Summary:

- Price insensitive and valuation insensitive passive fund flows are creating the biggest bubble in modern market history.

- Case in point, Nvidia’s stock price has reached absurd levels, reflecting the current market insanity.

- The irony is that the pain and suffering that Jensen Huang rightly preaches will be ultimately borne by Nvidia shareholders, in my opinion.

letizia strizzi/iStock via Getty Images

“If everybody indexed, the only word you could use is chaos, catastrophe… The markets would fail.”

– John Bogle, May 2017.

“The AI hype is a classic example of a big market delusion. It’s just like the dot com era when everyone was laying huge bets the internet would change everything. The narrative was correct. But the market bet that narrative would play out a lot faster than it ultimately did.”

– Rob Arnott As Told To The FT.

Introduction

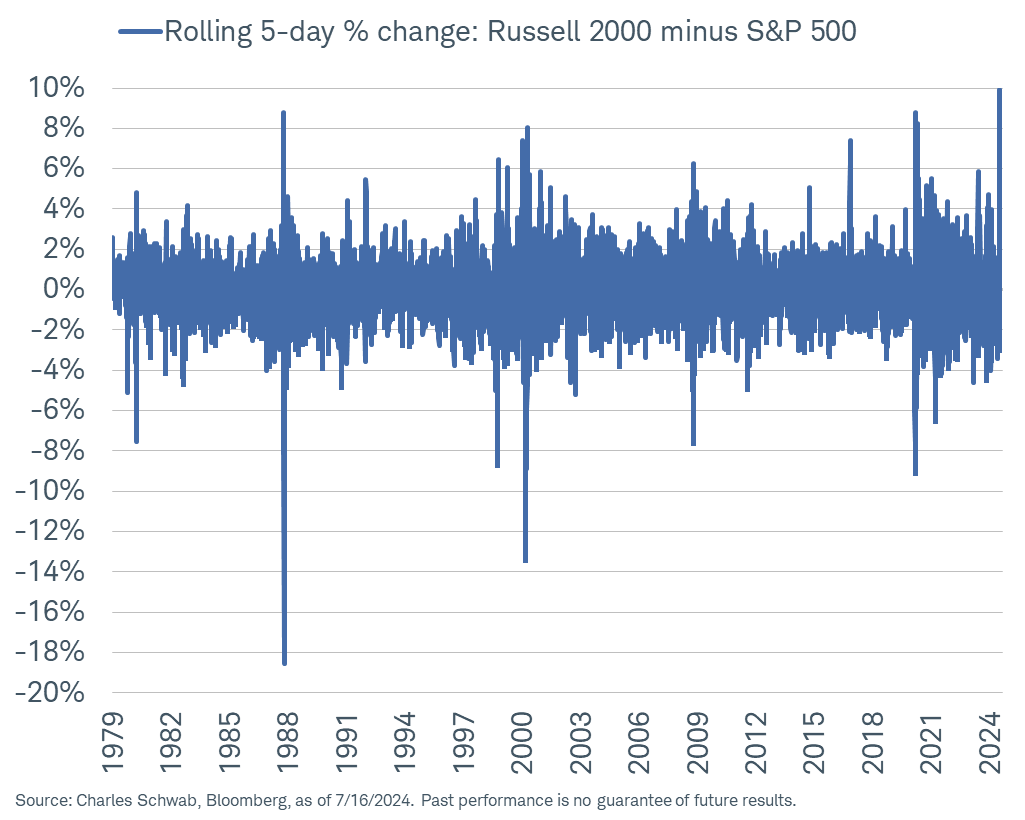

The momentum trade is faltering, as the Russell 2000 (RTY) has surged the most relative to the S&P 500 Index (SP500) in history the past five days ending Tuesday, July 16th (this was true for the chart ending on Tuesday, July 16th’s close, however it stayed true for Wednesday’s close as well).

Russell 2000 Versus S&P 500 (Bloomberg, Charles Schwab)

Additionally, momentum favorites are starting to fall like dominoes, one by one. This was evident from price action on Wednesday, July 17th, 2024, and Thursday, July 18th, thus far, with momentum favorites like Eli Lilly (LLY), which is down over 7% today as I edit this note, and Nvidia Corporation (NASDAQ:NVDA, NEOE:NVDA:CA) retreating from their recent highs in the same aggressive fashion that they visited these highs.

