Summary:

- Nvidia Corporation is reporting great quarterly results and especially revenue from Data Center is driving the top and bottom line.

- But Nvidia seems to be another example of a bubble and the irrational exuberance that is haunting the stock market from time to time.

- It seems extremely difficult to justify Nvidia’s stock price as the company must keep its market share and extremely high margins while the market must grow at a high pace.

- I would certainly not buy Nvidia at this price and shareholders might think about trimming or exiting the position.

Anna Nelidova/iStock via Getty Images

In the case of NVIDIA Corporation (NASDAQ:NVDA), I was wrong. I was wrong when looking at the fundamental results, as I did not expect these extremely high growth rates the business could report. And I was wrong when looking at the stock performance in the last 1.5 years – really wrong.

But that is only part of the story and is one statement one can make. Time will have to tell if I am wrong in the long run. In the following article, I will pick up my line of reasoning I already made in my last article titled “NVIDIA is giving me Dotcom Vibes” – the argument that Nvidia is in a gigantic bubble.

And since my last article, Mr. Market is clearly mocking me as the stock increased 74% in the meantime. Of course, a 74% price increase in about three months is not proof itself that the stock is in a bubble, but such a stock price movement should at least be reason enough for all of us to prick up our ears.

Results

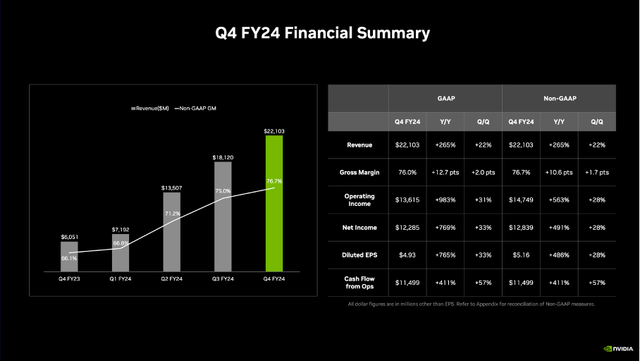

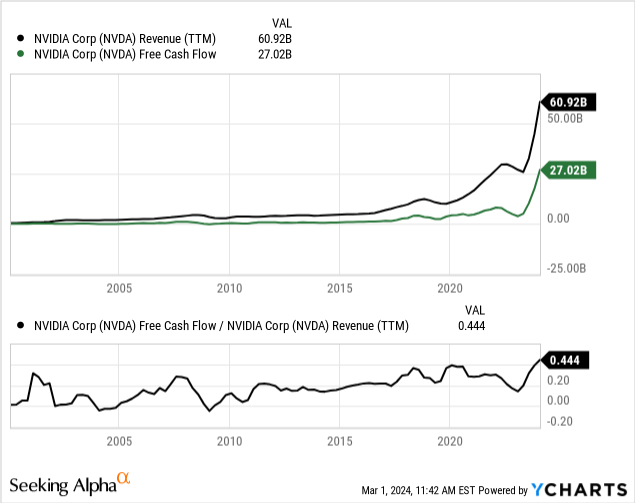

Let’s start by looking at the last results the business reported – and once again the Q4 results were impressive. Not only did Nvidia beat top and bottom line expectations in the fourth quarter of fiscal 2024, revenue for the full year increased from $26,974 million in fiscal 2023 to $60,922 million in fiscal 2024 – resulting in 126% year-over-year growth. And without much discussion, more than doubling the top line within a year despite already generating $27 billion in revenue is impressive.

But even more impressive is the operating income reported for fiscal 2024. In fiscal 2024, operating income was $32,972 million and compared to an operating income of $4,224 million this is an increase of 681% year-over-year. And diluted net income per share increased 586% year-over-year from $1.74 in the previous year to $11.93 in fiscal 2024. And when looking at the quarterly results, the picture is looking even better.

