Summary:

- Nvidia Corporation dominates the AI accelerator market with over 95% share, despite recent design issues with its Blackwell GPUs.

- Investors’ fears are unwarranted; Nvidia is committed to shipping Blackwell GPUs, with increased capacity dollar commitments from Taiwan Semi.

- Nvidia’s valuation suggests a 22% upside, with a forward P/E of ~40x and expected revenue growth doubling in 2024.

- Short-term pressures from Blackwell’s design flaws are temporary; production is ramping up, making Nvidia a strong Buy recommendation.

BING-JHEN HONG

Investment Thesis

No semiconductor company can demonstrate the ability to dominate the GPU market for the AI data center like Nvidia Corporation (NASDAQ:NVDA) does.

The Santa Clara, CA-based chip company accounts for over 95% of the AI accelerator market till date, bolstered by phenomenal demand for its GPUs. The bulk of Nvidia’s production volume of GPUs was on the Hopper platform, and the company was expected to ship its Blackwell line of GPUs at some point this year.

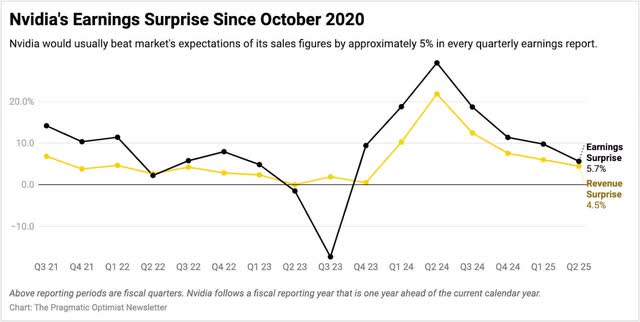

But design issues in Nvidia’s Blackwell platform caused severe anxiety among market participants, with several investors beginning to doubt two things: one, Nvidia’s dominant market share, and two, the company’s impressive track record of robust beats-and-raises.

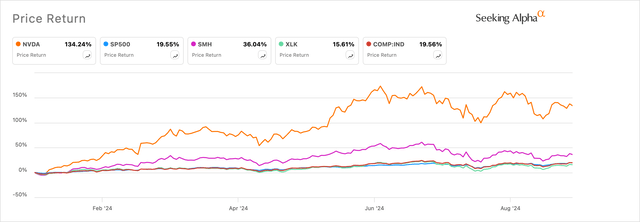

Exhibit A: Nvidia’s stock is taking some well-earned rest after running through H1 2024 (Seeking Alpha)

Upon deeper evaluation of Nvidia’s filings, I believe investors are unnecessarily pessimistic about Nvidia. The company is deeply committed and is on track to ship Blackwell GPUs, with its obligations and capacity commitments with supply chain partners such as Taiwan Semiconductor (TSM) actually rising.

This is very bullish and in line with how hyperscalers are raising capex at their end.

I believe Nvidia’s stock has room to grow, and I recommend a Buy on this powerful name.

Rationalizing Investors’ Fears About Nvidia’s Prior Results

I noted two reasons in my opening statement of this research note that investors feared would hamper Nvidia’s explosive growth, with the first being its dominant market share. Nvidia’s GPUs have become the de facto choice for AI accelerators to be deployed in the data center over the past ~18 months, which has led to the company holding a 98% share over the AI accelerator market, per HPC.

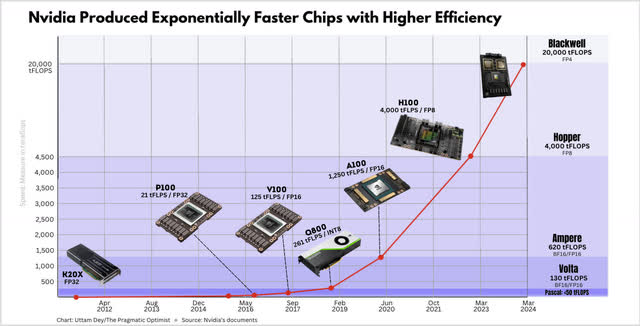

In response, Nvidia has been rapidly scaling their architectural platforms to pack in additional compute gains in their GPUs, which get exponentially better, as I have illustrated in the chart below. As can be seen in Exhibit B, with each platform, Nvidia exponentially packs in more teraflops of compute power at higher precision.

Exhibit B: As Nvidia launches a new architecture platform for GPUs, the chips get exponentially better at compute (Company sources)

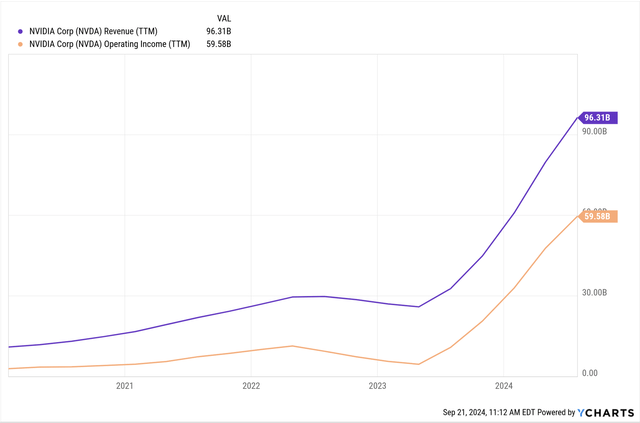

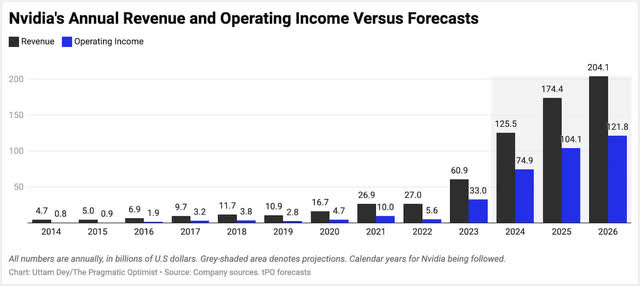

Naturally, any startup, VC, enterprise, or anyone who has anything to do with running training and inference model workloads wants to get their hands on the best chips as they get launched. This demand has been pivotal in Nvidia’s ascent as one of the most valued companies in the world, and that demand has manifested in Nvidia’s financials, as seen below.

