Summary:

- Nvidia Corporation’s RSI hovers near neutral at 49, signaling no strong trend, but bullish divergence suggests potential upward movement.

- Nvidia posted a record Q2 FY2025 revenue of $30 billion, a 122% YoY growth driven by AI and data centers.

- Nvidia’s leadership in AI and data centers remains robust, driven by demand for Hopper and Blackwell architectures.

- Next-gen AI models require 10-20x more computing power, positioning Nvidia to benefit from rapidly increasing AI infrastructure demand.

- Nvidias’s Ethernet for AI revenue doubled, with Spectrum-X boosting performance by 1.6x, signaling multi-billion-dollar potential.

Jonathan Kitchen

Investment Thesis

Despite NVIDIA Corporation’s (NASDAQ:NVDA) recent 15% pullback since our last coverage, its long-term fundamentals remain strong. The giant continues to lead in AI and data center technologies, driven by growing demand for cutting-edge GPU computing, networking platforms, and next-gen architectures like Hopper and Blackwell. Nvidia’s record-breaking revenue and expanding market presence across multiple industries position it for sustained growth as the AI revolution accelerates globally, reaffirming our strong buy rating.

On the technical side, Nvidia’s momentum is currently neutral, but bullish divergence hints at potential upward movement. Combined with robust fundamentals, this presents a compelling opportunity for investors to capitalize on Nvidia’s future growth despite short-term market fluctuations.

Bullish Divergence: Is Nvidia Poised for a September Rebound?

