Summary:

- NVIDIA’s stock fell after reporting high growth and positive outlook, suggesting AI hype may have run out of steam.

- Valuation is overstretched and risks such as dependence on China and future competition are not priced in.

- NVDA stock could fall close to 40% in the next three months, and a broad market correction would hit NVDA and the tech sector the hardest.

georgeclerk

Thesis Summary

NVIDIA Corporation (NASDAQ:NVDA) reported Q2 earnings last Wednesday after the close, and though the stock was up 6% pre-market on Thursday, it gave back all those gains and continued to fall on Friday.

While NVDA continued to deliver high growth and a positive outlook for the full year, it looks like the AI hype might have run out of steam.

NVDA’s valuation is incredibly overstretched, and so are its technicals. On top of that, numerous risks are not priced in, such as dependence on China and future competition.

I believe that if we get a broad market correction, NVDA, and to a lesser extent, the tech sector, will be the hardest hit.

In my previous article on NVIDIA, I gave it a neutral rating. This was following Q1 earnings. Although the stock had already appreciated substantially, the AI hype was relatively new, and I still thought there was more upside in the broader market.

Today, though, both the fundamental and the technical outlook look even worse, and I don’t think NVIDIA can sustain this price much longer.

I estimate NVDA could fall close to 40% from here in the coming three months, which is why I am changing my rating to Sell.

Q2 Earnings Were Okay

Though most market participants were expecting a big move after Earnings, NVDA stock has remained mostly flat since the announcement. Indeed, NVDA delivered on its high growth promise, but this was already priced in.

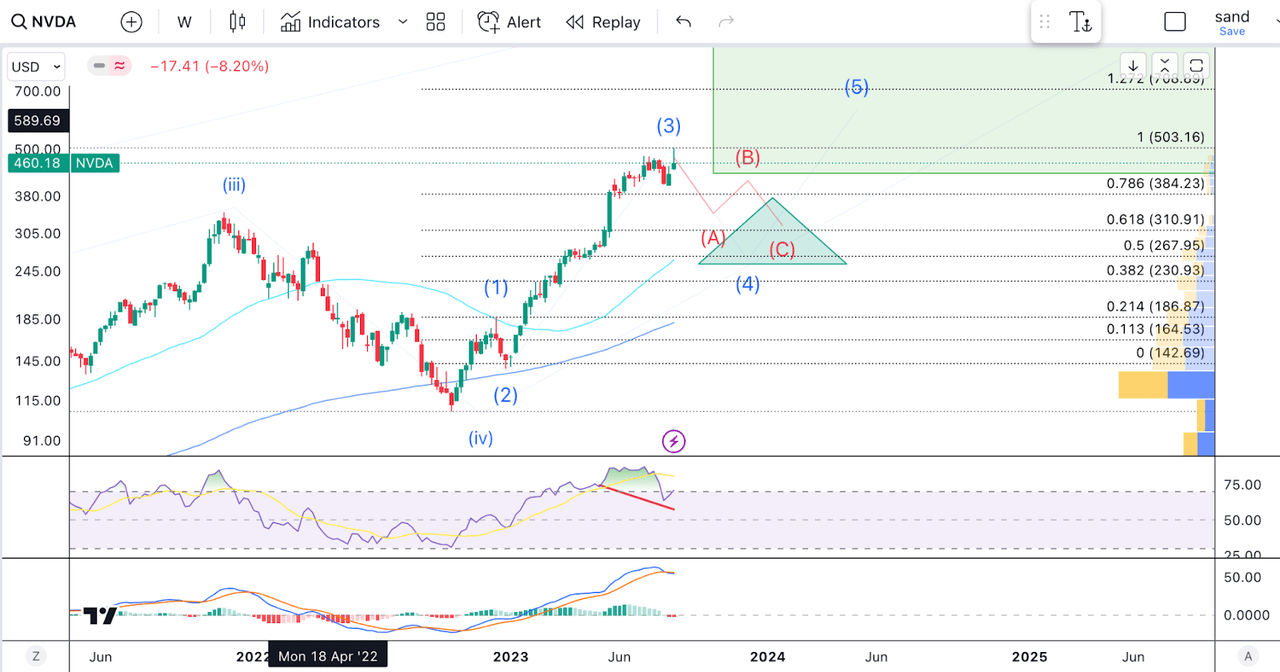

NVDA Q2 revenues (Press Release)

Both on a quarterly and YoY basis, NVDA’s revenue and earnings have exploded. GAAP Operating Income was up 1263% YoY and 218% QoQ. EPS also tripled QoQ.

