Summary:

- Nvidia Corporation’s Q3 revenue soared to $35.1 billion, a 94% YoY growth, driven by AI adoption across sectors, reiterating my Strong Buy rating with a $200 target.

- Data Center segment generated $30.8 billion, growing 112% YoY, highlighting AI infrastructure demand and Nvidia’s technological lead in accelerated computing and AI-generated software.

- Enterprise AI and sovereign computing markets are new growth vectors, with Nvidia’s software segment nearing a $2 billion annual run rate and major partnerships accelerating adoption.

- Despite supply chain and regulatory risks, Nvidia’s market position, technological leadership, and operational excellence justify premium multiples, offering an attractive entry point for long-term investors.

J Studios

In my previous article about Nvidia Corporation (NASDAQ:NVDA), “Nvidia Is About To Beat Estimates Again” I made a strong case for Nvidia’s continued dominance in the AI chip market and predicted they would exceed Q3 expectations.

Nvidia’s Q3 performance was nothing short of extraordinary, with revenue soaring to $35.1 billion, representing a staggering 94% YoY growth. With Q4 guidance of $37.5 billion, which suggests the growth trajectory isn’t just sustainable, but actually accelerating.

Last time, the main reason for my Strong Buy rating was the near-term outlook and huge demand for the Blackwell platform. However, the Q3 results revealed that the growth is not only driven by short-term demand. It is mainly due to the industrial shift toward AI adoption across multiple sectors that creates a huge total addressable market. Based on the Q3 FY2025 performance and the expanding market, I am reiterating my Strong Buy rating and with a 12-month price target of $200.

The first thing that I want to highlight from Q3 results is the Data Center segment, which I’ve long viewed as the main growth factor, generated $30.8 billion in revenue growing 112% YoY. This performance is particularly remarkable considering the scale of the Data Center segment alone now generates more revenue in a single quarter than the entire company did in fiscal year 2023. The sustainability of this growth is underpinned by several new market conditions and structural factors.

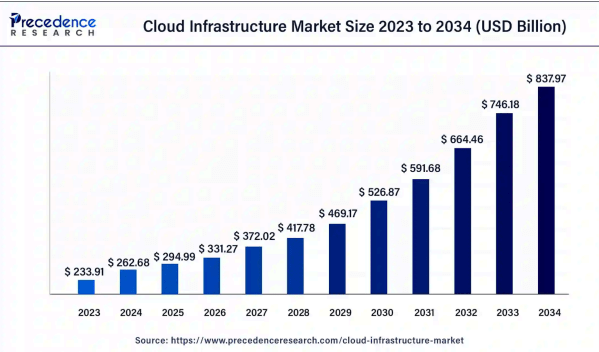

First, the demand for AI computing infrastructure shows no signs of slowing. According to my research of recent market data, the cloud infrastructure market alone is projected to reach $837.97 billion by 2034, growing at a CAGR of 12.3%. This massive market opportunity is being driven by what CEO Jensen Huang describes as two simultaneous platform transitions: the shift from general purpose to accelerated computing, and the evolution from human engineered to AI-generated software.

Nvidia Q3 FY2025 Presentation Deck

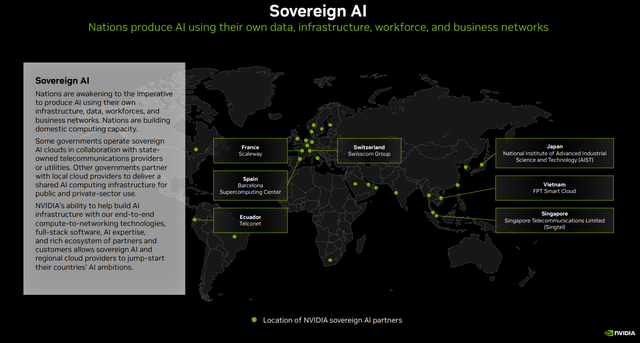

Nvidia’s expansion into enterprise AI and sovereign computing markets represents a new growth vector. The company’s software segment is approaching a $2 billion annual revenue run rate and Major partnerships with companies like Accenture which has trained 30,000 professionals on Nvidia AI technology shows the scale of enterprise adoption. Meanwhile, sovereign AI initiatives are expected to generate low double-digit billions in revenue this year alone, with projects like Japan’s National Institute of Advanced Industrial Science and Technology’s AI bridging cloud infrastructure showcasing the global scale of this opportunity.

