Summary:

- The recent Blackwell deployment by Microsoft and the integration with closed-loop liquid cooling suggest to me that Nvidia Corporation is poised for another ramp-up in its AI chip sales.

- The company could become a one-stop AI shop with Blackwell’s superior performance (both in terms of computing throughput and energy efficiency) and its software ecosystem.

- The upside from this scenario is too large to ignore and outweighs all the negatives (such as high P/E, antitrust concerns, etc.).

syahrir maulana/iStock via Getty Images

NVDA stock: Previous thesis and new Blackwell developments

My last article on Nvidia Corporation (NASDAQ:NVDA) was published a bit more than a month ago by Seeking Alpha. The article was entitled “Nvidia Q2: Don’t Forget Software.” And as you can already guess from the title, the article was a review of its Q2 earnings, with a focus on its software ecosystem. More specifically, I argued for a BUY rating based on the following considerations:

Nvidia Corporation’s Q2 FY25 results showed robust growth, driven by strong demand for AI chips. However, I think Nvidia’s software ecosystem is an aspect underappreciated by the bulls. History has taught me that a software ecosystem can form a more durable — and also more lucrative moat — than hardware eventually.

At the time of that writing, a key issue overhanging the stock was the uncertainties surrounding its Blackwell chips. The market was cautious – or even nervous – about the progress on the company’s next-generation chip Blackwell platform. The caution is for good reasons, as Nvidia has reported some adjustments to the production process for its Blackwell chips.

Against this background, the purpose of this article is to analyze the new development surrounding the Blackwell chips since my last writing. And as you will see in the next section, the developments indicate to me that the issues have largely been resolved and the Blackwell chips are experiencing a production ramp-up as we speak. Together with the software ecosystem I detailed in my last article, I see good odds for NVDA to become a one-stop AI shop, a scenario that can support a BUY thesis despite the high valuation multiples.

This one-stop shop scenario is an entirely new possibility that was not considered in our previous articles (or by other authors to our knowledge). The interplay between its Blackwell’s computational boost, liquid-cooling’s boost on energy efficiency, and its software ecosystem could fundamentally alter developer’s budget structural and create a customer lock-in advantage. The latest developments (as detailed in the next section) suggest to me the deployment of the Blackwell chips and the supporting liquid cooling technologies are in its ramp up phase, adding another catalyst, very likely the final one needed, to materialize this one-stop shop scenario. Given these considerations, this article upgrades my rating from the earlier BUY to STRONG BUY.

NVDA stock, Microsoft Azure, and liquid cooling

The first key development on my list was that Microsoft (MSFT) has recently reported the deployment of the Blackwell system AND closed-loop liquid cooling in its Azure segment. More specifics are quoted below (with emphasis added by me):

Seeking Alpha news: Microsoft (MSFT) said on Tuesday that its Azure unit is the first cloud to run Nvidia’s (NVDA) Blackwell system, via the GB200 AI servers. “We’re optimizing at every layer to power the world’s most advanced AI models, leveraging Infiniband networking and innovative closed-loop liquid cooling,” Microsoft said in a post on X, formerly known as Twitter.

To corroborate the above developments, a key partner of NVDA, Super Micro Computer (SMCI) also reported the application of liquid-cooling system technology in scale. The specifics are quoted below (and again with emphasis added by me):

Seeking Alpha News: SMCI said that it had recently deployed more than 100,000 GPUs with its liquid cooling solution system for some of the largest AI factories… Super Micro also said that the liquid cooling systems also cut customers’ power demand, in some cases, by up to 40%. The liquid cooling system includes cold plates to let the liquid flow through to microchannels, a specifically designed CDM to enable up to 96 Nvidia (NVDA) B200 GPUs per rack and a “state-of-the-art” CDU solution with a cooling capacity of 250kW and swappable pumps and power supplies.

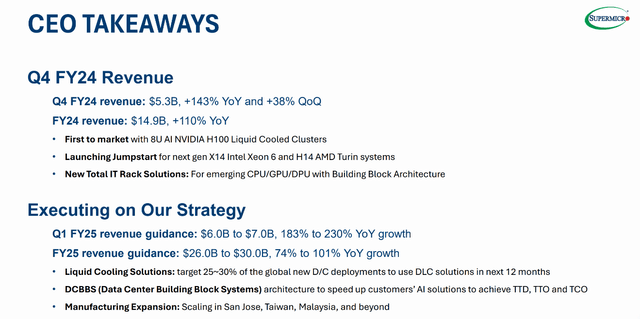

As shown in its Q4 ER slide below, SMCI reported “first to market with its 8U AI NVIDIA H100 liquid-cooled clusters”. Given my professional background (renewable energies and thermal-fluid sciences), I consider cooling a key bottleneck for further expansion of AI technologies. The above application of the liquid-cooling technology – deployed with 100,000 GPUs – is quite convincing evidence in my mind that the technology is ready for the next stage of ramping up.

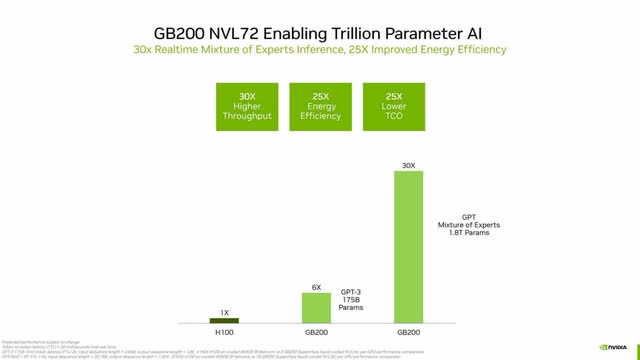

The combination of liquid cooling and NVDA’s Blackwell chips (which are designed for 30x higher throughput and 25x energy efficiency improvement) could totally change customer’s budget allocation. Currently, electricity cost – both to run chips and keep them cool — is a key component in the budget of AI training and application. A 25x improvement, further augmented by liquid cooling, could fundamentally change the cost structure and pave the way for expanded applications.

