Summary:

- We rate Nvidia Corporation stock a Hold, with the key consideration a conflict between two fundamental signals.

- On the one hand, there are signs that Nvidia is exiting the contracting phase of the chip cycle and entering a new expansion phase.

- On the other hand, its flagship AI chips are facing intensifying pressure from competition offerings while too much optimism is baked into its P/E.

mikkelwilliam

Nvidia: State of the cycle

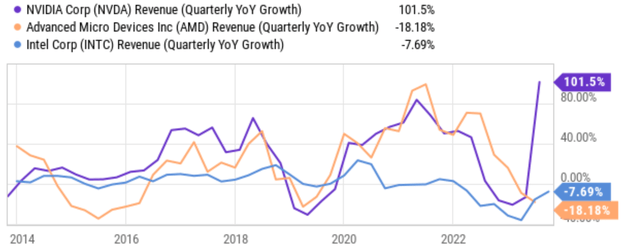

For cyclical stocks like Nvidia Corporation (NASDAQ:NVDA), I closely monitor the state of the cycle. And there are signs that NVDA is exiting the contracting phase of the current chip cycle and entering a new expansion phase. To provide context and convince you of the cyclical nature of chip stocks, the chart below shows quarterly YoY revenue growth for both NVDA and Advanced Micro Devices, Inc. (AMD) over the past 10 years. As seen, during the past decade, both stocks went through roughly 2 cycles with strikingly similar phases and magnitude.

Author based on Seeking Alpha data

I strategically ended the above chart around mid-2023, roughly when they experienced the worst contraction. The reason is to contrast what has happened since then, as shown in the next chart. As seen, since then, it is unclear if the contraction phase is over for the sector as a whole or not. Intel Corporation (INTC) has shown signs of recovery (see more details in my early article on its Q3 earnings review), but results from AMD are yet to be seen. However, NVDA has staged a remarkable reversal of its contraction, and its most recent quarter’s revenue grew 101% YoY.

Next, I will argue that NVDA’s growth is driven by good fundamentals.

Fundamentals driver

There are several key factors driving the above cyclical behavior. The biggest factor is macroeconomic conditions, which is a factor that I will leave out of this discussion as it impacts all stocks. Since this is an NVDA article, I want to focus on issues that are more specific to NVDA. Thus, I will focus on the next two factors in more detail: inventory churn and the company’s product cycles.

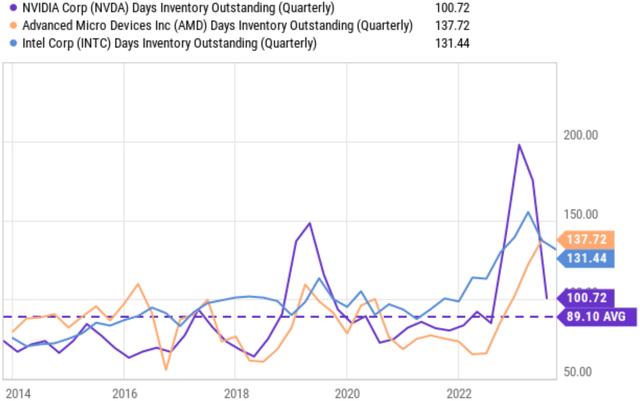

Inventory churn is of particular relevance to the current cycle NVDA is going through, as a Reuters report pointed out back in 2022. Quote:

Due to the chip shortage earlier in the year, companies started to hoard chips “just in case” they need them and cannot get them (just like people hoarding toilet paper when COVID first broke out). And quickly the shortage turns into a glut.

The report went on to call, very insightfully in my view, the situation to the “toilet paper hoarding moment for the chip business.” An extreme inventory causes a range of risks, including higher storage costs, product obsolescence, reduced selling prices, et al.

Fast forward to now, the chart below shows that Nvidia’s day’s inventory outstanding (“DIO”) has dramatically decreased (from a peak of 200 days of inventory standing) to the current level of ~100 days. Admittedly, its current level is still a bit higher than its long-term average of 89 days. But much of the risks associated with inventory churn have dissipated already in my view.

Next, I will examine its product cycle.

Flagship AI chips face competition

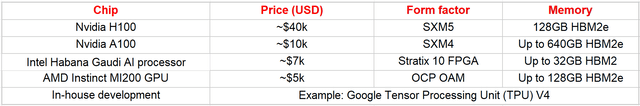

Nvidia’s current flagship AI chips are the A100 and H100. These chips are designed for AI training and inference in data centers. Nvidia’s A100 and H100 are both high-end GPUs that are specially engineered for AI and machine learning applications. They are the most powerful GPU on the market and are used by many of the world’s leading companies. To further add to its moat, NVDA also offers a suite of software that accompanies these chips.

