Summary:

- Nvidia Corporation CEO compares the company’s success to Apple’s “iPhone moment” and stock jumped 58% in 4 months.

- Warren Buffett preferred the iOS moment to the iPhone moment.

- We have yet to observe Nvidia building a robust stream of service revenues. One potential factor behind this could be the presence of conflicts of interest and fit issues.

- Companies heavily reliant on large tech firms also raise concerns regarding their TAM and use cases.

- We are awaiting specific indicators before making a big decision.

David Paul Morris/Getty Images News

“This Is the Company’s iPhone Moment”

On May 27, 2023, Nvidia Corporation (NASDAQ:NVDA) CEO Jensen Huang declared, “This Is the Company’s iPhone Moment.” In less than 4 months, shares have surged another 58%.

Many investors were enthused by the comparison to Apple’s (AAPL) success under Steve Jobs. However, it’s important to unpack what exactly Huang meant by Nvidia’s “iPhone moment” and why it matters.

The iPhone represented a breakthrough device that catalyzed a smartphone revolution. Its multi-touch interface and sleek hardware design made existing products instantly obsolete. Huang’s analogy suggests Nvidia is undergoing a similarly transformative shift that will redefine its market position. Nvidia’s GPU computing parallelism disrupted legacy CPUs much as the iPhone revolutionized phones.

Warren Buffett’s Investment Strategy

The iPhone launched in 2007, yet Warren Buffett didn’t invest in Apple until 2016 with the iPhone 7. Why the delay? Only by 2016 did Tim Cook reveal services were ~10% of revenues with the potential to reach $100 billion. We believe that: (1) the iPhone’s iOS platform, which transformed the smartphone landscape, offers a broader range of applications than the iPhone’s initial appeal of sleek design and touch interface. (2) Buffett avoids companies without sustainable cash flows. The high-margin iPhone secured iOS’ pricing power and sustainable revenues by locking in users. Though the hardware commanded initial hype, Buffett waited nearly a decade for evidence of recurring monetization before investing, once the services ecosystem was quantified.

Similarly, investors shouldn’t take Nvidia’s iPhone moment as blind faith. The analogy only holds weight if Huang’s declared inflection catalyzes an enduring platform like iOS with recurring revenues, pricing power, and competitive moats. However, despite promoting its cloud and other services like Omniverse as potential software ecosystems, Nvidia has yet to demonstrate sustainable recurring revenues.

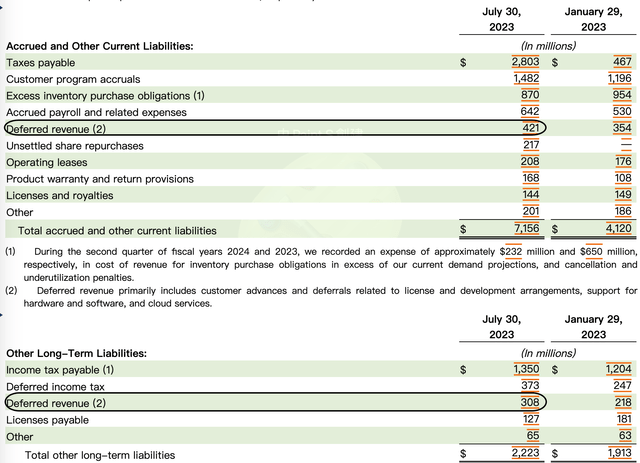

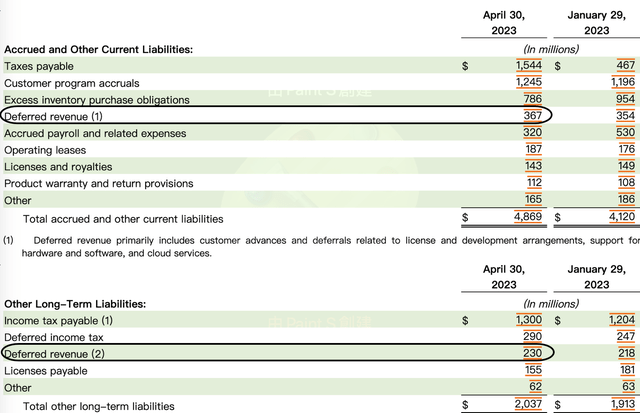

Examining Deferred Revenues as an Indicator

Unlike Apple’s clear services disclosures, Nvidia does not break out product vs. service revenue. However, deferred revenue progress provides some insight into services and platform traction as they measured the multi-year service contracts.

