Summary:

- Nvidia Corporation is transitioning from a GPU designer to an AI factory builder.

- AI spending will continue to grow in healthcare, government, and robotics.

- CEO Jensen Huang says the AI robot industry could be bigger than the auto and consumer electronics industries combined.

JHVEPhoto

Introduction

Per my March article, NVIDIA Corporation (NASDAQ:NVDA) has a bright future with accelerated computing, and we need to think about them as an AI factory builder rather than merely a GPU designer. Since the time of that writing, new information has come out, including the March 18th GPU Technology Conference (“GTC”), the 1Q25 10-Q through April 28, the latest annual review with the May 2024 letter to shareholders, and the June 2024 Computex keynote video.

My thesis is that Nvidia is just getting started with AI as more waves are taking shape. AI spending will continue with healthcare, government, robotics, and other areas as new waves of development gain strength.

Improvements For Future AI Waves

Nvidia is making a great deal of money because of the first major AI wave, which is large language models (“LLMs”) like ChatGPT. This is merely one wave in the AI journey, and there are shortcomings with this first major wave. Some LLM limitations were discussed in an April Lex Fridman podcast when Meta Platforms, Inc. (META) Chief AI Scientist Yann Lecun said LLMs lack four essential characteristics of intelligent systems (emphasis added):

They don’t really understand the physical world. They don’t really have persistent memory. They can’t really reason and they certainly can’t plan.

Like Meta Chief AI Scientist Lecu, McKinsey also says more breakthroughs are needed:

But although gen AI tools such as ChatGPT may seem like a great leap forward, in reality, they are just a step in the direction of an even greater breakthrough: artificial general intelligence, or AGI.

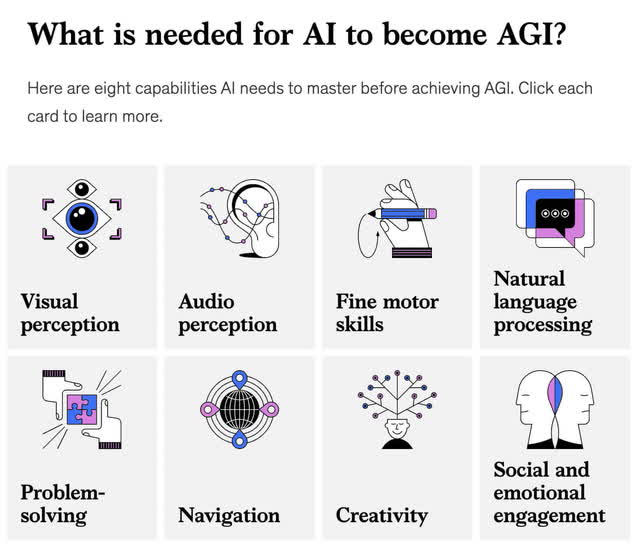

McKinsey shows eight capabilities AI needs to achieve:

Healthcare And Government

The Mastering AI book by Jeremy Kahn says AI is helping medicine regarding challenges such as protein folding. The book says AI will do many things for healthcare beyond drug development:

The applications of AI to healthcare extend far beyond new drugs. The technology is already helping radiologists spot tumors and signs of pneumonia in medical imagery. At Johns Hopkins Hospital in Baltimore, an AI algorithm has been used to better predict which patients will develop sepsis, reducing mortality from the condition, which kills 250,000 Americans each year, by 20 percent.

[page 176.]

The Mastering AI book goes on to say the US military is investing heavily in autonomous capabilities. Former House Speaker Nancy Pelosi has unique insight into future government spending and healthcare spending; she bought 10,000 shares of Nvidia in late June.