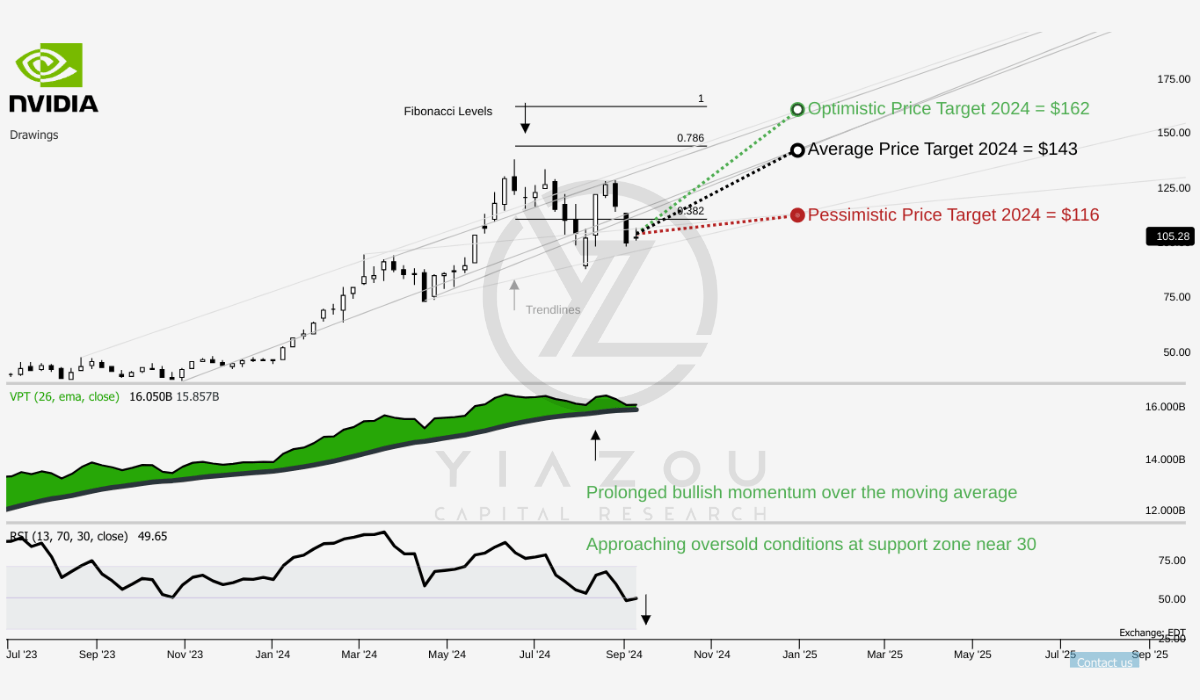

NVDA is currently trading around $108. The average price target for 2024 is set at $143, which corresponds to a 3-point Fibonacci level (0.786). This level indicates potential growth in alignment with common retracement patterns. The optimistic target of $162 aligns with the 1 Fibonacci level, suggesting a possible bullish run. Meanwhile, the pessimistic target of $116 matches the 0.382 level, which reflects a conservative estimate with limited downside.

Moreover, the RSI is at 49.65, hovering near the neutral zone of 50, indicating a lack of clear momentum. However, the presence of bullish divergence signals potential upward price movement. This can happen even though the RSI trend is reverting downwards. This downward shift in the RSI suggests short-term weakness, but the long setup near 30 hints at a possible bottom formation that offers an entry point for buyers if the RSI touches this level.

Further, the Volume Price Trend (VPT) line is currently at 16.05 billion, slightly above its moving average of 15.86 billion, which signals modest volume support. However, the downward trend in the VPT line indicates a reduction in buying pressure. A potential reversal could occur as the VPT line approaches the moving average, which marks a bottom touchdown scenario.

Yiazou (trendspider.com)

