Summary:

- Nvidia Corporation’s stock dip, possibly due to a DoJ subpoena, presents a buying opportunity as the company continues to deliver strong financial performance and guidance.

- Despite a slight margin dip, Nvidia’s revenue and operating income remain robust, with no significant competitive threats from AMD or Intel in the near term.

- Nvidia’s future EPS growth may be limited by normalized margins, but the company still trades at a favorable valuation relative to its growth prospects.

BING-JHEN HONG

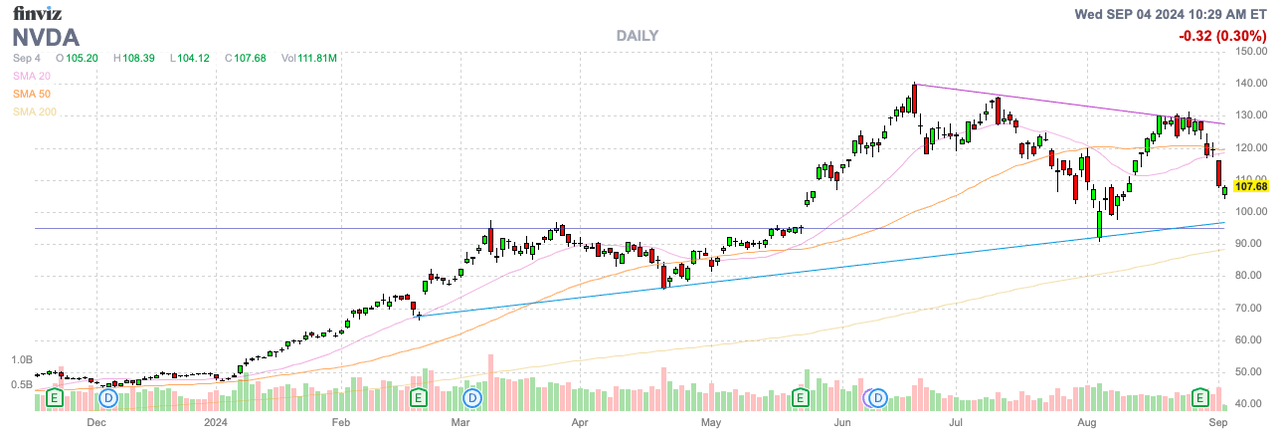

NVIDIA Corporation (NASDAQ:NVDA) had slipped since an extraordinarily strong quarter, with the market wanting more upside. The AI GPU company provided remarkably strong guidance despite issues with new chips. This raises whether the dip wasn’t actually related to a subpoena from the DoJ and not supposedly disappointing guidance. My investment thesis is more Bullish on the chip company in the short term until the margin issue creeps up on Nvidia in the upcoming years.

Big Beats

Nvidia just reported a quarter with revenues of $30.0 billion smashing consensus estimates by $1.3 billion, yet the markets sold off the stock. The AI GPU company even guided to FQ3 revenues of $32.5 billion, compared to $31.7 billion consensus estimates.

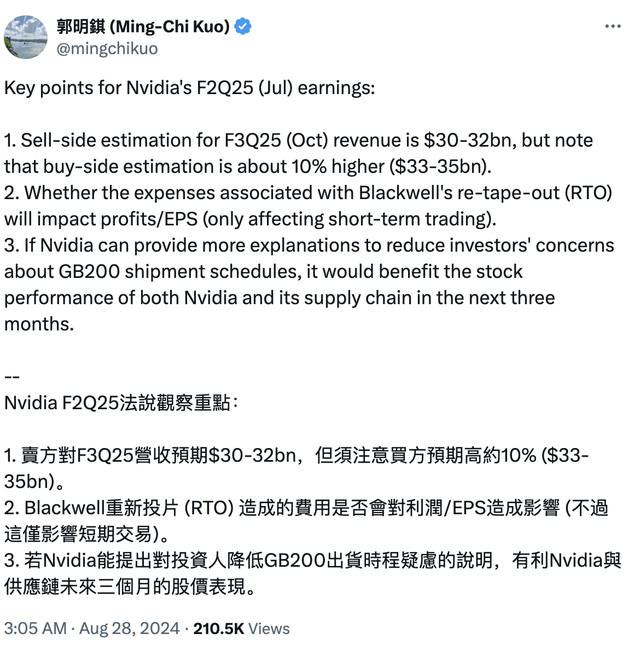

The stock is down in part due to buy-side sales estimates up at $33 to $35 billion as highlighted by influential tech analyst Ming-Chi Kuo as follows:

Either way, the justification for selling off Nvidia doesn’t add up. The stock ended September 3 down 16% over the 4 trading days since the earnings report back on August 28.