Robotics

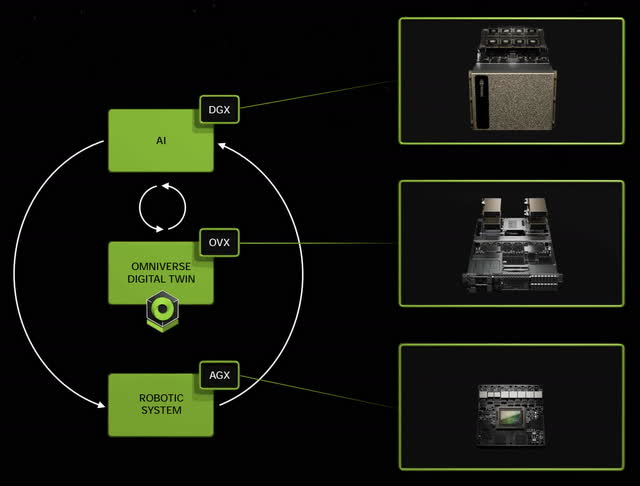

During Nvidia’s March 2024 GTC keynote video, CEO Jensen Huang discussed the next wave of AI robotics – physical AI. He says we’ll need 3 CUDA-compatible computers in the next wave, where the AI machines understand the physical world. The first computer is the same as what we use now – DGX. Rather than consuming text, it will be watching videos.

Nvidia has been building the end-to-end systems for robotics for some time. CEO Huang spells out specifics with 2 of the computers, the DGX and the Jetson AGX robot computer:

And so if you want to run transformers in a car or you want to run transformers in anything that moves, we have the perfect computer for you. It’s called Jetson. And so the DGX on top of training the AI, the Jetson is the autonomous processor.

Per CEO Huang, the third computer for robotics is in the middle – reinforcement learning:

And so we need a simulation engine that represents the world digitally for the robot so that the robot has a gym to go learn how to be a robot. We call that virtual world Omniverse. And the computer that runs Omniverse is called OVX.

The March 2024 GTC keynote pdf puts these 3 computers together in a diagram:

Robotics computers (March 2024 GTC keynote)

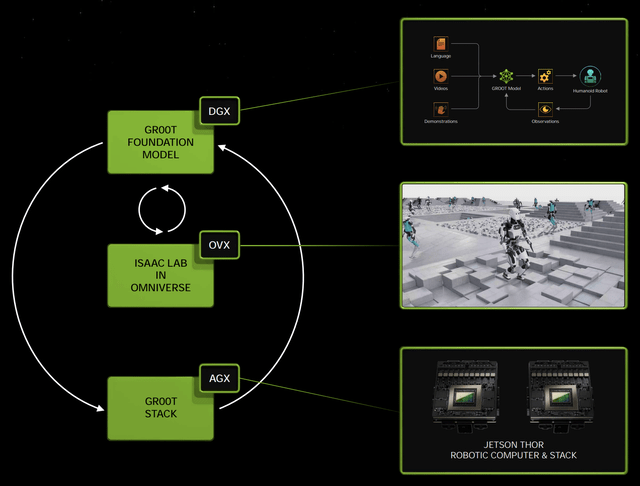

Here is another slide from the same keynote showing how Generalist Robot 00 Technology (“GR00T”) fits in regarding DGX and AGX with the Jetson stack:

GR00T (March 2024 GTC keynote)

Towards the end of the GTC keynote, CEO Huang said there are over 1 million robotics developers in the Nvidia CUDA ecosystem. He said the next generation of robotics will likely be humanoid robotics. Humans are constructed similarly, so we have a great deal of imitation training data which can be provided.

Per the May 2024 letter from Jensen Huang in the latest annual review, the future for AI-powered robots is immense. He says it will be bigger than the auto and consumer electronics industries combined (emphasis added):

NVIDIA robotics platforms for building and deploying AI-powered robots, such as the Isaac software and Jetson computer, have over 1.2 million developers and 10,000 customers and partners. NVIDIA has dedicated nearly a decade to robotics AI and is excited to see it all come together. In time, humanoid and task-specific robots will be an industry larger than the auto and consumer electronics industries combined.

A May 2024 nature article talks about the AI revolution coming to robots, including simulated worlds such as Habitat from Meta Platforms, Inc. (META) and Isaac Sim from Nvidia. It shares thoughts from Nvidia Marketing Manager Gerard Andrews and Meta AI Researcher Akshara Rai (emphasis added):

“Simulation is an extremely powerful but underrated tool in robotics, and I am excited to see it gaining momentum,” says Rai. Rai is among those pursuing the hypothesis that “true intelligence can only emerge when an agent can interact with its world”. That real-world interaction, some say, is what could take AI beyond learning patterns and making predictions, to truly understanding and reasoning about the world.