NVIDIA AI Cloud Service Offerings

We entered and may continue to enter into multi-year cloud service agreements to support these offerings and our research and development activities.

Surprisingly, its deferred revenues at the end of Q2 stood at just $735 million, marking a 23% sequential growth from Q1’s $597 million, or 28%. This doesn’t align with its sequential revenue growth of 87% or its year-over-year growth of 101%.

NVDA

NVDA

Nvidia’s Software-Hardware Bundling Strategy

We believe this situation arises from Nvidia’s strategy of bundling its software with its hardware systems. This approach might not align with the best interests of its customers. As reported by Reuters, AWS considered partnering with Advanced Micro Devices, Inc. (AMD) and opted not to collaborate with Nvidia on the DGX cloud offering. This decision could stem from potential conflicts of interest, given Nvidia’s aspirations to dominate the data center space. The Information highlighted that Nvidia’s ambitions might lead to capturing a larger share of profits in the value chain. Whatever the underlying reasons, there’s no solid evidence at present to suggest that Nvidia has robust service contracts in place to ensure a consistent cash flow.

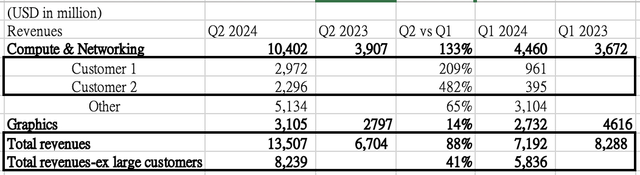

The Significance of Customer Concentration

Furthermore, when Buffett invested in 2016, Apple had sold over 1 billion iPhones, evidencing broad mainstream demand beyond just high-end consumers. This worldwide user base gave Apple steady bargaining power.

In contrast, Nvidia’s top two largest customers accounted for 17% and 22% of its Q4 2023 revenue, respectively. Likely Google (GOOG) and Microsoft (MSFT), this high customer concentration suggests a narrower, more concentrated buyer base than Apple’s at the time of Buffett’s investment.

One data center distributor customer represented approximately 17% and 13% of total revenue for the second quarter and first half of fiscal year 2024, respectively, and was attributable to the Compute & Networking segment.

A large CSP, which primarily purchases indirectly through multiple system integrators and distributors, is estimated to represent approximately 22% and 19% of total revenue for the second quarter and first half of fiscal year 2024.

Excluding the top two customers, Nvidia’s sequential revenue growth would have been a still-strong 41% versus the reported 88% including them. This highlights Nvidia’s reliance on a concentrated number of heavy AI-spending tech giants, likely Microsoft and Google.

NVDA, LEL

The Role of AI in Computing

These mega-customers accounted for $5.1 billion in sales last quarter, turbocharging overall results. It’s debatable how many other customers can spend at a similar scale on accelerated computing. While AI is a fast-growing field, most companies have far smaller data processing needs than Big Tech.

This mirrors debates during the PC revolution – PCs vastly expanded individual capabilities but initially faced questions on mainstream necessity. However, it’s essential to consider that PCs empowered individuals to perform tasks they couldn’t when PCs’ main competition was human effort.

In contrast, Nvidia competes against alternative silicon-like CPUs and AMD GPUs. While its parallel computing excels at AI, it remains to be seen if this capability is as indispensable for most businesses as PCs were for individual productivity versus human effort.

A similar example can be drawn with credit cards when digital wallets emerged. They became more successful in countries other than the U.S., like China, the EU, and other emerging nations where a widespread credit card payment network didn’t exist. Therefore, we’re skeptical about Jensen Huang’s claim that CPUs are outdated and that GPUs will take over, as there are many tasks still performed well by CPUs at lower costs. Investors should tread carefully, especially since Nvidia’s massive market capitalization is based on this bold assertion.

