Summary:

- Nvidia shares have also doubled their value this year, representing one of the biggest gainers amid a fragile market climate.

- But considering persistent cyclical pressures and mounting macroeconomic uncertainties, there is low visibility into when Nvidia’s falling sales will recover.

- With substantial optimism priced into the Nvidia stock at current levels, a lot hangs on the chipmaker’s upcoming earnings, and a focus on AI alone is unlikely to cut it.

Justin Sullivan

Nvidia’s stock (NASDAQ:NVDA) has demonstrated some of the most resilient gains this year relative to the broader market, recouping almost all of its losses incurred through 2022 due to the double whammy of a cyclical downturn and an aggressive monetary policy tightening cycle that have undermined growth valuations. Much of the stock’s gains this year have been primarily driven by the AI frenzy – particularly on the rapid deployment of generative AI solutions – that has been gaining momentum since late 2022 following the public release of OpenAI’s ChatGPT. The chipmaker’s market value has almost doubled on a year-to-date basis, thanks to its dominant market share in both AI hardware and software critical to enabling continued advancements in the technology’s budding subfield.

Yet, on the fundamental front, Nvidia has been nursing two consecutive quarters of revenue declines, dragged down primarily by an industrywide inventory glut as PC sales remained sluggish, as well as a cautious enterprise spending environment amid deteriorating economic conditions. And while data center hardware demand has proven more resilient than market participants had expected earlier this year, considering consistent outperformance among Nvidia’s key hyperscaler clients in the latest earnings season, alongside incremental tailwinds from the continued development and deployment of generative AI technologies that require substantial computing power and capacity, there remains little visibility on how the dynamics of current macroeconomic conditions would impact the broader company’s end-market demand environment ahead. The following analysis will walk through various valuation methods to gauge an understanding of what Nvidia’s current market value might imply about the underlying business prospects, and discuss potential risks to the durability of the stock’s recent gains.

Nvidia Fundamental Analysis

Signs of weakness in Nvidia’s previously resilient fundamentals had started to gain prominence since the July quarter of last year when investors were notably taken back by disappointing preliminary results that the company had released ahead of its earnings call to temper expectations at the time. The company’s consolidated sales have been on a consecutive decline since, and faces a similar fate for the April quarter just ended as PC shipments – a critical gauge for its expansive gaming segment’s performance – remained sluggish, while enterprise IT spending driving its more resilient data center sales have also stayed in a cautious stance.

Specifically, persistent macroeconomic challenges continue to weigh on Nvidia’s end-market demand based on recent industry and economic data. PC shipments have been on a steadily accelerating decline in recent quarters, falling by 28.5% y/y during the first three months of 2023, marking the worst demand environment in more than three decades. Although industry peers have collectively raised optimism that the ongoing PC slump has likely bottomed out in the first quarter, improvements in the current period are likely to remain muted due to conservative guides reported to date. This is corroborated by ongoing inventory correction efforts observed across the supply chain, which remain in progress amid persistent macroeconomic uncertainties that have curtailed both retail and enterprise spending:

Three months ago, we said we expect fabless semiconductor inventory to start gradually reducing 4Q 2022 and we forecast a sharper reduction throughout the first half of 2023.

However, due to weakening macroeconomic conditions and softening end market demand, fabless semiconductor inventory continued to increase in the fourth quarter and exited 2022 at a much higher level than we expected. In addition, the recovery in end-market demand from channels reopening is also lower than our expectation. Therefore, the fabless semiconductor inventory adjustment in the first half ’23 is taking longer than our prior expectation. It may extend into the third quarter of this year before rebalancing to a healthier level.

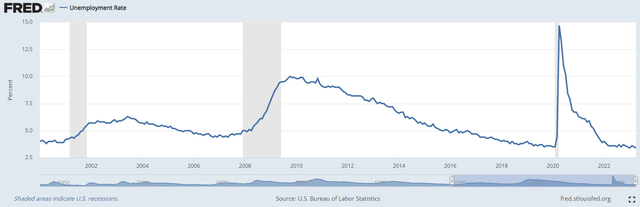

The cautious tone maintained by Nvidia’s industry peers also reflects an increasingly bleak consumer outlook based on recent economic data. In addition to declining retail sales reported in recent months – particularly in consumer electronics run on hardware provided by Nvidia and its peers – the Fed’s latest Beige Book report also found consumer spending to have weakened, with the central bank’s economists predicting an impending recession as “tighter credit conditions are likely to weigh on economic activity” further. While there have been signs of a loosening labour market, which would be a welcomed sight for Fed policymakers looking for a “better balance” in job supply and demand to ensure easing wage growth pressure on inflation, recent data showing a return of the unemployment rate to a “multi-decade low of 3.4%” in April remains a headache, underscoring complexity on the mixed near-term macroeconomic outlook.

The U.S. Unemployment Rate was at 3.4% in April (FRED)

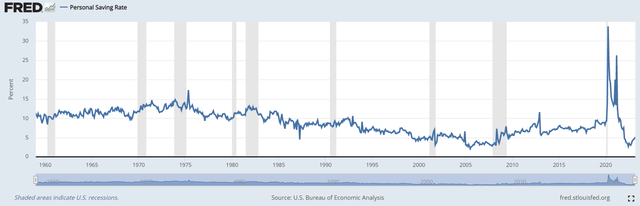

And the steadily declining household savings rate towards historically low levels is inadvertently diminishing the cushion to absorb incremental pressure from tightening financial conditions and persistent inflation as well, which will likely weigh further on the anticipated recovery in Nvidia’s end-market demand over the coming months.