Nvidia just guided October quarterly revenues ~$3.8 billion above the consensus estimates for the July quarter. Here again is where analysts and investors get caught focusing on the company beating targets and not the relative growth rates. The current consensus target for FQ3 amounting to nearly 82% growth, while the chip company consistently beats analyst estimates by $1+ billion.

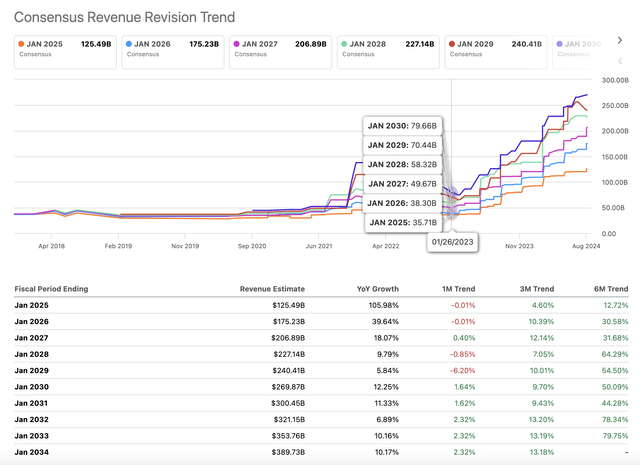

The below consensus targets highlight how the consensus revenue estimates for Nvidia have risen over time. Starting in 2023, analysts had FY27 revenues at only $50 billion, and the estimates are now up to $207 billion. The FY27 estimates are up ~32% over the last 6 months.

Clearly, the revenue numbers for Nvidia remain strong.

No Competitive Threat

A primary reason to turn more bullish on Nvidia in the short term is that Advanced Micro Devices, Inc. (AMD) has been unable to ramp up AI GPU sales and Intel Corporation (INTC) is talking about AI investments still years away from paying off. The former chip giant is in the midst of another restructuring that will distract the business from taking on Nvidia.

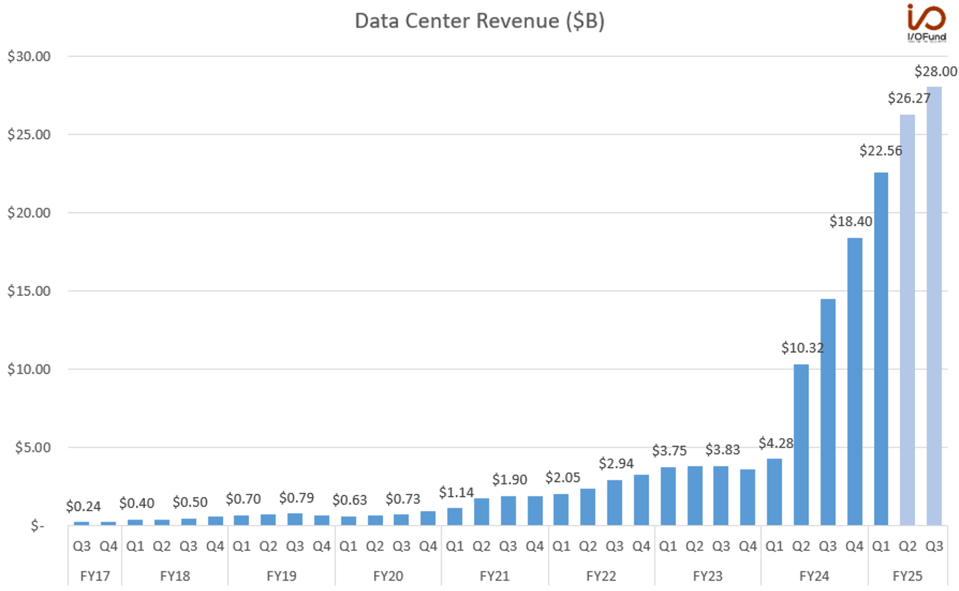

AMD just reported Q2 GPU sales only topped $1 billion. Nvidia just added $3.7 billion in additional GPU data center revenue in the last quarter alone and the guidance suggests another $1.7 billion in additional revenues, while AMD is still just adding millions each quarter.

Source: I/O Fund

Analysts now have AMD reaching $5 billion in GPU sales this year, with New Street Research placing a goal of only $20 billion by 2027. Nvidia has already topped an annual rate of $100 billion, suggesting AMD is only grabbing scraps at this point and has no threat to impact margins for possibly years.

