Summary:

- Nvidia’s Q2 FY2025 results were strong, but Q3 may not exceed forecasts significantly, leading to a potential stock price decline.

- It’s hard to deny that there has been significant business growth in recent years, which explains Nvidia’s stock price performance – this is evident in the company’s EPS momentum.

- Despite robust demand for AI and data center products, supply chain issues and geopolitical tensions pose risks to Nvidia’s short-term performance.

- Analysts’ high expectations leave little room for Nvidia to impress, potentially signaling peak margins and growth rates.

- I’m downgrading NVDA to “Hold” due to limited upside potential and risks of not significantly outperforming current consensus estimates.

BING-JHEN HONG

My Thesis Update

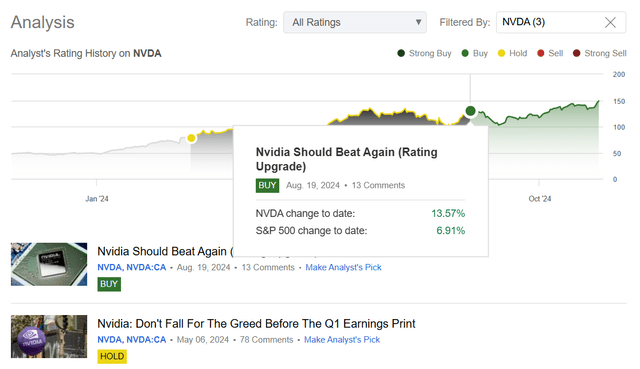

Towards the end of February 2024, I started covering NVIDIA Corporation (NASDAQ:NVDA) on Seeking Alpha, voicing my concerns about a potential challenge from rising competition and possibly falling demand as the investment cycle turns. Those threats, however, haven’t materialized and NVDA stock has rallied further. In mid-August, about one week before Nvidia’s fiscal Q2 2025 report came out I upgraded the stock to “Buy” in anticipation that the company would outperform consensus as management’s guidance remained strong – all of which should have made NVDA’s continued rally in the medium term clearer. As it turned out, Nvidia once again beat forecasts and the stock continued to soar:

Seeking Alpha, Oakoff’s coverage of NVDA

According to Seeking Alpha Premium data, Nvidia’s Q3 FY2025 report is due in nine days. So I’d like to offer a brief preview of the upcoming release. In my view, the company may not exceed analysts’ forecasts this time – the likelihood of this happening has somewhat decreased amid rising EPS and sales estimates. Or rather, even if forecasts are exceeded this time, the surprise magnitude is unlikely to be as significant as before, which could signal to the market that the company’s business growth is slowing down. Consequently, the third quarter report could trigger a fall in the stock price. So I downgrade NVDA to “Hold” today.

My Reasoning

First, let’s take a quick look at the past results (Q2 FY2025) as I didn’t cover them in my previous article. In late August Nvidia reported yet another record-breaking quarter with $30 billion in revenue, a 15% sequential growth rate, and 122% YoY growth, exceeding the internal expectation of $28 billion (and also beating the consensus revenue by 4.48%, according to Seeking Alpha Premium data).

The primary driver of this strong top-line performance was the data center segment, which brought in $26.3 billion in Q4 – 16% sequential and 154% year-over-year growth. Nvidia’s Hopper platform, GPU hardware, and network infrastructure will continue to be in demand because of the growing generative AI, model training, and inferencing workloads, management noted. Revenues from computing and networking nearly doubled from last year and I’m sure there’s huge demand out there for the company’s high-end products.