However, I am seeing intensifying competitive pressure on these flagship chips. I see competitive pressure on the horizon. The following table summarizes a few of the main competitive offerings in my view. These main competitive products include AMD Instinct MI250X and Intel’s Gaudi series. Other non-chip companies such as Google (GOOG) (GOOGL) and Meta Platforms (META) are also developing their own in-house AI chips.

Note the price information is only meant to be very approximate estimates. The prices vary significantly depending on technical specifications and market fluctuations. Nonetheless, NVDA’s A100 and H100 in general demand a price premium – a quite large one as seen. While on the other hand, it is not all that clear if NVDA’s flagship chips indeed offer the best performance/price ratios. Varies benchmark AI tests have shown mixed results.

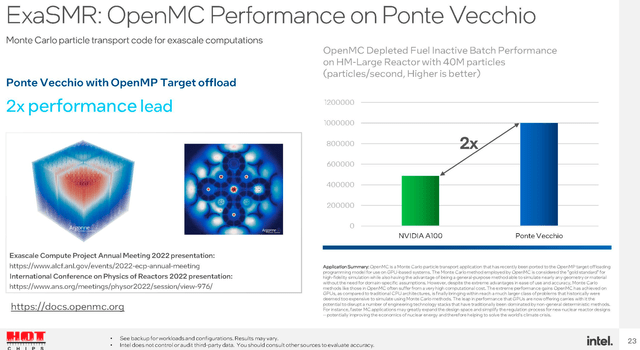

For example, Intel Gaudi has been reported to outperform Nvidia’s H100 in Visual-Language AI Models. In imaging processing applications (e.g., generating images from text cues with Stable Diffusion), Intel’s Gaudi Gen 2 chips were also reported to outperform A100. Initial testing on Intel’s next-generation AI chip, Ponte Vecchio, showed 2.0x to 2.5x higher performance than NVDA’s A100 chip on some key benchmark tasks (see the next chart below).

Other Risks and Final Thoughts

There are a few other risks worth mentioning, in both directions. On the positive side, Nvidia’s next generation of AI chips is expected to be based on the Grace architecture. Grace is a new type of chip that combines a GPU with a CPU, which is expected to improve performance and efficiency for AI workloads. The new product lineup, when/if successfully released, could help NVDA maintain its competitive edge over other products.

On the negative side, the stock is trading at a large valuation premium (37x FWD P/E as of this writing) compared to the overall market and many of its close peers. Furthermore, competition intensification does not only come from close peers such as Intel and AMD. Other major tech players are developing their own AI chips. As aforementioned, Google is a major player in the AI chip space, and it has developed a number of custom chips for its own AI research projects. Google’s TPU chips are some of the most powerful AI chips on the market, and they are used in a variety of Google products, including Google Search, Google Translate, and Google Photos. Global competitors in the AI space include Graphcore (a British AI chip developer) and Habana Labs (an Israeli AI chip company). Their chips are used by heavyweights like Amazon, Microsoft, Samsung, Baidu, JD.com, et al.

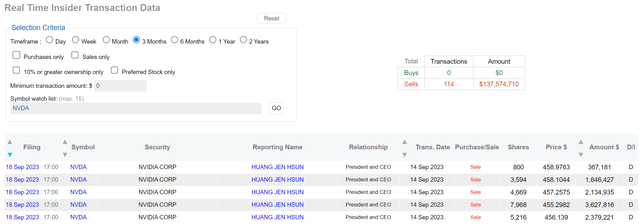

Finally, potential investors should also take a look at its recent insider activities. In the past 3 months, the insider transactions were 100% dominated by selling activities. In September 2023 alone, Jen Hsun Huang (President and CEO of NVDA) made a series of sizable sales, mostly in a price range of $450 to $485 per share. Admittedly, insider selling does not necessarily reflect management’s lack of confidence in the company’s future. However, when the picture is so one-sided, investors should take note and it should become part of the consideration.

All told, this article argues for a hold thesis on NVDA. I see two conflicting fundamental forces at play: cyclicality and competitive pressure. On the one hand, there are signs that both NVDA and the chip sector as a whole are exiting the current contracting phase and starting a new expansion phase. Especially for NVDA, it has resumed its revenue growth vigorously in recent quarters and successfully digested its hoarded inventory to a large degree. However, on the other hand, I see strong competitive pressure on its flagship chips. I expect a tug-of-war between these two forces in the near term and the stock price to move sideways without a definitive direction.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.