Summary:

- Nvidia Corporation’s record earnings from the AI wave have led to all-time highs and a market capitalization of $1.2 trillion.

- The company’s revenue growth is primarily driven by generative AI, but its high valuation may not be justified.

- Nvidia faces the risk of competition from major tech companies that are developing their own GPUs, potentially leading to a decline in margins and market share.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) has reached all-time highs on the basis of record earnings from the AI wave. The company’s $1.2 trillion market capitalization puts it at almost 10x the market cap of peers such as Intel. As we’ll see throughout this article, led by other companies’ efforts to cut the company out of their supply chain, we expect its earnings to not justify its valuation.

Nvidia’s Blockbuster Earnings

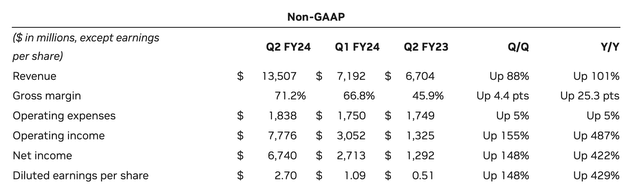

The company clearly had a blockbuster second quarter, as demand for its GPUs matched all it could produce.

The company had $13.5 billion in revenue, up from $7.2 billion last quarter, and $6.7 billion a year ago. That increase shows how small the company’s revenue growth rate was prior to the generative AI growth. It’s safe to say that generative AI is making up the entirety of the company’s growth in revenue currently.

The company’s gross margin has also expanded substantially, as demand for GPUs has enabled the company to effectively name its price. The company is earning 1000% profit on each GPU it sells, which helps it in the short term, but also incentivizes competition to move away over the long term. $6.7 billion in net profit is impressive, but look at the current valuation.

The company now has a market cap of almost $1.2 trillion. Its net profit is $25 billion annualized. That means it’s trading at a P/E of ~48. Even with its massive profit, the market is pricing in long-term growth and staying power of these earnings. It’s an expensive mistake to make. If the market is wrong, multiples could contract rapidly.

Nvidia’s Guidance and Buyback

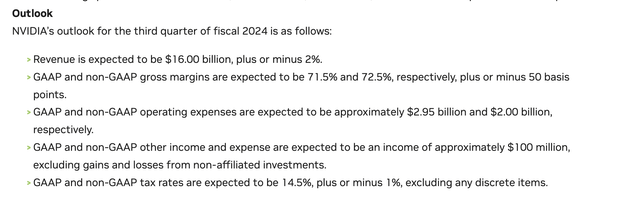

Nvidia’s guidance does show the company expects the growth to continue.

The company is expecting revenue to be $16 billion for the next quarter +/- 2%. That’s roughly 20% QoQ revenue growth with a tight spread, indicating the company has likely sold effectively everything it can produce to the large tech companies. The company expects margins to improve by roughly 1%, but there’s an indication it’s making out here, too.

The company’s operating expenses are also ramping up as it invests more in growth, which will keep margins from increasing dramatically. The more concerning part of the company’s targets are its announced $25 billion in buybacks. It’s taking the massive pile of cash from its earnings, with higher margins, at a high valuation, and it’s buying back stock.

It’s leveraging up on its valuation, which increases the risk should something go wrong.

Nvidia’s Big Customer Problem

Nvidia has a problem that many other large tech companies do not have. The same problem that Intel (INTC) faced with Apple (AAPL) building its own silicon. When Nvidia built GPUs, its competition was Advanced Micro Devices, Inc. (AMD), but its customers were not the competition. In fact, they were almost a captive market in many senses. That was a market where Nvidia excelled.

Unfortunately, its massive revenues now come from a new business. Major tech companies who currently need all the GPUs they can get to compete in generative AI. However, in parallel, these companies are working on their own creations. Google (GOOG) (GOOGL), a major competitor in AI, has announced its TPUs that it argues are more effective than many of Nvidia’s offerings.

Microsoft (MSFT), majority owner of Open AI, and Amazon (AMZN), the largest cloud service provider in the world, are also working on their own chips. That’s tough for Nvidia. Best case scenario, the company’s margins drop as competition increases. Worst case scenario, having a cloud business worth $10s of billions enables these companies to overtake Nvidia.

They spend billions of dollars to build market-leading AI chips, and Nvidia loses its market as it can’t outcompete.

Generative AI

Generative AI is the current hot topic for Nvidia. Nvidia is going all in on it hoping that the hype and its sales will continue. For the next year, we expect that to be true. But there are two key aspects of generative AI to pay attention to here. The first is GPU training, and the second is consumer benefits.

Looking at the first, GPU training, Nvidia dominates this, and every company out there wants their hands on its GPUs. That’s clearly evident with the company’s 1000% margins. Even in China, where export controls have toned down what’s allowed, the company is selling everything that it can produce. However, as we discussed above, competition is increasing dramatically.

The company that started this all, Open AI, is backed by Microsoft which is building its own training processors. Google, a major competitor, is also building its own. This segment will see competition increase dramatically in the next several years.

The next part is more interesting, because the question becomes how much can Nvidia benefit. Open AI recently launched ChatGPT Enterprise, perhaps its most important launch. Generative AI might overtake many currently automate customer chat prompts etc. or many other tasks. We don’t see it overtaking in situations such as self-driving.

There are two developments here though about ChatGPT use. The first is that indications are that bigger models aren’t necessarily better. There are arguments being made that Open AI pushed the limit of the scalable benefits from more parameters. The second is that training models uses dramatically more computing power than running models.

Rumors are that ChatGPT 4 used 10k GPUs for training. That might sound like a ton, but it is $100 million in revenue, roughly, one-time for Nvidia. After the model launches, costs go down. For a company that’s looking to generate $10s of billions in annual revenue, it needs many Chat GPTs. That change in long-term computing power need can affect demand.

Thesis Risk

The largest risk to the thesis is Nvidia’s reinvestment into its business. The company’s announced share buybacks indicate it can’t find much more to invest in, but the question is whether the company can maintain the competitive GPU advantage. If it can, there could easily be the long-term demand to justify its valuation.

Conclusion

Nvidia is a great company and the company discovered the power of using GPUs and their architecture for much more than just gaming, at scale, before almost everyone else. That’s built the company a commanding lead. Open AI figured out how to use that technology for a platform that attracted numerous consumers.

That combination has skyrocketed demand for Nvidia GPUs and its valuation. However, that valuation is now too lofty. Especially with the company’s customers being large and wealthy tech companies attempting to build their own GPUs. We see Nvidia Corporation’s business as peaking and withering, which could hurt its ability to ever justify its valuation, making it a poor investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.