Summary:

- This has played out with a 40%-plus gain via the path we illustrated three months ago. Alpha found, indeed.

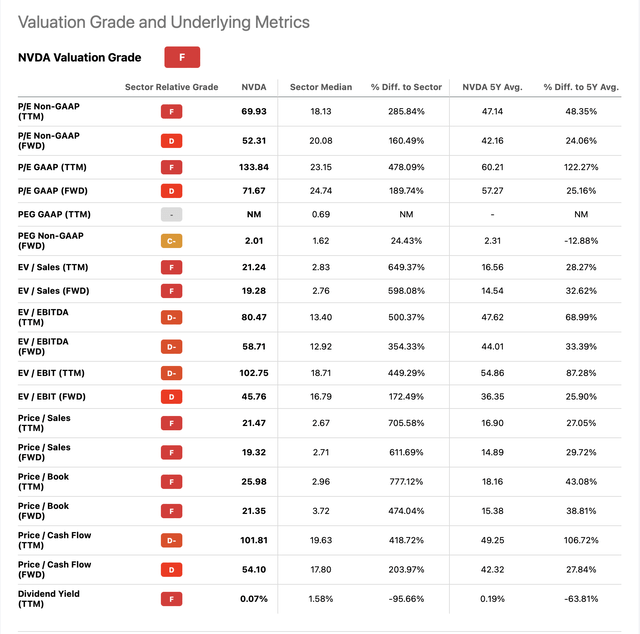

- Fundamentals are already flashing warning signs via valuation.

- What’s the technical setup for a near-term top? Where might NVDA be headed next?

steverts/iStock via Getty Images

By Levi at StockWaves, produced with Avi Gilburt

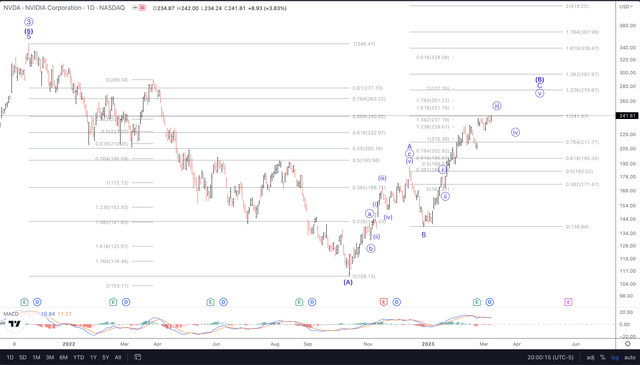

It was back on Nov. 30 of last year that we published the article, “Nvidia: (NASDAQ:NVDA) Let’s Have Another Look At This One” (see here). By way of a brief review, the chart published with the piece was anticipating a near-term top and pullback, before a larger rally. That was the reason for the “hold” rating on that date.

Chart from November 30, 2022 – TradingView

Now we have another setup that also will garner a “hold” rating, but with a much different outcome probable. We search for high-probability setups that show where fundamentals and technicals align. Nvidia is nearing that type of setup. Let’s discuss the outlook and specific price levels to guide us on our way.

Fundamentals With Lyn Alden

It’s a great privilege to work along with Lyn Alden to identify these setups. For those that follow Lyn’s work, you will know that her unique blend of an engineering background coupled with her knowledge and expertise in the financial world brings perspective. It’s this point of view that meshes so well with our technical analysis and produces these articles that we bring to the readership.

Lyn offered this commentary with the last article:

“Nvidia continues to produce some of the most important technology for this decade. However, valuation remains a concern. The bubble aspects have worn off by this point, and the stock is back down to normal historical valuations. However, with the highest cost of capital at the current time, the appropriate valuation for the stock is likely somewhat lower. I would like to see more consolidation in the stock before I would consider establishing a long position.”

This viewpoint is more valid now than at that moment. The valuation has once again crept up to rich levels. Note the attached graphic available to us via Seeking Alpha:

We view this current rise as ready to find an important high. So, what’s the technical setup, and where might Nvidia head to if it plays out in its entirety?