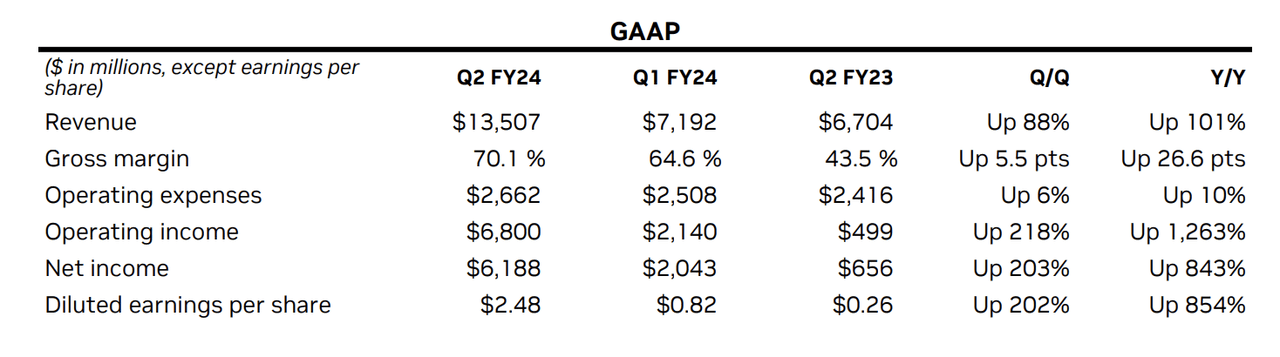

Overall revenue was up 88% QoQ, and below, we can see the breakdown of the revenue by segment and Market platform to see what the segments are that are pushing this growth.

Segment Results (Press Release)

The Computer and Networking segment grew by 133%, thanks to the staggering growth in Data Centers. This is where all the AI growth is concentrated, with numerous companies ramping up their AI efforts.

In its latest press release, NVIDIA mentioned key partnerships with large names in tech, like ServiceNow (NOW), VMWare (VMW) and Snowflake (SNOW).

But with so much growth priced in already, what can we expect moving forward? Can NVIDIA keep up this pace of growth? What challenges will it face? And where will the stock price go from here?

Outlook and Insights From The Earnings Call

This is the company’s guidance for Q3:

Revenue is expected to be $16.00 billion, plus or minus 2%

GAAP and non-GAAP gross margins are expected to be 71.5% and 72.5%, respectively, plus or minus 50 basis points.

GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, respectively.

GAAP and non-GAAP other income and expense are expected to be an income of approximately $100 million, excluding gains and losses from non-affiliated investments.

GAAP and non-GAAP tax rates are expected to be 14.5%, plus or minus 1%, excluding any discrete items.

Source: NVDA Press release

It’s worth pointing out that, already, growth is expected to fall to a much more “normal” 23% QoQ. The company also expects some small improvements in profitability.

But how long can this trend be sustained? Let’s dive into some of the insights from the earnings call to see what management is thinking right now.

During the earnings call, CEO Jensen Huang was asked how sustainable he thought the AI demand was, and this was his answer:

The world has something along the lines of about $1 trillion worth of data centers installed, in the cloud, in enterprise and otherwise. And that $1 trillion of data centers is in the process of transitioning into accelerated computing and generative AI…

You’re seeing the data centers around the world are taking that capital spend and focusing it on the two most important trends of computing today, accelerated computing and generative AI. And so I think this is not a near-term thing. This is a long-term industry transition and we’re seeing these two platform shifts happening at the same time

Source: Earnings Call

So, Jensen points to the fact that there is $1 trillion in data centers which are being updated. And this is a double update, as it involves accelerated computing and generative AI. He then even went on to mention that this could amount to around $0.25 trillion in capital spending each year.

