Summary:

- After being up 73.20% since our last buy rating, we currently designate Nvidia as a hold based on excessive valuation concerns on both a relative and absolute basis.

- The current valuation seems excessive, both on a free cash flow and EBITDA basis, leaving virtually no margin of safety and risk tilted towards the downside.

- We believe there are alternatives to obtain exposure to Artificial Intelligence, at a much more reasonable valuation.

- Earlier this week, experts and scientists in AI and technology, including Elon Musk and Steve Wozniak, petitioned to suspend further AI research amid concerns.

Just_Super/iStock via Getty Images

Investment Thesis

Since our last buy rating on Nvidia (NASDAQ:NVDA) at $160 last November, the stock has returned a stunning 73.20%. The article called “Goodbye Crypto, Hello AI” may have been ahead of its time, as it was released shortly after ChatGPT in December.

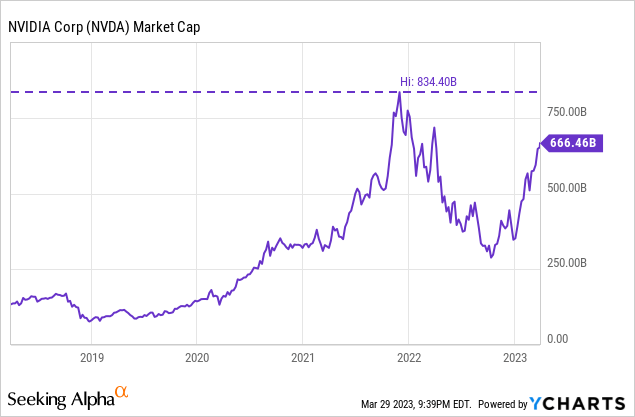

This time we have taken another look at the company, although we think investors may need to be more cautious, as we think the stock price may be ahead of its fundamentals. While we still affirm our expectation that Nvidia will exceed a market cap of $1T in the future, we think it may take longer than investors currently expect, given its underlying profitability, relative valuation and measures such as EV/EBIT and Price to Free Cash Flow.

We will explain why we currently put Nvidia on a “hold,” at what price we would buy again, looking at fundamentals, and when we think Nvidia can still join the trillion-dollar club in the distant future.

Shiny Object Syndrome?

Last week, at Nvidia’s annual global AI conference (GTC), the genius of CEO Jensen Huang was once again on display, explaining the progress the company has made in accelerated computing. It showed once again how Jensen’s rightful commitment to accelerated computing is once again paying off, this time with their main focus shifting from Gaming to AI.

But it leaves us with a burning question, whether the rise in share price is justified hype, or just investors chasing the shiny object syndrome now that the stock has nearly doubled in the last 3 months. Especially since the presentation has already been viewed over 22 million times in 1 week, capturing the attention of the retail audience. This even surpasses other events in which many retail investors participate, such as the unveiling of a new Tesla (TSLA), which typically receives 10 million views.

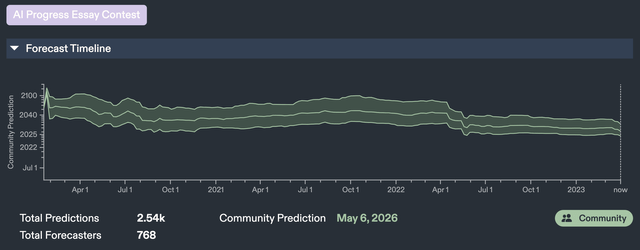

To track developments in the AI landscape, we often use Metaculus as a proxy of where AI, more specifically machine learning, is headed in the distant future. Metaculus collects predictions, and uses a special method to reward participants who are right, and more right than the general community, which has proven to generally outperform the median of other prediction methods.

As for when a “Weakly General AI” will become publicly known, the time frame has shortened a lot in recent months, as forecasters now expect a weak artificial general intelligence to be here by May 2026, rather than November 2027 earlier this year.

This follows a trend in recent years, where people who predicted the advancement of AI constantly underestimated the extent of developments in this field, until certain products such as ChatGPT from OpenAI finally hit the market.