The U.S. households savings rate has been in the sub- to near-5% range in recent months (FRED)

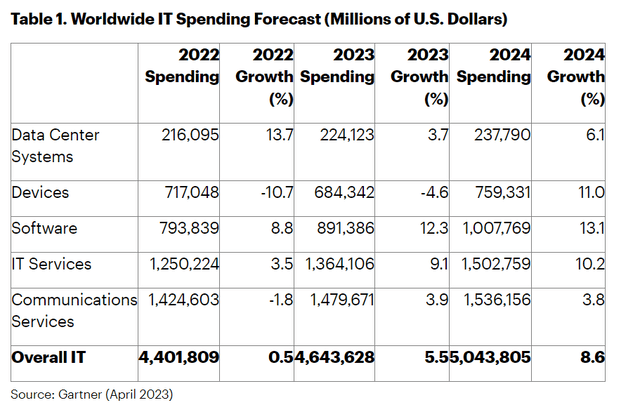

Meanwhile, the enterprise IT spending segment also remains conservative in response to lingering macroeconomic uncertainties. Outlays for hardware are likely to stay muted in the current year, which would be an ongoing headwind for Nvidia as the demand environment for its most resilient segment dampens.

2023 Global IT Spending Forecast (Gartner)

But increasing momentum in generative AI, and ensuing demand for incremental compute capacity, is favourable by creating a new long-term growth frontier for the company. Specifically, generative AI is expected to expand the cloud TAM given incremental demand for high-performance computing capacity, which will inadvertently bolster the need for supporting hardware including Nvidia’s data center GPUs optimized for AI workloads. Generative AI-driven demand will likely prove to be the data center segment’s near-term lifeline in reinforcing its resilience against macroeconomic-driven weakness in its end-market, which is corroborated by favourable ramp-up trends in the company’s latest H100 Hopper GPU – related chips have been sold in secondary markets at prices north of $40,000 compared to its estimated MSRP in the $36,000-range. Generative AI leader Microsoft (MSFT) has also poured significant investments into Nvidia hardware in recent months to bolster its development of supercomputers required to run the increasingly complex workloads, kicking off the chipmaker’s aspirations in maintaining its leadership in the nascent technology’s development to a strong start.

And Nvidia’s hardware-software duo strategy will also remain a key competitive advantage amid transient macroeconomic headwinds in the near-term. Cloud-related spending is likely to stay resilient, in line with better-than-expected hyperscaler demand observed in big tech earnings earlier this month despite “previously bleak expectations for unprecedented deceleration [indicative of a] structural slowdown in enterprise cloud migration”. Generative AI-induced cloud TAM expansion as discussed in the earlier section is also likely to drive incremental investment dollar allocation to related software spend, while hardware spend remains prone to macro-driven weakness.

The software segment will see double-digit growth this year as enterprises prioritize spending to capture competitive advantages through increased productivity, automation and other software-driven transformation initiatives.

Source: Gartner

Resilient software demand is expected to bode favourably with Nvidia’s recent release of NVIDIA AI Enterprise’s version 3.0, which “supports more than 50 NVIDIA AI framework and pretrained models and new workflows for contact center intelligent virtual assistance, audio transcription and cybersecurity” – some of the most high-demand verticals stemming from increased momentum in conversational AI services. The upcoming public deployment of Nvidia’s newest “NeMo” and “BioNeMo” large language model services, which will provide developers with access to a “number of pre-trained foundation models” that can be further customize-trained using “prompt-learning” is also expected to capture resilient enterprise spending on IT services.

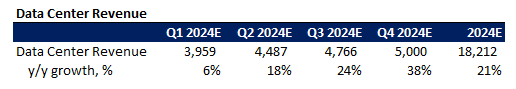

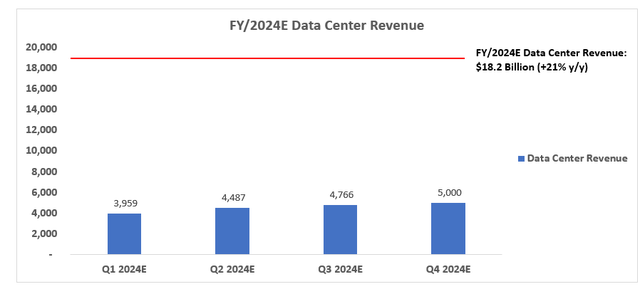

Taken together, we expect Nvidia’s data center segment to have maintained growth in the April quarter, though at a slightly decelerated pace given the inevitable impact of evolving macroeconomic challenges. The segment’s resilience is likely to stay subdued in the first half of fiscal 2024 though, reflective of a challenging end-user demand environment. But the segment’s growth is expected to reaccelerate in the second half of the year – likely earlier than any other end-market vertical – considering the continued ramp up of new hardware (e.g. H100) and software (e.g. NVIDIA AI; NeMo and BioNeMo LLMs) offerings, and the mission-critical nature of data center technologies in the advent of cloud- and connectivity-driven IT infrastructures.