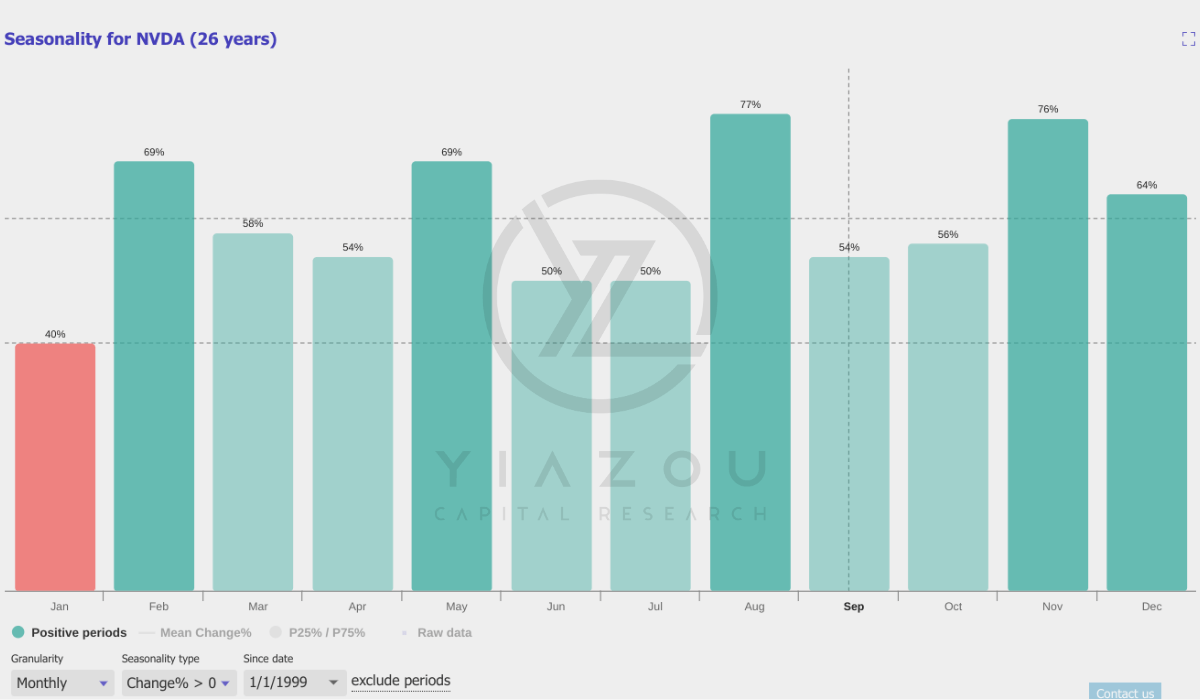

September has a 54% chance of positive returns, signaling a neutral outlook with modest potential gains. October improves slightly to a 56% probability, suggesting a more favorable environment as the month progresses. November has a 76% likelihood of positive returns, making it one of the strongest months for NVDA historically. This upward trend from September to November indicates increasing seasonal strength, with November offering the best odds for gains.

Yiazou (trendspider.com)

Q2 FY2025: Dominating the AI and Data Center Boom with Record-Breaking Revenue Growth