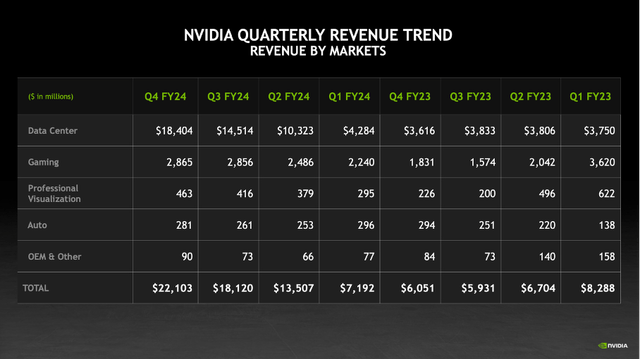

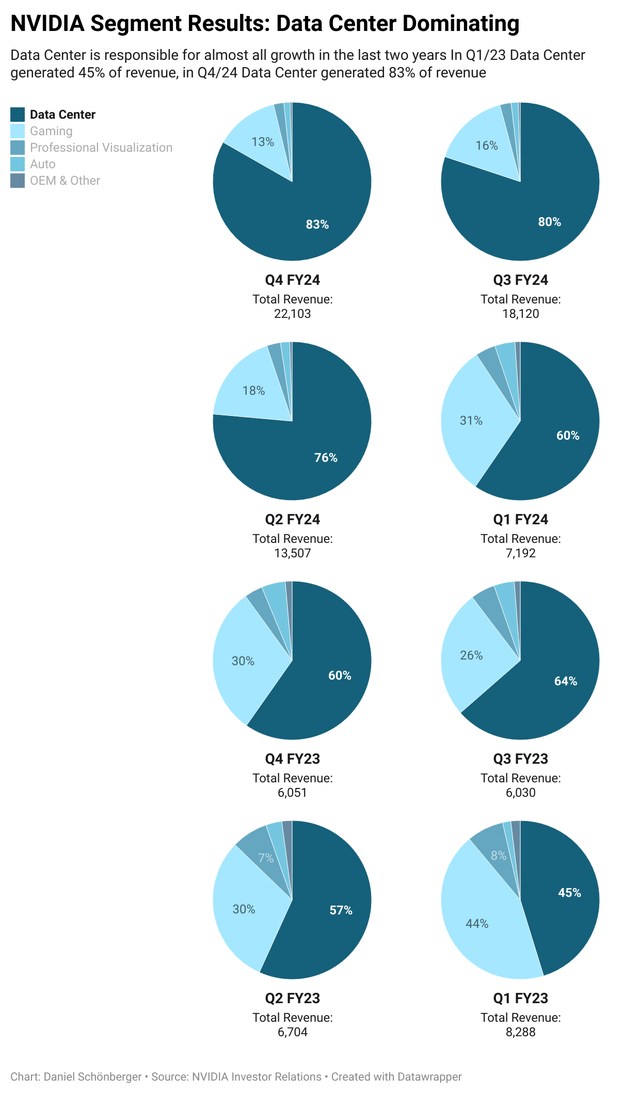

When looking at revenue by market platform, the statement is very simple. Almost all revenue was generated by Data Center and almost the entire growth in fiscal 2024 stemmed from this segment. Revenue from Data Center increased from $15,005 million in fiscal 2023 to $47,525 million in fiscal 2024 resulting in 217% YoY growth. By the way, in the fourth quarter, revenue for Data Center increased even 409% year-over-year to $18,404 million.

Mot only did Data Center revenue increase, but revenue increased from $9,067 million in fiscal 2023 to $10,447 million in fiscal 2024 – resulting in 15.2% year-over-year growth. And revenue for Professional Visualization is also up slightly, but only 1% from $1,544 million to $1,553 million.

And when looking at the last eight quarters, we see the dramatic shift in revenue distribution – only two years ago Data Center was responsible for 45% of total revenue, and in the last quarter Data Center was responsible for 83% of total revenue.

