Summary:

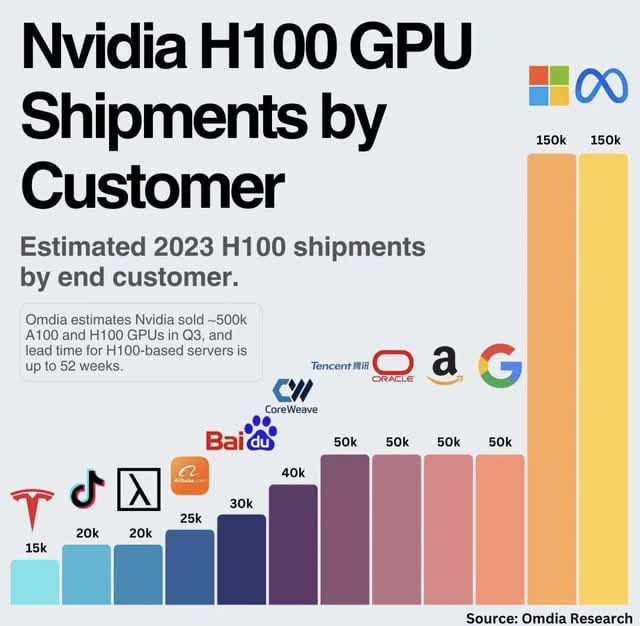

- Nvidia Corporation saw double-digit returns due to continued GPU demand from key customers like Meta Platforms and Google.

- Customers are indicating they may be overspending on Nvidia GPUs and could be done purchasing additional units.

- Despite strong financial results, Nvidia’s path to justifying its almost $3 trillion valuation and future profitability is uncertain.

BING-JHEN HONG

Nvidia Corporation (NASDAQ:NVDA) had an incredible day on the back of Microsoft (MSFT) and AMD (AMD) earnings. The company saw its first double-digit returns in a while as investors celebrated continued demand for GPUs. Despite that, indications are that the company only has a few key customers, and they’re admitting that they’re overspending on GPUs.

Nvidia Customer Warning

Nvidia’s customers are indicating that they both might be done purchasing additional GPUs and that Nvidia’s GPUs are expensive versus the competition. Meta and Google represent two of Nvidia’s largest customers and have made statements such as:

From Meta:

“I think that there’s a meaningful chance that a lot of the companies are overbuilding now and that you look back and you’re like, oh, we maybe all spent some number of billions of dollars more than we had to,” Zuckerberg said on a podcast this week with Bloomberg’s Emily Chang.

From Google:

On Alphabet’s earnings call on Wednesday, CEO Sundar Pichai said his company may well be spending too much money on AI infrastructure, which largely consists of Nvidia’s graphics processing units (GPUs). But he sees little choice.

“When we go through a curve like this, the risk of underinvesting is dramatically greater than the risk of overinvesting for us here,” Pichai said.

These customers are indicating that the number of GPUs that they’re purchasing is more than they need. Other companies are indicating that the price of utilizing Nvidia GPUs is too high. Apple, among the largest tech companies in the world, released that its AI was trained on Google’s custom chips, itself one of Nvidia’s largest customers.

Nvidia GPU Shipments by Customer : r/singularity

Given that Nvidia’s demand is concentrated in a few customers, demand drops from any one of these customers who don’t see sufficient returns on their artificial intelligence investments could be limited. There is a flip side to be seen here. Microsoft does seem to be enjoying its Nvidia hardware with Open AI.

Microsoft CEO Satya Nadella and finance chief Amy Hood said Tuesday the company plans to spend even more on Nvidia-based infrastructure next year.

How this pans out remains to be seen, but as we’ll discuss in more detail below, Nvidia needs to see revenues grow to a multiple of its current size. So not only do customers need to remain already hefty spending, they have to grow that spending for the long run. Whether that happens is a risk that remains to be seen.

Some customers might be having second thoughts.

Nvidia Prior Results

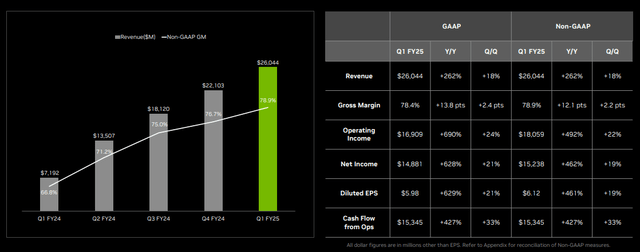

Nvidia has continued to generate strong results with hefty YoY growth. However, that’s versus a market capitalization of almost $3 trillion.

