Summary:

- Nvidia Corporation has a divided fan base, with some strongly supporting the company and others hoping for its downfall.

- The company is firing on all cylinders, delivering yet another record quarter with $18.12 billion in revenue, reflecting a remarkable 206% YoY increase.

- The adoption of AI is accelerating and broadening, with cloud providers, enterprise software, and governments playing catch-up, fueling Nvidia’s growth.

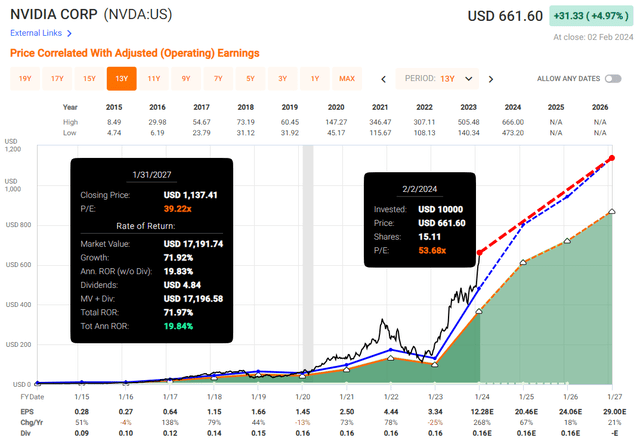

- The company is currently trading at a blended P/E of 53.6x, but the anticipated EPS growth is expected to significantly reduce the valuation.

- I am revising my investment thesis, increasing the target price for Nvidia Corporation from $1,200 to $2,000 by 2023, based on the faster-than-expected adoption of AI.

eclipse_images

Nvidia Corporation (NASDAQ:NVDA) seems to have sparked a divided fan base – those who cheer for its success and those who are almost betting on its downfall.

It brings to mind the early days of Apple (AAPL) and Tesla (TSLA), where you either loved their products and brand or were fervently against them, leaving little room for middle-ground opinions.

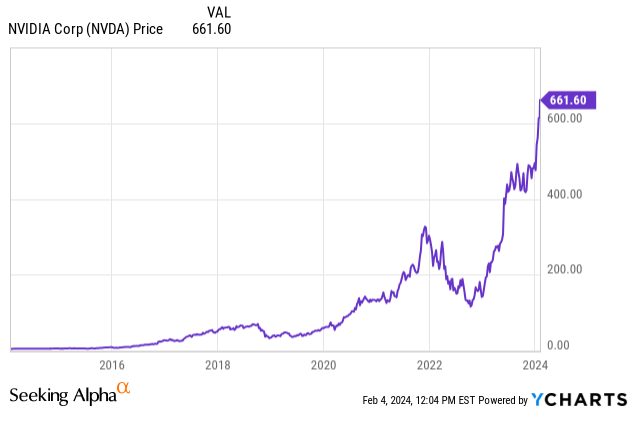

Regardless of where you stand on this, it’s hard to ignore the undeniable facts: Nvidia has been a standout both in terms of business success and returns.

In 2023, it stole the spotlight as the top-performing stock in the S&P 500 (SP500), boasting an eye-popping annual growth rate of 237%.

And the momentum didn’t fizzle out in 2024, with the stock showing another impressive surge of 33.6% in year-to-date returns.

Whether you’re in the “pro-Nvidia” or “anti-Nvidia” camp, the numbers speak volumes.

Price Development (Seeking Alpha)

Caught up in the trading frenzy or artificial intelligence (“AI”) FOMO? Perhaps.

Nvidia holds the coveted title of being number one AI pick of many and the darling of Wall Street. But delving into the intricacies of its success reveals a story beyond mere price actions.

I wrote an article on Nvidia back in November, “Path to $1,200 by 2030” and also put the company on “My Top 3 Stock Picks For 2024.”

However, recent earnings reports and developments have prompted a reassessment of my thesis. The faster than expected AI adoption and Nvidia’s EPS growth has pleasantly surprised, making it plausible for the target goal to be reached even earlier, possibly by 2027.

For a more conservative investor, such a bold prediction might not sit well. Yet, the reality is, despite the impressive stock price performance, Nvidia currently trades at a “mere” blended P/E of 53.6x.

Looking ahead, the stock appears relatively cheap, thanks to its relentless growth trajectory:

- Forward P/E FY25: 32x its earnings

- Forward P/E FY26: 27x

- Forward P/E FY27: 23x.

It’s important to acknowledge that the projected growth might not pan out as expected. In that scenario, Nvidia wouldn’t exactly be considered a bargain. Nvidia does have a history of wild price swings, after all.

But, if AI continues to be the hot topic, we might just be gearing up for another year of stellar returns.

