Summary:

- Nvidia will soon replace Intel in the Dow Jones Industrial Average, ending INTC’s 25-year run of underperformance in the index.

- NVDA’s recent market outperformance suggests investors are getting pumped up for its upcoming earnings release later this month.

- Recent earnings releases from AMD and Intel show that the King of AI’s market leadership remains structurally bullish.

- Nvidia’s robust partnership with TSMC is expected to be a critical underpinning of its growth prospects.

- I argue why NVDA’s medium- and long-term prospects look increasingly enticing as it expands into other growth optionalities.

BING-JHEN HONG

Nvidia: Pulling Away From The Market Again

Nvidia Corporation (NASDAQ:NVDA) investors who ignored the market’s pessimism have been rewarded as the stock surged toward its October 2024 highs. The stock suffered volatility in August and September 2024 as investors took profit as the market rotated toward value stocks and battered sectors. In my previous Nvidia article, I enunciated the market’s concerns over the production challenges with its Blackwell AI chips. However, these concerns have been resolved, as the company has prepared for a Q4 production ramp, aligned with expectations of shipping in volume through 2025.

NVDA Ends Intel’s Run In The Dow Jones Industrial Average

Therefore, I’m not surprised by its recent outperformance, as the AI infrastructure growth thesis has been revived. Big tech and the leading hyperscalers have upped the ante, lifting their CapEx growth outlook. Therefore, it’s expected to benefit NVDA, given its market leadership in AI chips. The recent earnings release from arch-rival AMD (AMD) suggests the Lisa Su-led company is not assessed to offer significant near-term challenges to Nvidia’s throne. Furthermore, the expected $500M AI revenue miss by Intel (INTC) demonstrates how far the Pat Gelsinger-led company has fallen behind.

To make matters worse for Intel, NVDA will soon replace INTC in the Dow Jones Industrial Average (DJI) (DIA). S&P 500 Dow Jones Indices decided there’s a need to “ensure a more representative exposure to the semiconductors industry.” Therefore, it marks the end of an era under Gelsinger’s watch, as INTC is removed after a 25-year run that saw it underperform significantly.

Hence, NVDA’s inclusion is expected to lift its already buoyant buying sentiments (“A+” momentum grade over the past six months) to new heights as accelerated computing takes center stage. I assessed that the market’s enthusiasm for the Jensen Huang-led company is justified, as AMD and Intel have not kept up the pace with Nvidia’s full-stack AI chips leadership.

Nvidia’s AI Leadership Is Structurally Sound

Its ability to demonstrate an annualized launch/upgrade cadence should keep its arch-rivals on their toes while impacting their capabilities to benchmark and overtake Nvidia’s performance. In addition, Nvidia’s networking and software chops have earned the trust of Tesla (TSLA) and xAI CEO Elon Musk. Nvidia’s Spectrum-X Ethernet platform is specifically designed for high-speed networking for large-scale AI clusters. AI companies are expected to rapidly scale their massive AI infrastructure beyond deploying 100K NVDA GPUs, assessed as “table stakes.” Hence, LLM developers are expected to dedicate more compute capacity to training requirements, potentially scaling AI clusters to outcompete their peers. Therefore, it aligns well with management’s confidence that Spectrum-X is projected to become a “multi-billion dollar product line” over the next year, bolstering its current leadership through InfiniBand.

TSMC’s (TSM) ability to support Nvidia’s aggressive roadmap is assessed as a critical underpinning for Nvidia’s dominance. The leading-edge foundry is expected to increase its advanced packaging capacity markedly, fostering an even closer partnership with Nvidia. Given the challenges in Apple’s (AAPL) ability to accelerate its Apple Intelligence-driven iPhone supercycle upgrade, TSM must increasingly rely on NVDA’s remarkable growth momentum to justify the recent market optimism.

AMD Isn’t A Close Challenger Yet

Despite that, AMD isn’t resting on its laurels, as the company lifted its AI revenue outlook at its Q3 earnings release. Wall Street expects AMD to gain market share against Nvidia, although NVDA is expected to maintain its market dominance. Therefore, Nvidia must broaden its AI growth prospects beyond the hyperscaler market into other verticals, potentially gaining a critical advantage over its peers.

Accordingly, it has made significant inroads in healthcare, as seen with Denmark’s national AI supercomputer built with Nvidia’s chips. Therefore, Nvidia’s sovereign AI proposition is expected to gain traction. In Vertiv’s Q3 earnings conference (VRT), the power and thermal management company highlighted increased growth momentum in EMEA, corroborating the sovereign AI ambitions of the Middle Eastern countries. Given the intense competition among nation-states in their quest for global AI hegemony, it seems unlikely that they would settle for the “dark horse” in AMD. In addition, “insane” demand dynamics underpinning Nvidia’s Blackwell AI chips suggest money isn’t a problem for its customers.