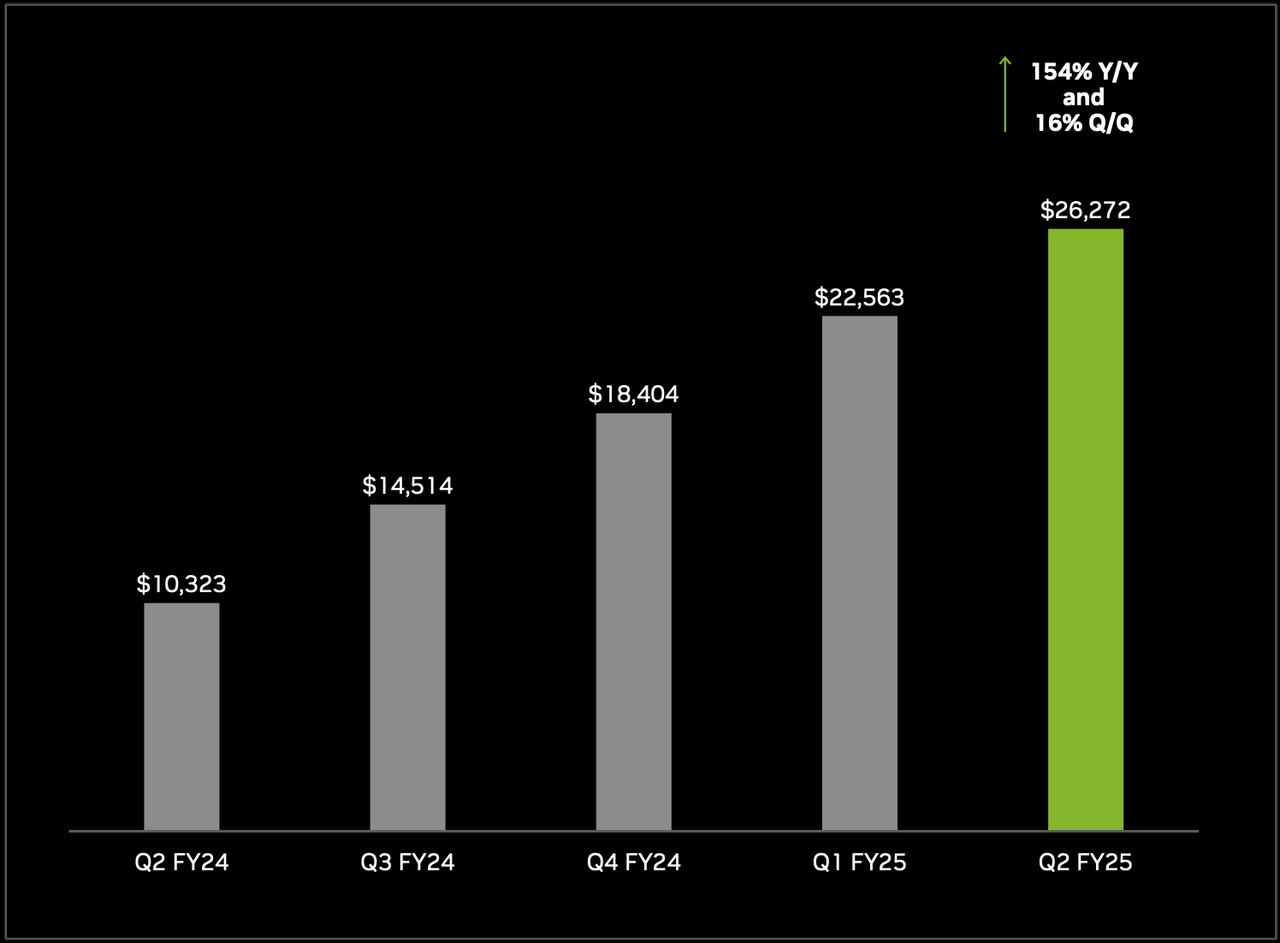

Nvidia’s earnings highlight explosive growth and solidify its strategic leadership in the AI and data center sectors. Record revenue came in at $30 billion, 15% higher than last quarter and 122% higher year over year. This is driven mainly by the Data Center segment, with revenue of $26.3 billion, up 154% compared to last year.

As enterprises and cloud providers accelerate their adoption of AI and generative AI technologies, Nvidia’s GPUs and AI software platforms have become essential tools. Demand for that forthcoming Blackwell architecture, says CEO Jensen Huang, is “incredible,” a prophecy of future solid demand and an exceptionally favorable market position for its AI hardware.

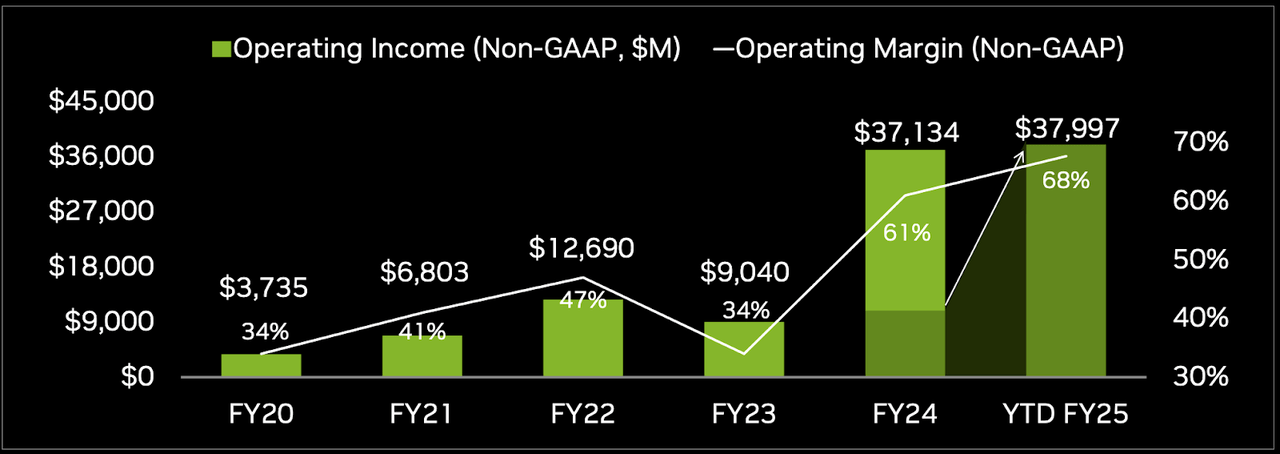

Despite such fantastic revenue growth, its GAAP gross margins fell to 75.1% from 78.4% in the previous quarter. This likely reflects increased operational expenses, up 12% quarter-over-quarter to $3.93 billion because the company invests heavily in research and development to keep its competitive edge. Operating income demonstrated strong growth, effectively managing rising costs relative to top-line expansion. It surged by an impressive 174% year-over-year, reaching $18.6 billion.

