutions, which have already been booked for several quarters ahead.

Valuation Outlook

As an M&A advisor (a fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method, which is a leading tool in transaction processes. It allows for accessible and market-driven benchmarking.

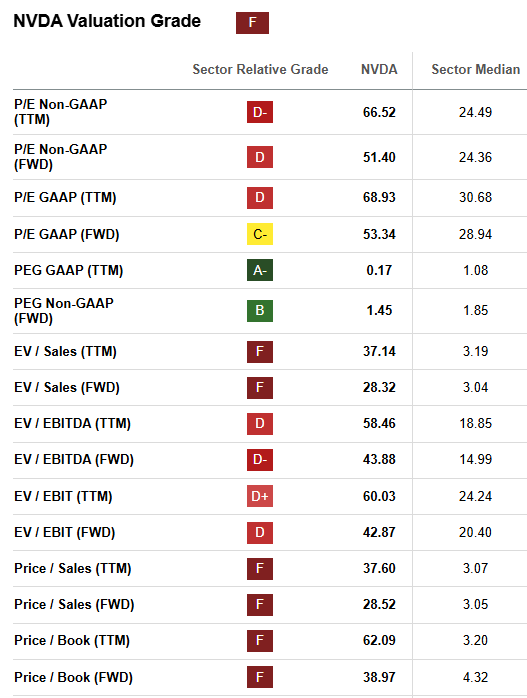

On paper, NVDA may seem overvalued when considering most of the standard metrics. Given the ‘rule-of-thumb’ metric utilized in transactional processes, its forward-looking EV/EBITDA multiple is almost three times higher than the sector median.

Seeking Alpha

However, as I usually mention, one has to remember that we are talking about NVDA – an undisputed leader of a highly attractive and dynamically growing sector. If my experience as an M&A advisor has ever taught me one thing, it’s that there is no ‘right’ multiple that you can apply to a given sector and consider each entity exceeding the median overvalued (or falling short of the median undervalued).

One always has to consider specific conditions and competitive advantages of a given business. Have I ever sold a company of such scale at such a high EV/EBITDA multiple? No. I had the pleasure of advising on deals with 20-30x EV/EBITDA multiples, but they were rare cases. Typically, multiples ranged from high single-digit to high teens, but most of these businesses were:

- Much smaller

- Privately held

- Operating within less attractive industries

- Unable to hold such an outstanding competitive advantage over their peers as NVDA does

The question remains – will NVDA keep on growing into its valuation by dynamically increasing its financial scale? I believe it will, and as long as it does, it remains within a ‘buy’ range.

My Conclusion: Your Takeaway

Obviously, I am bullish on NVIDIA. I’m a long-term holder who has never sold a share and kept on adding regularly. Now, NVDA holds one of the most prominent positions in my portfolio and is my largest tech holding.

I believe the company has much more to present in the coming years, as its Blackwell hasn’t been reflected in the financial results so far, yet it generates outstanding demand. Many of NVDA’s customers are proud of introducing innovative changes, such as Blackwell.

As Jensen Huang’s expectations around the demand and impact of NVDA’s solutions have proved accurate so far (e.g. commentary about Blackwell demand), I am more than happy to stick to the business under his management, enthusiasm and effectiveness:

The age of AI is in full steam, propelling a global shift to NVIDIA computing (…)

Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference (…)

AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI. And countries have awakened to the importance of developing their national AI and infrastructure

Despite potential risk factors (incl. Fed policy, geopolitical tensions, potential delays or technological failures, and relatively high stock price volatility), I’ve decided to reiterate my ‘strong buy’ rating for NVDA, as I believe it to be a long-term winner.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.