These factors collectively point to what, I believe, is the beginning of a multi-year growth cycle that will drive Nvidia’s stock to my target of $200 per share. The convergence of AI adoption, data center modernization and Nvidia’s expanding technological lead creates a perfect storm of growth catalysts that, I believe, will drive significant value and return to the investors in the next five years.

AI Infrastructure Market

Based on recent market data, the total addressable market (TAM) for AI infrastructure is substantially larger than most analysts and investors currently recognize. The convergence of multiple high-growth segments is creating a perfect opportunity that could drive Nvidia’s growth for the next decade and beyond.

Precedence Research

The cloud infrastructure market represents the foundation of this opportunity, with projections showing it will reach $837.97 billion by 2034, growing at a compound annual growth rate of 12.3%. North America currently holds a dominant 42% share of this market, with businesses prioritizing digital transformation and showing increasing confidence in adopting cloud infrastructure services. According to the U.S. Census Bureau, approximately 85% of companies in the United States have already incorporated cloud technologies, suggesting substantial room for deeper AI integration.

The AI accelerator market is experiencing even more dramatic growth, expected to reach $54.76 billion by 2030 at a CAGR of 22.6%. This segment is particularly crucial for Nvidia, as it represents the core market for their GPU and specialized AI chips. The demand for AI accelerators in data centers is surging, with estimates indicating that over 65% of data centers embraced AI accelerators by 2024, up from 45% in 2022. This rapid adoption is driven by the increasing complexity of AI workloads and the need for specialized hardware to handle tasks like training large language models and running inference at scale.

The Edge AI market represents another massive opportunity, forecast to grow to $163 billion by 2033 at a CAGR of 24.1%. This market is particularly compelling because it extends AI capabilities beyond centralized data centers to the network edge, enabling real-time processing and decision-making for applications like autonomous vehicles, smart cities and industrial automation.