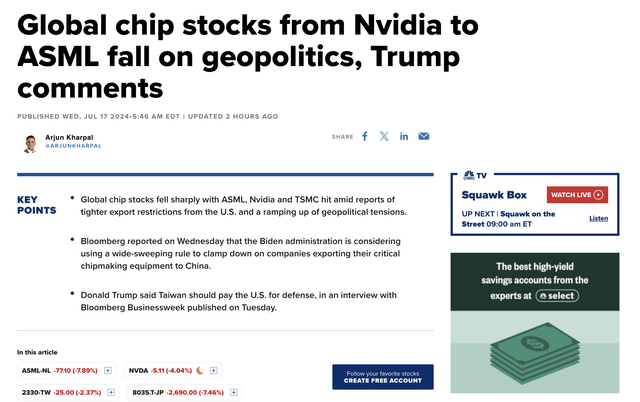

Adding to the cloud overhanging semiconductor stocks, which had their worst single day performance since 2022 on Wednesday, there is pertinent negative news developing on the semiconductor sector and Nvidia itself. The Biden administration seeks to enforce a broader mandate on semiconductor exports to China, and the prospective Trump administration says that Taiwan has taken chip manufacturing jobs from the United States, specifically naming Taiwan Semiconductor aka TSMC (TSM) as a beneficiary. Additionally, ASML Holding N.V.(ASML), the chip equipment maker, just reported earnings, and they received 49% of their revenue from China, so the more comprehensive export ban will impact Nvidia and its cohorts directly and indirectly.

Semiconductor Headwinds Developing (CNBC, Author)

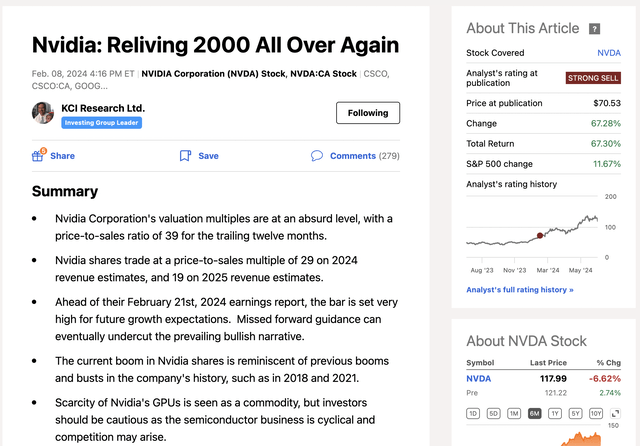

Suffice it to say, I have been spectacularly wrong, at least thus far, with my previous public February 8th, 2024, Seeking Alpha article on Nvidia. There, I hypothesized that we were living in 2000 all over again and NVDA shares were set to peak. Again, I emphasize temporarily wrong, as epic bubbles have a way of overshooting even previously unbelievable levels. However, this is the risk, and it is still the risk today in NVDA shares, that irrationally can go on a lot longer than you think is possible.

Author’s February 8th, 2024 NVDA Snapshot (Author, Seeking Alpha)

For now, I have to own this incorrect call. However, any good analyst, trader, or investor, will continually try to take advantage of the market opportunities that are the reality facing us, even when they make mistakes. As the saying goes, when there is blood in the streets, even if it is your own, take advantage of the resulting opportunity.

Ultimately, the speculative blow-off top in Nvidia shares went much further than I ever imagined, something I will discuss in the next section, to give perspective. I have chronicled this along the way, yet each time, Nvidia shares have kept galloping higher and higher, ignoring any traditional valuation bounds like price-to-sales ratio.

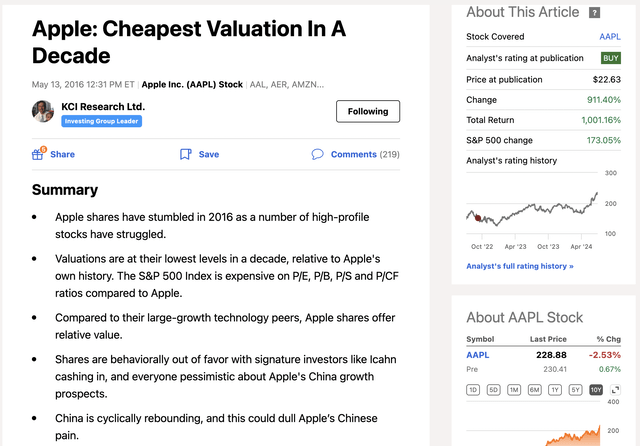

Critics point out that it seems like I am a Perm-bear on technology stocks. However, that is not true, as evidenced by my May 13th, 2016 bullish take on Apple (AAPL), published right here on Seeking Alpha.