DCF Analysis and Nvidia’s Ambitious TAM Projection

We constructed a discounted cash flow, or DCF, analysis based on Jensen Huang’s assertion that the cloud market is currently $1 trillion, though other estimates peg it around $500 billion. Adopting his figure and assuming a 15% CAGR over 10 years yields a $4 trillion total addressable market (“TAM”).

Even if we assume Nvidia disrupts 30% of this market, maintains 30% free cash flow margins, and hits target market share in a decade, it would require 43% revenue CAGR for Nvidia to reach $1.2 trillion in sales by 2033.

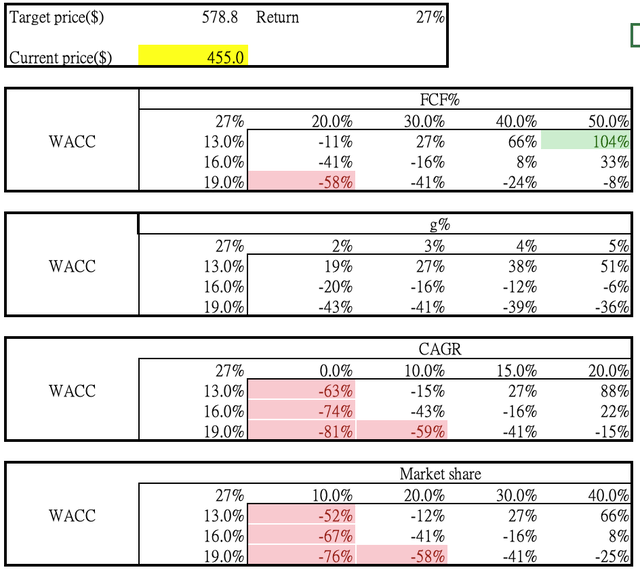

Discounting back at a 13% WACC, this gives us a valuation of the market cap of $1.4 trillion, or $578 per share – a 27% upside from current levels.

Sensitivity analysis (LEL)

Sensitivity Analysis and Potential Downside Risks

However, this upside relies on Nvidia both sustaining its considerable edge in accelerated computing and the market scaling to $4 trillion as projected. Unless Huang’s lofty TAM figure proves accurate, our DCF may embed overly optimistic assumptions.

Beyond the Cloud Sector

The results from the DCF model are intriguing, as it only assumes Nvidia’s disruption in the cloud sector. With the above stress test, the model presents an appealing value, and that’s without considering if Nvidia disrupts one or two other sectors such as auto and gaming. Its valuation could easily surpass $4 trillion. However, since Nvidia’s growth is primarily observed in data centers, we believe the current market sentiment is reasonable. It’s based on Jensen’s ambitious vision, and given his track record of delivering results, he has earned credibility.

The key downside risks are lower industry growth and Nvidia underachieving the 30% share assumed. If the cloud market doesn’t sustain 10%+ CAGR and reach $4 trillion, or Nvidia fails to capture its projected share, the downside could exceed 50% based on our sensitivity testing. Considering just the cloud, the risk-reward is unappealing based on the growth rates embedded in our DCF.

Autonomous Driving

Some might highlight the potential use case in autonomous driving. However, it’s essential to note that, strictly speaking, the training of autonomous driving models is still part of the data processing narrative. Moreover, it might not be indispensable for every car manufacturer. Take Tesla (TSLA) as an example: while it has purchased from Nvidia, it also developed its own Dojo chip tailored for autonomous driving. This perspective is further reinforced by the fact that Nvidia didn’t report significant growth in the automotive sector in Q2.

Conclusion

Overall, while Nvidia maintains a strong competitive position currently, high customer concentration and minimal services revenue pose concerns. We like the iOS moments much better than the iPhone moments. In addition, its parallel computing excels in data processing, but the addressable market may be narrower than anticipated.

We remain neutral absent proof points like: (1) meaningful high-margin services revenue; and (2) validated use-cases beyond concentrated data center/supercomputer demand. While the potential exists to expand Nvidia’s disruptive reach, exercising caution until market uptake broadens seems prudent given growth expectations embedded in its valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.