Summary:

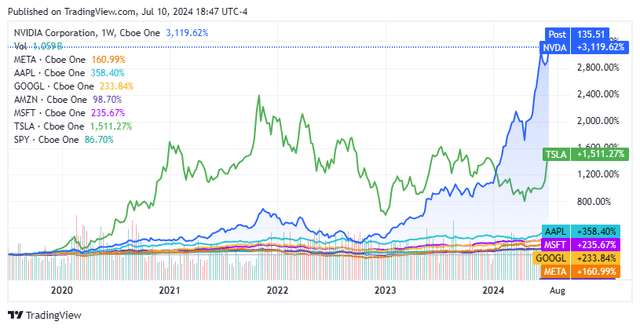

- Nvidia stock has seen a remarkable increase of over 3,000% in the past 5 years, outperforming the S&P 500 by more than 35 times.

- The risks to investing in Nvidia include potential competition from companies developing their own chips and a potential decline in demand as infrastructure upgrades slow down.

- Despite the stock’s high valuation, Nvidia’s strong financials and potential for future growth make it an attractive investment opportunity, with the possibility of further share buybacks driving earnings growth.

BING-JHEN HONG

Like many investors, I missed out on one of the most incredible runs I have seen from a stock over the past several years. Shares of Nvidia Corporation (NASDAQ:NVDA) on a split-adjusted basis increased from $4 on July 10th, 2019, to $32.67 on November 24th, 2021, before retracing back down to $11.23 on October 14th, 2022. What happened since the market bottomed is incredible, as shares of NVDA increased by more than 10x in less than 2 years, reaching $140.76. Today, shares are trading for $135.51, and NVDA has appreciated by 3,119.62% over the past 5 years.

NVDA is the best-performing stock in the Magnificent Seven, and has outperformed the S&P 500 (SP500) by more than 35x over the past 5 years. Before the Magnificent Seven, there was FANG, and I was a shareholder in Amazon (AMZN), Alphabet (GOOGL), and Meta Platforms (META). FANG has been upgraded to the Magnificent Seven, and the only company I am not currently invested in is Microsoft (MSFT).

I missed the boat on NVDA, as I was looking at them as a GPU company. When the A.I. boom hit and NVDA rose, I just never got aboard, and shares just keep climbing higher. I have never a company accelerate their profitability or revenue growth the way NVDA has, and after creating my own profitability models, I decided to start buying even if I was starting the position at a temporary top.

Currently, my cost basis is $123.87, and I am not done adding to the position. While I missed out on one of the best gainers in any 5-year period, I think NVDA can go much higher over the next 5-10 years, and I don’t mind being late to the party.

The risks to investing in Nvidia

This may shock many investors, but valuation isn’t a risk factor to me at the moment. NVDA looks to have grown into the multiple being assigned to it and trades at 48 times 2024 earnings and 30.45 times 2026 earnings. With the amount of growth that NVDA has generated and the amount of earnings growth being forecasted, I feel that NVDA could actually be cheap, and I’ll get into that in the next section. My risk factors revolve around demand and innovation, and we won’t know how these factors impact NVDA until the story unfolds.

Years ago, Apple (AAPL) moved away from NVDA GPUs in its products as it moved to fully designing their silicon. First, AAPL moved away from Intel (INTC) for its CPU, then Advanced Micro Devices (AMD), and NVDA for its GPUs. Currently, anyone who wants to train their LLMs (large language models) on the largest scale is dependent on NVDA.

The first risk factor revolves around innovation. AMZN, GOOGL, META, and Microsoft are all designing their own A.I. chips to reduce their dependence on NVDA. If they are successful is anyone’s guess, but they have the capital and engineering to accomplish their goals. If this does occur, it will negatively impact NVDA because these are the companies allocating the most capital to CapEx in the market. If the day comes when NVDA’s largest customers can augment their current data center infrastructure with homegrown chips, it could be catastrophic to their forward revenue and earnings projections.

The next risk factor for me is demand. Currently, we are experiencing a super cycle as it’s a race to build infrastructure. Not every company has a blank check like GOOGL, AMZN, MSFT, or META and won’t be in a position to upgrade with each new GPU that NVDA produces. At some point, companies will need to depreciate and monetize their assets. We could be in a situation where NVDA is pulling so much growth forward that orders could flatten out or decline over the next several years.