Own work created with Datawrapper

Bubble, Dotcom, and Irrational Exuberance

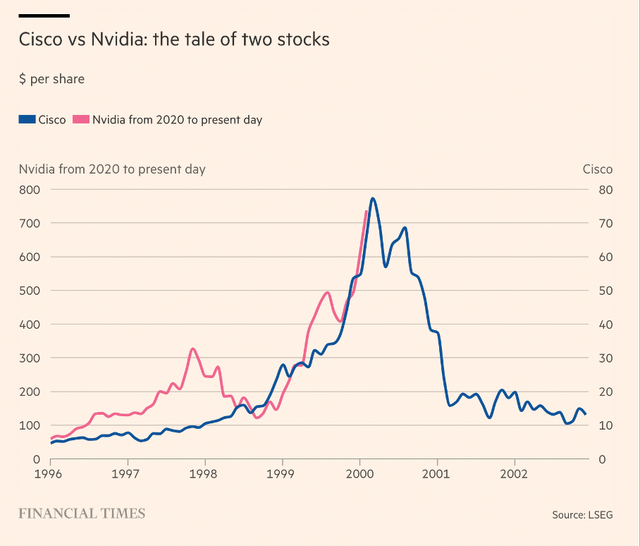

These results are great, but investing is never about past results, but about future free cash flow a company can generate. And here it is getting interesting. On the one hand, we have bullish expectations about high growth rates for the coming years. On the other hand, we had several comparisons in the last few months between the late-stage Dotcom bubble companies and Nvidia. One comparison that was made again and again (including my last article already mentioned above) – is the comparison between Nvidia and Cisco Systems, Inc. (CSCO).

For starters, I am not a big fan of just overlapping two charts – for example, the chart of Cisco in 1999/2000 and the chart of NVIDIA today. Nevertheless, I must admit that the two charts are showing many similarities – as demonstrated by the Financial Times in several articles.

When comparing stocks to the Dotcom bubble era, we should not just talk about stock prices, but the overvaluation of stocks is one of the characteristics of such a bubble and could therefore be a good starting point for a discussion.

Probably one of the best books on this topic is Irrational Exuberance by Robert Shiller, where the Nobel laureate explains the contributing factors in a very compelling fashion. Usually, we have a “new era of economic thinking” with people expecting the future to be bright – mostly due to new technology. This was the case in the years leading up to the Dotcom bubble, and it is the case right now. Similar to Cisco or Intel (two companies hit hard following the Dotcom bubble), Nvidia is also providing the hardware for a new technology. In both cases, we also see herd behavior fueled by the media (or social media).

And an argument we are reading quite often is that we are in a new bull market. But the opposite is true, we are in the last stages of a bull market and bubbles and irrational exuberance are symptoms of the last stage in a bull market. Investors being irrational and exuberant about a potential new and long-lasting bull market is also typical for this stage. Nvidia seems to be the poster boy for this irrational exuberance just as Cisco was the poster boy in 2000 or Cathie Wood and the ARK Innovation ETF (ARKK) was the poster girl for the tech bubble in 2021.

Intrinsic Value Calculation

Usually, we are trying to determine an intrinsic value for a stock to make a discussion if a stock can be bought or not. In this case, we are reversing the process – we are determining what amounts of free cash flow Nvidia must generate in the years to come to be fairly valued at this point.

As always, we are calculating with a 10% discount rate and the last reported number of outstanding shares – in this case 2,490 million. The basis for our calculation is the free cash flow of the last four quarters, which was $26,947 million, and for Nvidia to be fairly valued right now it must grow the free cash flow with a CAGR of 22% for the next ten years followed by 6% growth till perpetuity.

Now let’s look at these assumptions in more detail. But for starters, 22% growth for ten years is achievable, and there certainly are businesses that have grown at such a high pace, but these are already growth assumptions one must be cautious about making.