The EPS also reflected strong profitability, with the GAAP EPS reaching $0.67, representing 168% year-over-year growth. Such massive growth in EPS further confirms the company’s substantial net income, up 168%, reaching $16.6 billion. Such a figure suggests that NVIDIA effectively converts its revenue growth into shareholder value.

Additionally, the company’s aggressive share repurchase program further bolsters confidence in continued growth. The return of $15.4 billion to shareholders during the first half of FY2025, with another $50 billion authorized for share repurchases without expiration, shows a solid commitment to shareholder value enhancement. It further indicates that management is confident that future cash flows will be vital.

The outlook for Q3 FY2025 remains optimistic, with NVIDIA projecting revenue of approximately $32.5 billion, with a margin of plus or minus 2%. This guidance supposes that business and demand will remain strong for the company’s products, AI, and data center solutions. Forecasted gross margins in the mid-70% range anticipate the company continuing to gain profitability without any cost increases. Hence, with strategic investments in next-generation AI architectures, partnerships, and more product offerings, Nvidia is poised and ready to take full advantage of the acceleration in AI technology usage across critical industries.

Data Center Is Still A Triple-Digit Game Changer

In Q2 fiscal 2025, Nvidia attained solid top-line performance, with revenue reaching $30 billion, marking a 15% sequential growth and a 122% year-on-year (YoY) increase that exceeded Nvidia’s projection of $28 billion for the quarter. The data center segment revenue at $26.3 billion was a record for the company, representing a 16% sequential rise and a 154% YoY growth.

Additionally, Nvidia continues to capitalize on strong demand for GPU computing and networking platforms, especially the Nvidia Hopper platform. Hopper’s accelerating demand still leads the company’s progress in data centers. Advanced demand for Blackwell is considerably above the supply in this segment, as production ramps will initiate in Q4.

Specifically, compute revenue surged 2.5 times YoY, while networking revenue more than doubled during the same period. Cloud service providers (CSPs) accounted for about 45% of this revenue, while consumer, internet, and enterprise companies contributed over 50%, forming a diversified client base. This diversification helps Nvidia adapt to shifting market demands across industries. Nvidia’s platform architecture, particularly Hopper integration with AI-centric workloads like model training, may continue to fuel the demand.

Looking forward, next-generation AI models now require 10 to 20X more computing power. This puts Nvidia in a lead position to capitalize on this growing demand. Over the last four quarters, inference workloads contributed 40% to the company’s data center revenue. Nvidia’s tech advancement and related accelerating AI demand create a growth cycle. Thousands of companies and startups rely on Nvidia for generative AI applications across healthcare, advertising, and robotics. The Hopper and the upcoming Blackwell architectures will help maintain Nvidia’s top-line lead in scalable AI infrastructure.

For instance, Nvidia ramped up its H200 platform in Q2 2025, which delivers 40% more memory bandwidth than its predecessor, H100. This back-to-back architectural improvement promotes the companies’ transition from Hopper to Blackwell, slated for fiscal 2026. Nvidia’s upcoming Blackwell platform may integrate GPU, CPU, DPU, NVLink, and networking chips to power next-gen AI systems. This technology and Hopper boost performance, enabling up to 30 times faster inference for large language models (LLMs) in real-time.