Nvidia FY/2024E Data Center Revenue (Author)

Nvidia FY/2024E Data Center Revenue (Author)

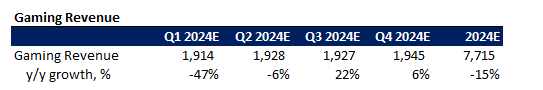

Meanwhile, the consumer-heavy gaming segment is expected to experience continued weakness, with persistent sales declines in the first half of fiscal 2024 consistent with the ongoing PC market slump. Limited visibility on the impact of near-term macroeconomic weakness on demand later in the year – which some are expecting to recover, though with cautious optimism, given the multi-decade low demand in PC end-markets – have also been further complicated by a weaker-than-expected inventory correction cycle based on industry commentary in the latest earnings season. But an easier PY comp set-up in the second half, alongside typical seasonality trends, will likely support reacceleration, even if market recovery-driven demand stays modest. The gaming segment is likely to be a prime demonstration of a “tale of two halves”, with anticipated reacceleration approaching the fiscal year end to help slow the y/y decline in full-year sales.

Nvidia FY/2024E Gaming Revenue (Author)

Nvidia FY/2024E Gaming Revenue (Author)

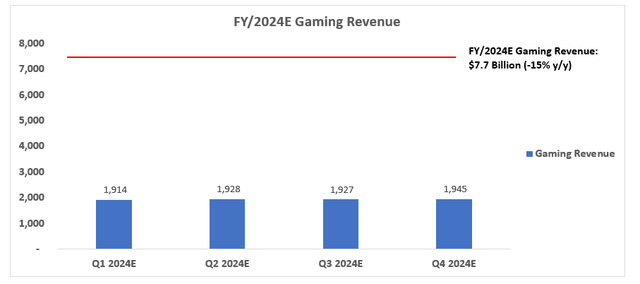

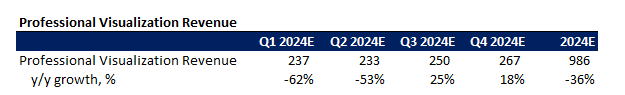

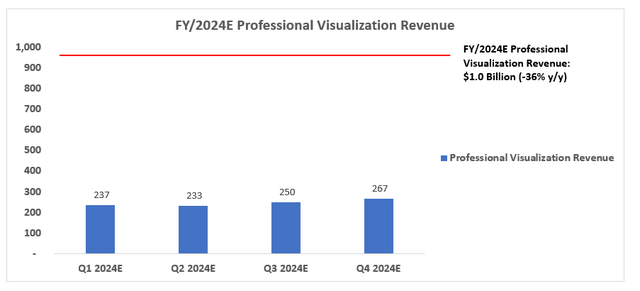

Performance in Nvidia’s professional visualization segment is likely to imitate expectations in its consumer-centric gaming segment. This is consistent with market forecasts for continually weak enterprise demand for devices and, inadvertently, high-performance GPUs (e.g. RTX 4000 series). Previous momentum in virtual experience developments, like NVIDIA Omniverse, are likely to take a backseat for now as well, given macroeconomic uncertainties alongside growing interest for generative AI solutions overshadow demand for related services.

Nvidia FY/2024E Professional Visualization Revenue (Author)

Nvidia FY/2024E Professional Visualization Revenue (Author)

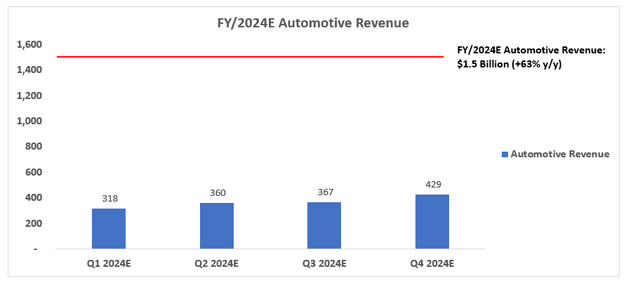

Nvidia’s automotive segment is likely to have remained a bright spot during the April quarter, given the industry’s resilient demand upon easing supply constraints. But backlogs that have propped up auto sales amid the deteriorating consumer end-market is likely to diminish as the year progresses with demand risks taking comfort in the driver’s seat. This is expected to normalize momentum for Nvidia’s automotive segment sales in the latter half of the current fiscal year.

Nvidia FY/2024E Automotive Revenue (Author)

Nvidia FY/2024E Automotive Revenue (Author)

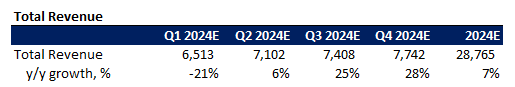

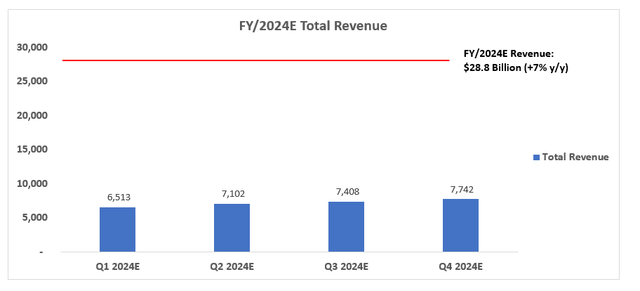

Taken together, Nvidia’s total revenue is expected to have experienced a similar drop in the recently finished April quarter as in the previous January quarter. Anticipated reacceleration in the latter half of fiscal 2024, driven primarily by an easier PY comp set-up and seasonal trends, alongside expectations for modest demand recovery in its currently battered consumer-centric segments, is expected to help consolidated revenue finish the year with 7% y/y growth.