Without any major threat, the Blackwell delay won’t impact Nvidia to a great extent. On the FQ2 ’25 earnings call, the company made the following statement regarding the expectations for the new Blackwell GPUs shipping several billion dollars in FQ4:

Hopper demand is strong and Blackwell is widely sampling. We executed a change to the Blackwell GPU mass to improve production yields. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year ’26.

In Q4, we expect to ship several billion dollars in Blackwell revenue. Hopper shipments are expected to increase in the second half of fiscal 2025. Hopper supply and availability have improved. Demand for Blackwell platforms is well above supply, and we expect this to continue into next year.

Nvidia reported margins actually dipped slightly in FQ2, with non-GAAP margins dipping 3.2 percentage points from FQ1 to 75.7%. The operating margins were still an extremely strong 66.4% with operating income jumping $1.9 billion sequentially due to a limited boost in operating expenses to only $2.8 billion.

Gross margins only dipped due to inventory provisions for low-yielding Blackwell material. Naturally, Nvidia isn’t seeing any pricing pressure, with AMD unable to achieve higher volumes to meet surging GPU demand.

Nvidia only trades at 30x FY26 EPS targets. The consensus estimates have EPS growing at a 40% clip next fiscal year to reach nearly $4 per share.

Nvidia should rally on these numbers. The big issue is the transition to more normalized margins in the future, where gross margins hardly top 60% and operating margins might fail to hold 40%.

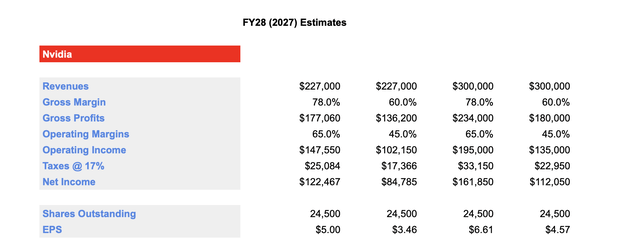

Based on the updated estimates for FY28 (2027), Nvidia could actually see EPS dip over the course of the next 3 years. The consensus estimates are for FY28 revenues of $227 billion, nearly doubling over the period, yet normalized gross margins of 60% with operating margins of 45% yield an EPS of only $3.46 versus the current EPS target of $3.96 for FY26.

Even the 45% operating margin is extremely elevated, but Nvidia is only operating at a nearly $11 billion annual opex rate. The chip company would have to ramp up spending to $34 billion to reach this target level.

As the estimates highlight, even if revenues surge to $300 billion in FY28, EPS estimates hardly rise on lower margins. The key is how long can Nvidia maintain these gross margins that appear excessive while hardly spending on opex.

DoJ Case

Based on the stock falling over $11 and nearly 10% to start trading in September, the after-hours news of a DoJ subpoena was the likely culprit for the major dip. The regulators are apparently reviewing whether the chip company violated antitrust laws by making it harder for customers to switch to competitors.

From the outside, whether the DoJ has a case is difficult to tell. The major question is how Nvidia is allegedly preventing competitors from switching to other competitors which lack chip supply.

Unless AMD and the DoJ have a case where Nvidia has blocked the company from obtaining additional manufacturing supply, the DoJ wouldn’t appear to have a case. AMD hasn’t openly complained about such a scenario.

Nvidia apparently e-mailed Bloomberg the following statement, suggesting the company wins orders based on merit:

Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them.

Investors can’t know the actual outcome of any DoJ case, but one can look to past cases involving tech giants. Alphabet Inc. (GOOG) (GOOGL) was found to violate antitrust law with their default placement on iPhones, yet analysts don’t foresee a remedy for possibly years. Ironically, Google didn’t lose the trial over search default deals until AI became a threat to the search business.

In essence, the DoJ would still have to bring a case against Nvidia and take the company to trial, which could take years to play out. Meanwhile, Alphabet recently hit an all-time high above $190 while the DoJ trial has been ongoing since 2020, along with cases against other tech giants.

Investors might get a chance to buy Nvidia near $100. The stock would only trade at 25x FY26 EPS targets, with growth rates still exceeding this multiple.

Takeaway

The key investor takeaway is that Nvidia is still firing on all cylinders. The stock dip, whether due to the DoJ subpoena or worries about guidance, is an opportunity to load back up on the AI GPU stock. Nvidia will eventually face a margin reckoning, but the company likely has another 1-2 years of strong margins before the competition catches up.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.