Author’s May 13th, 2016 Apple Article. (Author, Seeking Alpha)

For reference, when I published that Seeking Alpha article on Apple in May 2016, Apple’s price-to-earnings ratio was 10.3, compared to the S&P 500’s price-to-earnings ratio of 18.8 at that time, and Apple’s price-to-sales ratio was 3.9. For comparison, Nvidia’s price-to-earnings ratio for the trailing twelve months today is 69.0, and its price-to-sales ratio for the trailing twelve months is 36.9.

Ultimately, starting valuation is incredibly important, and Nvidia’s starting valuation today is historically high, especially compared to something like Apple in May 2016.

Nvidia Shares Remain Historically Overvalued & 2000 Comparison Remains Valid

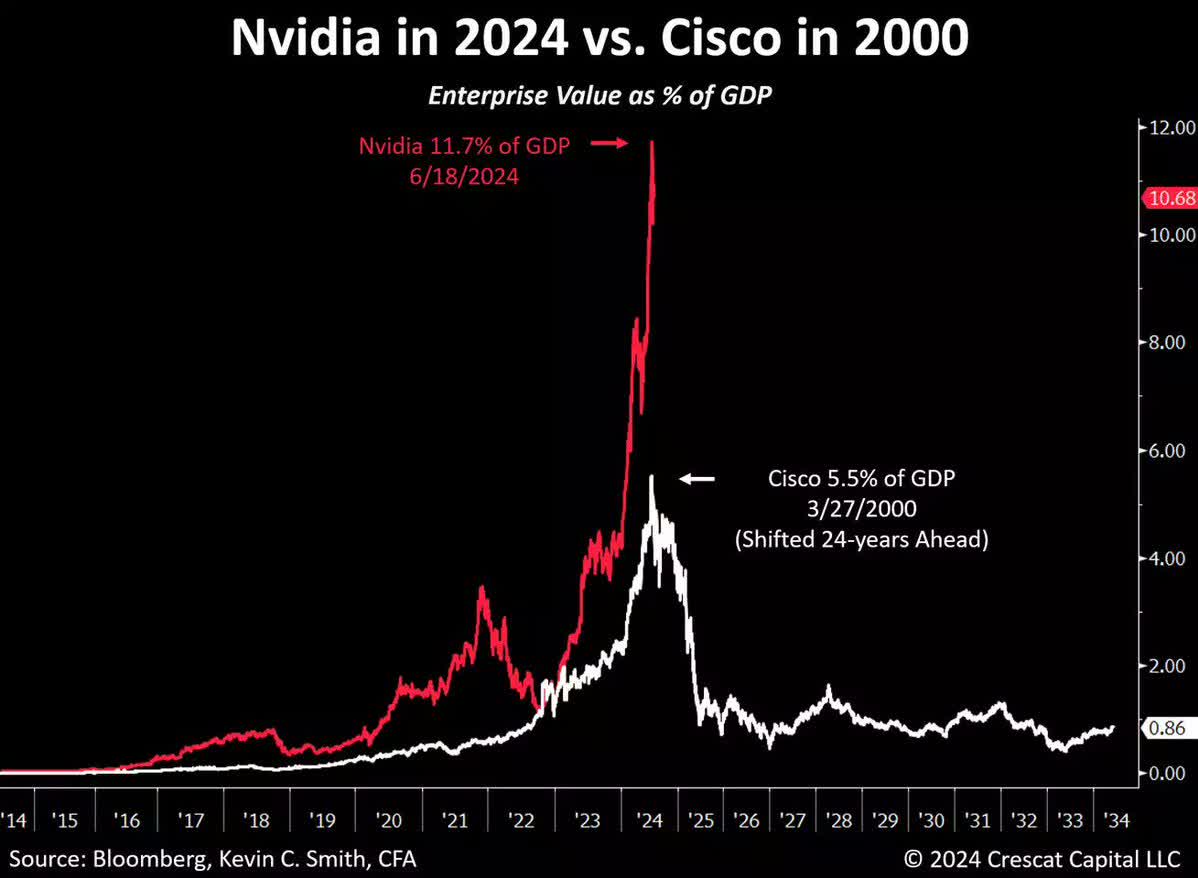

While it has been a bumpy start to my prediction, I still think Nvidia is going to play out like Cisco Systems (CSCO) in 2000. In fact, there is a cogent argument that NVDA shares are far more overvalued than Cisco was comparatively in 2000. Building on this narrative, looking at enterprise value as a percentage of GDP, Nvidia has skyrocketed past Cisco at its June 18th, 2024 peak.