At the June 2024 Computex keynote, Nvidia CEO Huang discussed the way AI limitations are going away. Here is his explanation from the keynote transcript regarding the next wave, which understands the laws of physics. He said all the world’s factories will eventually be driven by AI robotics (emphasis added):

The next wave of AI is physical AI. AI that understands the laws of physics, AI that can work among us. And so they have to understand the world model so that they understand how to interpret the world, how to perceive the world, they have to, of course, have excellent cognitive capabilities so they can understand us, understand what we asked, and perform the tasks. In the future, robotics is a much more pervasive idea. Of course, when I say robotics, there’s a humanoid robotics that’s usually the representation of that. But that’s not at all true. Everything is going to be robotic. All of the factories will be robotic.

A May 2024 blog post from Nvidia talks about the challenges we’ve seen with robot grasping up to this point. This is improving thanks to simulation efforts from Nvidia and Alphabet Inc.’s (GOOG, GOOGL) Intrinsic (emphasis added):

Grasping has been a long sought after robotics skill. So far it’s been time-consuming, expensive to program and difficult to scale. As a result, many repetitive pick-and-place conditions haven’t been seamlessly handled to date by robots. Simulation is changing that. Enlisting NVIDIA Isaac Sim on the NVIDIA Omniverse platform, Intrinsic generated synthetic data for vacuum grasping using computer-aided design models of sheet metal and suction grippers.

The Unlocking the Metaverse book by Paul Doherty talks about the benefits of digital twins, which improve efficiency and lessen the need for physical testing:

Digital twins can help facility managers optimize the use of space in a facility. For example, a digital twin of a warehouse could be used to simulate different layouts and determine the most efficient use of space.

[Kindle book location: 461.]

Self-Driving

Today’s electric vehicles (“EVs”) are robots on wheels, but they warrant their section here. CEO Huang is excited about robotics in general and autonomous driving specifically. During the March 2024 GTC keynote, he mentioned projects with Mercedes, Jaguar Land Rover (“JLR”) and BYD:

Everything that moves will be robotics. There’s no question about that. It’s safer. It’s more convenient. And one of the largest industries is going to be automotive. We build the robotic stack from top to bottom as I mentioned, from the computer system, but in the case of self-driving cars, including the self-driving application. At the end of this year, or I guess, the beginning of next year, we will be shipping in Mercedes and then, shortly after that JLR.

A January post by former Tesla AI Director Andrej Karpathy talks about the potential for Waymo and Tesla. He implies it is now a question of when and a question of who regarding robotaxis rather than a question of if. He highlights the different strategies used by Waymo and Tesla:

Waymo has taken the strategy of first going for autonomy and then scaling globally, while Tesla has taken the strategy of first going globally and then scaling autonomy.

Unlike Tesla, Waymo trains their neural networks using TPUs. Given Tesla’s use of Nvidia GPUs, it wasn’t surprising when Nvidia CEO Huang said Tesla is ahead of the competition regarding autonomy. Regardless of which companies end up making the bulk of the world’s self-driving vehicles, I think it is a good bet they will be powered by Nvidia.

Valuation

I expect Nvidia’s earning power to remain strong in the years ahead, as competitors will have a difficult time taking share. I believe customers will have no choice but to spend prodigious sums in the years ahead on Nvidia AI factories to satiate their needs. In a June 2024 Goldman Sachs report, Head of Global Equity Research Jim Covello said it is a big leap to expect competitors to dethrone Nvidia from its dominant position:

Today, Nvidia is the only company currently capable of producing the GPUs that power AI. Some people believe that competitors to Nvidia from within the semiconductor industry or from the hyperscalers – Google, Amazon, and Microsoft – themselves will emerge, which is possible. But that’s a big leap from where we are today given that chip companies have tried and failed to dethrone Nvidia from its dominant GPU position for the last 10 years. Technology can be so difficult to replicate that no competitors are able to do so, allowing companies to maintain their monopoly and pricing power.