Hence, it remains to be seen how much capacity AMD and peers could snag from TSMC, as the supply chain for the complex AI chips is expected to be tight. Nvidia’s recent production and yield challenges with TSMC underscore how challenging it has become for even TSMC to secure acceptable yields with these advanced processes.

OpenAI’s frustration in obtaining the necessary compute capacity to build even more advanced AI models underscores the need for hyperscalers and AI companies to diversify from Nvidia’s merchant chips. Hence, I expect custom AI chips from Broadcom (AVGO) and Marvell (MRVL) to gain traction. Despite that, the scale, costs, and complexities required in custom chips design and manufacturing suggest it’s not expected to unhinge Nvidia’s market leadership. Hence, I expect NVDA’s structural advantage against its closest peers to be maintained, corroborating the market’s bullish optimism.

NVDA Bulls Must Be Realistic

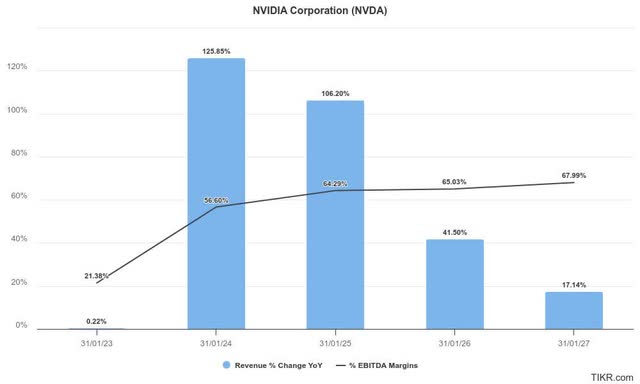

Nvidia Bulls could point to these growth optionalities as the company broadens its opportunities beyond the hyperscalers and big tech companies. Although Wall Street’s estimates on NVDA have mostly been upgraded, the law of large numbers could affect its revenue growth traction through FY2027. In other words, Nvidia investors must be realistic in their projections unless the company demonstrates more significant growth optionalities through its Spectrum-X networking platform or more robust growth prospects through its Sovereign AI segment.

Notwithstanding my caution, Nvidia has also expanded its focus to the healthcare and finance verticals. Enterprise adoption is expected to be a vital growth opportunity for Nvidia. However, downstream AI monetization by the leading software companies is expected to remain uncertain. Despite that, the potential proliferation of AI agents could bolster the enterprise segment. Therefore, investors are urged to pay close attention to the Agentic AI proposition, as it could propel the next growth phase for NVDA.

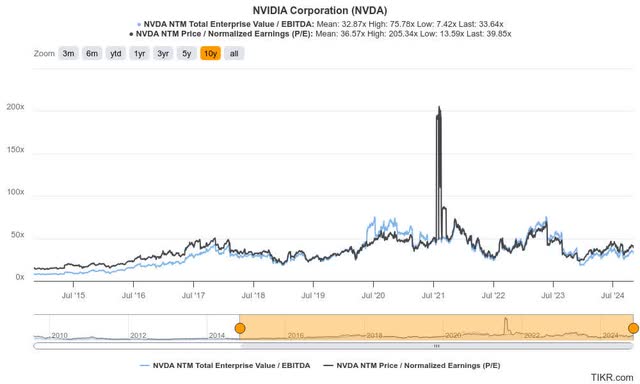

NVDA Stock: Valuations Far From FOMO Levels

NVDA’s forward adjusted EBITDA multiple of 33.6x is slightly over its 10Y average of 32.9x. Therefore, the market has not gone FOMO over its growth prospects, suggesting a relatively cautious valuation re-rating phase. Nvidia has demonstrated its ability to capitalize on the AI growth spurt, reflected in its earnings and best-in-class profitability (“A+” profitability grade). Given the growth optionalities as part of its bullish thesis, the market has likely lifted its expectations of a solid outlook at Nvidia’s upcoming earnings release later this month.

I observed a potential consolidation zone for NVDA stock under the $140 level. A possible breakout has not been assessed, suggesting a near-term pullback is likely as the stock is overbought. Notwithstanding its near-term caution, I assess Nvidia’s medium- and long-term prospects remain structurally sound.

Therefore, management’s ability to telegraph more confidence in its outlook and improved supply chain dynamics could bolster Wall Street’s confidence in augmenting its projections post-FY2027. As a result, a further valuation re-rating opportunity on NVDA isn’t out of the blue. Given the stock’s recent outperformance, a “drop the mike” moment at its upcoming earnings scorecard could fuel the potentially decisive breakout for Nvidia investors.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, TSM, AMD, AVGO, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!