Nvidia Versus Cisco (Bloomberg, Crescat, Kevin C. Smith)

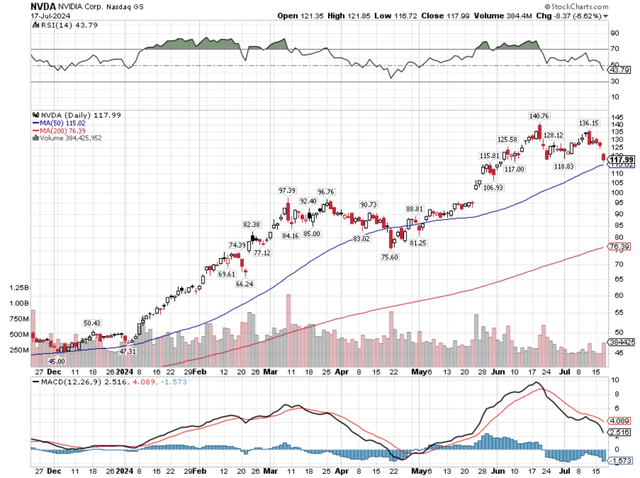

Shorter-term price action for Nvidia looks like a top is indeed forming in NVDA shares, with momentum now starting to break to the downside.

NVDA Shorter-Term Price Action (Author, StockCharts)

Citigroup (C) made the observation that the volume weighted average share price of Nvidia is now lower than where it was on May 24th, which was Nvidia’s last earnings date.

Said another way, volume weighted purchasers of NVDA shares on average are down since May 24th, when the stock price was actually much lower back then.

The next demarcation line of interest is NVDA’s 50-day moving average at $115.02. Breaking this moving average would open a door to a test of the 200-day moving average, which is much lower.

Closing Thoughts: The 2000 Analogy Is Still Valid, Caveat Emptor, & Pain & Suffering Is Nearly A Requirement For Outperformance

Scratch your head, take a snapshot in time, and remember this insanity that we are mired in right now, and take advantage of the historic opportunity.

Seemingly each day, something mesmerizing happens in the markets. Said another way, it is unbelievable price action on top of unbelievable price action that makes everything not normal feel somewhat normal, in an environment where asset prices are anything but normal.

Those that lived through the markets in 1998-2003, this feeling now is precisely how the markets felt back then. What I mean is, with unbelievable price action, and the recent volatility in the Invesco QQQ Trust (QQQ), which had its worst day relative to the iShares Russell 2000 ETF (IWN) in 22 years on Thursday, July 11th. It then had its worst absolute day since 2022, yesterday, on Wednesday, July 17th. This is bringing back shades of price action from January 2000.

As many remember, the Nasdaq Composite (COMP:IND) famously cracked in March 2000, before an almost double-top in the SPDR S&P 500 Index ETF (SPY) in October 2000.

Could Nvidia be leading the markets lower after it led the markets higher? On the short-term chart shown earlier, it certainly looks like it. On the longer-term chart, however, the recent decline is just a blip, at least for right now, in Nvidia shares.

NVDA Longer-Term (Author, StockCharts)

What a beautiful stock chart and a beautiful American company.

How could I not buy this on the long side somewhere along the way? Just looking at the stock price chart, I feel like a dunce, and my 30 plus years of market participation and education has all been for naught.

The silver lining, though, is there is now opportunity on the other side.

Clearly, Nvidia is a wonderful company, and the founder and CEO of Nvidia, Jensen Huang, has a backstory that is an amazing story, too. In fact, I admire Jensen Huang, particularly his viewpoint about needing pain and suffering to foster resilience.

Here is one of his direct quotes on the topic.

Greatness is not intelligence. Greatness comes from character. And character isn’t formed out of smart people, it’s formed out of people who suffered.

Jensen Huang.

The next quote is particularly near and dear to my heart, as I believe in it immensely, so in a way, I feel a bond with Jensen Huang on this topic.

Unfortunately, resilience matters in success, (and) I don’t know how to teach it to you except for I hope suffering happens to you.

Jensen Huang.

Read that last quote again that Jensen gave in his March 2024 address at Stanford, which is music to my heart because Jensen Huang is saying you need to go through pain and suffering to have resilience to ultimately have success.