Business Update

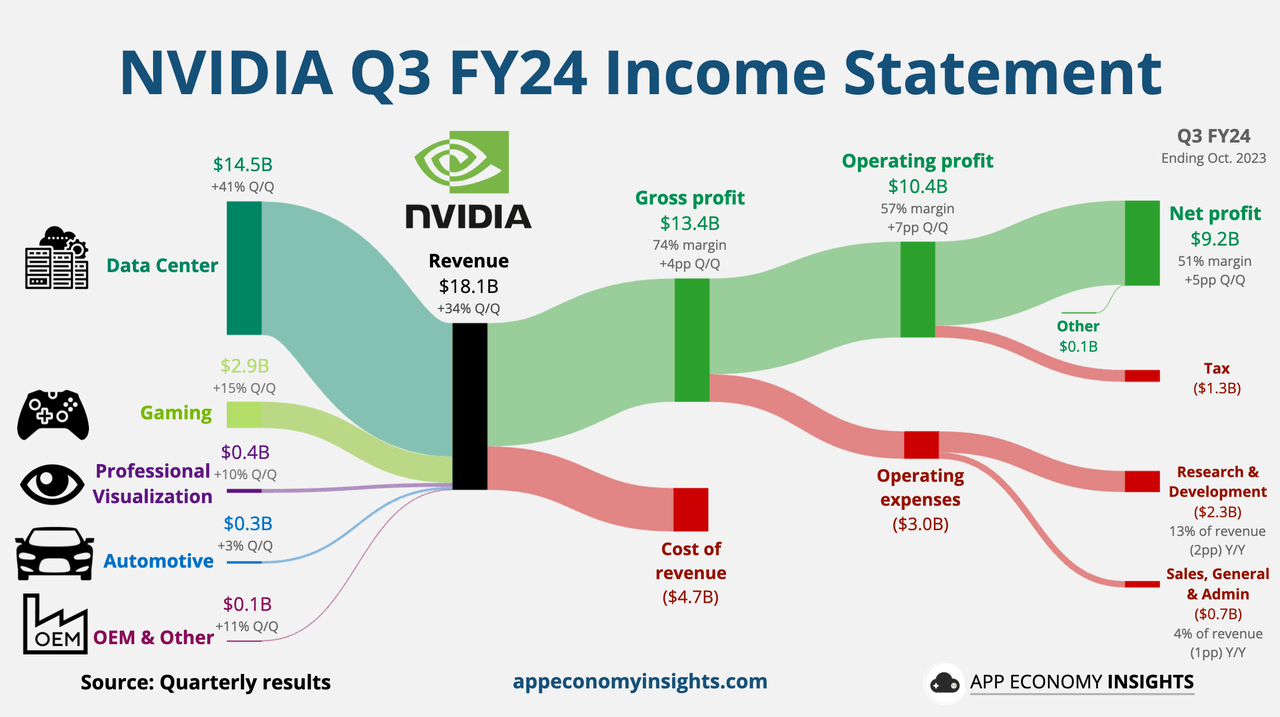

Back in November, when Nvidia unveiled its Q3 FY24 earnings, it marked yet another quarter of surpassing expectations on all fronts.

Nvidia achieved a record revenue of $18.12 billion, showing a remarkable 34% increase from Q2 and an astounding 206% surge from just a year ago.

The gross margin witnessed a significant improvement, reaching 74% and growing over 2,000 basis points since the previous year. This underscores Nvidia’s current pricing power, attributed to its superior products.

Operating Income soared to $10.4 billion, marking an increase of more than 16x YoY. This robust performance translated into $9.2 billion in Net Income or $4.02 in diluted EPS, surpassing analysts’ estimates by a significant margin of $0.63.

The robust growth is indicative of the industry’s broader shift from general-purpose to accelerated computing and generative AI.

Nvidia Q3 Earnings (App Economy Insights)

Nvidia’s CEO, Jensen Huang, is radiating optimism about the future of AI. He sees a wave of new players entering the field, beyond the initial wave of large language models or “LLMs,” consumer Internet companies, and global cloud service providers.

Governments and regional cloud service providers are investing in AI clouds to cater to local needs. Enterprise software companies are integrating AI “copilots” and assistants into their platforms. Individual enterprises are developing custom AI solutions to automate large-scale industrial processes.

This AI boom is fueling Nvidia’s growth across various sectors. Their hardware and software offerings, including GPUs, CPUs, networking solutions, AI foundry services, and Nvidia AI Enterprise software, are all experiencing significant growth.