Nvidia FY/2024E Total Revenue (Author)

Nvidia FY/2024E Total Revenue (Author)

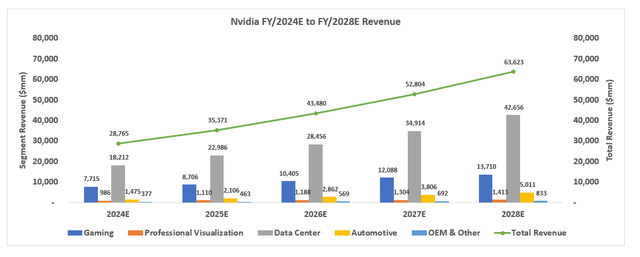

Looking ahead, Nvidia’s data center sales will continue to be the core driver of the company’s consolidated growth given secular tailwinds in cloud migration, as well as incremental TAM enabled by the deployment of generative AI solutions. And the increasing mix of more profitable data center sales will be key to driving longer-term margin expansion for Nvidia, alongside continued scale across the broader business. And Nvidia’s automotive sales will likely continue to post robust growth and expand its share of revenue mix over the longer-term with the eventual return of cyclical tailwinds in the industry, given accelerating OEM demand for connectivity and advanced driving assistance features in next-generation vehicles in which the chipmaker is a core enabler of through both its hardware and software offerings. Meanwhile, the gaming and professional visualization segments will likely experience normalized demand trends over the longer-term, supported primarily by the sheer size of Nvidia’s market leadership in GPUs.

Nvidia FY/2024E to FY/2028E Revenue (Author)

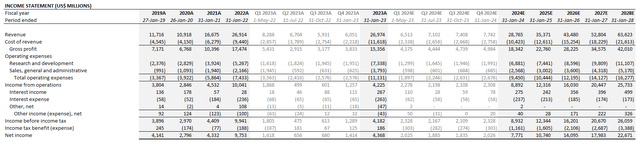

Taken together with gradual margin expansion expected from the increasing mix of more profitable data center sales, alongside the continued ramp up of new offerings to scale with normalization of opex spend – particularly in R&D – Nvidia’s income is estimated to expand the high $7 billion range in fiscal 2024 towards the $22 billion range by the end of fiscal 2028.

Nvidia Financial Forecast (Author)

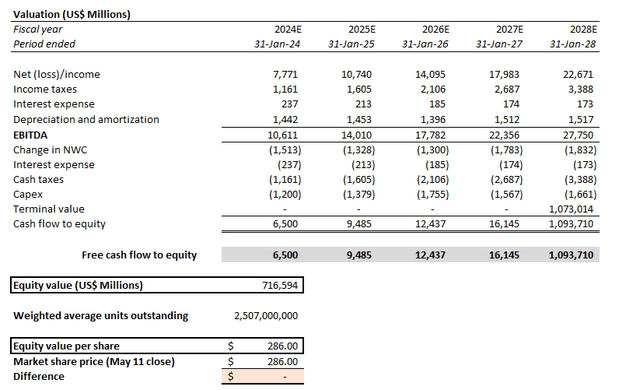

Discounted Cash Flow Valuation

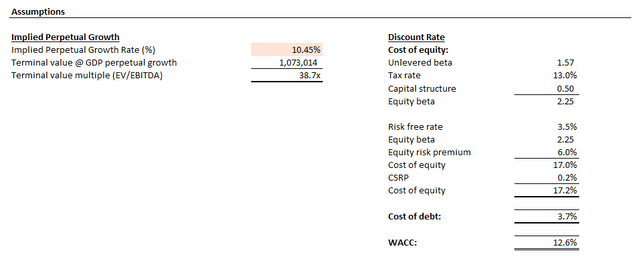

Nvidia’s projected free cash flows over a five-year discrete period taken in conjunction with our fundamental analysis in the foregoing discussion, discounted at a WACC of 12.6% based on the company’s risk profile and capital structure, would imply a perpetual growth rate north of 10% at its current share price of about $286.

Nvidia’s current share price of $286 implies a perpetual growth rate of 10.5% (Author)

Nvidia’s current share price of $286 implies a perpetual growth rate of 10.5% (Author)

Growth companies like Nvidia are typically valued at an implied perpetual growth rate closer to the anticipated pace of GDP increase across their core operating regions, given their leading role in driving economic expansion. This rate typically lands near the 3% range, though it is reasonable for companies that demonstrate a robust economic and market moat – like Nvidia – to benefit from an incremental premium. But currently trading at a greater than 10% implied perpetual growth rate, the market has likely priced in substantial optimism into Nvidia’s longer-term prospects, which raises the stock’s susceptibility to near-term weakness in the broader market climate when fundamental performance amid the looming recession comes back into focus. Even if Nvidia’s WACC decreases to the 10%-range to reflect further improvements to its risk profile and capital structure, the implied perpetual growth rate at the stock’s current levels would still be in the high single-digits, which is well beyond a reasonable growth premium attributable to the underlying business’ market leadership moat.