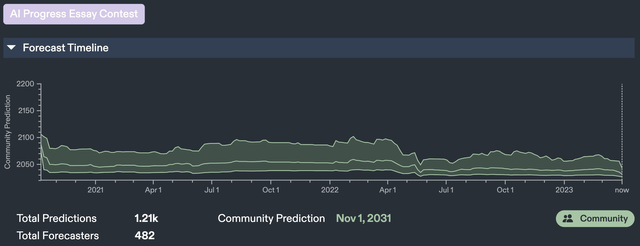

We ourselves have also been guilty of such a mistake, predicting that the real deal, “Artificial General Intelligence,” would be at least 15 years away. But since we launched that article in November with new information, the time frame of forecasters expecting Artificial General Intelligence has dropped from 2040 to November 2031.

That means most of our forecasts were probably not aggressive enough in predicting future revenue and free cash flow. Other experts and researchers in the field of AI, along with other leaders in the technology such as Elon Musk and Steve Wozniak, even called for a pause in AI development earlier this week in an open letter signed more than 2,200 times.

The shorter timeline for progress in AI can be attributed to new developments by OpenAI (GPT-4), Google’s (GOOG) Bard, among other scientific discoveries by AI researchers.

Hitting A Wall

Perhaps the hype surrounding the AI revolution is justified, as it will arguably contribute to massive increases in productivity or the replacement of many service sector jobs worldwide, with an estimated market size of $15.7 trillion by 2025.

Although, it is also easy to be fooled by such a huge addressable TAM, and justify buying the company at any given price. In fact, we think the trade of the past few months may be more of a buying frenzy, following a lot of positive news around Nvidia’s AI event, along with new rollouts like GPT-4. It wouldn’t be the first time such action has been seen either, as BuzzFeed (BZFD) shares quadrupled in just 2 days, after they announced plans to implement AI in article writing. The optimism was short-lived, however, as reality struck again, and the stock plummeted 75%, back to where it was trading before the announcement.

We think the price action, with the stock price going almost vertical and rising 5% a week to date, is not sustainable and is likely to hit a wall, similar to the price action observed in late 2021, when there was a shortage of GPU’s for both mining & gaming.

From a long-term technical perspective based on Fibonacci retracement levels, we see much more downside risk, not ruling out a retracement back to the $100-180 levels, while upside risk is more likely to be capped by the current underlying fundamentals, which we will address in a moment.

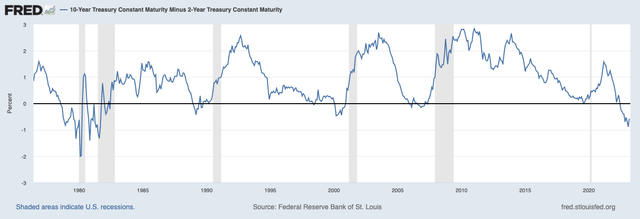

The 157% rise in the share price from its low last October is also at odds with current economic uncertainties, with Fed Funds rates currently at 5% and a recession as a fairly likely scenario, now that the 2-10 yield curve inverted last month for the most since the 1980s. We believe these headwinds also apply to Nvidia, and investors may need to proceed with extreme caution.

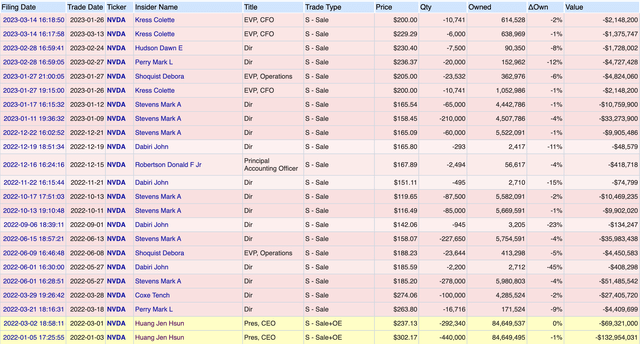

Management and directors have also not been shy about selling shares on the open market, with some directors selling shares for tens of millions of dollars, despite the shiny prospects for AI’s future. In this case, we would strongly choose to attach more importance to the actions of management and directors than to their words.