The company’s revenue has ballooned, given excitement around GPUs and everyone’s goal to get their hands on them. However, the company is also showing some signs of demand slowdown as the company’s margin growth rate has tapered off. The company has almost 79% in margins here versus 75% 2 quarters ago, much slower growth.

The company’s financial results have continued to outperform, with CFFO going up by 5x YoY. It remains to be seen whether the company can continue to grow its CFFO at the same rate.

AMD Earnings Indication and Competition

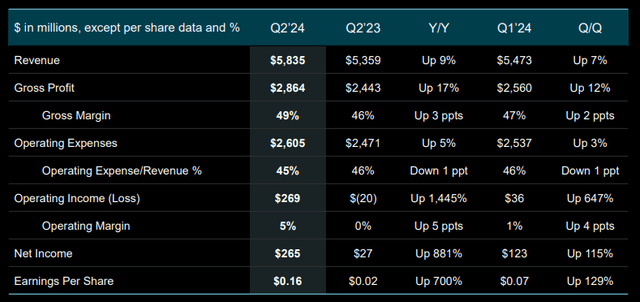

Part of Nvidia’s returns recently is based on AMD’s earnings, which shows continued demand for GPUs. However, to us, there’s also a concern about increased competition.

AMD reported strong revenues, up 7% QoQ. The company benefited from $2.8 billion in quarterly data center revenue, which more than doubled YoY and showed that customers are interested in the company’s MI 300x instinct GPUs. Operating income for the segment more than quadrupled YoY and sits at around a 25% margin.

The risk here is that AMD is willing to accept much lower margins than Nvidia, and other competitors are likely the same. That means even if GPU demand remains high for the long-term, margins and therefor the profits that Nvidia needs to justify its valuation could decline substantially.

Nvidia Financial Math

Nvidia is an almost $2.9 trillion corporation. At some point, the company will need to utilize its earnings to justify that valuation. Given the long-term high single-digit returns of the S&P 500, that means that Nvidia needs an eventual future path to making $250+ billion in annual profits. It doesn’t need to happen today, but it must happen at some point.

We simply don’t see a path for Nvidia to hit that.

Nvidia GPUs

Nvidia is selling roughly 2 million of these GPUs annually (based on 2023). While that number has grown so far into 2024, the vast majority are going to just a handful of companies, mostly cloud computing companies. We discussed above how some of these companies are arguing that they’re potentially spending too much on these GPUs but are scared about FOMO (fear of missing out).

That’s respectable at a time when these companies are setting record profits and have the extra capital to throw away. What we don’t see is how a business earning ~$80 billion in annual revenue, from a few customers who already think they might be spending too much, and growing competition from companies such as AMD, is going to turn that into $250 billion in profit.

We actually expect Nvidia’s profit to go down as both the mania around GPU demand declines and increased competition from company’s such as AMD force a decline in profit margins. That shows how the financial math indicates that Nvidia is heavily overvalued and will struggle to drive future returns, making it a poor investment.

Thesis Risk

The largest risk to our thesis is what has driven Nvidia’s valuation. Fear of missing out. The company is surrounded by massive companies, such as Google, Amazon, etc. which have $10s of billions if not $100s of billions to spend on something if they think it’ll threaten their core business models. That could drive substantial continued revenue for Nvidia.

The other is a chance of a major artificial intelligence breakthrough that justifies these companies and their continued investments. That could result in more substantial long-term demand for Nvidia and its GPUs.

Conclusion

Nvidia is a great company that benefited hugely well from the wave of artificial intelligence. The company showed a unique ability to predict where the market was headed and position itself in the right place and the right time for Open AI’s breakthrough. That propelled the company to become one of the largest companies in the world.

However, as its share price as petered out, the company now needs to justify its valuation. The company needs a path to earning hundreds of billions of $ in annual profits and with customers concerned about how much they’re spending, we don’t see a path to that happening. That makes Nvidia a poor long-term investment.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.