At a 10% WACC, Nvidia’s current share price of $286 would imply a perpetual growth rate of 7.7% (Author)

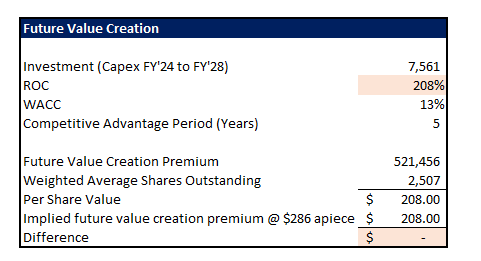

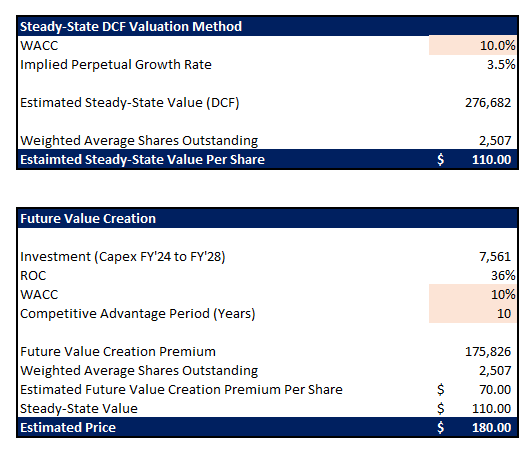

Steady-State and Future Value Creation Premium Valuation

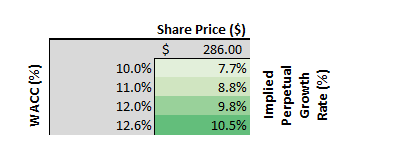

The steady-state valuation method measures the worth of cash flows in a company that can be sustained indefinitely regardless of whether incremental capital investments are made. This metric can be denoted by a P/E multiple equivalent to one divided by the cost of capital:

Steady-State P/E Computation (Valuation Theory)

A company can continue to grow earnings as it invests at the cost of capital. It will just fail to create value, and hence should trade at its steady-state worth. We can readily translate from the steady-state value to a steady-state price-earnings multiple, which is the reciprocal of the cost of [capital].

Source: Credit Suisse

The Gordon growth model is another way to gauge steady-state firm value, with the key assumption here other than cost of capital being GDP growth.

Gordon Growth Model (Valuation Theory)

Consistent with our discussion in the earlier section, GDP growth is typically used as a key benchmark to gauge the implied perpetual growth of a company, with additional consideration of the maturity of its industry as well as other company-specific factors such as market leadership, competitive advantages, and/or market share.

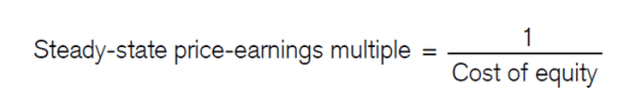

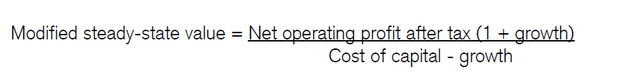

Meanwhile, the future value creation premium accounts for the incremental value that additional investments at the cost of capital would generate (i.e. return on capital) for the company, and also takes into consideration the time period in which this value-creation opportunity would last.

Future Value Creation Premium Computation (Valuation Theory)

Future value creation is essentially the premium to the steady-state firm value, and typically explains the incremental outperformance observed in certain stocks relative to their peers and/or the broader market.

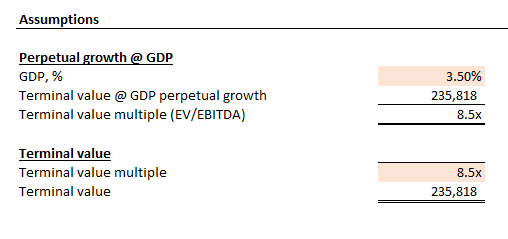

To gauge what Nvidia’s market value at current levels implies under the steady-state value and future value creation valuation method, we have applied an implied perpetual growth rate of 3.5%, in line with the estimated pace of economic expansion in its core operating regions (i.e. U.S., Europe, China), to its projected cash flows discussed in the earlier section, discounted by a WACC of 12.6%. The implied growth rate of 3.5% yields an implied terminal value multiple of about 8.5x, which is consistent with the steady-state P/E multiple of about 8x computed by one divided by the 12.6% WACC.

Nvidia Implied Terminal Value @ 3.5% Perpetual Growth Rate (Author)

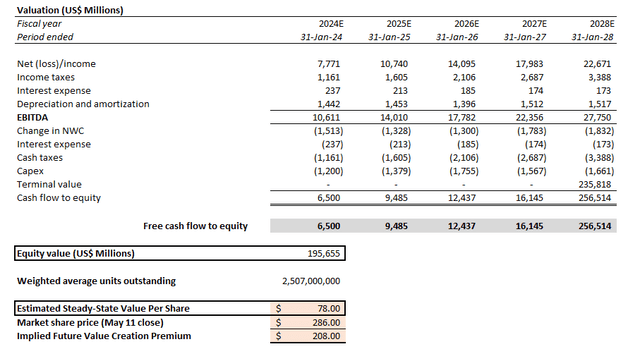

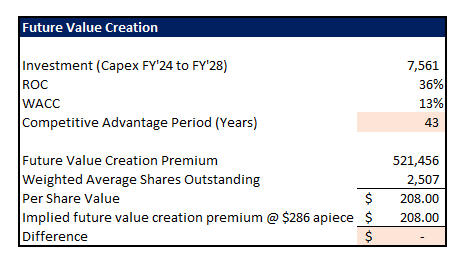

This computation yields an estimated steady-state value of $78 apiece, implying a future value creation premium of $208 based on the share’s current price at the $286 range.

Nvidia Steady-State and Future Value Creation Premium Valuation (Author)

Circling back to the future value creation formula, while holding the cost of capital constant at 12.6% to reflect Nvidia’s risk profile and capital structure, a future value creation premium of $208 would imply either a competitive advantage period of more than 40 years based on a 36% ROC, or a ROC of more than 200% based on a competitive advantage period of five years consistent with the forecast period.