The Fundamentals

The story about Nvidia’s huge growth prospects when it comes to AI only goes so far as the fundamentals supporting such an elevated stock price, which are not (yet) up to par.

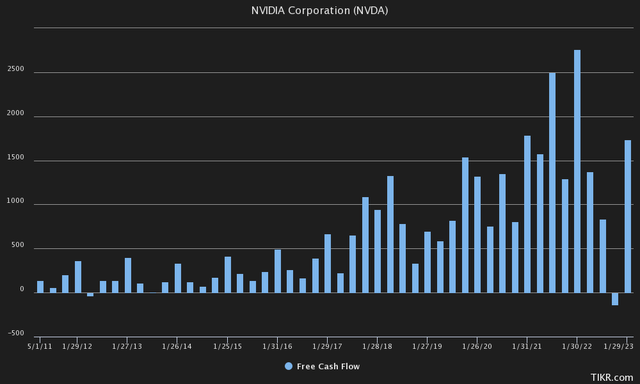

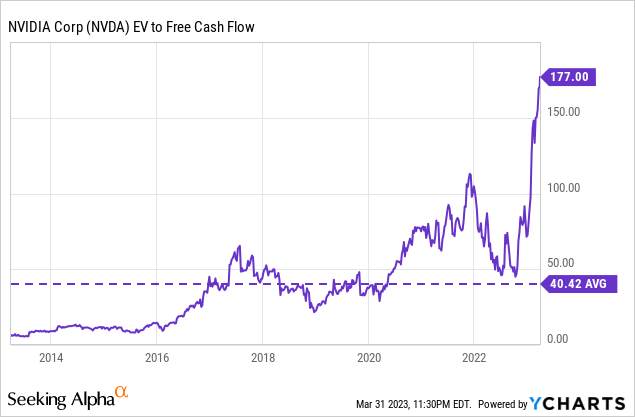

From a free cash flow perspective, Nvidia is currently pulling in $1.74BN as of last quarter, or an annual rate of $6.96BN. This is in stark contrast to its market cap, which currently stands at $686 billion. In recent history, perhaps the only company of this size that we have seen trade nearly above 100x Free Cash Flow was Tesla, which was eventually compressed all the way to 43x Free Cash Flow (TTM) earlier this year.

It may also be a cautionary tale, as Tesla fell sharply from a $1.23T valuation to $324B as it entered an environment of higher interest rates and severe macroeconomic and competitive headwinds.

Not that Nvidia does not deserve such multiples, but it does take away virtually all margins of safety, as other large-cap tech stocks typically trade around a P/FCF multiple of 20 over the long term. At Nvidia’s current valuation of $686BN, we believe investors have already priced in $34.3BN of annual free cash flow against a 20x P/FCF multiple, or nearly 5x the current free cash flow, which is $6.96BN annualized. Therefore, we see absolutely no margin of safety from current price levels, because if this priced-in free cash flow level doesn’t get realized, the stock could theoretically fall by 80%. At 20x Free Cash Flow of $6.96BN, the downside scenario, although very unlikely, would mean a valuation of $139.2BN, or $56.36 per share.

