Summary:

- Nvidia Corporation’s Q1 results showed strong revenue growth, driven by the growth of their Data Center segment.

- The company’s quarterly free cash flow has increased significantly, leading to share repurchases and an increase in dividends.

- Despite the good news, the valuation of Nvidia stock raises questions about its long-term returns and suggests that other businesses utilizing AI may offer better investment opportunities.

photobyphotoboy/iStock via Getty Images

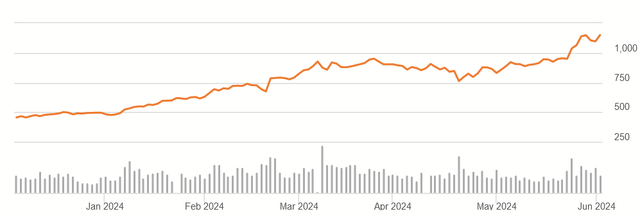

NVIDIA Corporation (NASDAQ:NVDA) has continued to amaze the world as it stands first in line on the AI wave. Following positive Q1 results in late May, share prices finally pushed through the $1,000 mark.

NVDA 6M Price History (Seeking Alpha)

Yet, I question the reality of this valuation and if entry at this price will produce good returns for long-term investors. Even when it was half the current price, I questioned it. Despite the continuing the good news, the price is the main reason it’s not a Buy right now, and I rate it a Hold.

Q1 Fiscal 2025 Results

Nvidia’s dynamic revenue growth continued in the quarter, as it has for the past several quarters.

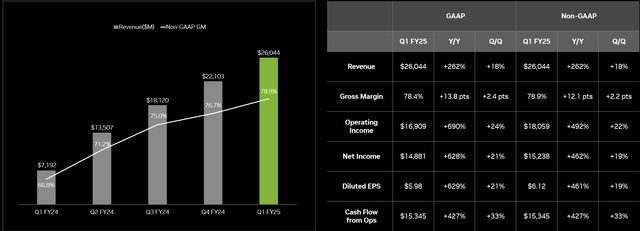

Q1’s revenue came in at $26 billion, up 262% YoY and 18% QoQ, all while enjoying a gross margin of 78%. Most of this was driven by the growth of their Data Center segment over the past year.

Q1 2025 Company Presentation

In the earnings call, CFO Collette Kress summarized the results as such (emphasis added):

Strong sequential data center growth was driven by all customer types, led by enterprise and consumer internet companies. Large cloud providers continue to drive strong growth as they deploy and ramp NVIDIA AI infrastructure at scale and represented the mid-40s as a percentage of our Data Center revenue.

CEO Jensen Huang also had to say:

AI will bring significant productivity gains to nearly every industry and help companies be more cost and energy efficient while expanding revenue opportunities…Strong and accelerated demand — accelerating demand for generative AI training and inference on Hopper platform propels our Data Center growth. Training continues to scale as models learn to be multimodal, understanding text, speech, images, video and 3D and learn to reason and plan.

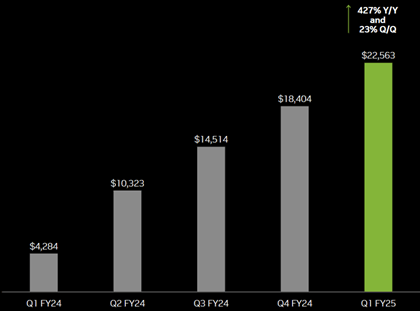

Crucially, this has led to an explosion in free cash flow.

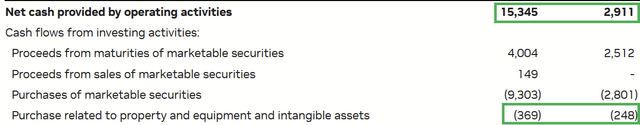

Cash Flow Statement (Q1 2025 Press Release)

Quarterly FCF up to $15 billion, compared to $2.7B in Q1 2024. This was driven by a pure increase in operating cash flows, with capex barely increasing by comparison.

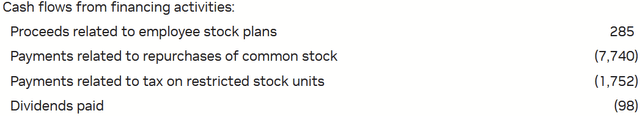

Cash Flow Statement (Q1 2025 Press Release)

About half of FCF was spent on share repurchases. While the dividend remained unchanged (and reflects a much smaller allocation of their capital), management did mention they would begin increasing it by 150%.

Finally, when asked in Q&A about potential frictions for the company over the next decade, Huang said:

Well, I can announce that after Blackwell, there’s another chip. And we are on a one-year rhythm. And so and you can also count that — count on us having new networking technology on a very fast rhythm.