Holding WACC and ROC constant at 12.6% and 36%, respectively, a future value creation premium of $208 would imply a competitive advantage period of 43 years for Nvidia. (Author)

Holding WACC and competitive advantage period constant at 12.6% and 5 years, respectively, a future value creation premium of $208 would imply a ROC of 208% for Nvidia. (Author)

Both scenarios would suggest substantial optimism priced into the stock at current levels, especially given elevated multiple compression risks amid persistent macroeconomic uncertainties.

Even if the assumed WACC is reduced to the 10% range to imitate the risk profile of typical value companies, and the competitive advantage period is extended to 10 years, which remains reasonable considering Nvidia’s mission-critical role in enabling key next generation technologies, the future value creation premium would be closer to $70 apiece. Taken together with an estimated steady-state value of about $110 apiece at a 10% WACC and 3.5% implied perpetual growth rate, Nvidia should trade closer to an estimated intrinsic value of about $180 apiece under the most conservative perpetual growth and competitive advantage premium attributable to the company’s underlying business even amid transient macroeconomic and cyclical headwinds.

Nvidia’s Steady-State Value and Future Value Creation Premium @ 10% WACC, 3.5% implied perpetual growth rate, and 10-year competitive advantage period would together yield a reasonable base case PT of about $150 (Author)

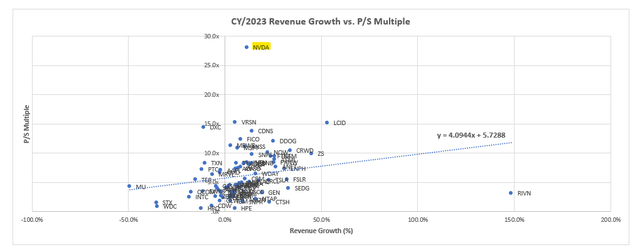

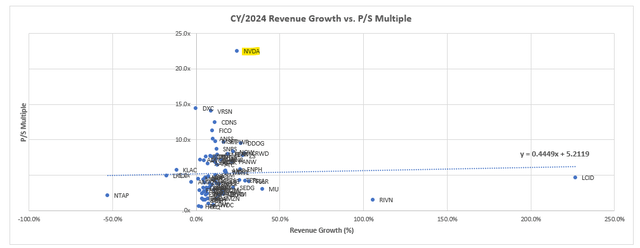

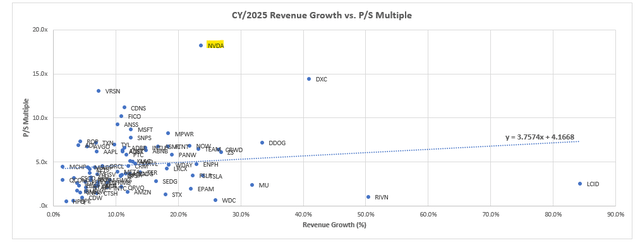

Relative Valuation

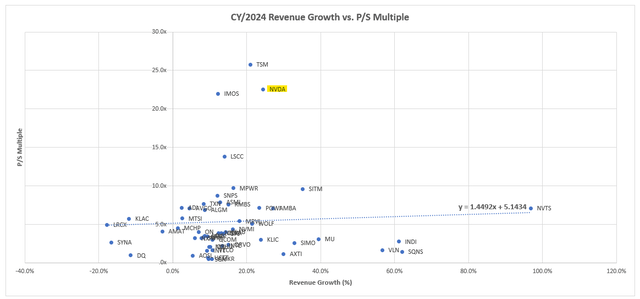

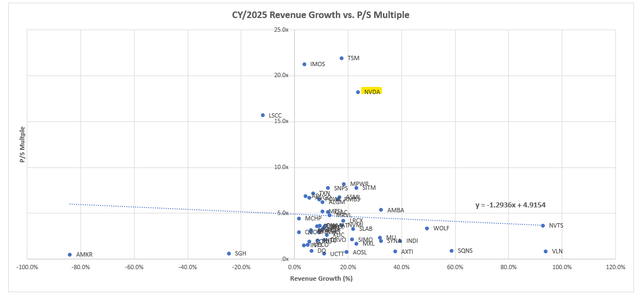

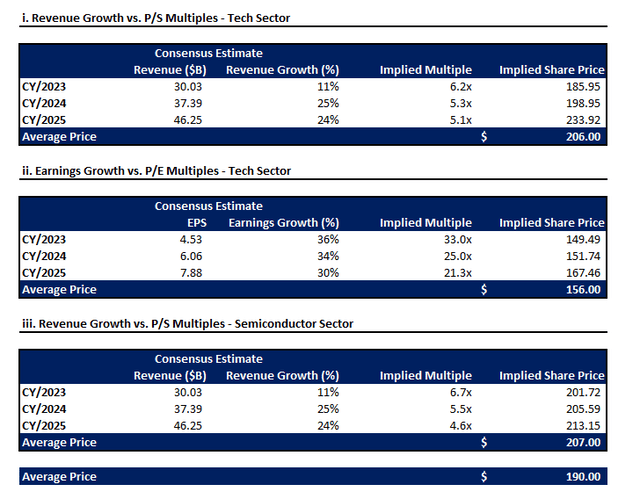

To gauge Nvidia’s relative valuation to its tech and semiconductor peers, we have plotted their consensus revenue and earnings growth estimates against current price/sales and price/earnings multiples over CY/2023, CY/2024 and CY/2025. The results demonstrate Nvidia’s substantial valuation premium on a relative basis to its peers in both the broader tech sector and the semiconductor industry.