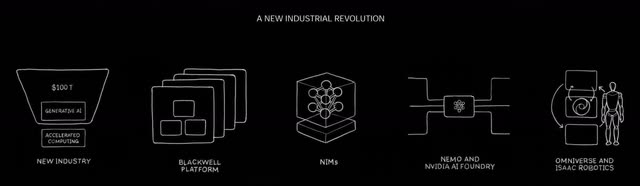

It is a mistake to merely value Nvidia as a GPU chip company. I like to think of the company holistically, starting with five of the main points of focus from the March 2024 GTC keynote:

New industrial revolution (March 2024 GTC keynote)

AI factories are the modern types of data centers in this new industry, and the vertically integrated Blackwell platform will play an essential role. NVIDIA Inference Microservices (“NIMs“) are pre-trained models which have been packaged and optimized. Neural Modules (“NeMo“) microservice is an end-to-end platform of composable building blocks for developing custom generative AI. Providing NIMs, NeMo microservice, and DGX Cloud, Nvidia sees themselves as a 3 pillar AI foundry, doing for the AI industry what Taiwan Semiconductor Manufacturing Company Limited (TSM) does for the chip industry.

As we said above, the AI robotics business could grow to be bigger than the auto and consumer electronics industries combined. Valuation comes down to the amount of cash we can pull out of a company from now until judgment day. These considerations from the March 2024 GTC keynote make me think it’s a good bet Nvidia will have significant earning power in the future. This should mean substantial amounts of cash will be pulled out eventually as the company matures years down the road.

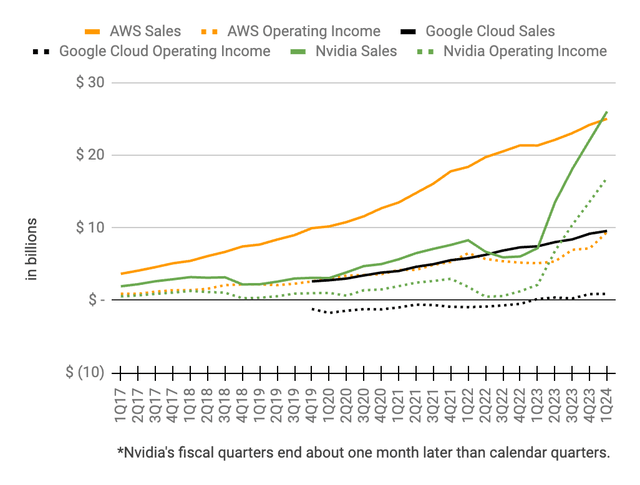

Here are operating income and sales figures for Nvidia, AWS, and Google Cloud by calendar quarter. Note that Nvidia’s quarters are a month late. Nvidia has an unbelievable operating margin, so they passed AWS in operating income back in the calendar period ending June/July 2023. They also passed AWS in sales for the period ending March/April 2024:

Nvidia sales (Author’s spreadsheet)

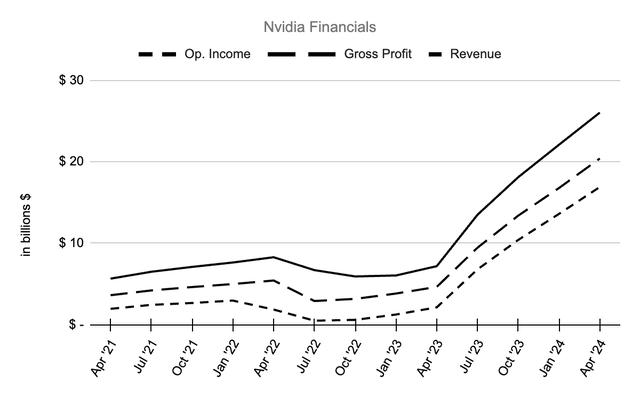

Nvidia’s revenue, cost of revenue, and gross profit have gone up prodigiously over the last 4 quarters as AI demand has skyrocketed. Q/Q revenue growth from the last 4 periods was 18.9%, 87.8%, 34.2% and 22%. The cost of revenue increases were 14.7%, 59.0%, 16.7%, and 12.5% such that gross profit growth percentages were 21.3%, 103.6%, 41.6%, and 25.3%. The quarter through July 2023 was an inflection point, but increases in the 2 quarters since then have been incredible as well:

Nvidia financials (Author’s spreadsheet)

I like to keep track of the Q/Q and Y/Y growth rates for operating income, gross profit, and revenue in a table:

|

Q/Q Op Inc. |

Q/Q G. P. |

Q/Q Rev. |

Y/Y Op Inc. |

Y/Y G. P. |

Y/Y Rev. |

Y/Y CoR |

|

|

Apr ’21 |

|||||||

|

Jul ’21 |

25% |

16% |

15% |

||||

|

Oct ’21 |

9% |

10% |

9% |

||||

|

Jan ’22 |

11% |

8% |

8% |

||||

|

Apr ’22 |

-37% |

9% |

8% |

-4% |

50% |

46% |

|

|

Jul ’22 |

-73% |

-46% |

-19% |

-80% |

-31% |

3% |

65% |

|

Oct ’22 |

20% |

9% |

-12% |

-77% |

-31% |

-17% |

11% |

|

Jan ’23 |

109% |

21% |

2% |

-58% |

-23% |

-21% |

-16% |

|

Apr ’23 |

70% |

21% |

19% |

15% |

-14% |

-13% |

-11% |

|

Jul ’23 |

218% |

104% |

88% |

1263% |

225% |

101% |

7% |

|

Oct ’23 |

53% |

42% |

34% |

1633% |

322% |

206% |

71% |

|

Jan ’24 |

31% |

25% |

22% |

983% |

338% |

265% |

139% |

|

Apr ’24 |

24% |

22% |

18% |

690% |

339% |

262% |

122% |

On an annual level, revenue increased 126% from $27 billion in FY23 to $60.9 billion in FY24. Cost of revenue went up 43% from $11.6 billion to $16.6 billion, such that gross profit grew 188% from $15.4 billion to $44.3 billion.

A large portion of Nvidia’s cost of revenue is what TSMC sees as AI-related revenue. In the 1Q24 TSMC call, CEO C. C. Wei said the following regarding AI-related demand for energy-efficient computing power (emphasis added):

For the next 5 years, we forecast it to grow at 50% CAGR and increase to higher than 20% of our revenue by 2028.

If TSMC has a 50% revenue CAGR for AI-related compute for 5 years, then the implications for Nvidia are enormous. Again, much of Nvidia’s cost of revenue goes to TSMC, and they should lose some share such that their cost of revenue may have a 5-year CAGR of less than 50% – perhaps 45%. Looking at Y/Y percentages for the last quarter ending in April 2024, Nvidia’s cost of revenue went up 122%. The increase in revenue was higher than this at 262% while the increase in gross profit was higher still at 339% and the lift in operating income was the highest of all at 690%. This shows the operating income CAGR can be much higher than the cost of revenue CAGR.

If the 5-year cost of revenue CAGR is 45%, then it’s not out of the question for the 5-year operating income CAGR to be 60%. If this happens, then every dollar of yearly operating income from today will be more than $10 in 5 years. Forward-looking investors need to be patient and remember the way the math works. If everything is consistent, then a 60% CAGR means Q/Q increases of about 12.5%.

I recently wrote about the way economic benefits from AI have more of an impact on designers like Nvidia than fabricators like TSMC. I expect this to continue, and it is one of the reasons why Nvidia has a bright future ahead. Nvidia’s 1Q25 operating income was $16.9 billion on revenue of $26 billion, for an operating income run rate of $67.6 billion. Given expected long-term growth, I think a multiple of 45 to 50x is not unreasonable for a valuation range of $3 to $3.4 trillion.

Per the 1Q25 10-Q, there were 2.46 billion shares outstanding as of May 24, 2024, and there has been a 10:1 split since then. The July 18 share price was $121.09, so the market cap is just under $3 trillion. The market cap is close to an explainable valuation range, and I think Nvidia Corporation stock is between a buy and a hold for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMZN, GOOG, GOOGL, META, MSFT, TSLA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.