So there’s a lot going here, a lot going for Nvidia, and I believe we are going to see material improvement in the fundamentals, near term and long term, as they continue to lead the way in GPUs.

Valuation

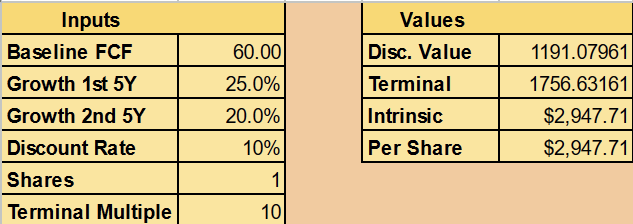

What does this mean for the value of Nvidia? Well, with one quarter’s FCF at $15 billion (annualizing to $60B), we can do a basic Discounted Cash Flow, or DCF, model on that.

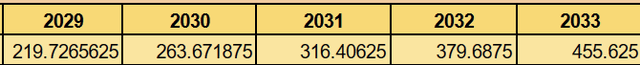

Author’s calculation

If we assume that growth continues over the decade in a high range of 25% to 20%, then the business only needs to trade at a multiple 10 at that point to be fairly valued at its current market cap. I’ve avoided doing a per-share valuation since the stock will be split soon and because significant cash is being devoted to buybacks.

Questioning the Valuation

This valuation is more of an educated guess, and there’s room to question it. If you don’t apply my discount rate (which is 10% to reflect a market index average), this growth suggests that Nvidia should be reporting hundreds of billions in just free cash flow in a decade.

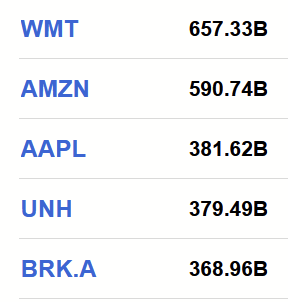

With FCF currently about 57% of revenue, that suggests NVDA would be making almost $800B in sales. To give you an idea of just how huge that is, let’s look at this stock screener I made that shows the largest American companies by revenue.

Top 5 Stocks by TTM Revenue (Seeking Alpha)

I did at least give the Top 5. I think we can all appreciate how difficult it is to achieve that kind of sales volume. Not even Walmart (WMT), with stores practically everywhere and being the #1 grocer in America, has that much revenue, and plenty of other giants, be they retail or tech, have a long way to go before they can sell that much.

This means that growth assumptions on the high end may not be accurate. With lower growth, today’s buyers would depend on the market paying a higher multiple than 10 to make today’s price a fair value. It’s worth asking why the market would want to do that for a megacap that, at that point, has probably saturated global GDP and wouldn’t have the same growth ahead.

Again, that’s just talking about the whole business. Half of FCF is being spent on buybacks, currently for a multiple of 46, which is extremely high. That’s like buying a bond with 2.17% interest, which I don’t find to be a good return on capital. I am puzzled why it isn’t being distributed as dividends, when we can at least make 5% from that in a money market. Moreover, it’s possible that much of the rally seen in the past year is just due to the price being pumped up by these growing buybacks.

Over the long term, even if NVDA doesn’t crash, it may trade flat for a long time as the fundamentals eventually catch up to the valuation.

Riding the AI Wave

If people are so eager to ride the AI wave, and if they truly believe it’s going to change everything, why not buy other businesses that also have runways for growth but haven’t been pumped up by hype and buybacks?

A couple of months ago, I covered Expedia (EXPE). A travel agency with a tech-heavy model, they are poised to revolutionize their sales process with the assistance of AI. I found them to be undervalued, even with much more modest growth assumptions.

Or, you could invest in Kinsale (KNSL), a specialty insurance provider that has some of the best underwriting profits you’ll see in property-casualty, made possible by its data analytics, which also improves with the kind of AI technology that Nvidia makes possible.

It’s difficult to get a good, long-term return if everyone wants to buy the same stock. If people truly believe in Nvidia’s product, why not also invest in the kinds of businesses that will be utilizing it for their own bottom line?

Conclusion

Nvidia has continued to set records and achieve not only positive results but tremendous growth. Yet, there is a finite value on what such a business is worth, and the current valuation implies future cash generation exceeding an economy that can even provide it, one that would dwarf many of the largest, most successful, and most essential businesses. This is all paired with buybacks occurring at this high multiple, when dividends would be a more ideal way to return value to shareholders.

Since plenty of other businesses will benefit from AI but haven’t been so pumped up, I don’t see why we need to rush to buy NVDA. With the other options out there, it’s better to consider Nvidia Corporation stock a Hold for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.