Summary:

- Blackwell is a game-changer for Nvidia Corporation, combining multiple advanced technologies to deliver unprecedented AI performance and capabilities.

- Despite increasing competition, Nvidia’s cash flow and revenue growth remain strong.

- An optimistic valuation range for Nvidia Corporation suggests a market cap range of $3 trillion to $3.75 trillion.

JHVEPhoto

Introduction

Per my July article, more AI waves are taking shape. Nvidia Corporation’s (NASDAQ:NVDA) Q2 2025 numbers have come out since then, and it is time to reevaluate.

My thesis is that Nvidia keeps breaking sales records while waiting for their Blackwell architecture to make a contribution.

The Numbers

Companies are essentially buying shovels from Nvidia. Nvidia has a new shovel coming out soon, and it’s their Blackwell architecture. They’re expecting to include Blackwell sales in their Q4 2025 fiscal period. I like all the companies in this space, the ones digging for gold and the ones selling the shovels.

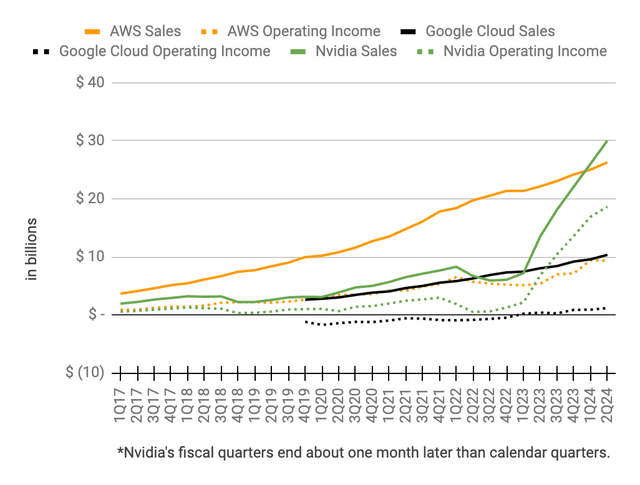

The economics for Microsoft (MSFT) Azure can be a bit obfuscated, but the numbers for AWS from Amazon (AMZN) and Google Cloud (GOOG, GOOGL) are straightforward. Meta Platforms (META) isn’t a hyperscale cloud company, so I didn’t include them in the graph below, but they had operating income of $14.8 billion on revenue of $39.1 billion in 2Q24. Per the graph below, Nvidia had more sales than ever in the most recent quarter while they wait for their Blackwell architecture to be available for customers:

Nvidia operating income and sales (Author’s spreadsheet)

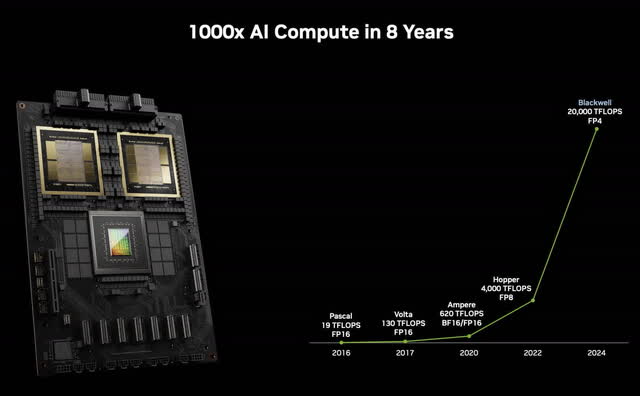

Per the August 29 presentation, Blackwell outperforms Hopper dramatically:

Blackwell vs Hopper (August 29 presentation)

In the Q2 2025 call, CEO Jensen Huang says Blackwell is a complete game changer for the industry and a step-function leap over Hopper. More than just a GPU, it is an AI infrastructure platform:

The Nvidia Blackwell platform brings together multiple GPU, CPU, DPU, NVLink, NVLink switch, and the networking chips systems, and NVIDIA CUDA software to power the next-generation of AI across the cases, industries, and countries. The NVIDIA GB 200 NVL72 system with the fifth-generation NVLink enables all 72 GPUs to act as a single GPU and deliver up to 30 times faster inference for LLMs, workloads, and unlocking the ability to run trillion parameter models in real-time.