And, oh boy, you are in luck, dear reader, because Mr. Market can surely dish out his share of pain and suffering.

In fact, I wrote about the importance of resilience all the way back in October 2018, the article I wrote about resilience is linked here, with a snapshot of that post shown below.

Author’s October 29th, 2018 Post (Author)

At the time I wrote that blog post, we were in the middle of a tremendous amount of pain and suffering. However, that character that this pain and suffering built, that resilience, ultimately paid off remarkably.

Let me tie everything together now. So let’s recap and get to the concluding thoughts and takeaways.

-

The equity market, and more specifically, the Invesco QQQ Trust ETF has lost its mind.

-

Nvidia, who has a CEO whose view on resilience I admire greatly, and who has built a company to be proud of, has seen its valuation double Cisco’s peak valuation relative to the GDP of the U.S. that Cisco achieved at its peak in 2000.

-

Pain and suffering is almost a prerequisite to build character and have success.

-

Pain and suffering builds character, and most importantly it builds resilience.

-

Ironically, the paradox is that having a rational mind about the echo bubble we are firmly in now in 2024, which is a follow-up to the 2021 bubble, with the echo bubble occurring now in relatively high-quality stocks that have traded to ludicrous valuations, has caused a lot of pain and suffering, spurring resilience, and creating tremendous absolute and relative opportunity.

On July 9th, 2024, Keybank (KEY) raised its price target on Nvidia from a $130 to $180, which would be an $1800 share price for Nvidia pre-split, and on July 12th, Benchmark raised their price target for Nvidia shares to $170.

This is the same Nvidia that has the following characteristics.

-

Nvidia, at a market capitalization of $2.9 trillion at yesterday’s close, is trading for roughly 24 times this year’s revenue estimate of $120.5 billion. This is difficult to believe given the enormous market capitalization where Nvidia is trading like a small technology start-up, and this ludicrous price-to-sales valuation is a function of the river of fund flows from price insensitive and valuation insensitive investors. Read that again, a price-to-sales ratio of 24 for this year! Remember Scott McNealy’s demarcation line of a price-to-sales ratio of 10 being an impossible hurdle to surpass for future shareholder returns.

-

According to roughly 50 analysts, Nvidia is expected to see consensus sales growth of roughly 34.8% next year (down from this year’s sales growth of 97.8%) to sales of $161.5 billion. Still good, still healthy, but the law of large numbers is starting to catch up to even this market darling. Thus, on next year’s price-to-sales forecast, Nvidia is trading at a price-to-sales multiple of 18!

-

Stanley Druckenmiller, one of the greatest investors in history, an investor who built his Nvidia stake initially in 2022, and added to it in every quarter of 2023, exited a bulk of his Nvidia position in the first quarter of 2024. He was out of the remaining shares in the second quarter at pre-split price of roughly $840, or $84 post split, with Nvidia shares closing at $117.99 yesterday.

-

Remarkably, and the markets have a history of rhyming, however, on June 18th, 2024, Nvidia, like Cisco in March 2000, passed Microsoft (MSFT) to become the largest market capitalization stock.

-

For perspective, when Cisco passed Microsoft on March 24th, 2000 to briefly become the largest market capitalization stock, its intraday market-cap high was $575.93 billion. When Nvidia passed Microsoft on a closing basis to make it the largest market capitalization stock on June 18th, 2024, Nvidia’s market-cap exceeded $3.3 trillion, at an aforementioned price-to-sales multiple of 27.