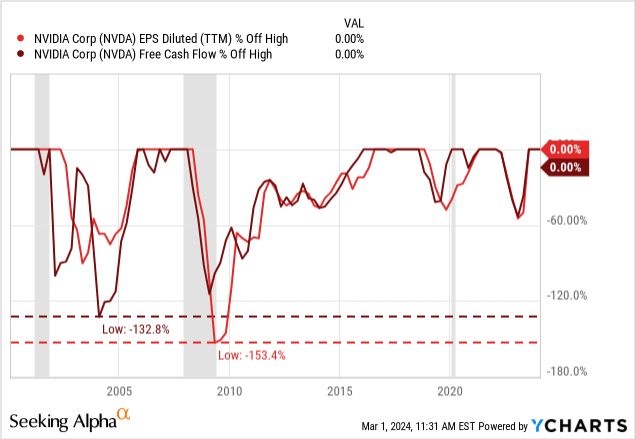

Second, these assumptions also imply that Nvidia is growing at a stable pace in the next ten years and that the business is able to avoid every recession as well as the typical cyclicality in the semiconductor industry. And when looking at Nvidia’s past, we can call such a scenario rather unlikely.

And not only should we talk about recessions and cyclicality. We should also talk about the risk of a new technology not playing out as expected. Let me be very clear: I also expect AI to be one of the major forces driving technological innovation and shaping the world in the coming decade, but without a crystal ball we can’t really know what will happen. I made the mistake of being too optimistic about an invention with Fitbit and wearables, where I assumed a huge trend that did not materialize.

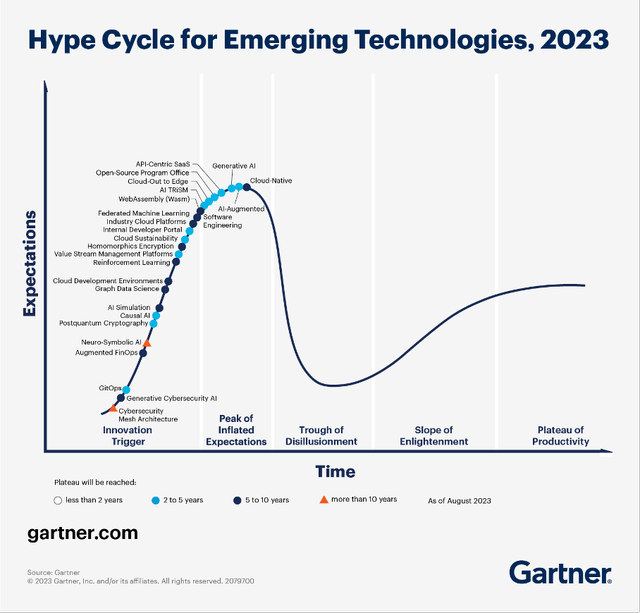

When making the argument on a more general level, we could talk about the typical hype cycle new technologies and inventions usually go through. And following the phase of inflated expectations where everybody is extremely optimistic and bullish is usually the trough of disillusionment where investors and early adopters realize that the invention is still existing and getting better and better – but not at the high pace expected at the beginning.

And when looking at the hype cycle for emerging technologies Gartner released in August 2023, generative AI is at the peak of inflated expectations. Of course, this is only one opinion, but certainly not one speaking for Nvidia. It is implying that growth could be lower in the next few years. We must include in our calculation the possibility of investments in AI slowing down (growth in ChatGPT for example seems to stall right now).

Going hand-in-hand with the hype cycle is the productivity cycle. Another big problem that companies like Nvidia could be faced with in the next few years is the ramping up of productivity. According to an FT article, about 70 new fabrication sites are built and there is the risk of Nvidia being a victim of this productivity cycle as well – high supply is suddenly meeting lower demand which is generating a problem and is leading at least to lower prices.

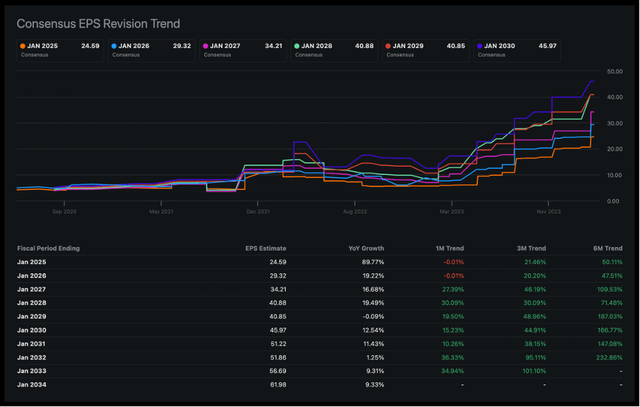

At this point, we can also look at analysts’ assumptions for Nvidia in the next ten years. Analysts are expecting revenue to grow with a CAGR of 16.87% in the next ten years and earnings per share are expected to grow with a CAGR of 16.94% in the same timeframe. Of course, we must point out that estimates beyond 2028 are based on only one or two analysts. We can also point out that analysts are getting more and more optimistic over the last few quarters.

