Summary:

- Nvidia Corporation reported record revenues of $18.1 billion in Q3, beating analyst estimates by $2.0 billion.

- Solid Nvidia forward guidance is tempered by U.S. sanctions against GPU exports, causing concerns for future growth.

- At 12x F2026 revenues, Nvidia remains far too rich for my tastes. I recommend current holders sell.

jetcityimage

After last quarter’s earnings, I wrote a cautious article on Nvidia Corporation (NASDAQ:NVDA), highlighting warning signs from its second quarter earnings report. My concerns mostly revolved around disclosures and the quality of Nvidia’s earnings. Since my article, Nvidia had dipped to a low of $405 / share before rebounding with the markets in November (Figure 1).

Figure 1 – NVDA has been flat since September (Seeking Alpha)

As Nvidia recently reported another “stellar” quarter with revenues with guidance “blow[ing] past expectations,” I wanted to take some time to review the third quarter results and examine my lingering concerns from the second quarter.

Another Beat And Raise…

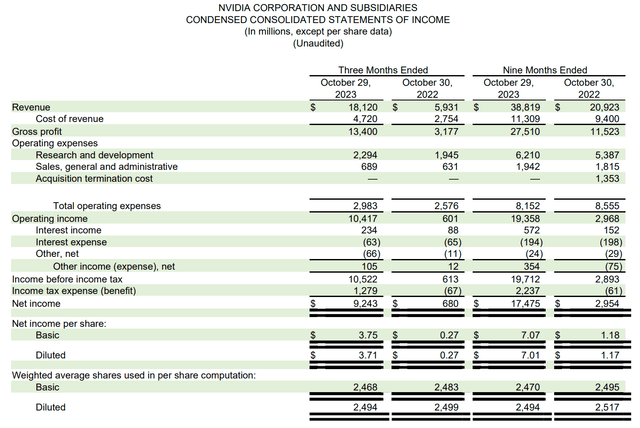

First, with respect to the third quarter, it was another large beat to consensus as Nvidia reported record revenues of $18.1 billion (+206% YoY, +34% QoQ), $2.0 billion ahead of analyst estimates (Figure 2).

Figure 2 – NVDA Q3/F24 financial summary (NVDA Q3/F24 10Q report)

On the bottom line, Nvidia’s diluted EPS of $3.71 for the quarter (up 50% QoQ) beat consensus estimates of $3.39 / share.

…But Forward Guidance Tempered By Chinese Sanctions

Looking forward, Nvidia raised its Q4/F24 guidance to $20 billion, plus or minus 2%, compared to analyst estimates of $17.9 billion. Usually a “beat and raise” quarter like the one Nvidia just delivered should be well received by investors. However, as of the writing of this article, Nvidia’s stock reaction is actually down on the day (Figure 3).

Figure 3 – NVDA has reacted negatively to Q3 earnings (Seeking Alpha)

The most likely culprit for NVDA’s poor stock reaction is the company’s guidance. Although Nvidia is guiding for $20 billion in revenues for the upcoming quarter, Nvidia is expecting sales in China to decline significantly due to new tougher sanctions imposed by the U.S. government.

Although Nvidia believes the decline in Chinese revenues will be more than offset by growth in other jurisdictions, China accounted for 20-25% of Data Center revenues for Nvidia in the past few quarters, so the new licensing requirements for the export of high-end Nvidia GPUs to China could prove to be a major headwind for the company in the coming years.

What Is The Ultimate Potential For Data Center Revenues?

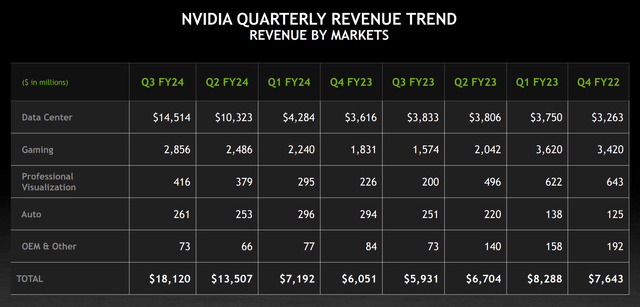

Moreover, the quarterly growth rate in Data Center revenues has slowed significantly, from 140% in Q2/F24 to only 41% in Q3 due to the law of large numbers (Figure 4).

Figure 4 – Quarterly revenue trend (NVDA investor presentation)

While 40% growth on a $10 billion / quarter business is still fantastic, investors need to realize Nvidia is priced for perfection at over $1.2 trillion in market cap, so expectations were likely looking for more.