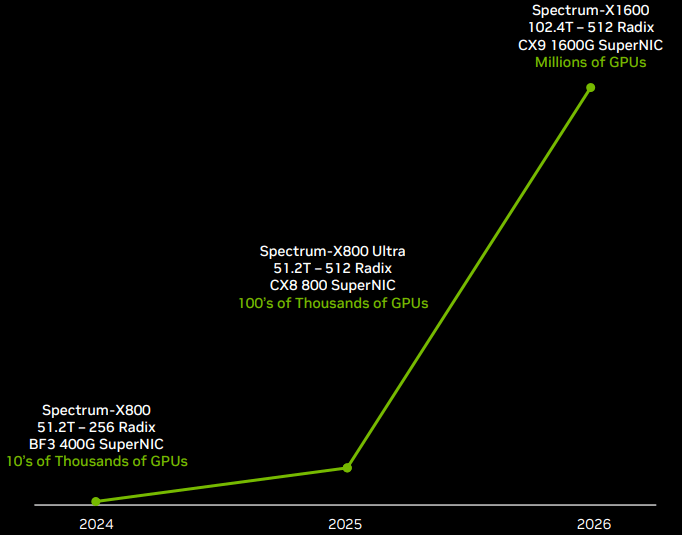

Similarly, Nvidia’s Ethernet for AI revenue doubled sequentially due to strong demand for AI infrastructure. The Spectrum-X platform provided a 1.6 times performance boost over traditional Ethernet, complementing Nvidia’s dominance in the GPU sector. The Ethernet segment may become a multi-billion-dollar product line in the upcoming quarters.

Finally, the sovereign AI market is another promising area of top-line growth for Nvidia. Countries like Japan are investing in Nvidia’s AI infrastructure for large-scale projects like the AI Bridging Cloud Infrastructure (“ABCI”) 3.0 project. These sovereign AI opportunities are projected to generate double-digit billions in revenue in fiscal 2025, marking Nvidia’s expansion into new, large-scale markets.

Q2 Fiscal 2025 Presentation

The Stock’s Overvaluation Is Justified

Nvidia has strong growth potential to justify its high valuation. For instance, its forward-looking PEG ratio of 1.02 is 42.75% lower than the sector median, indicating better growth prospects. The ratio is also 50.81% lower than its five-year average, indicating potential undervaluation. Nvidia’s market position in AI, too, justifies such expectations, while generative AI and autonomous vehicles are some of the trends that will keep up this growth.

Specifically, Nvidia may outperform the sector in the coming years as the generative AI market offers a major opportunity. For instance, as per Goldman Sachs, US tech giants will spend $215 billion on AI in 2024, up from $125 billion in 2022. Although AI spending may decline, Nvidia’s Hopper and Blackwell platforms remain critical for AI infrastructure, as the tech enables companies to leverage AI across industries. The successful development of its Blackwell platform will help Nvidia capture the next wave of AI-driven growth.