NVIDIA: Consensus EPS Revisions (Seeking Alpha)

Between January 2023 and today, estimates in some cases more than tripled for the years to come.

Third, unless the overall market is not growing with a higher percentage than 22% for the next ten years, Nvidia must be able to keep its current market share to achieve a 22% growth rate for the next ten years.

And here we must put the numbers a bit in perspective. Recently, management of Advanced Micro Devices, Inc. (AMD) came up with extremely optimistic assumptions. The company raised its estimates for the total addressable market (“TAM”) in 2027 from previously $150 billion to around $400 billion in only four years from now. This would result in a CAGR of more than 70% for the next four years. Other studies are less optimistic here, but are still expecting growth rates of 38% annually between 2023 and 2032 and see the global artificial intelligence chip market at $384 billion by 2032.

We also can point out that Nvidia has an extremely high market share. And as Jesse Felder pointed out (based on an article from Platformonomics), Nvidia’s total data center revenue was 40% of the entire capital expenditures of Amazon.com, Inc. (AMZN), Alphabet Inc. (GOOG) (GOOGL), Meta Platforms, Inc. (META) and Microsoft Corporation (MSFT) (those businesses spending heavily into AI). Of course, this is just one statistic, but it is indicative of the extreme market share Nvidia currently has.

In my opinion, the market will never grow at the pace AMD is expecting and 38% growth is also optimistic, but the 22% top line growth that would be necessary for Nvidia in our calculation might be possible and sound like a goal that seems achievable in theory.

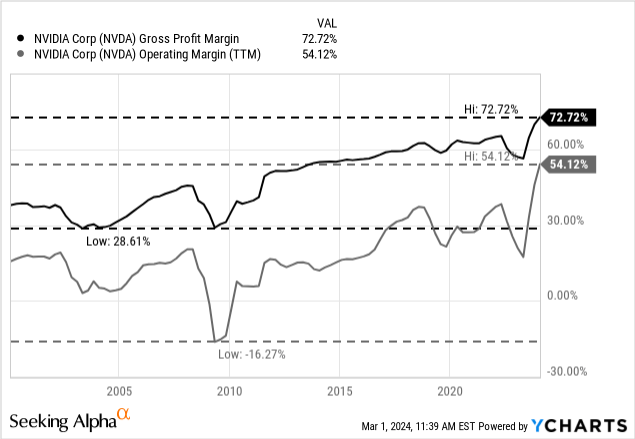

Fourth, the calculation also implies that Nvidia is able to generate a similar high percentage of revenue as free cash flow as in fiscal 2024. Right now, about 45% of revenue is ending up as free cash flow and Nvidia is reporting record high margins. For this calculation to make sense, we have not only to assume that Nvidia can grow its top line by 22%, but also that it is able to keep margins at the same high level as today.

We should not ignore that these margins are incredibly high, and it seems extremely unlikely for a business to be able to keep up these margins for 10 years.

And finally, we are calculating here with a 10% discount rate. For those that don’t already know this (because sometimes we must spell out things that seem otherwise obvious): A 10% discount rate is telling us that investing in Nvidia (under the assumptions made above) would generate a 10% return on investment annually. It means your investment will increase 10% the first year and another 10% the next year. To double your investment, it would take a little more than 7 years. I am just saying this as those people being extremely bullish about Nvidia are probably assuming to double, triple, or quadruple their investment in the next few quarters. A 10% annual return is extremely good, but it doesn’t go hand-in-hand with the dream of becoming rich quickly.

An FT article summed up the thesis quite well:

So Nvidia shareholders are making a bet that the law of large numbers does not apply, and that competition, innovation, and pricing pressure will not come to bear until at least the mid-2030s. Good to know.