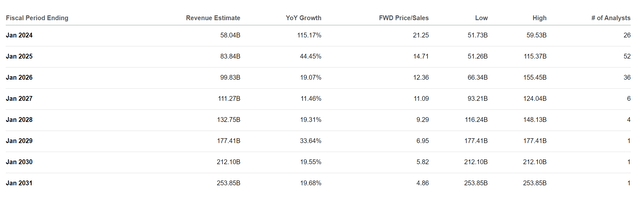

The vast majority of Nvidia’s growth is expected to come from Data Center sales, since Gaming and Auto are more mature markets. If the Chinese market is shut off for Nvidia, it may be hard to build a bridge from Nvidia’s current LTM revenues of $45 billion to $100 billion in revenues by F2026 and $212 billion by F2030 (Figure 5).

Figure 5 – NVDA consensus revenue estimates (Seeking Alpha)

Are Customers Not Paying Their Bills?

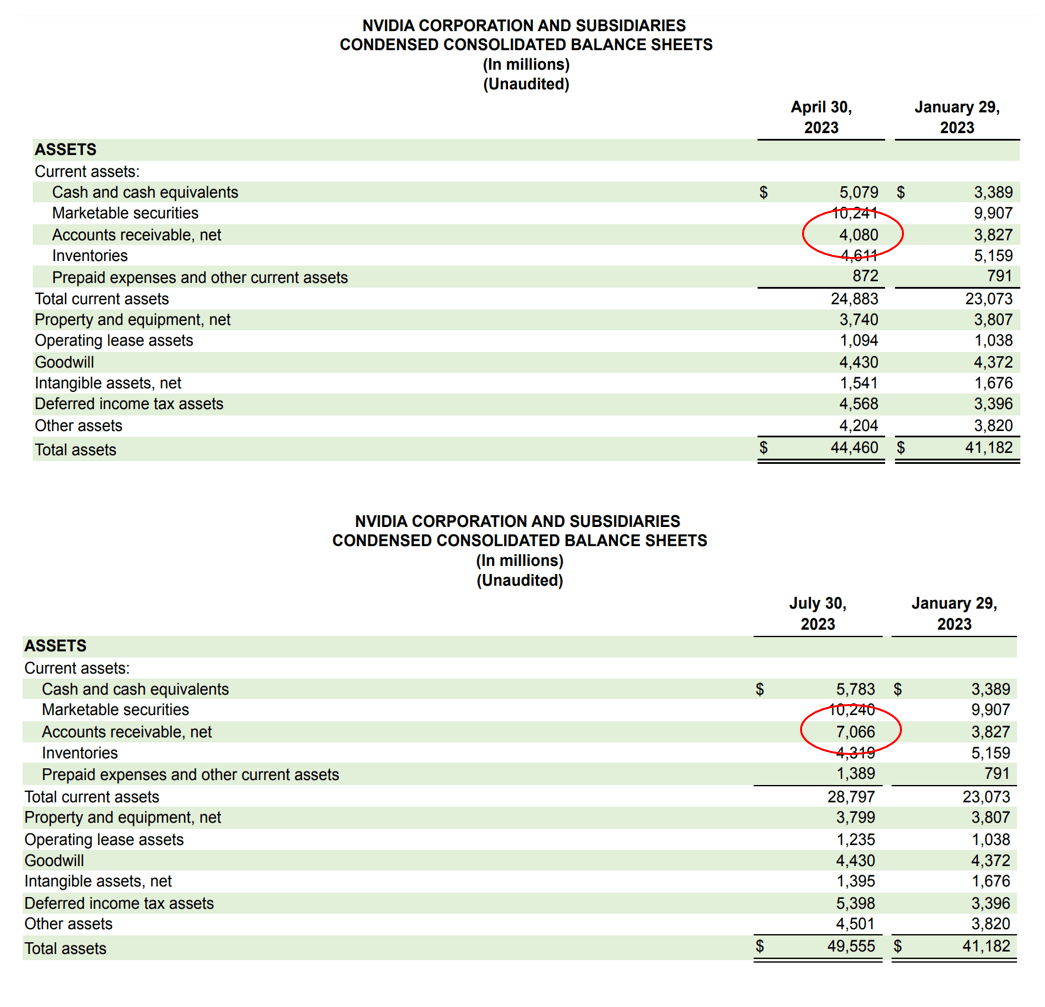

Revisiting my concerns from the second quarter, one potential issue I highlighted was the sudden and large jump in Nvidia’s accounts receivables, from $4.1 billion at April 30 to $7.1 billion at July 30 (Figure 6).