i. Revenue Growth vs. P/S Multiples – Tech Sector

CY/2023E Tech Sector Sales Peer Comp (Data from Seeking Alpha)

CY/2024E Tech Sector Sales Peer Comp (Data from Seeking Alpha)

CY/2025E Tech Sector Sales Peer Comp (Data from Seeking Alpha)

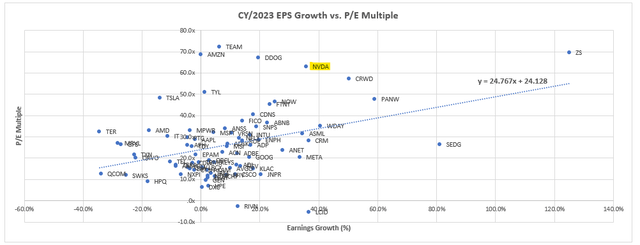

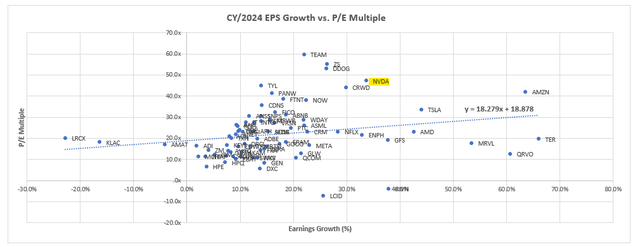

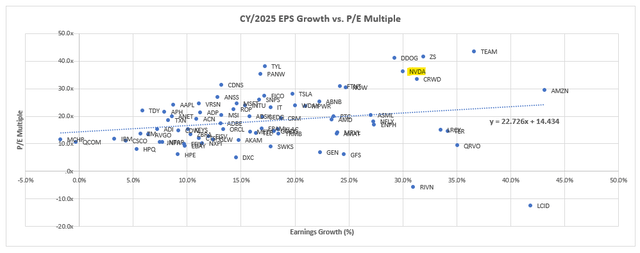

ii. Earnings Growth vs. P/E Multiples – Tech Sector

CY/2023E Tech Sector Earnings Peer Comp (Data from Seeking Alpha)

CY/2024E Tech Sector Earnings Peer Comp (Data from Seeking Alpha)

CY/2025E Tech Sector Earnings Peer Comp (Data from Seeking Alpha)

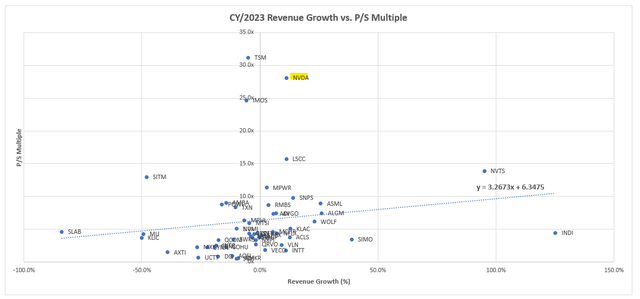

iii. Revenue Growth vs. P/S Multiples – Semiconductor Sector

CY/2023E Semiconductor Industry Sales Peer Comp (Data from Seeking Alpha)

CY/2024E Semiconductor Industry Sales Peer Comp (Data from Seeking Alpha)

CY/2025E Semiconductor Industry Sales Peer Comp (Data from Seeking Alpha)

Narrowing Nvidia’s current valuation premium to peers should bring the stock to trade closer to the $190 to $200 range per share. We view this as a reasonable base case for Nvidia’a stock, as it would imply a perpetual growth rate at about 6.5% at a normalized WACC of about 10% to reflect the underlying business’ risk profile and capital structure when long-end Treasury yield – a gauge for the risk-free rate – normalizes, and to reflect the premium attributable to the company’s market leadership in the provision of mission-critical hardware and software for enabling key next-generation growth trends (e.g. AI).

Nvidia Relative Valuation Analysis (Author)

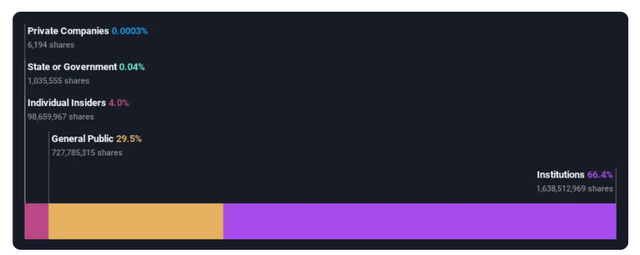

Fund Driven Momentum

While the forgoing valuation analyses reflect substantial optimism over Nvidia’s growth and profitability prospects currently priced into the stock, it is likely that fund-driven momentum has also played a role in propping up its current market value. Specifically, Nvidia’s stock currently accounts for about 3% of the S&P 500 and more than 5% of the tech-heavy Nasdaq 100. This makes it a crucial holding for funds tracking the key market gauges, which is in line with the institutional-heavy investor base in Nvidia – recent data shows more than two-thirds of the chipmaker’s stake is held by institutional investors at the moment. This has likely added incremental momentum to the stock’s latest rally, which has defied relatively flat market performance over the past month.