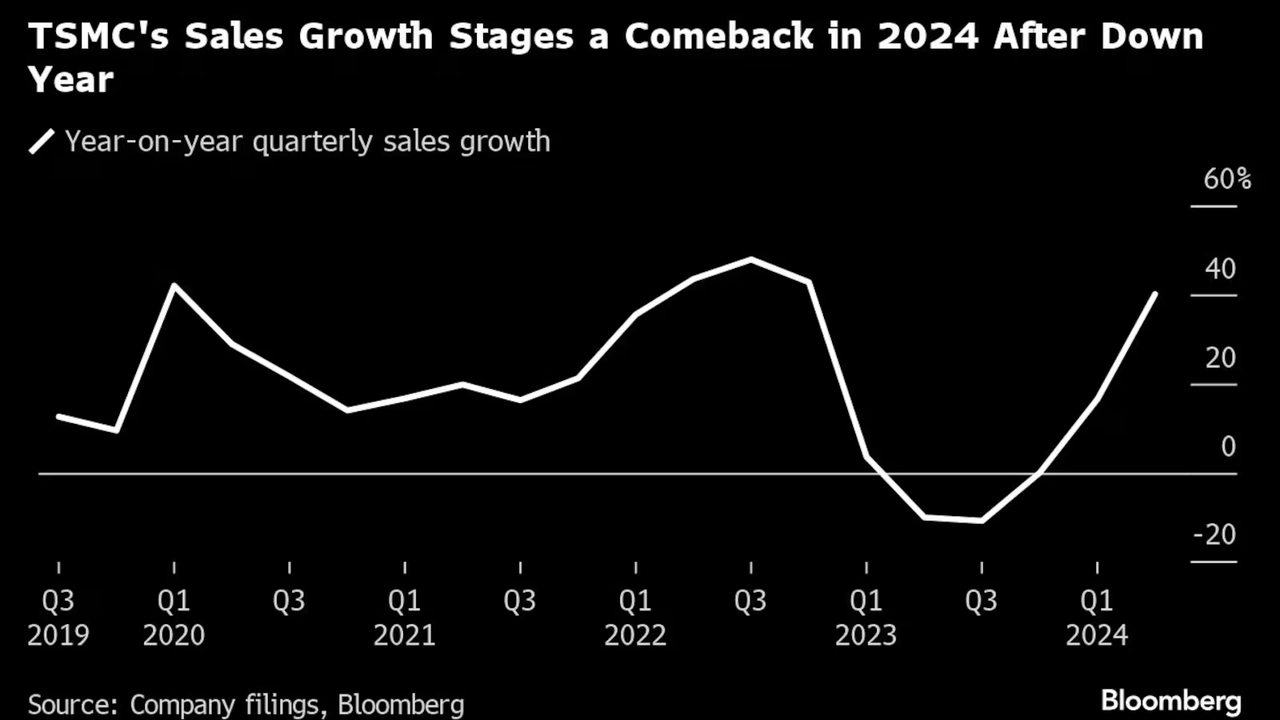

Overall, the market is not expecting continuity of midterm triple-digit growth in the company’s top-line. In contrast, the company itself is not sending any signal of revenue slowdown, and the street revisions are going in a positive direction. To support the argument further, TSMC’s robust Q3 2024 revenue estimates (+37% YoY) indicate healthy demand from consumer electronics, automotive, and high-performance computing industries. Lastly, a critical indicator of Taiwan Semiconductor Manufacturing Company Limited’s (TSM) August revenue (+33% YoY) also signals a recovery in sectors like data centers, a significant Nvidia market.

Downsides: High Dependence On Data Center And Supply Chain Bottlenecks

Nvidia’s Q2 2025 earnings marked this rapid expansion with specific challenges. Despite the company’s dominant market position and expanding product offerings, data center revenue remains the strongest and largest fraction of Nvidia’s top-line.

The growth in this segment points to Nvidia’s heavy reliance on its data center business and AI-driven products like Hopper and the future Blackwell architecture. This reliance poses a concentration risk, creating an overdependence on AI spending budgets in the sector. In short, Nvidia’s other segments are failing to cope with data center revenue growth, making Nvidia vulnerable to shifts in cloud spending or changes in corporate demand for AI-related hardware.

As demand for AI-related hardware grows, production constraints may emerge, especially with the upcoming Blackwell platform. Nvidia acknowledged supply shortages for Blackwell, a new GPU platform. Although demand for the platform is robust, supply is currently constrained, and the ramp-up for Blackwell may also be subject to shipment restrictions, the same as on Hopper platform shipments. These supply chain bottlenecks could slow the company’s capability to capitalize on rising market demand (as China is excluded).

Finally, street sentiment is also an issue with Nvidia’s stock. The company’s massive base of irrational followers (investors) may cause massive downside moves if it fails to feed their expectations about back-to-back moonshots.

Takeaway

Nvidia Corporation shows potential for a September rebound, with a price target of $143 aligning with Fibonacci retracement. Bullish divergence and a neutral RSI hint at upward movement despite short-term weakness. Seasonal trends indicate increasing strength, with November being historically strong. Therefore, Nvidia’s dominance in AI and data centers drives growth, but supply chain constraints and reliance on AI demand pose risks.

Nevertheless, Nvidia maintains strong leadership in AI and data centers, driving long-term growth despite short-term stock fluctuations. The company’s outlook remains highly positive, with continued investments in cutting-edge technologies like Blackwell and increasing AI demand. Strategic share buybacks further reinforce confidence in Nvidia’s sustained growth trajectory.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.