Figure 6 – NVDA accounts receivables jumped in Q2 (Author created from company reports)

While a large jump in accounts receivables could simply be due to the timing of sales (perhaps some sales were recorded right at the end of the quarter), it could also be due to a change in business mix.

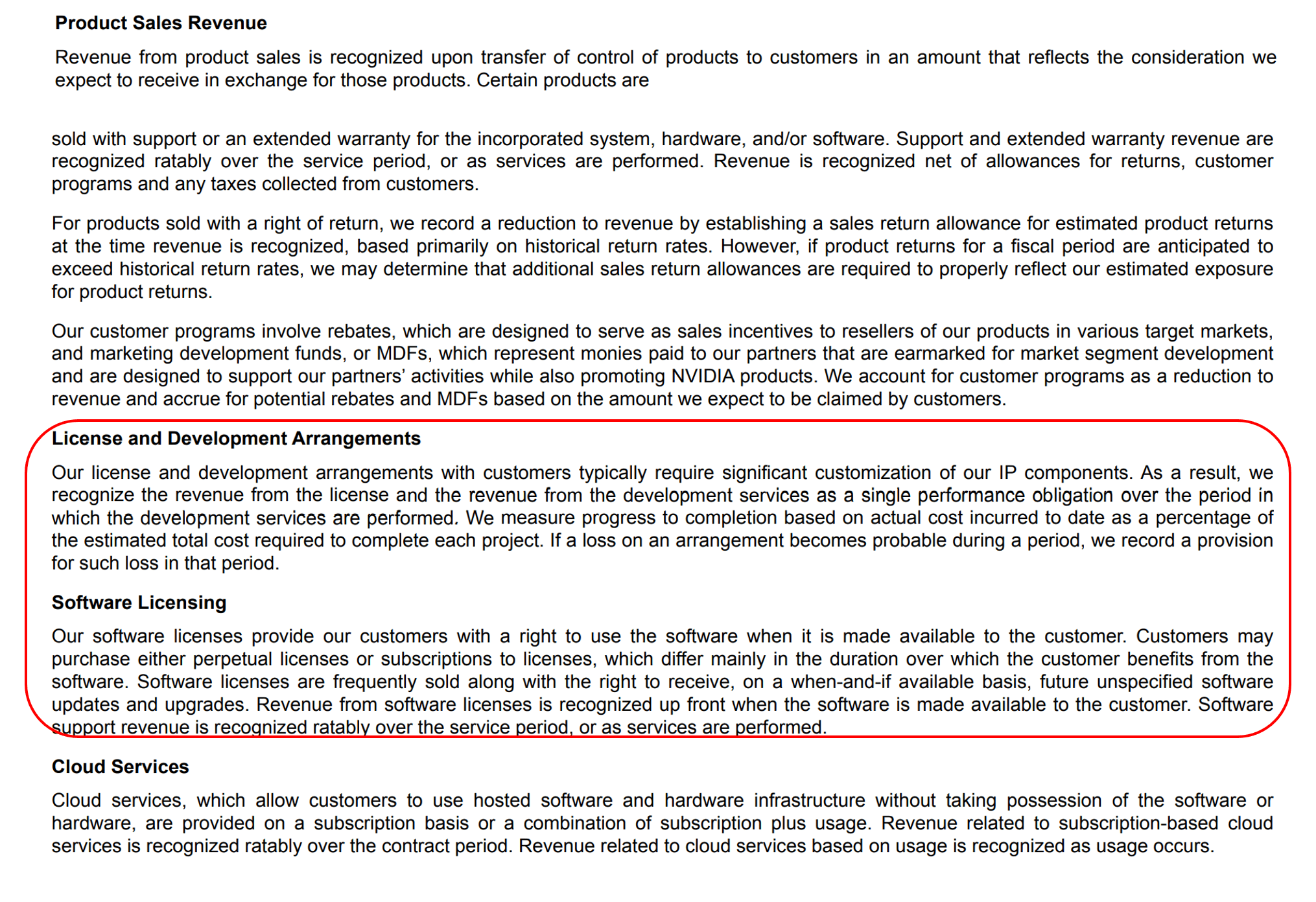

Unlike product sales where revenue is recognized when the product has been shipped (transfer of control) to customers, part of Nvidia’s data center revenues could be software licenses where revenues are recognized upfront, even though payment and deliverables could be at a later date (Figure 7).