And margins also keep doing well: For fiscal Q2 2025, non-GAAP gross margin for Nvidia decreased to 75.7% from 78.9% in Q1 but up from 71.2% in Q1. Non-GAAP EBIT margin was 66.4% in Q2 2025, which is also down from Q1 FY2025 (69.3%), but up from last year’s 57.6%. Therefore, Nvidia’s non-GAAP EPS was $0.68 in the second quarter of 2025, up 153% from $0.27 (split-adjusted) Q2 FY2024 and $0.07 from $0.61 Q1 FY2025 due to increased volumes sold. So Nvidia Q2 EPS outperformed the consensus estimate of $0.57 (Seeking Alpha shows a positive surprise of 5.66% in Q3):

Seeking Alpha, NVDA Seeking Alpha, NVDA

The company’s balance sheet is intact, with $34.8 billion in cash and ST investment and fueled by $14.5 billion in operating cash flow in Q2. The firm spent $7.4 billion on shareholder value via repurchases and dividends, which includes a higher per-share dividend (1.5x higher than before). Nvidia’s board has approved an additional $50 billion share repurchase authorization that shows it believes its long-term growth prospects are good.

Overall, the demand for the company’s products is remarkably strong. The company’s Hopper architecture continues to grow, and users are rushing to make purchases ahead of the next Blackwell architecture. This will likely continue to drive growth since newer models use much more computing power. Nvidia’s inference platform, which drove >40% of data center revenue over the past 4 quarters, is prized for its throughput and performance and has customers ranging from frontier model makers to large companies across different industries. However, it appears a bit difficult for NVDA to maintain the peak levels of margins it achieved last quarter. I’m somewhat puzzled by the fact that the company’s margins have started to slightly decline, even though they are still at the highest levels they’ve ever been when we look at the long-term chart.

I’m concerned Nvidia might be under pressure in the forthcoming Q3 2025 fiscal year as the company may suffer an EPS or sales “lack of positive surprise” so to speak (relative to the current consensus) for several reasons. For one, the switch to the Blackwell architecture, although promising, could cause short-term impacts on production and supply chain logistics. In addition, demand for Blackwell platforms – which exceeds the available stocks – may cause delays and affect short-term revenues. In addition, geopolitical concerns and export bans, especially in the China market, now threaten Nvidia’s upward trajectory after Trump took office.

Another risk is that the market’s reaction to the report could be negative even if NVDA beats the consensus. This is mainly because NVIDIA has increasingly outperformed forecasts in recent quarters, but if you look at the last few years, you’ll see that the magnitude of positive surprises has rapidly decreased. The illustrations I attached above clearly show that. Given that the market has become accustomed to NVIDIA consistently beating expectations, it could react unfavorably if this trend doesn’t continue the way it was before. I mean, if Nvidia beat the current consensus EPS by just a few cents that wouldn’t impress anyone – I think that would actually lead to a negative stock price reaction because many investors might consider the slightly-than-usual beat as a sign of a growth/profitability peak. In addition to that, unlike many other companies, Wall Street hasn’t lowered its estimates for the firm’s Q3 and even for the remainder of fiscal 2026, which is in contrast to the general market trend where many companies saw their forwarding forecast figures getting much lower. Thus, in my opinion, the market continued to make overly optimistic forecasts without adjusting them before the report release (which was the case for most other tech firms as of late), leaving Nvidia less scope for a potentially stronger EPS beat.

Seeking Alpha, NVDA’s EPS revisions

What’s interesting to note about this earnings season is that sell-side analysts have ratcheted down their estimates more than usual, which is even more notable considering last quarter they barely moved their estimates. Since June 30, Q3 earnings estimates have come down by 3.6 percentage points, more than the 3.3 percentage points that we’ve seen on average over the last ten years. This compares to the mere 0.5 percentage points that analysts drew down Q2 2024 estimates at this point in the quarter.

Source: Wall Street Horizon [October 2024]

Now to the guidance. Nvidia’s management expects Q3 2025 revenues to top $32.5 billion with Hopper architecture and Blackwell product sampling continuing to increase. The firm anticipates a production ramp for Blackwell during Q4 that will bring in a few billion dollars in revenue. Gross margins are expected to be held in the mid-70% range with the data center product mix continuing to evolve. Operating costs will rise as NVIDIA continues to build out its next-gen products and strives to maintain its market leadership in AI and the data center. I suspect that if OPEX does increase as management expects, the market may not be prepared for this outcome because the consensus continues to anticipate rapid, long-term EPS growth for many quarters ahead (the deterioration of EPS growth priced-in today still looks too rosy to me).