Nvidia Ownership Composition (Yahoo News)

Risks to Consider

Admittedly, Nvidia’s technologies remain the backbone of key secular growth trends over the longer-term. This accordingly reinforces its current technology and economic moat, and provides justification for a premium attributable to the stock. However, the substantial premium currently priced into the stock, as discussed in detail throughout the foregoing analysis, represents a significant disconnect from still uncertain macroeconomic conditions weighing on both Nvidia’s near-term fundamental and valuation prospects (i.e. multiple compression risk), among other risks. And the potential realization of these risks could catalyze a downward valuation adjustment to the stock, drawing concerns over the durability of its recent rally.

- AI Regulatory Risks: The rapid development and deployment of generative AI solutions in recent months has brought up concerns about the potential misuse of related technologies. This has encouraged both government and industry participants to consider regulating the technology and “mitigate the potential harms” that might follow. Related concerns are in line with some corporate organizations that have banned the use of generative AI tools to prevent both intentional and unintentional disclosure of “sensitive” information to the public. A recent survey conducted by Samsung (OTCPK:SSNLF) (OTCPK:SSNNF) among its employees showed 65% of respondents believe currently available generative AI tools “pose a security risk”. Reputable individuals in the industry, including Apple (AAPL) CEO Tim Cook and the “godfather of AI” Geoffrey Hinton have also recently warned of “growing potential for harms from AI” with concerns in the technology’s deployment that “still need to be sorted out”. Disruptive technologies typically come with disruptive regulations following their initial deployment, which could lead to transient challenges to their growth curves (e.g. rules on user privacy that have continued to evolve since the advent of IoT, regulatory reforms on crypto assets/Web 3 developments, etc.). And we expect a similar fate as the adoption of AI technologies accelerate, which could risk altering current optimism priced into Nvidia’s prospects in the field, and temper momentum (either temporarily or permanently) for related offerings.

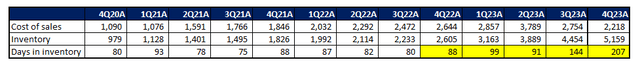

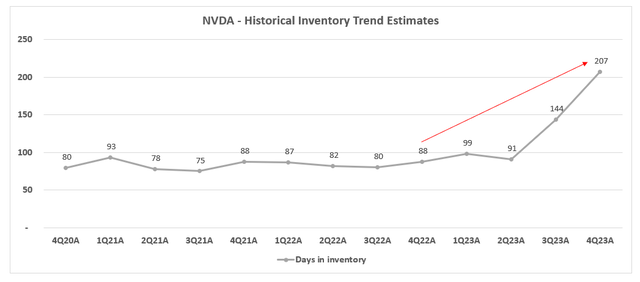

- Protracted Cyclical Headwinds: As discussed in the earlier section of the foregoing analysis, persistent macroeconomic uncertainties remains a multiple compression risk for Nvidia. This also draws into question the durability of the stock’s recent rally, especially as the disconnect with anticipated near-term fundamental weakness widens. In addition to continued weakness in revenue growth over the near-term, Nvidia is also dealing with industry stockpiles and, inadvertently, internal inventory that remains elevated. Despite Nvidia’s expectations for impact related to “channel inventory correction” to be “largely behind us”, uncertainties remain over the broader supply chain’s digestion of excess stockpiles and the extent of anticipated normalization over the near-term. And Nvidia’s ballooning inventory balance, and gradually building days of inventory, will likely persist over the foreseeable future due to looming uncertainties over the timing of stockpile digestion across the supply chain, driving incremental downside risks to its near-term fundamental performance as end-market demand stays subdued.

Nvidia’s days in inventory has expanded substantially in recent quarters (Data from Nvidia’s SEC Filings)

Nvidia Days in Inventory Trends (Data from Nvidia SEC Filings)

- Geopolitical Risks: Escalating geopolitical tensions – particularly between the U.S. and China – continue to overshadow growth prospects in one of Nvidia’s largest markets. Following Washington’s order to ban exports of advanced semiconductor technologies to China last year, Nvidia and its peers have inevitably experienced reduced demand from the region, in addition to incremental costs incurred to conduct business in the region. This includes lost sales from the inability to ship the advanced H100 GPUs to China – a core demand center for AI technologies – as well as the need to reconfigure the technology’s predecessor with a China-specific model, the A800 GPUs, to comply with U.S. regulatory requirements and ensure adequate capture of market share. Although related challenges have placed an immaterial impact to Nvidia’s valuation prospects, risks remain over fraying U.S.-China relations which could further decrease the chipmaker’s TAM access ex-China.

The total data center sequential revenue decline was driven by lower sales in China, which was largely in line with our expectations, reflecting COVID and other domestic issues.

The Bottom Line

Admittedly, Nvidia boasts ones of the strongest moats and bullish narratives supportive of a sustained long-term growth trajectory – including its leading market share in core growth verticals, buoyed by continued commitment to technological advancements, particularly in its software-hardware strategy that allows it to double-dip and optimize TAM capture. However, the stock’s substantial outperformance relative to peers and the broader market, paired with the anticipation for continued weakness due to transient macroeconomic and cyclical challenges leaves an ever-expanding disconnect that keeps us incrementally cautious. The stock’s valuation premium at current levels prices in substantial optimism over Nvidia’s underlying business performance, yet its fundamentals will likely remain subdued over the foreseeable future due to immediate challenges to the end-market demand environment. For now, much of the market’s optimism on the company’s long-term prospects have likely already been priced into the stock. The next leg to sustaining the stock’s recovery will likely rely on Nvidia’s effectiveness in translating the prospects into real fundamental strength – including reacceleration and margin expansion over the coming quarters despite lingering cyclical headwinds – which will then bolster durability in its rebound.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!