Exhibit C: Nvidia’s compounded growth in revenue and GAAP operating income has doubled since 2020 (YCharts)

However, through the summer, reports surfaced about constraints in Nvidia’s design for its Blackwell line of chips causing compatibility issues with Taiwan Semi’s advanced CoWoS-L chip packaging technology. Investors feared Nvidia’s robust growth rates would recede, especially after its Q2 results showed a far lower earnings beat.

Exhibit D: Nvidia’s earnings beat is now closer to its long-term average (author)

That has caused fears among some investors and bears to be more optimistic about Nvidia’s bearish potential.

Nvidia’s Capacity Obligations With Taiwan Semi & Others Is Bullish

Unfortunately, I do not believe there is any structural weakness arising from the Blackwell delay and am encouraged by management’s consistent vocal efforts to assuage investors.

During the Q2 earnings call, Nvidia’s Jensen Huang revealed that the design issue in Blackwell has been fixed, and they now expect to “start shipping out in billions of dollars [of Blackwell chips] at the end of this year.” Huang topped up this positive view further at the Communacopia conference, where he said that they are “ramping Blackwell,” which is in full production, and will “start scaling in Q4 and into next year.”

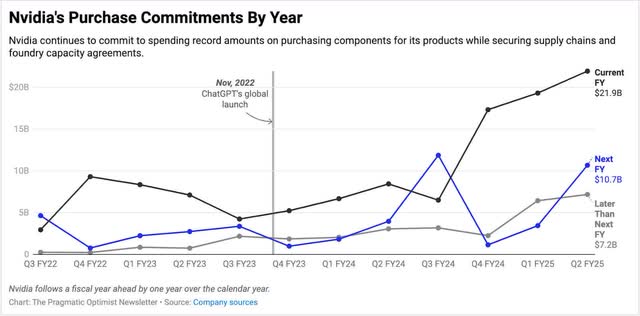

His comments match the future capacity commitments and raw material supply obligations that Nvidia is buying from its supply chain. For example, Nvidia buys commitments from Taiwan Semi, which is one of its biggest manufacturing partners, manufacturing leading-edge chips for Nvidia.

Upon further inspection of its purchase commitments from its filings, I note that Nvidia’s commitments through CY25 have actually risen 43% from the previous quarter, which is the strongest acceleration of dollar commitments since 2022.

Exhibit E: Nvidia is ramping up its purchase commitments and supply chain obligations through CY25 (Company filings)

These actions by Nvidia embolden my view of how serious Nvidia is in ramping up production and shipment of its Blackwell chips, which should boost the outlook for the GPU company.

Valuations Point To Upside For Nvidia

The design issues in Blackwell have pushed out potential revenue from the new line of GPUs by 2 quarters to the end of the year. While I still expect 2024 revenues to more than double, I expect some of that growth pace to normalize to a 50% CAGR range through 2026.

Exhibit F: Nvidia’s projections for Revenue and Operating Income for the next 3 years. (Author)

I believe margins may be under marginal pressure for 1–2 quarters, possibly dipping below the 60% GAAP margin mark as inventory levels rise anticipating demand, but this should revert above 60% through next year. With the company selling products in a high-demand environment, I expect Nvidia to price to value in an elevated-demand environment, which should continue to keep margins above 60%.

Nvidia should warrant a forward P/E of ~40x given that its earnings will be growing much faster than the ~8% earnings growth of the S&P 500 (SP500), which translates to a price target of ~$140, implying ~22% upside from Nvidia’s current levels.

Risks & Other Factors To Know

At this point, Nvidia is a victim of its success. With such strong demand levels, Nvidia has also moved to an annual architectural refresh of its GPU platforms. Nvidia’s Huang already preannounced next year’s platform to be Rubin and is expected to deliver on that platform as well while scaling Blackwell’s production. Any slip-ups in these goals can have severe impacts on the market cap since. There is also some marginal impact that may be seen in its dominant GPU market share, with competitors such as Advanced Micro Devices (AMD) and Broadcom (AVGO) competing for the same hyperscaler capex dollars. But this remains a marginal impact through next year, if any, in my opinion.

I always observe inventory levels of semi-companies and note that Nvidia’s inventory levels have risen sequentially. While I usually do not prefer rising inventories, I believe there are solid reasons for inventory to be rising, as I noted earlier with Nvidia ramping up production of Blackwell. This was also seen by production capacity scaling in their purchase commitments and obligations. However, over the near term, I would prefer to see these levels move lower.

Takeaways

Nvidia’s stock looks to be currently taking a break, but I expect that to reverse course since I anticipate stronger results as the company cycles through short-term pressures from its prior Blackwell design flaw.

The company has appeared to fix all pending design constraints with their manufacturing partners, and production of Blackwell should be ramping up this year, with shipments expected by the end of the year. This should alleviate many concerns currently held by investors against Nvidia.

I recommend a Buy on Nvidia.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.