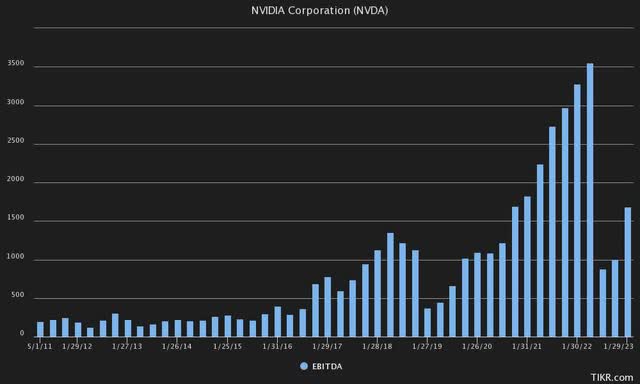

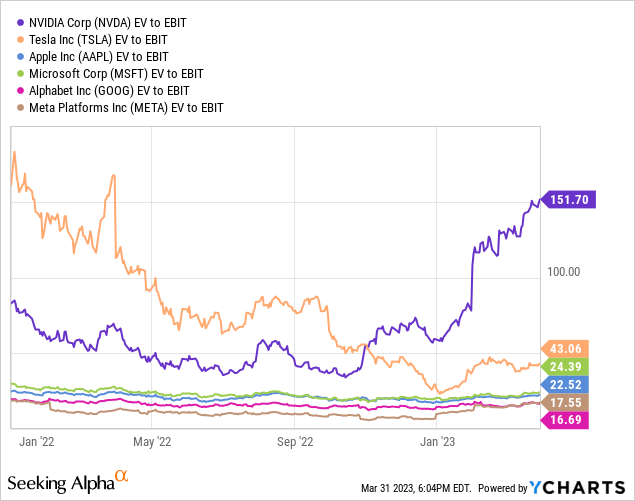

Even from other angles, such as EV/EBIT and EV/EBITDA, we find it extremely difficult to justify the valuation, as it is currently much more expensive even than Tesla, at 151.70x EV/EBIT. And it’s not like Nvidia is a needle in a haystack compared to the other large-cap tech companies it is now part of. Rather, it sticks out of a plain like Himalayan peaks, relative to companies like Alphabet and Meta (META) that trade around 17x EV/EBIT.

And we are not shy about bundling Nvidia with these other large-cap tech companies because Nvidia only needs a 45.75% rise to reach the trillion-dollar club from current levels. At its current pace of a 5% gain in share price per week so far this year, it would reach that valuation before the second quarter is over. A valuation of $1T implies a current share price of about $404.86.

To join that trillion-dollar club, at 20x P/FCF, Nvidia would have to accomplish the feat of generating an immense $50BN of FCF annually, which is an even starker contrast to the nearly $7BN FCF on an annualized basis in the fourth quarter. Even from an EV/EBITDA perspective, it is difficult to fathom the growth already priced in. For Nvidia to outperform the historical S&P 500, the company would have to be worth at least $1.34T by 2030, assuming current price levels and an average 10% annual gain. That means that at a 18x EV/EBITDA multiple, Nvidia would need to bring in $74BN in EBITDA by 2030. Currently, EBITDA is $6.73BN on an annualized basis.

In other words, if Nvidia wants to get on par with the average return of the S&P 500 in recent history, EBITDA would need to grow at a CAGR of 40.84%. Needless to say, in this scenario, we believe the downside risks far outweigh the rewards, even if Nvidia can grow EBITDA more than 40% a year.

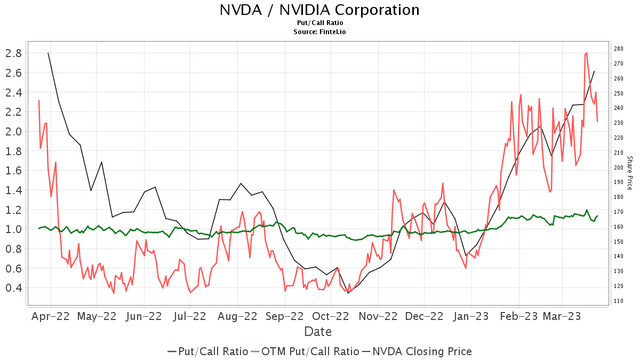

Speculators have also recently bet on a sharp decline in Nvidia’s share price while the stock has risen, with the out of the money Put/Call ratio again at 52-week highs with a ratio of more than 2x.

Similarly, we think there are other options that are actually quite reasonably priced to get exposure to AI, although Nvidia remains the leader when it comes to their AI software stack, and hardware that currently remains the industry standard.