Management was also asked about the outlook for supply, which could be a bottleneck for growth.

So thanks for that question regarding our supply. Yes, we do expect to continue increasing ramping our supply over the next quarters as well as into next fiscal year. In terms of percent, it’s not something that we have here. It is a work across so many different suppliers, so many different parts of building an HGX and many of our other new products that are coming to market. But we are very pleased with both the support that we have with our suppliers and the long time that we have spent with them improving their supply.

Source: Earnings Call

We did not get a concrete number in terms of the extent of the ramp-up in supply, but CFO Colette Kress said that they were pleased with the support from their suppliers.

Lastly, Jensen Huang also did a good job of summarizing NVDAs moat:

What makes NVIDIA special are: one, architecture. NVIDIA accelerates everything from data processing, training, inference, every AI model, real-time speech to computer vision, and giant recommenders to vector databases. The performance and versatility of our architecture translates to the lowest data center TCO and best energy efficiency…

Two, installed base. NVIDIA has hundreds of millions of CUDA-compatible GPUs worldwide. Developers need a large installed base to reach end users and grow their business. NVIDIA is the developer’s preferred platform. More developers create more applications that make NVIDIA more valuable for customers. Three, reach. NVIDIA is in clouds, enterprise data centers, industrial edge, PCs, workstations, instruments and robotics. Each has fundamentally unique computing models and ecosystems.

Source: Earnings Call

All in all, the Earnings call didn’t add too much. The same topics from last quarter were reinforced, but I don’t think some of the key issues were addressed.

My 2 cents

I’ll start with the good and then move on to my concerns following this quarter.

There is no denying that NVDA is in a league of its own. Indeed, as stated by the CEO in the earnings call, it is the unique confluence of hardware and software, combined with their already established ecosystems, that make NVIDIA, in a lot of regards, the only viable option.

With that said, I have numerous concerns moving forward, and I believe a lot of the risk is not being priced in.

Chia Is a No-No

Firstly, NVIDIA has massive exposure to China, with nearly ¼ of its revenues from Data centers originating from there. This is a huge risk, and there doesn’t seem to be much talk about it. Not only is China’s economy showing signs of distress, but the US also has an ongoing campaign to limit exports to China. It wouldn’t be far-fetched to think that stopping NVIDIA from selling China chips to build supercomputers might be on the cards. And of course, there’s the issue of supply, too, with NVIDIA being heavily reliant on chip manufacturing in Taiwan.

With that said, it’s worth noting that NVIDIA has already avoided prior US sanctions on chip sales to China by designing a less powerful or “nerfed” version of their GPUs. There are also likely other ways they could sidestep this regulation, like, for example, selling the chips indirectly to China through an intermediary. However, this would expose NVIDIA to possible fines from the US government.

According to NVIDIA, there’s plenty of demand backlog, so even if the company stopped selling to China tomorrow, the effects might be less pronounced than we could expect.

Still, I don’t like the idea that one of NVIDIA’s main clients has been essentially blacklisted by the US government.

Buybacks, really?

My second concern comes from the fact that NVIDIA is choosing to spend $25 billion on buybacks when the stock is trading at such a high premium, and everyone is trying to take some of the AI pie for themselves. Was there really nothing better to do with this money?

Yes, the company enjoys a substantial moat right now, but large companies are pouring money into developing products that can compete with NVIDIA’s chips. As I’ve mentioned before, Alphabet’s (GOOGL) TPUs could one day be a threat. While NVDA gives money back to shareholders, Advanced Micro Devices (AMD) is releasing new GPUs.

And going back to our previous point, since China knows that it can’t rely on the supply of chips from NVIDIA, this gives them a very strong incentive also to work overtime to try and develop their own GPUs.

I am very surprised with the buyback, and I don’t think the timing is right,

Valuation Is Still Worrisome

It’s obvious to most investors that NVIDIA’s valuation has come too far. At a $1.14 trillion market cap and a P/S of 21, it’s hard to justify buying at today’s price.

My biggest concern in this regard, though, is that NVIDIA will be one of the stocks that will be hardest if the US economy suffers some shock. Not only would this affect demand for its chips, but it would have a much deeper impact on the company’s stock price.