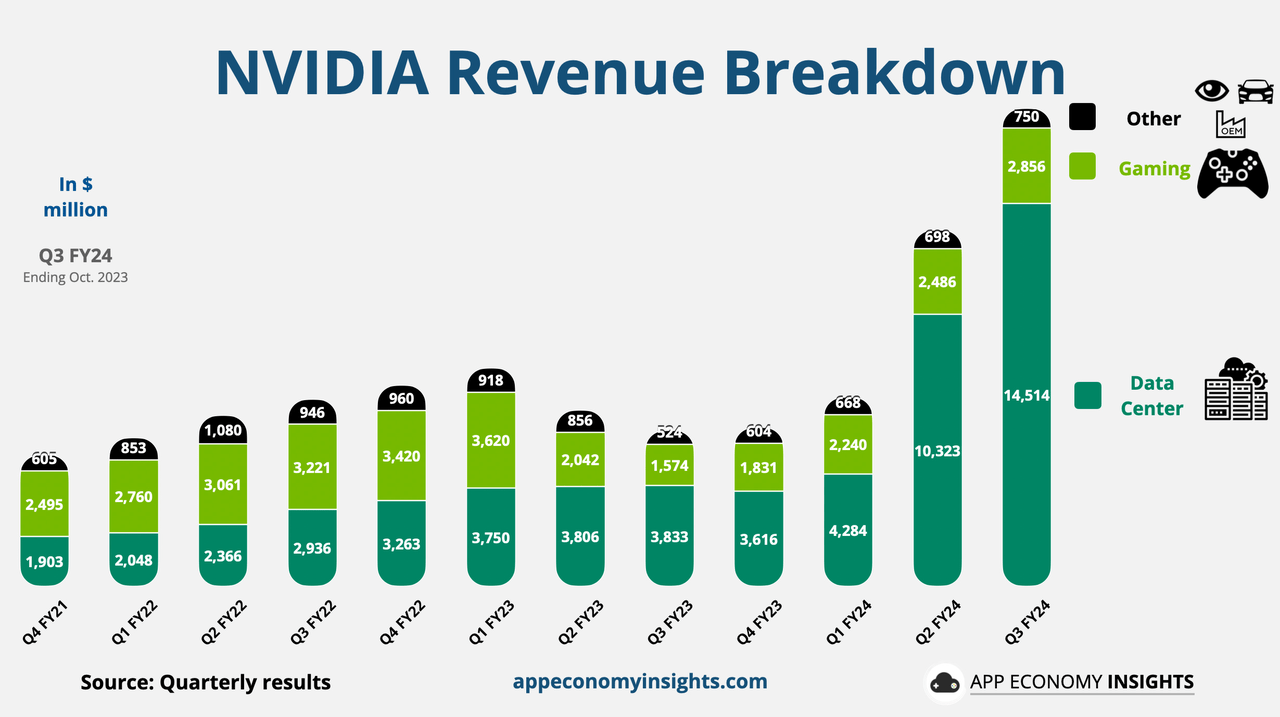

Historically known for powering gaming and crypto mining, Nvidia’s revenue streams have shifted dramatically. Data center revenue now accounts for over 80%, compared to 41.3% in Q3 FY22, highlighting the company’s transformation and riding the industry’s tailwinds.

The NVIDIA HGX platform and InfiniBand networking saw record revenue growth, solidifying their position as the preferred architecture for AI supercomputers and data center infrastructure. Leading generative AI applications like Adobe Firefly, ChatGPT, Microsoft 365 Copilot all rely on Nvidia technology. Data center compute revenue increased 4x YoY, and networking revenue grew nearly 3x.

With the growing demand, Nvidia is well positioned to capitalize on the exciting opportunities emerging in the world of AI.

Revenue Breakdown (App Economy Insights)

AI spending is booming, and that’s good news for Nvidia. Companies are investing heavily in infrastructure for training and running powerful AI models, like LLMs and generative AI applications. This demand is fueling strong growth for Nvidia’s accelerated computing solutions.

Both consumer Internet companies and traditional businesses are driving this growth. In fact, nearly half of Nvidia’s recent data center revenue came from these two sectors. Companies like Meta Platforms (META) are using AI for everything from deep learning and recommendation systems to optimizing marketing materials with generative AI. And this trend is only expected to continue, with more and more major players jumping on the AI bandwagon.

The wave of AI adoption isn’t just limited to big consumer names. Even software companies like Adobe (ADBE), Snowflake (SNOW), and ServiceNow (NOW) are integrating AI “copilots” and AI-powered features into their platforms. This shows a broader shift towards AI-driven solutions across various industries.

Nvidia isn’t the only player in the game, though. Competitors like AMD (AMD), Intel (INTC), and cloud providers like Amazon (AMZN) and Google (GOOGL) are all developing their own AI hardware offerings which could present a challenge to Nvidia’s growth.

As the AI business proves lucrative, the fierce competition could eventually challenge Nvidia’s current undisputed superiority. To compete, AMD has introduced the Instinct MI300X accelerator and the Instinct M1300A accelerated processing unit, which the company claims work to train and run LLMs.