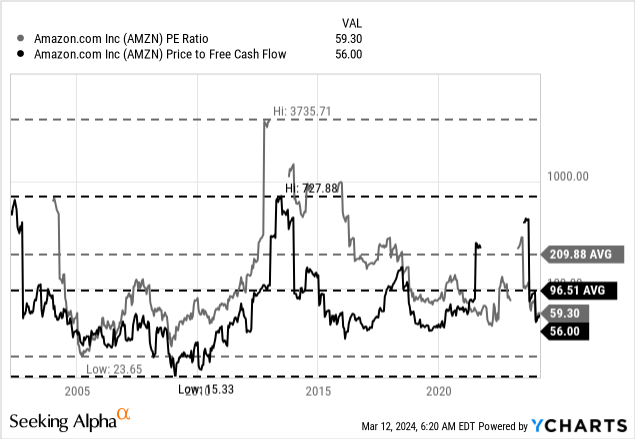

And I know there are examples of companies that continued growing for a long time although everybody was convinced the stock was overvalued – Amazon might be the perfect example here. Amazon was always trading for a high P/E or P/FCF ratio, but the stock continued moving higher and higher. But Amazon collapsed following the Dotcom bubble.

We also don’t have to assume Nvidia will completely collapse in the next few years – as Cisco and many others did in 2000 – it is enough if Nvidia is stagnating for several years to make it not a good investment at this point.

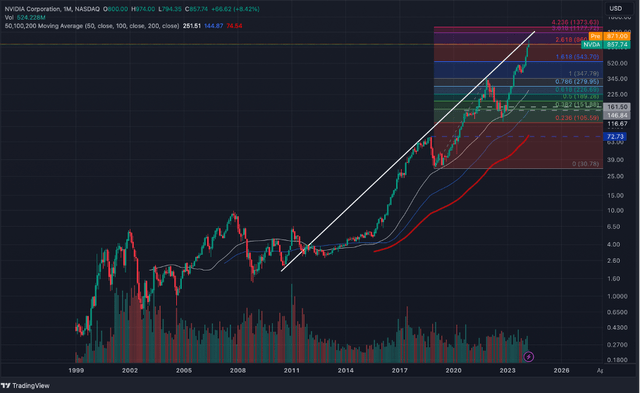

Technical Picture

In a final step let’s look at the chart to determine the price levels where Nvidia could end up. In my opinion, it is extremely difficult to make predictions about how high the stock could run, and several biases take over our thinking. Extremely bullish people will assume the stock will continue to run higher and bearish people see the stock collapsing 80% or 90% in the next few quarters.

When using Fibonacci extension levels from the last bull run from 2018 to 2021, we got a potential target of around $863 (the 2.618 extension). However, Nvidia already exceeded this level (I started working on the article about two weeks ago). The next potential target would be the 3.618 Fibonacci extension around $1,180. At this level, we also have a white trendline which is combining the two highs of 2018 and 2021 and would generate a resistance level somewhere around $1,050 in the next few weeks/months for Nvidia.

According to the chart, Nvidia could climb a little higher from here – but this is certainly not a scenario I would bet a single cent on. In my opinion, the stock is dangerously close to a price level where a correction is very likely, and looking at the chart the correction could already have started. And time will tell if it is a correction or a crash.

Conclusion

One aspect we should not forget here is even if the fundamental business continues to grow at a solid pace, there is still the risk of the stock collapsing. This is basically the theory of the hype cycle: The fundamental business can continue to grow, but sentiment among investors is swinging from one extreme to another and in the coming quarters it might swing from hype (extremely high stock prices, overvaluation) to disillusion (collapsing stock prices, low valuation multiples).

I seldom rate a stock as “Sell” because it is dangerous to bet against momentum, to bet against a bubble and to bet against high quality businesses, but at this point, I would argue that Nvidia is not a “Hold” anymore. And there is still a difference between shorting (here I would be cautious) and selling a stock I hold in a portfolio (which might be a good idea at this point).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.