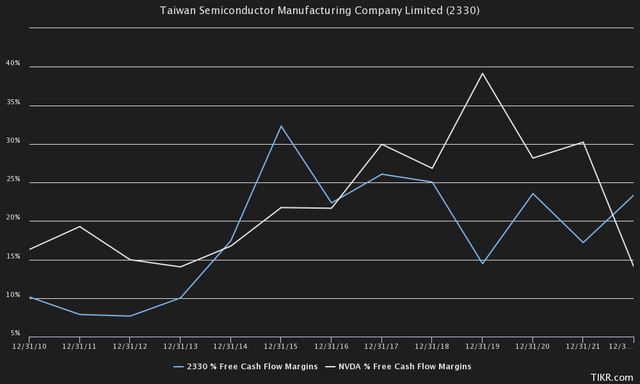

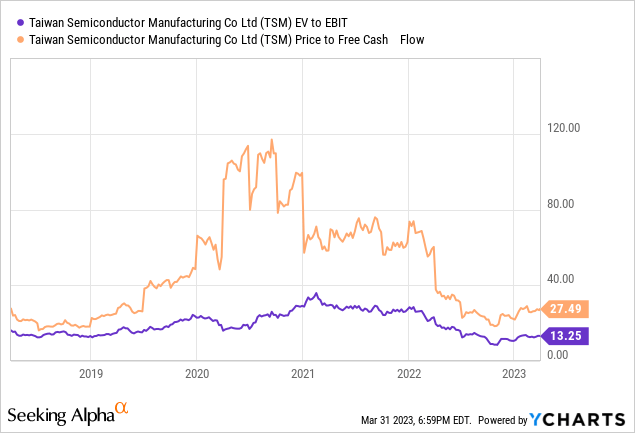

But when looking at hardware, it is important to understand that Nvidia’s hardware is primarily manufactured by Taiwan Semiconductor (TSM). It is likely that TSMC will also benefit greatly from AI, as the assumed AI revolution will require large amounts of computing power, increasing demand for semiconductor manufacturing. In our view, TSMC has an excellent position in this story, although it is currently seemingly overlooked at 27x P/FCF or just 13x EV/EBIT.

Warren Buffett’s Berkshire Hathaway considered a position in the chipmaker earlier this year, but unconventionally stepped out of that position the following quarter.

As a side note, we would point out that there may be something to be said for Nvidia being able to exert more operating leverage than TSMC, and that it is not apples to apples because TSMC is generally tied to its CapEx-weighted nature. As Charlie Munger said in the recent Daily Journal meeting:

In the semiconductor industry, you have to take all the money you’ve made, and with each new generation of chips, you throw in all the money you previously made. So it’s compulsory investment of everything you want to stay in the game. Naturally, I hate a business like that… Now, if you’re now ahead of it, like Taiwan Semiconductor is, that may be a good buy at these prices.

Currently, according to estimates from Seeking Alpha, Nvidia is expected to have earnings per share of $7.82 by 2025, meaning it is currently trading at a staggering 35.01x 2025 forward earnings.

Even looking at other high-growth companies like Tesla, they are only expected to trade at around 28.20x 2025 forward P/E. Given that Nvidia’s earnings growth is expected to be around 36% over the next few years, in this scenario we would adopt a PEG ratio, or price to earnings to growth of 1, or be very reluctant to buy the stock above 36x forward earnings of $4.49, which would equate to $161.64 per share.

The Bottom Line

While there have been many developments around AI in recent months, we think investors have moved too far away from the fundamentals of Nvidia and are currently more likely to be in a “buy at any price,” mode as the company is trading at over 100x FCF annualized for Q4, or 151x EV/EBIT.

We are big fans of the ability to buy companies with a wide margin of safety, which seem extremely difficult to justify at current price levels. As mentioned earlier, at a market multiple of 18x EV/EBITDA in 2030, Nvidia would need to grow EBITDA at a CAGR of 40.84% over the next 7 years to reach the historical average of 10% to rival the S&P 500. In other words, it leaves very little room for additional alpha, above these benchmarks, while at the same time taking on additional risk through all this future growth that is currently being priced in, and the price swings that come with it.

Artificial intelligence can be revolutionary, but we are currently very cautious, as we think some rationality is needed here. We are currently having Nvidia as a “hold” until we clearly see a drastic change in the underlying fundamentals or until a new buying opportunity arises. Nvidia may be on its way to the trillion dollar club, although exponential free cash flow will likely have to present itself first.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.