When investors are trying to raise cash, they often prefer to sell their winners, stocks where they have had a positive return, rather than stocks where they are down or not up as much. While this may seem counterintuitive, psychologically, locking in gains is less painful than taking losses.

NVIDIA is right now one of the biggest winners in most of the portfolios where it is held, so I believe it could become one of the first to go in case of a switch to risk-off sentiment.

Technical Analysis

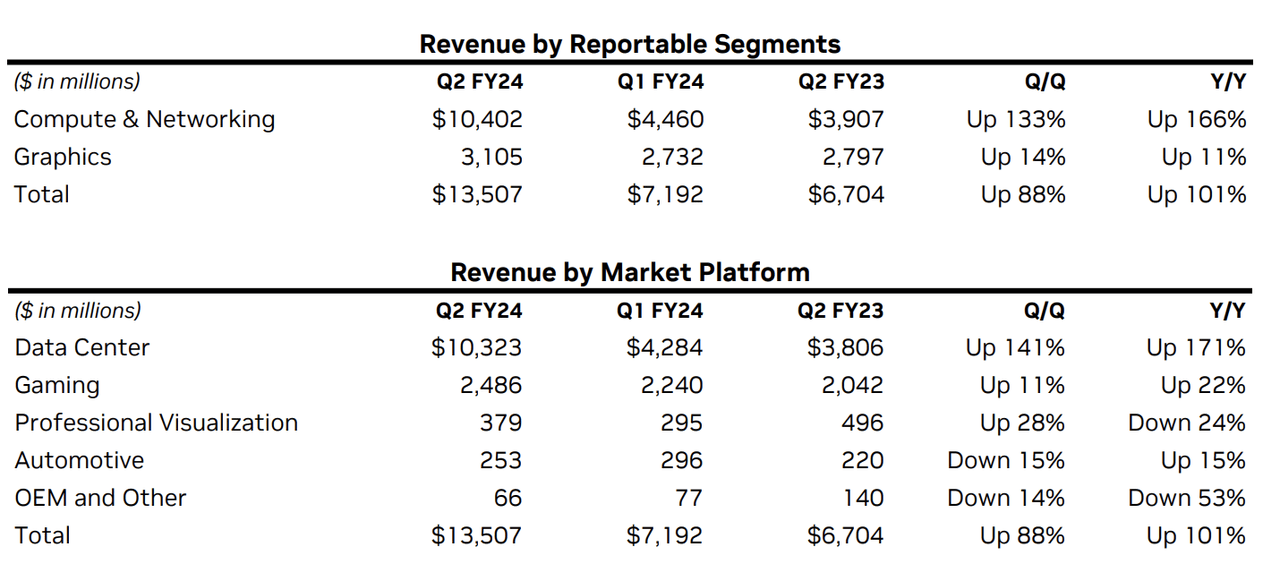

To wrap things up, I think it’s also very important to mention that NVDA’s chart looks ready for, at the very least, a correction.

Above, we can see NVDA’s recent rally on the weekly chart. In terms of EW structure, I would argue that we have seen the first three waves in a five-wave impulse. This means we could soon be beginning a pull-back in wave 4, which could take us back to at least $384.

Other technical indicators seem to suggest a retracement is due to. The RSI has formed a clear divergence, peaking back in June while the price made higher highs. With the latest rally, we are back into oversold territory. On the MACD, we have just completed a bearish crossover.

In terms of support below, the 50-week MA comes in at $267, which is also where we have the 50% retracement of the wave three rally. In my opinion, this could be an initial area to go long again, though we could arguably retrace even further.

Takeaway

In my opinion, the latest earnings call and guidance reinforce my view that NVIDIA’s stock is overvalued. While growth has been impressive, it is already tapering off. Furthermore, there are numerous risks that the market is overlooking. NVIDIA has been one of the biggest winners in this rally and will likely be one of the biggest losers if we sell off from here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sometimes technicals and fundamentals line up, and these produce great risk-reward opportunities.

This is what I look for at The Pragmatic Investor.

Join now and get instant access to:

– My portfolio

– Trade Ideas

– Technical Analysis Opportunities