The Technical Setup For A Near-Term Top

Please allow me to reiterate this point made at the outset of this piece. It’s important to understand how we view the markets. Our lens is a probabilistic point of view that will detail a primary path with an alternate that’s to be monitored should the primary not play out to fruition.

In this case, however, our primary not only played out, it really paid off, for those who followed it. The outlook at the end of November was for the A wave of the larger (B) to top and pull back in what would form the B of (B). Indeed, that is exactly what took place, resulting in a more than 40%-plus gain in a little over two months. In this same time period, by means of comparison, the (SPY) had a negative move, -2.5%.

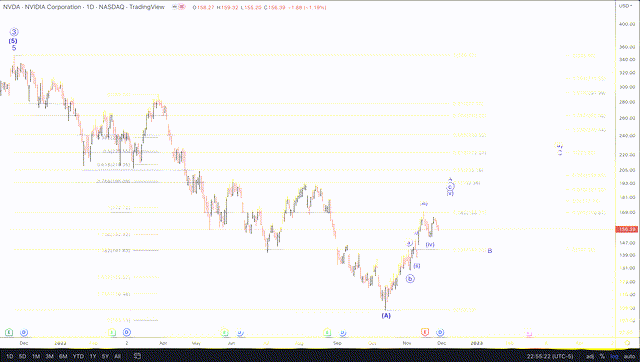

This current move is near complete. It’s nearly time to turn on the caution light. As you can see from the attached chart, we anticipate the $275 level +/- to be achieved. Ideal targets are not always struck, therefore we need specific levels to tell us when to shift our weight or even alter our perspective.

Risks

Could it be that Nvidia is actually in a larger rally phase? Sure, that’s possible. It’s simply not the path we see as the most probable at the moment. Even if this is a larger rally structure, the $275 area would probably serve as a waypoint with a pullback that pauses the current rise. (In the event that the $275 level is not seen, under $195 signals that this current rally has completed early.)

It will be the structure of that pullback that helps us determine what’s the most likely path. Should the pullback be corrective in nature, then we would be on the lookout for another push higher. However, if the pullback forms 5 waves down and then a corrective bounce, that will particularly be time to be on guard for a larger decline.

This potential decline could take Nvidia back near the lows seen in October of last year. It’s necessary to maintain vigilance in any market environment. Markets are non-linear, fluid, and dynamic in their nature. What exactly does this mean?

How Are We To Navigate In A Dynamic Environment?

Dynamics is defined as: “The science of the motion of bodies and the action of forces in producing or changing their motion.” This aptly describes the financial markets. It’s the ebbs and flows of these markets that captivate our attention. These motive movements also can leave many scratching their heads in an attempt to find reason and logic. However, this is going to be a failed venture.

Markets are emotional. They are irrational. In their wake, they can leave the seemingly most intelligent and logical among us battered, bloodied, and abandoned. Striving to constrain the markets in a linear box of reason and clean geometry will exhaust the brilliant and mercilessly bash the bravest.

This, of course, does not leave us in the lurch. A system is needed to bring structure to the madness. We have such a system in place, that’s the basis of our methodology. It’s what our analysts used to properly warn of an impending major top in Nvidia back in the Fall of 2021. It’s this same system used to correctly projected the rise we are seeing before our eyes.

I would like to take this opportunity to remind you that we provide our perspective by ranking probabilistic market movements based upon the structure of the market price action. And if we maintain a certain primary perspective as to how the market will move next, and the market breaks that pattern, it clearly tells us that we were wrong in our initial assessment. But here’s the most important part of the analysis: We also provide you with an alternative perspective at the same time we provide you with our primary expectation, and let you know when to adopt that alternative perspective before it happens.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in NVDA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities!

“Thus far, the best stock-picking service I’ve seen–and I’ve been doing this for 35+ years! (Gunfighter)

“Stock Waves has produced more gains in the past month(+) than many sites do in years or decades.” (Keto)

“The amount of trades I’ve been able to take resulting in 100%+ returns is nothing short of amazing. If you do not have Stockwaves, you are only doing yourself a disservice.” (dgriff617)

Click here for a FREE TRIAL.