I wouldn’t short NVDA stock before its Q3 as the compute resources are increasing in demand, with Alphabet (GOOGL) (GOOG), Meta Platforms (META), Microsoft (MSFT), and Amazon (AMZN) all reporting high AI infrastructure spending. Increased depth and sophistication of AI models, along with a growing number of AI use cases across different industries, are likely to fuel the demand for Nvidia’s selling products for years to come. Further, their strategic alliances and collaborations with other leading technology companies and enterprises further enhance the growth potential of the company.

I don’t question the company’s ability to deliver cutting edge technologies and build an ecosystem of partners/customers. Nvidia, however, will face restrictions on supply chain, geopolitics, and increased AI and data center competition. It’s going to make the difference in whether or not the company can manage these risks and capitalize on the new opportunities, and whether or not it continues to expand. Such risks do not appear to be reflected in the analysts’ current projections. It would make me more bullish on the company’s next earnings report (which will be announced on November 20) if analysts had lowered the expectations slightly and given the company more latitude to exceed expectations. But even if the company outpaces consensus Q3 estimates, I don’t believe the magnitude of the beat will be as large as the trend in the last few quarters, nor do I think it’s easy to see right now how management could surprise the market in a good way with something that analysts still haven’t figured out yet.

Regarding the company’s valuation, I see it has become cheaper than it was a few months ago. According to the Seeking Alpha Quant Rating system, Nvidia’s Valuation grade has improved from “F” to “D”, which is quite good considering this change occurred in just 3 months.

Seeking Alpha, NVDA’s Valuation

Additionally, according to Goldman Sachs [proprietary source, November 2024], Nvidia’s P/E (TTM) is now trading around its three-year median. Also, compared to the industry as a whole, NVDA’s valuation premium has decreased significantly (from 137% to now 68%):

GS reports [proprietary source], November 2024![GS reports [proprietary source], November 2024](https://static.seekingalpha.com/uploads/2024/11/11/53838465-17313109494964757.png)

It is hard to deny that there has been significant business growth in recent years, which explains Nvidia’s stock price performance – this is evident in the company’s EPS momentum, which is superimposed on the stock price below. Nevertheless, even bullish analysts (such as those at Goldman Sachs) see Nvidia’s fair value at around $150/share in their base case valuation model, which is only about 1.6% above the current stock price. This suggests that there is not much upside potential left.

GS reports [proprietary source], November 2024, notes added![GS reports [proprietary source], November 2024, notes added](https://static.seekingalpha.com/uploads/2024/11/11/53838465-17313112036677701.png)

Your Takeaway

Overall, Nvidia’s Q2 2025 fiscal results demonstrate the company’s solid performance and future growth in AI and data centers – the firm is truly a beast when it comes to moat and growth analysis. As far as Q3 and FY2025 are concerned, management is optimistic, with revenue expected to remain fueled by Hopper and Blackwell architectures. The market is also bullish, pointing to the rising demand for computing capacity and booming AI use cases as tailwinds. On the other hand, supply chain disruptions and geopolitical tensions might impact short-term performance. I’m also concerned that the market does not give the company much room to significantly outperform forecasts. This could result in actual numbers falling short of or only slightly exceeding current consensus estimates, which could lead investors to think that the company’s margins or growth rates have peaked. As a result, the company may not be able to justify its high valuation compared to the rest of the industry. This scenario could cause the stock to fall even after a positive report for Q3 2025. Therefore, this risk can’t be ignored and I wouldn’t increase my position in the company ahead of the Q3 report. I’m downgrading NVDA to a “Hold” rating – it looks more moderate but also more justified right now.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.