The first risk of innovation could also impact demand because INTC or AMD could come out of nowhere with chips that can compete with NVDA or be good enough to offer a lower-end option as an alternative. Also, if innovation from a use case level tapers off, there may not be a need to scale data centers at the rate we have seen over the past 2 years, and it could take time for the need for enhanced chips to create a new wave of demand.

I decided to start buying NVDA at the upper range because shares may actually be trading at a good value despite the massive run

There is an old saying: better late than never. I can’t get everything correct, and while I have been a shareholder of many companies for a long time, I missed a massive run in NVDA. Rather than sitting on the sidelines waiting for shares to retrace, I tore through the financials and determined that this was a stock I wanted to invest in despite the easy money being made.

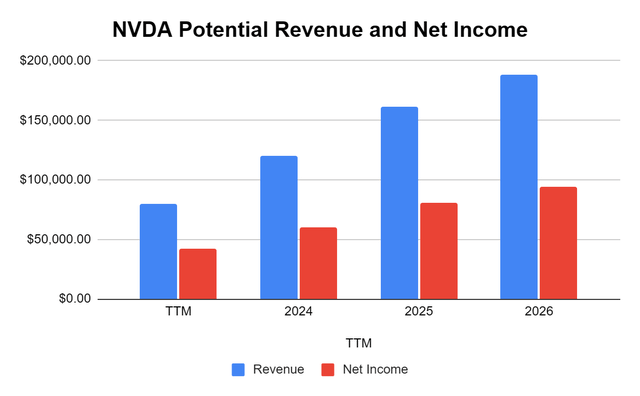

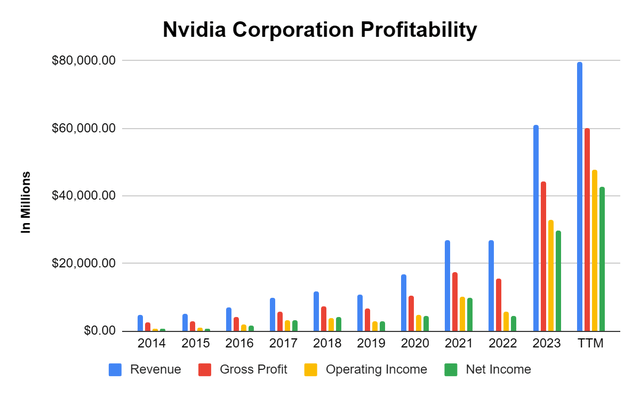

What if I told you there was a company that was generating $79.77 billion in revenue annually, operating at a 75.29% gross profit margin and a 53.4% profit margin? Then I said their revenue grew by 125.85% YoY last fiscal year, and in the trailing twelve months (TTM) their revenue has increased by 30.95% YoY after just the first quarter, and based on the projections, the revenue is expected to grow by 97.34% throughout this fiscal year? I would be shocked, but those are the facts regarding NVDA. When I build a profitability model, the current valuation looks exciting to me.

Steven Fiorillo, Seeking Alpha

I want to preface this section by saying that NVDA has $31.44 billion in cash and short-term investments on the books, with an additional $1.75 billion in long-term investments. NVDA only has $8.46 billion in long-term debt and $11.24 billion in total debt on the balance sheet. NVDA is a cash-rich company that is producing more profitability than they know what to do with, and the best part is that it is only allocating $1.19 billion toward CapEx. All of their R&D is covered in their operating expenses, and they have been able to scale the business and produce this level of profitability with a minimal capital allocation toward CapEx.

In the TTM, NVDA has generated $79.78 billion in revenue. After their cost of revenue is accounted for, NVDA’s gross profit was $60.06 billion, which is a 75.86% margin. After total operating expenses, NVDA was left with $47.74 billion, which placed their operating margin at 59.85%. After taxes and interest expenses, NVDA produced $42.6 billion in net income, with a profit margin of 53.4%.

I can’t think of another company that I follow with operating and profit margins this high. The margins have also scaled rather than decreasing as revenue grew. In the 2022 fiscal year, NVDA had a gross profit margin of 56.93%, which grew to 72.72% in 2023 and is currently at 75.29%. From a profitability standpoint, NVDA had a profit margin of 16.19% in 2022, and it grew to 48.85% in 2023 before it scaled to 53.40% in the TTM. NVDA’s financials look like an anomaly to me, and the analyst community doesn’t see the trend reversing anytime soon.