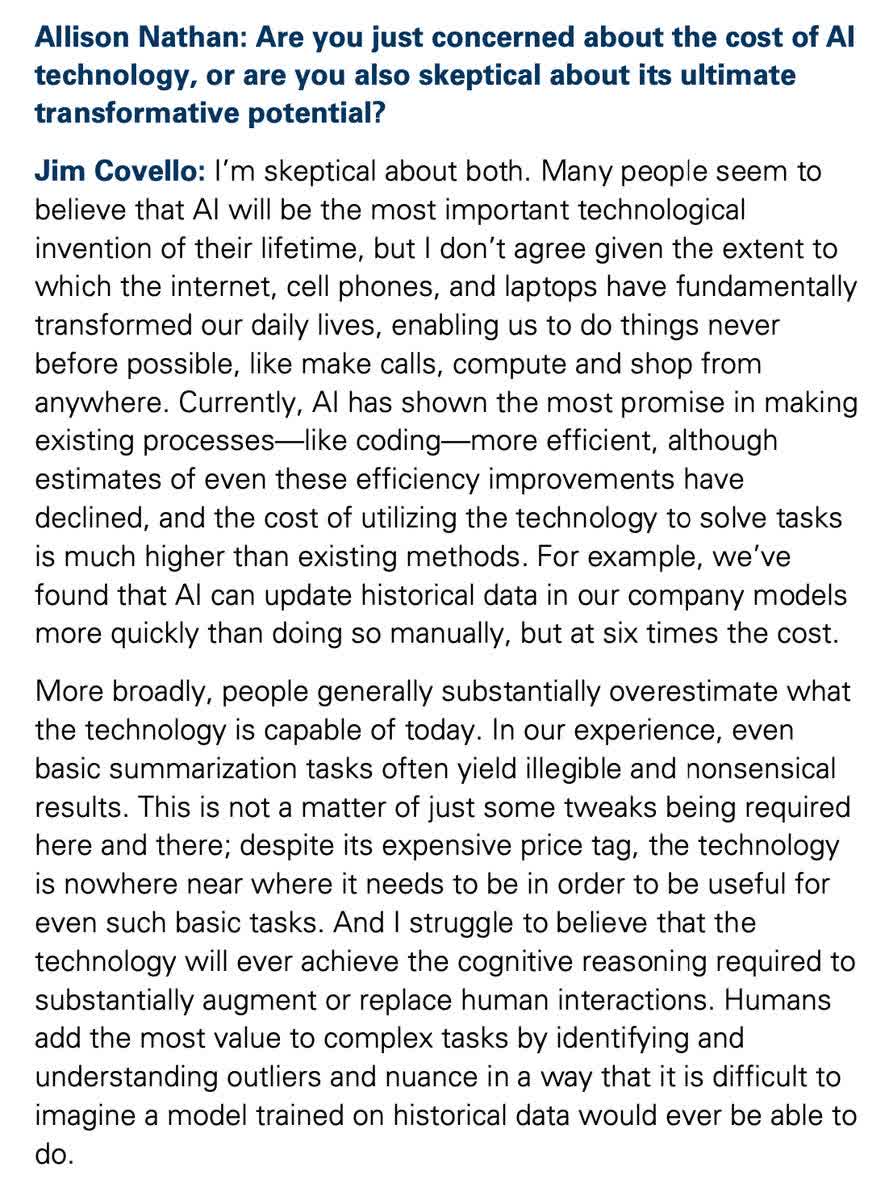

The cherry on top of the sundae here is that Goldman Sachs (GS) came out in the last few days reiterating something that Julian Garran, a partner at MacroStrategy, has been saying. Specifically, that AI, 18 months after its heralded introduction to the world, and roughly 14 months after the Nvidia May 2023 kick-off, has yet to produce one transformative application. Think about that for a minute. Here is an excerpt below and the link to the report.

Excerpt From Goldman Sachs On AI. (Goldman Sachs)

Wrapping up, if you have time, read the report, and if you don’t, read the excerpt above.

I’ll translate for you, too, as follows.

TL:DR – Price action in the broader stock market is a replay of 2000 and price action in AI stocks is a historic bubble.

Could it keep going? Yes, that is the risk. However, there are building signs in the past week that the air is starting to be let out of the balloon.

Thank you for your readership,

WTK.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AR, BTU, AM, SWN, X, TLT PUTS, NEM, RH, EQT, ETRN, CLF, TGB, RRC, TECK, HCC, KMI, OXY, CVE, BABA, WBA, LEG, PARA, WBD, CNX, BCS, ATUS, TELL, WFC, DB, CTRA, OVV, XOM, CVX, BHC, UNG, ENVX, AER, RDFN, ET, SLB, Z, LC, PAAS, GOLD, SLV, SIL, CPG, PL, AAL, AND SPG AND I AM LONG PALADIN ENERGY AND PANTHEON RESOURCES AND I AM LONG THE POSITIONS IN THE CONTRARIAN PORTFOLIOS AND I AM SHORT AAPL, NVDA, QQQ, SPY, AND TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Every investor's situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The Contrarian

For further perspective on how the investment landscape is changing, and where to find the superior free cash flow yielding companies, consider joining our team of battle tested analysts at The Contrarian. Collectively, we have a unique history of finding under-priced, out-of-favor equities with significant appreciation potential relative to the broader market. Additionally, we have a robust investment discussion, alongside an equally robust discussion on portfolio strategy. Collectively, we make up The Contrarian, sign up here to join.