Summary:

- Nvidia Corporation has had a blistering rally in 2023 and has quickly become a battleground stock.

- We believe too much emphasis is put on short-term factors such as near-term earnings and the threat of competition.

- Nvidia is currently the king of AI hardware and software, which naturally makes them a target.

- The future of the company rests solely on their ability to continue to innovate and improve their value proposition.

- Despite the risks, we believe the potential reward makes Nvidia Corporation stock a buy at these levels.

Justin Sullivan

Thesis

Nvidia Corporation (NASDAQ:NVDA) is in no uncertain terms a battleground stock. While the bulls and the bears both have valid points, for this article we would like to focus on a more philosophical viewpoint regarding the sustainability of leadership in an increasingly competitive landscape. We believe that competition in artificial intelligence (“AI”) is a positive sign, not a negative one. After all, increasing competition often signals that a market is both highly profitable and important for future economic development.

Nvidia is currently the undisputed leader in AI hardware and software. As long as they can continue to innovate, they will continue to reap the rewards of being the frontrunner of this race.

Competition in Markets

One thing that has confounded me for years is the aversion investors have for competition in non-commodity markets. Competition is seen by many investors as a red flag that will (in their minds) certainly push down margins and reduce the profitability of the firm they are investing in. This is the wrong way of looking at it. Competition heating up is often a signal that an end market is highly desirable and expanding, and implies that the leaders in the market were wise to establish themselves early on. Even if margins eventually become pressured, the growth of the overall market often results in increased profits for industry frontrunners over time.

Would you prefer a company strive to rule a massive kingdom or a pile of garbage? Naturally there would be intense competition to rule the kingdom and no competition to rule the garbage. Does a lack of competition make the garbage pile an attractive prize? We all intuitively understand that there is a reason why nobody is fighting over the garbage, yet some investors don’t carry this principle with them when analyzing business economics and the attractiveness of end markets.

The Sword of Damocles

There is an old story that illustrates how being in a position of power carries risks as well as rewards. The tale centers around the classical Greek ruler Dionysius, and Damocles, a member of his court.

In the story, Damocles remarks at how wonderful Dionysius’ life must be as king, and how fortunate he is for being in that position. In response to this, Dionysius offers to trade places with Damocles for a day so that he may enjoy the perks of being the king. Of course, Damocles leaped at the opportunity. He had in front of him countless luxuries, food, and riches. Dionysius understood that this fortune wasn’t “free” and thus arranged for a sword to be hung over Damocles and held in place by a strand of hair tied around the hilt. This was meant to portray the need for a king to always be aware of threats to their position and those who seek to displace them. Damocles grew increasingly distressed by the sword hanging above him and found himself unable to enjoy the perks of sitting on the throne. He quickly learned that while the king may have endless riches at their disposal, if they become complacent their life will be a short one.

The lesson here is that while being the king increases the wealth and rewards that a person enjoys, it also comes with an invisible cost. This is because others also desire the benefits of being the king and are thus in perpetual competition with whoever the current king is. The greater the benefits, the fiercer the competition. If a king were to relax and take comfort in their excess and abundance, they would find their excess and abundance to be short-lived. This principle brings to mind the famous Andy Grove quote, “Only the paranoid survive.”

In Nvidia’s case, their competitors see the immense profits being generated and are seeking to gain a piece of the pie. Their customers see the price tag of pumping money into hardware, and many are attempting to design their own silicon and cut Nvidia out of the equation. Their suppliers see how high Nvidia’s margins are in relation to how much their input costs are and could look to raise fabrication/testing prices. There is no doubt that all three of these groups will increasingly pressure Nvidia over the coming decade, each in different ways.

This truth does not mean that Nvidia is doomed to lose their leadership position. Competitive pressures are the enemy of the mediocre and the friend of the exceptional. Nvidia has earned their position on the throne through years of investment and technological innovation, and their advantages will not evaporate just because they face economic pressures and other firms enter the arena. Intense competition is table stakes for high technology, and the participants (at least the companies that survive) understand that this game is corporate life or death. For this reason, Nvidia will likely continue to pour resources into R&D in order to maintain (or even accelerate) their rapid pace of innovation. In the face of pressure, Nvidia will not stand idle.

As long as Nvidia keeps an eye on the sword dangling above their heads, investors will continue to reap the benefits of their dominant position in AI hardware/software and continue to benefit from the growth of the overall market.

Valuation and Price Action

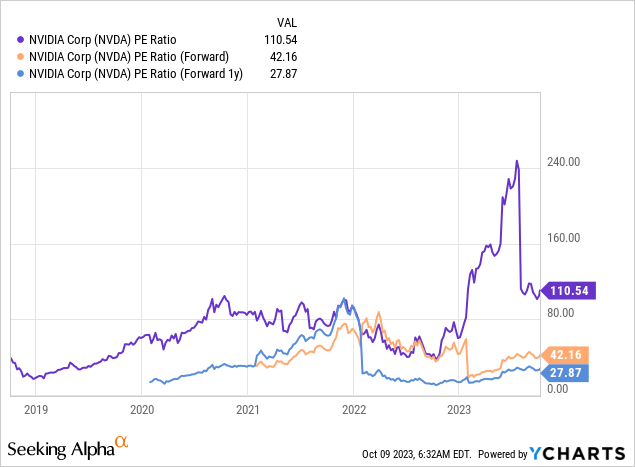

One of the reasons Nvidia has become a battleground stock lies in the fact that their relative valuation is a choose your own adventure book. Bearish investors will often point to the trailing numbers and bullish investors will point to the forward estimates. We believe this discussion largely misses the point. The long-term value of Nvidia is not determined by their historical or near-term earnings, it is determined by how well they can position themselves as the arms dealer in the AI race. Any number of things can happen in a cyclical industry such as semiconductors, and earnings can vary wildly over the course of the cycle.