Several billion dollars of Blackwell revenue are expected in 4Q25 along with increased Hopper shipments. In the 2Q25 call, CEO Huang reminds listeners we are going through several transitions (emphasis added):

Remember that computing is going through two platform transitions at the same time and that’s just really, really important to keep your head on – your mind focused on, which is general-purpose computing is shifting to accelerated computing and human engineered software is going to transition to generative AI or artificial intelligence learned software.

Valuation

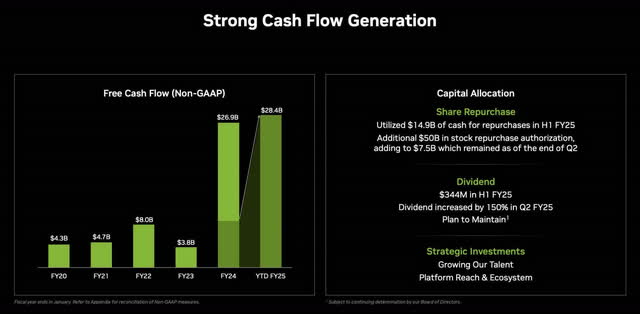

A company is worth the amount of cash which can be pulled out of it from now until judgment day. Per the August 29 presentation, Nvidia has generated more cash flow from the first 2 quarters of this fiscal year than all 4 quarters of the previous fiscal year:

Nvidia cash flow (August 29 presentation)

Nvidia is expected to have more competition in the future, and they already have some now. For example, Apple’s (AAPL) July 2024 research paper revealed the use of Google TPUs instead of Nvidia architecture for training. Nvidia is still growing as their base numbers swell, and they await Blackwell architecture, but the Q/Q growth rate has been declining for operating income, gross profit and revenue since the fiscal 2Q24 period through July 2023:

|

Q/Q Op Inc. |

Q/Q G. P. |

Q/Q Rev. |

Y/Y Op Inc. |

Y/Y G. P. |

Y/Y Rev. |

Y/Y CoR |

|

|

Apr ’21 |

|||||||

|

Jul ’21 |

25% |

16% |

15% |

||||

|

Oct ’21 |

9% |

10% |

9% |

||||

|

Jan ’22 |

11% |

8% |

8% |

||||

|

Apr ’22 |

-37% |

9% |

8% |

-4% |

50% |

46% |

|

|

Jul ’22 |

-73% |

-46% |

-19% |

-80% |

-31% |

3% |

65% |

|

Oct ’22 |

20% |

9% |

-12% |

-77% |

-31% |

-17% |

11% |

|

Jan ’23 |

109% |

21% |

2% |

-58% |

-23% |

-21% |

-16% |

|

Apr ’23 |

70% |

21% |

19% |

15% |

-14% |

-13% |

-11% |

|

Jul ’23 |

218% |

104% |

88% |

1263% |

225% |

101% |

7% |

|

Oct ’23 |

53% |

42% |

34% |

1633% |

322% |

206% |

71% |

|

Jan ’24 |

31% |

25% |

22% |

983% |

338% |

265% |

139% |

|

Apr ’24 |

24% |

22% |

18% |

690% |

339% |

262% |

122% |

|

Jul ’24 |

10% |

11% |

15% |

174% |

139% |

122% |

85% |

Per the Q2 2025 release, revenue for the quarter was $30,040 million, and it is expected to grow about 8.2% to $32.5 billion for 3Q25. Nvidia has a history of outperforming guidance, so it won’t be surprising if revenue for the next quarter is closer to $33 or $34 billion. Their growth rate has been slowing, but they’re still increasing sales. It won’t surprise me if Nvidia has higher quarterly revenue than Meta in calendar 2025 when the Blackwell hardware is in full production.

The run rate for the 2Q25 operating income of $18,642 million comes to $74.6 billion. Given the way growth is expected, I don’t think a valuation range of 40 to 50x the $75 billion is unreasonable which means $3 trillion to $3.75 trillion. This range is optimistic but not outrageous.

The 2Q25 10-Q shows 24.53 billion shares as of August 23, implying a market cap of $2.9 trillion based on the August 29 share price of $117.59.

The Nvidia Corporation market cap is near the bottom of an optimistic valuation range, and I think the stock is between a hold and a buy.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMZN, GOOG, GOOGL, META, MSFT, TSLA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.