I normally look at the forward EPS estimates and price to FCF when I am evaluating a company, and I will do that in this article for NVDA. Prior to comparing NVDA to its peer group, I built a financial model based on my assumptions, and the results were shocking to me. NVDA recently conducted a 10-1 split, and its share count reached 25 billion at the end of the 2023 fiscal year. NVDA recently repurchased 400 million shares in Q1 of 2024, leaving them with 24.6 billion shares.

If the analysts are correct in their forward revenue estimates, then NVDA will generate $120.23 billion of revenue this year and expand its revenue growth to $188.01 billion in 2026. If I assume that NVDA doesn’t continue to scale its profit margin higher but maintains a 50% margin which is 3.4% less than what it is in the TTM, they would produce $60.12 billion in net income this year and $94.01 billion in 2026. This would work out to $2.44 of profit per share this year, and $3.82 in 2026. NVDA would be trading at a 55.45 forward P/E based on 2024’s profitability, and a 35.46 forward P/E based on 2026’s profitability.

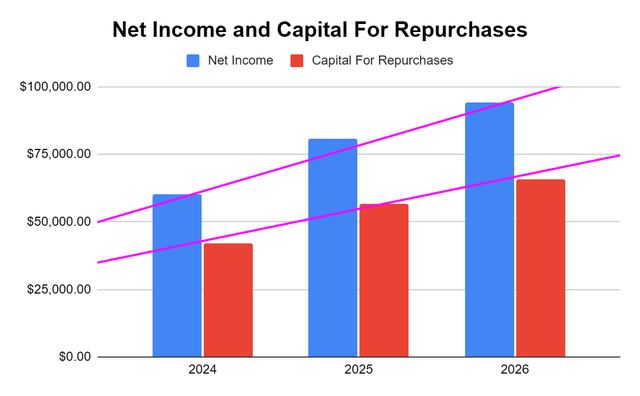

Now, what happens with all of the cash that NVDA is producing? In the annual report for 2023, NVDA disclosed that as of January 28th, 2024, the board authorized an additional $22.5 billion of share repurchases on top of the existing $25 billion that was authorized in August 2023. NVDA utilized $9.7 billion of their first $25 billion allotment and still has $37.8 billion authorized for repurchases. NVDA could generate $60.12 billion in net income this year and authorize additional buybacks.

Hypothetically, if NVDA allocates 70% of its profitability this year toward buybacks, it would amount to $42.08 billion in capital. At an average price of $150, NVDA could repurchase 280.54 million shares. This would bring their share count down to 24.32 billion and adjust my forward P/E estimate for 2024 to 54.82 from 55.45. If NVDA allocated 70% of their 2025 profitability toward buybacks, they could repurchase $56.47 billion worth of shares. If they allocated this at an average price of $175 per share, they could repurchase 322.66 million shares and bring their shares outstanding down to 24 billion.

This could bump their forward EPS in 2025 to $3.36 per share and place their forward P/E at 40.21 rather than 41.33. In 2026, NVDA could generate $94 billion in net income based on a 50% margin, and a 70% allocation rate would allow them to repurchase $65.80 billion worth of shares. If NVDA’s average price per share was $200, it could repurchase 329.02 million shares and reduce the share count to 23.67 billion shares. This could increase their EPS to $3.97 per share and reduce their 2026 forward P/E from 35.46 to 34.12.

I am shaving a few percent off NVDA’s margin in the TTM and modeling out through 2026 based on what could happen. I am using the analyst projections for revenue and making assumptions on how much capital NVDA may allocate toward buybacks based on what they have done over the past year. I believe that I could be conservative in my model, and that NVDA could beat earnings estimates and repurchase more shares than I am modeling for. NVDA may also repurchase shares at a lower average price point than I am estimating.

The forward potential is exciting, and I believe that based on what NVDA has achieved, its current margins, and what could occur, shares are inexpensive today. Normally, I wouldn’t be purchasing at all-time highs, but I have put a lot of time into studying NVDA’s numbers, and I am happy to be late to the party rather than not participating because the run could be far from over.