Figure 7 – NVDA revenue recognition disclosure (NVDA 10K report)

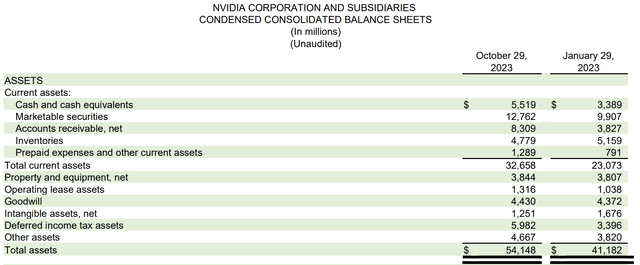

In the most recent third quarter, we continued to see elevated accounts receivable for Nvidia to the tune of $8.3 billion, suggesting my interpretation of changing business mix was correct (Figure 8).

Figure 8 – NVDA accounts receivable Q3/F24 (NVDA Q3/F24 10Q report)

Readers should note that I am not suggesting anything sinister with Nvidia’s accounting policies. However, it does change the risk profile of the company’s revenues.

Historically, bad debts have been very low for Nvidia, since products and cash changed hands almost at the same time. Going forward, if the “AI revolution” experiences any downturns and some of the Nvidia’s customers become financially stressed, we may see Nvidia having to take provisions and charge-offs against its “accounts receivables,” since it now records revenues, but cash is received at a later date.

Surging Private “Investments” In Non-Affiliates

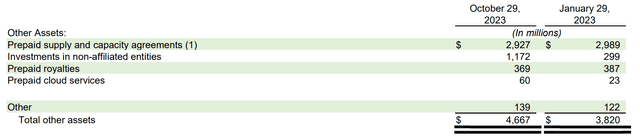

In addition to manufacturing and selling industry-leading GPUs, it appears Nvidia also has a nascent venture capital business, judging by the surge in capital invested in “non-affiliated entities.” As of October 29, 2023, Nvidia had $1.2 billion in investments in non-affiliated entities, a sharp $900 million increase from January (Figure 9).

Figure 9 – NVDA other assets (NVDA Q3/F24 10Q report)

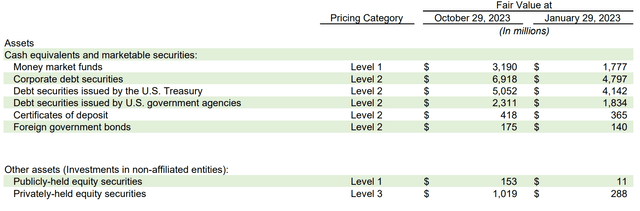

These are mostly privately held equity securities (Figure 10).

Figure 10 – Mostly privately held equities (NVDA Q3/F24 10Q report)

So what, you might ask. The potential issue, as highlighted in my prior article, is that these “investments” appear to be equity investments from Nvidia into private companies like CoreWeave that turn around and use their funds raised to acquire Nvidia GPUs.

While this practice of Nvidia funding startups that in turn acquire massive quantities of Nvidia GPUs financed by loans collateralized by said GPUs may be perfectly legal, it does optically create potential conflicts of interest. In fact, some may even argue this practice is reminiscent of the off-balance sheet entities used by Enron to illegally boost its revenues, although I am not alleging anything of the sort here.

Insiders Continue To Sell Shares With Nary A Buy

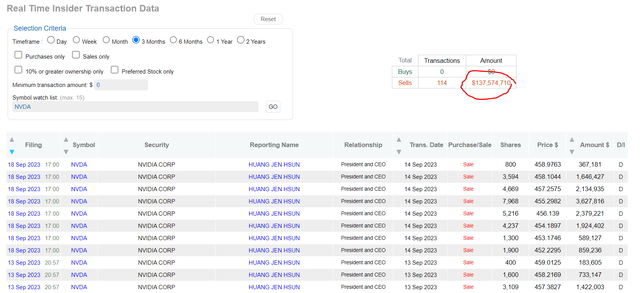

Since my last article, Nvidia’s CEO has continued to dump stock at a furious pace, selling $137 million in shares in 114 transactions (Figure 11).