Market.US

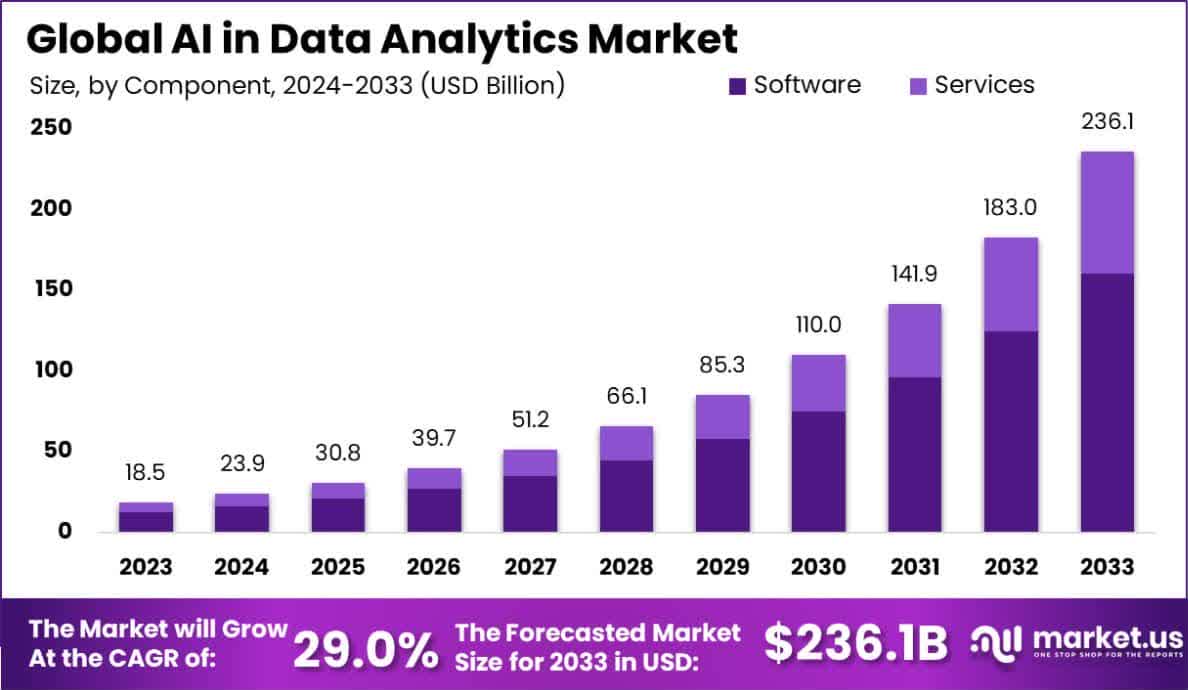

The AI in data analytics market adds another substantial opportunity, expected to reach $236.1 billion by 2033, growing at an impressive 29% CAGR. This segment is being driven by the exponential increase in data generation, which reached 120 zettabytes in 2023 and is projected to soar to 181 zettabytes by 2025. Organizations are increasingly recognizing the value of AI-powered analytics, with spending on cloud infrastructure for data storage growing by 48% compared to 2023.

The scale of this opportunity becomes even clearer when considering the traditional data center upgrading needs. There is currently over $1 trillion in existing data center infrastructure that needs to be upgraded to support AI workloads. This isn’t optional. As Jensen Huang has noted, the end of Moore’s Law means that traditional CPU-based computing can no longer keep pace with growing computational demands. The transition to accelerated computing powered by Nvidia’s GPUs and specialized AI chips represents the only viable path forward for enterprises facing these challenges.

Enterprise AI Adoption

The acceleration of enterprise AI adoption represents what, I believe, is the next major growth phase for Nvidia, potentially even larger than the initial AI infrastructure buildout.

Major cloud providers are racing to be first to market with Blackwell-powered instances. Microsoft (MSFT) has already announced they will be the first to offer private preview access to Blackwell-based cloud instances powered by Nvidia GB200. Oracle (ORCL) is planning what they describe as the world’s first Zettascale AI Cloud computing clusters capable of scaling to over 131,000 Blackwell GPUs.

The company has successfully executed a mask change to improve production yields and Blackwell is now in full production with 13,000 GPU samples already shipped to customers in Q3, including one of the first Blackwell DGX engineering samples to OpenAI. While demand is expected to exceed supply for several quarters in fiscal year 2026 Nvidia is actively working with supply chain partners to increase production capacity.

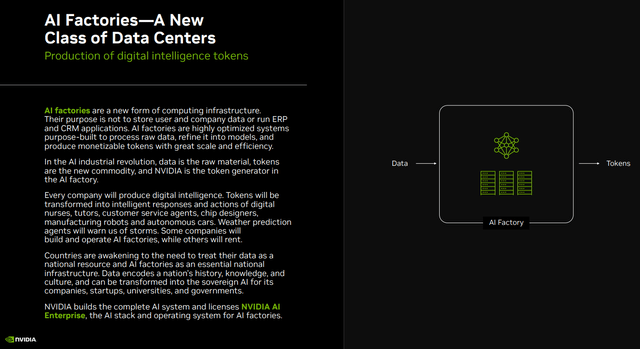

Nvidia Q3 FY2025 Presentation Deck

We’re witnessing the emergence of what Nvidia calls “AI factories,” an entirely new category of computing infrastructure. These are not traditional data centers focused on storing data and running applications, instead they are purpose-built facilities optimized for processing raw data, refining it into models and producing monetizable AI tokens at massive scale. Based on my analysis, this new category could represent an additional $1 trillion opportunity by 2030 as companies across industries build or rent AI factory capacity to power their AI initiatives.