To stay ahead, Nvidia is planning to launch new products even faster to cater to the diverse needs of the growing AI market.

There have been some challenges, like recent U.S. export restrictions targeting China. These initially raised concerns about a potential impact on Nvidia’s sales, but the company has adapted by launching a modified chip that complies with the regulations.

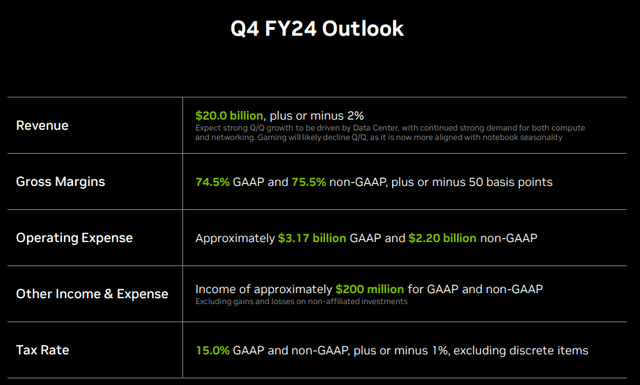

Despite these hurdles, Nvidia is expecting another record-breaking quarter with $20 billion in revenue. Their strong product portfolio and pricing power keep their gross margins at historical high levels, solidifying their position as a leader in the accelerated computing market.

Valuation

Given the impressive 2023 return of 237% and a year-to-date 2024 return of 33.6%, one might assume that Nvidia’s valuation is reaching sky-high levels.

I beg to differ.

Sure, Nvidia operates in the unpredictable semiconductor industry, where stock movements follow the swings of economic cycles, between periods of euphoria and peak pessimism driven by underlying demand.

Interestingly, Nvidia’s current valuation, at 53.7x its blended P/E, is historically lower than some instances in the past.

During the peak trading frenzy of 2021, the stock soared to a whopping 81.4x its earnings.

Comparing it to its historical average of 33.9x since 2003, today’s valuation seems significantly elevated. However, it’s crucial to factor in growth for a more nuanced perspective.

Over the years, Nvidia has seen an average annual EPS growth of 26.4% since 2003. But in the last four years, that growth has accelerated to an impressive 53.4% annually.

The expectation, according to analysts polled by S&P Global, is for this accelerated growth trend to persist:

- FY25: EPS of $20.46E, YoY growth of 67%

- FY26: EPS of $24.06E, YoY growth of 18%

- FY27: EPS of $29.00E, YoY growth of 21%.

This also implies that Nvidia’s Forward PEG for FY25 is currently 0.8. This is very favorable, considering that the valuations are stretched compared to other mega-cap tech businesses.

- Apple’s Forward PEG: 2.96

- Microsoft’s (MSFT) Forward PEG: 2.85.

Of course, if the growth does not materialize, the stock could be heavily punished, as we witnessed in 2022 when it plummeted to a low of $108 from its earlier peak of $346 during the COVID-driven trading frenzy, marking a significant 70% decline.

However, I am in the camp of people who believe in and actively use AI at my work. I think it will be the next leg up to drive the economy and allow us to enter times of unprecedented productivity. Therefore, Nvidia is in the right place at the right time with the right product.

If we look into the future valuation, the stock is expensive at all:

- Forward P/E FY25: 32x its earnings

- Forward P/E FY26: 27x

- Forward P/E FY27: 23x.

Having said that, in my opinion, despite its strong performance, Nvidia remains a bargain today. Buying now could potentially unlock returns of around 20% annually until 2027, even as I expect the valuation to contract to around 39x its earnings by that time.

Assuming the EPS growth beyond 2027 remains around 20% annually, we could see a stock price above $2,000 by 2030.

Takeaway

Nvidia has been enjoying a remarkable run in recent times, topping the charts as the best-performing stock of S&P 500 in 2023 and already up over 30% in 2024. This surge is largely fueled by the booming AI industry, which is driving significant growth across various sectors for Nvidia.

The company’s hardware and software offerings are experiencing a surge in demand, thanks to several factors. Regional cloud service providers are investing in AI clouds to cater to local needs, while enterprise software companies are integrating AI “copilots” and assistants into their platforms. Additionally, individual enterprises are developing custom AI solutions to automate large-scale industrial processes.

This surge in AI spending translates to good news for Nvidia. Companies are heavily investing in infrastructure for training and running powerful AI models, such as large language models and generative AI applications. While some might dismiss AI as mere hype, the increasing CapEx by companies to stay relevant and drive innovation demonstrates its tangible impact.

Currently, Nvidia’s stock is trading at a valuation above its historical standards. However, considering the expected EPS growth over the next three years, if it materializes, the valuation will significantly drop, below 23x its earnings by 2027. I am betting it will deliver double-digit returns for investors willing to embrace the potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.