And the tech world indeed has a large appetite for such an expansion, as detailed next.

NVDA stock: strong AI demand expected to continue

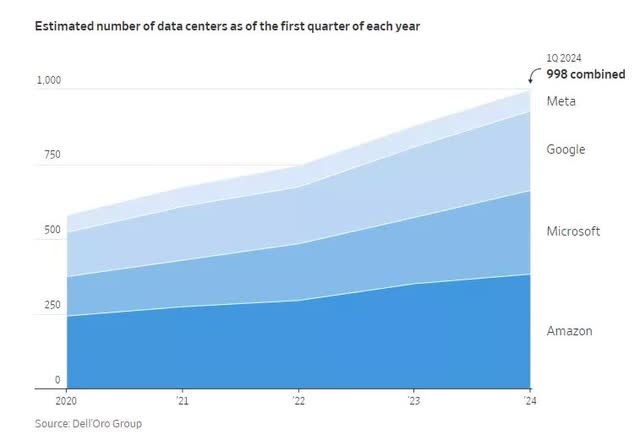

Tech majors are currently investing in AI-related technologies at a massive scale, with new data centers emerging like mushrooms after a spring rain. Unlike traditional data centers that primarily serve data storage and non-AI software operations, these newly constructed data centers are equipped with cutting-edge chips — like those made by NVDA — specifically designed for developing and running generative AI applications. As an example, as illustrated by the chart below, the number of Microsoft’s data centers has more than doubled since early 2020. Google is not far behind, with an 80% increase in the same period. Meta, Oracle, Amazon, etc. all have plans to vastly expand their data capacity in the near future.

Looking ahead, AI is a race that the tech majors cannot afford to lose. As a result, multiple chief executives have all expressed the willingness to overinvest now rather than underinvest. Two examples are quoted below:

“The risk of underinvesting [in AI] is dramatically greater than the risk of overinvesting.” – Sundar Pichai (Google CEO).

“At this point I’d rather risk building capacity before it is needed, rather than too late.” – Mark Zuckerberg (Meta CEO).

As such, I expect the demand to remain strong for the foreseeable future. Furthermore, I expect NVDA to be the best positioned to capitalize on such demand, given its technological lead analyzed above and the interplay between its software ecosystem and its Blackwell chips. NVDA’s software ecosystem (most importantly CUDA and cuDNN in my view) enables its Blackwell chips to deliver maximum performance and flexibility for AI applications. This interplay offers a comprehensive solution for AI development. In my mind, this could mean that AI developers can rely on Nvidia for all their AI needs in the future, from hardware to software, without having to piece together solutions from multiple vendors. This would give Nvidia the one-stop AI shop status and a customer lock-in.

NVDA stock: downside risks and final thoughts

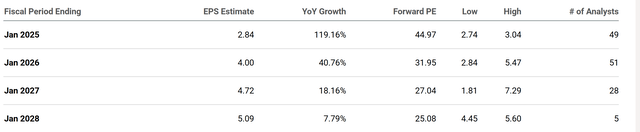

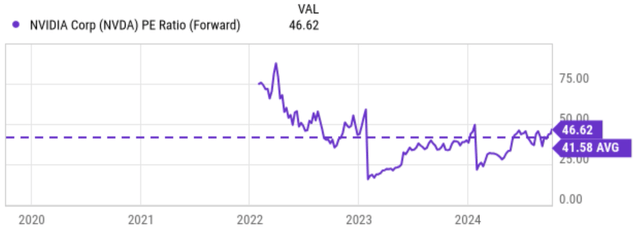

Now, the downside risks. The first downside risk is a substantial valuation risk. Trading at 45x FWD P/E (as of this writing based on the consensus EPS estimates for NVDA stock below), the multiple is very high in both absolute terms and relative terms. However, note that the current valuation could be compelling when benchmarked against its own historical range. As seen in the second chart below, the stock has traded in a range of about 25x to over 70x of the consensus EPS estimate in the past 2~3 years. The average FY1 P/E is about 42x, quite close to the current level.

As a second downside risk, the U.S. Department of Justice (“DOJ”) has recently opened an investigation into NVDA. The investigation focuses on potential antitrust violations by Nvidia. I don’t pretend to have specific legal knowledge or insight into any specifics of the investigation. I see good reasons on the DOJ’s side, given NVDA’s dominance in the AI space and some of its marketing practices reported below:

The DOJ sent subpoenas to Nvidia after rivals raised concerns suggesting that Nvidia promotes exclusive use of its chips and prioritizes customers that can immediately use its products, as well as that its recent acquisitions, particularly the purchase of AI management firm RunAI, foreclose competition from potential rivals.

On the other hand, I also see good odds for NVDA to address DOJ’s concerns satisfactorily. Many of NVDA’s top customers are some of the most resourceful and competent companies in the world (such as MFST, GOOG, META, etc.). In my view, these customers not only have sufficient bargaining power, but also the ability to source AI chips from other vendors or even use custom chips they’ve developed in-house themselves.

All told, my overall conclusion is that the upside potential exceeds the downside potential under current conditions. The recent developments surrounding its Blackwell deployment and the integration with closed-loop liquid cooling suggest to me that Nvidia Corporation is poised for another ramp-up in its chip sales. When combined with the software ecosystem (the focus of my last article), investors have to consider the scenario of NVDA being a one-stop AI shop. The upside created by this potential far outweighs all the negatives (high P/E, competition, antitrust concerns, etc.) in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.