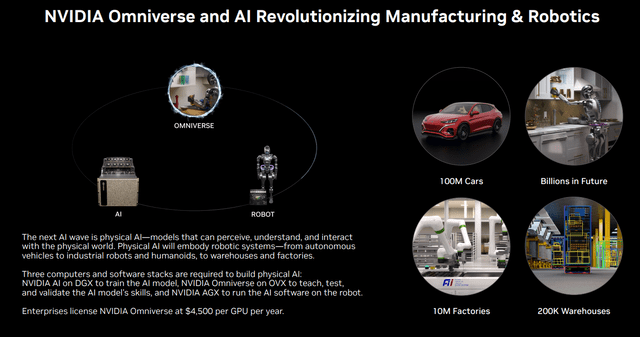

Nvidia Q3 FY2025 Presentation Deck

Major industrial manufacturers are adopting Nvidia Omniverse to accelerate their businesses, automate workflows and achieve new levels of operating efficiency. Foxconn is using digital twins and industrial AI built on Nvidia Omniverse to speed up their Blackwell factories’ deployment while significantly reducing energy consumption. In their Mexico facility alone, Foxconn (OTCPK:FXCOF) expects to achieve a reduction of over 30% in annual kilowatt-hour usage through these AI-powered optimizations.

Long-term Outlook

I am projecting the company’s revenue to reach $320 billion by FY2030 representing a 5-year CAGR of 19.9%. This is well-supported by the company’s current growth momentum and expanding market opportunities.

The Data Center segment will continue to be the primary engine of growth. Because the cloud service providers account for only 50% of Data Center revenue, the rest of it is coming from consumer internet companies and enterprise customers. This diverse customer base suggests the AI boom is broadening beyond the major hyperscalers creating a more sustainable growth trajectory.

The demand for AI infrastructure, combined with the successful ramp of Blackwell and future architectures like Rubin and Ultra, positions Nvidia to maintain strong growth in this segment. The company’s recent major architectural improvements delivered substantial performance gains with each generation, enabling them to maintain premium pricing while continuously expanding their addressable market.

Enterprise software represents an increasingly important growth vector. Nvidia’s software, service, and support revenue is currently annualized at $1.5 billion and is expected to exit this year at over $2 billion. The Nvidia AI Enterprise platform has seen its revenue more than double YoY, with nearly 1,000 companies now using Nvidia NIM. This high margin recurring revenue stream will continue to expand as enterprise AI adoption accelerates.

From a profitability perspective, I expect Nvidia to maintain operating margins around 60% because of several structural advantages.

Despite the massive scale up in production, Nvidia maintained a non-GAAP gross margin of 75% in Q3. Operating cash flow reached $17.6 billion, demonstrating strong cash generation capabilities even while investing heavily in growth. The company’s ability to execute large-scale manufacturing ramps while maintaining industry-leading margins speaks to their operational excellence.

The company’s Q3 FY2025 results demonstrate this potential, with non-GAAP operating income of $23.27 billion, representing a 66.3% operating margin. This level of profitability is sustainable due to Nvidia’s premium pricing power in AI chips, where they face limited competition in high-performance segments. The growing contribution from high-margin software revenue, which typically carries gross margins above 80%, will further support overall profitability.

From a valuation perspective, Nvidia currently trades at approximately 48x forward earnings Non-GAAP. While this multiple might appear expensive by traditional metrics, but I believe it’s justified given the company’s growth profile and market opportunity. The projected 5-year EPS CAGR of 37%+ implies significant earnings growth potential, supported by both revenue expansion and margin stability.