Figure 11 – NVDA CEO has sold $137 million in shares in past 3 months (dataroma.com)

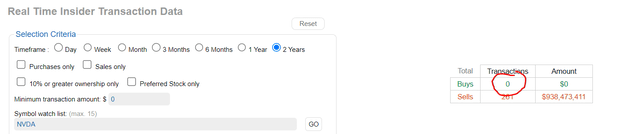

In fact, there have been zero insider buys of Nvidia shares in the past 2 years (Figure 12).

Figure 12 – There has been zero insider buys in 2 years (dataroma.com)

Valuation Remains A Concern

In the short term, the market is a voting machine, allowing speculators to bid up stocks to ridiculous levels. However, in the long run, the market is a weighing machine and valuations do matter.

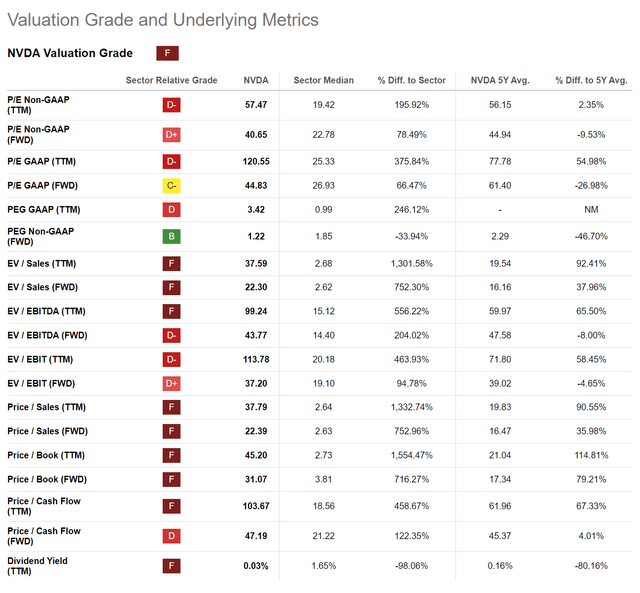

With respect to Nvidia, despite its furious pace of growth, it continues to trade at ridiculous valuation multiples like 44x forward EV/EBITDA and 22x forward EV/Sales (Figure 13).

Figure 13 – NVDA valuation is stretched (Seeking Alpha)

In fact, even if we give the company the benefit of the doubt, Nvidia’s current market cap of $1.23 trillion is 12x analyst estimates for F2026 revenues of $100 billion! I have said this in the past, but buying shares of any company at more than 10x revenues often lead to tears and regret.

Risks To Cautious Stance

Of course, Nvidia is one dangerous stock to bet against, since it has become synonymous with artificial intelligence and has garnered a cult following among speculators. While the stock appears to be in a bubble, I would not recommend investors short its shares.

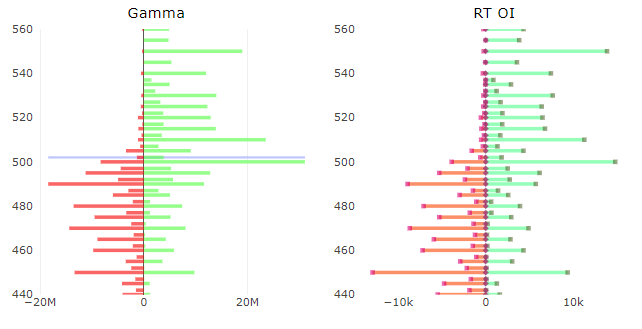

This is especially true with markets dictated by short-term options trading and gamma squeezes on a day-to-day basis. For example, heading into the latest earnings report, investors were placing millions of dollars in weekly option bets on Nvidia shares, ranging from a decline to $450 / share to a rally to $550 / share (Figure 14).

Figure 14 – NVDA is one of the most active optioned security (RT Gamma’s Twitter Feed)

It almost feels poetic that the stock is neither surging nor crashing post the earnings report, as both bullish and bearish options are bled out by the market makers.

Conclusion

Although Nvidia has delivered another “beat and raise” quarter, the stock’s reaction to the earnings release has been negative, as concerns regarding U.S. sanctions against China lingers. At a $1.2 trillion valuation, Nvidia Corporation shares may be priced for perfection and anything less is met with selling.

Looking through Nvidia’s quarterly report, my concerns from last quarter remains unaddressed. Account receivables remain elevated and the company is increasingly investing hundreds of millions of dollars into “non-affiliated entities” that may in turn use the funding to acquire Nvidia GPUs.

With Nvidia’s shares pricing in 12x F2026 sales, I think the best course of action for investors is to avoid the shares if they don’t own it, or sell it if they do.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.