How NVDA is comparing to the rest of the Magnificent Seven

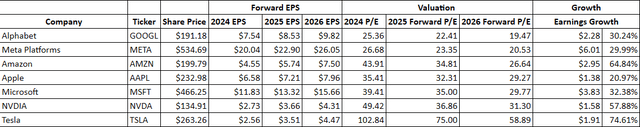

I always like to compare companies to see how the market is valuing them. NVDA is leading the Magnificent Seven, so rather than compare it to other semiconductors, I am comparing them to AAPL, GOOGL, META, TSLA, AMZN, and MSFT. Only TSLA and AMZN are expected to grow their EPS over the next 2 years by a larger percentage than NVDA.

The Magnificent Seven as a peer group is expected to grow its EPS by 44.41% over the next 2 years, while NVDA has 57.88% of EPS growth on the horizon. NVDA trades at 31.3 times 2026 earnings based on the analyst consensus estimates, while AAPL trades at 29.27 times and MSFT trades at 29.77 times.

When I look at the projections, I think NVDA is fairly valued and could grow into the valuation with some earnings beats and higher forward guidance.

Steven Fiorillo, Seeking Alpha

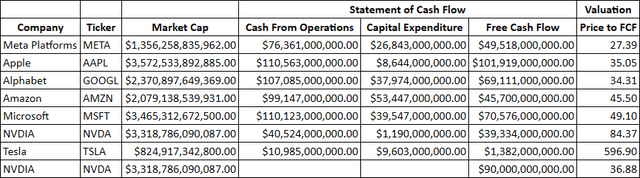

On a price-to-free cash flow (FCF) valuation, NVDA looks expensive, as they have generated $39.33 billion of FCF in the TTM. NVDA is currently trading at 84.37x their FCF, while most of the Magnificent Seven trade below 50x. Excluding TSLA, the peer group average trades at 45.95x their FCF, with META trading at the cheapest valuation at 27.39x its FCF.

When I think about how NVDA is expected to scale their profitability, it could very well generate $90 billion in FCF during the 2026 fiscal year. If I plug in $90 billion, NVDA would have a price to FCF of 36.88 times, which is significantly less than AAPL And MSFT, which trade at 45.5x and 49.1x their FCF. I don’t think it’s unreasonable that if NVDA does accomplish what the forward projections indicate that the price to FCF will grow into the valuation and continuously trade at a premium compared to most of the Magnificent Seven.

I could see NVDA scaling its FCF and growing into a multiple of 45-50x, which would place their market cap at $4.05 – $4.5 billion in 2026. I think there is still a significant upside in NVDA based on their ability to scale profitability.

Steven Fiorillo, Seeking Alpha

Conclusion

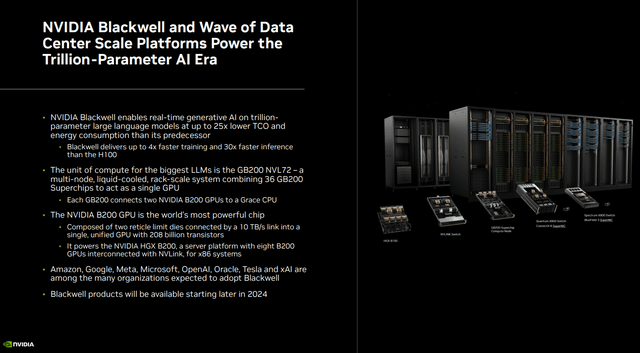

NVDA has produced the largest amount of appreciation I have witnessed over a 5-year period. While replicating these results over the next 5-years isn’t probable, I think there is still upside waiting to be unlocked. There are some projections that Nvidia will ship 1.5 million A.I. server units per year by 2027 as companies allocate more capital toward building out their A.I. infrastructure. Nvidia just announced the Blackwell product line, and there should be no shortage of customers as companies such as MSFT allocated $14 billion to their CapEx and leases to support scaling its cloud demand. I have never seen profitability margins this high from a company that is generating $80 billion in annualized revenue.

Based on my assumptions and the ability to deploy tens of billions in buybacks on an annual basis, I think that the rally in NVDA can be extended for quite some time. I am late to the party because I was looking at NVDA incorrectly, but I have been buying and plan on continuing to build my position into earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, TSLA, AMZN, GOOGL, META, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.