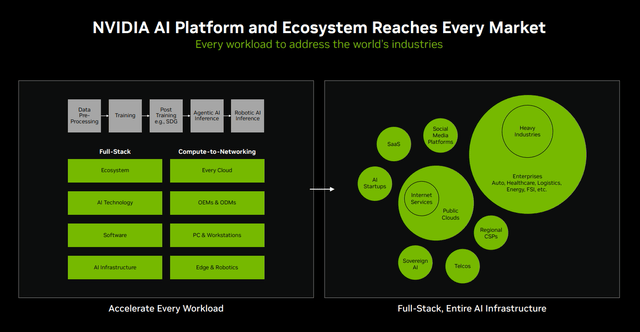

Nvidia Q3 FY2025 Presentation Deck

Nvidia’s competitive moats are particularly strong. Their CUDA software ecosystem, which has attracted over 5.5 million developers, creates high switching costs for customers. The company’s full-stack approach, incorporating seven different types of chips optimized through their software stack, makes their solutions difficult to replicate. This technological leadership, combined with their first mover advantage in AI acceleration, positions them to maintain their market leadership.

The TAM expansion provides a substantial runway for growth. The traditional data center modernization opportunity alone represents over $1 trillion in existing infrastructure that needs to be upgraded for AI workloads. The emergence of AI factories, AI Accelerators And Edge AI could add another $1 trillion to the TAM by 2030. The AI accelerator market is expected to reach $54.76 billion by 2030, while the Edge AI Market is expected to hit $163 billion by 2033.

Hurdles Ahead

I maintain my bullish outlook on Nvidia, but my investment thesis would be incomplete without discussing the potential risks that could impact the company’s growth trajectory. Based on my analysis, these risks fall into three main categories: supply chain vulnerabilities, regulatory challenges competition.

Nvidia relies heavily on TSMC’s (TSM) advanced manufacturing capabilities particularly their CoWoS (Chip-on-Wafer-on-Substrate) packaging technology, which is crucial for products like Blackwell. While TSMC has scaled up CoWoS capacity tremendously, with plans for further expansion through 2025, this geographic and technological concentration creates potential vulnerabilities.

On the other hand, regulatory scrutiny of AI technology is also intensifying globally. Regulators in the European Union, United States, United Kingdom, China, and South Korea have requested information about Nvidia’s sales practices, supply allocation and partnerships with companies developing foundation models. This increased regulatory attention could potentially lead to restrictions on Nvidia’s business practices or market access.

The EU AI Act, formally adopted in June 2024, will be implemented in phases between now and 2030, potentially imposing new restrictions on hardware, software, and systems used to develop frontier foundation models and generative AI. These regulatory changes could increase costs, delay deployments and reduce the number of potential customers for Nvidia’s products.

Lastly, the competitive landscape is becoming increasingly complex as major cloud providers invest in developing their own AI chips. Several of Nvidia’s largest customers, who currently represent approximately 46% of their data center revenue, are actively pursuing in-house chip development. Apple has begun using Google chips for some AI workloads instead of Nvidia’s solutions, and other major cloud providers are exploring similar alternatives.

However, I believe Nvidia’s competitive moat is stronger than many appreciate. Their full-stack approach involves seven different types of chips working in concert to create their AI infrastructure. This level of vertical integration and optimization is extremely difficult to replicate and requires expertise across multiple domains and years of development.

Despite these challenges, I believe Nvidia’s strong market position, technological leadership, and operational excellence position them well to navigate these risks.

Key catalysts For Q4 FY2025

I’m watching:

-

Blackwell production ramp

-

Enterprise AI adoption metrics

-

Software revenue growth

-

New market penetration

I believe Nvidia’s position at the intersection of AI, cloud computing, and enterprise digital transformation creates a unique opportunity. While the valuation may appear stretched by traditional metrics, the company’s execution and market opportunity justify premium multiples. For long-term investors, current prices still offer an attractive entry point into what I consider the defining technology company of the AI era.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.