While this may be an overused example, investors analyzing Apple (AAPL) in the year 2012 who were overly focused on what iPhone revenues and earnings were in 2011 and would be in 2012/2013 may have underappreciated the work the company was doing to build an ecosystem that would drive continuous value beyond one-time hardware sales. Investors who are modeling earnings for Nvidia should take the entire cycle into account and avoid focusing too much on any one quarter or year and avoid placing too much weight on positive surprises and disappointing results.

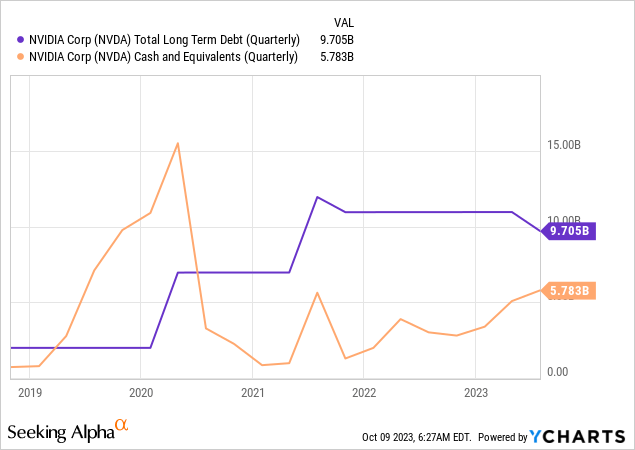

Nvidia faces reduced financial risk due to their low amount of net debt. While any investment can go to zero, investors can find some amount of comfort in being able to put their full focus towards analyzing risks to the business itself rather than balance sheet risks.

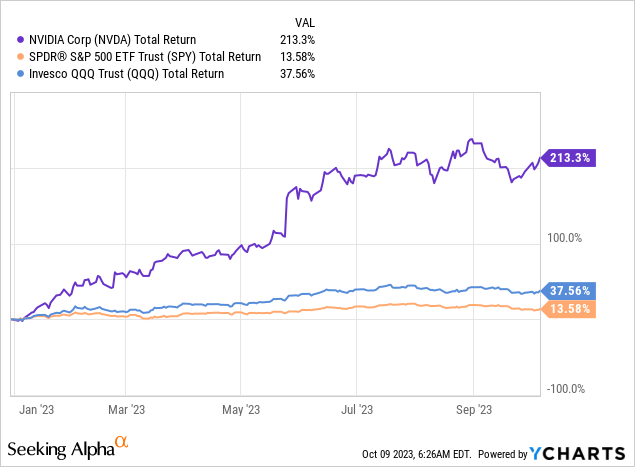

Nvidia has had a blistering rally year to date and has trounced both the S&P 500 (SP500) and the Nasdaq 100-Index (NDX). Investors would do well to remember that this period of outperformance came after a period of underperformance. This pattern has been typical of Nvidia over the years, but over the course of an entire cycle the company has outperformed. This is another reason for investors to avoid fixating on the performance of the stock over the short term. An often hyped and popular company participating in a cyclical and rapidly changing industry will almost always be prone to wild price moves in both directions.

Investors should generally ignore short-term swings in both earnings and the stock price, and instead focus their time on analyzing how the company is performing in their end markets and positioning themselves for future success (over the course of a cycle). This will be much more informative for the process of buying and selling than relying on short term earnings results/estimates or short term price movements.

Risks

A company like Nvidia carries with it many risks. Chiefly among these is a disruption to their supply chain and/or ability to sell into their end markets. The risk posed by a conflict between Taiwan and China or additional export restrictions has been repeatedly talked about by investors so we will simply state that these risks are material and move on.

Another risk is that Nvidia’s suppliers, competitors, and customers end up applying enough pressure that it hampers Nvidia’s ability to continue growing their earnings. This would impair the present value of their business and lead to valuation compression in the shares.

Lastly, the stock has had a massive run and is likely full of “hot money.” Short-term traders could run for the exit at any time, which would pressure the stock. While this would be immaterial to the business itself, it is another reminder that investors shouldn’t invest money into Nvidia that they will need over the near/medium term as high volatility is a feature of the stock.

Despite the fact that the stock could implode anytime for a variety of reasons, we view the risks as being justified by the potential rewards. Nvidia is not for risk-averse investors, and at this stage of the story even the most risk-tolerant investors would do well to limit position sizing just in case something goes wrong.

Key Takeaway

Nvidia is on the forefront of technological development and has had a meteoric rise in 2023. The company has a lot to prove, and the long-term trajectory of the stock will depend on how well the company can execute and improve their value proposition. We believe that risk tolerant investors can look to continue buying here, but limiting position size appears to be wise given the risks and cyclical nature of the industry.

Thanks for taking the time to read this article!

Today’s question for the comments is: What company involved in the semiconductor industry do you believe will have the best performance over the coming decade?

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to NVDA. UFD Capital, LLC manages a hedge fund and does not provide investment advice. Nothing contained in this article is investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions. Nothing contained in this article should be interpreted as a solicitation to buy or an offer to sell securities.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.