Summary:

- Nvidia Corporation is scheduled to reveal Q3 2024 earnings on November 21, 2023, expecting strong profitability.

- The company’s previous earnings report showed impressive revenue growth, particularly in AI and computing technologies.

- Technical analysis suggests that Nvidia’s stock price is bullish based on historical price development, with potential for upward momentum.

- The stock price is exhibiting robust growth ahead of the earnings, having developed a bullish technical pattern, and is poised to surge during the earnings announcement.

Antonio Bordunovi

Nvidia Corporation (NASDAQ:NVDA) is scheduled to reveal Q3 fiscal 2024 earnings post-market on November 21, 2023, expecting substantial revenue growth, reflective of strong market demand and strategic insight. These strong expectations follow an impressive performance in Q2 2024, where revenues considerably increased, credited to Nvidia’s advanced GPU technology and strategic market positioning. This piece builds upon the discussion from the previous article, centering on the technical evolution of Nvidia’s stock price and projecting its trajectory following the upcoming earnings reports. There is an indication that the stock is breaking out from bullish patterns, suggesting a potential robust increase in its value following the earnings release.

Nvidia’s Strong Earnings and Strategic Growth in 2024

Nvidia is scheduled to unveil its earnings for Q3 2024 on November 21, 2023. The company anticipates revenues to reach around $16.00 billion, with a possible variance of 2%. This expectation underscores the company’s confidence in the market’s demand for products and services. Regarding profitability, Nvidia expects GAAP and non-GAAP gross margins to be healthy, estimated at 71.5% and 72.5%, respectively, allowing for a 50 basis point fluctuation. This indicates strong cost management and value creation from offerings. Operating expenses are forecasted to be approximately $2.95 billion on a GAAP basis and $2.00 billion on a non-GAAP basis, reflecting the company’s strategic investments in its operations. Other income and expenses, GAAP and non-GAAP, are anticipated to contribute around $100 million to the financials, exclusive of gains and losses from non-affiliated investments. Finally, the expected tax rates are consistent for GAAP and non-GAAP, at around 14.5%, subject to a 1% variation, excluding discrete items. These projections highlight Nvidia’s solid operational planning and financial discipline, setting a positive tone for Q3 2024.

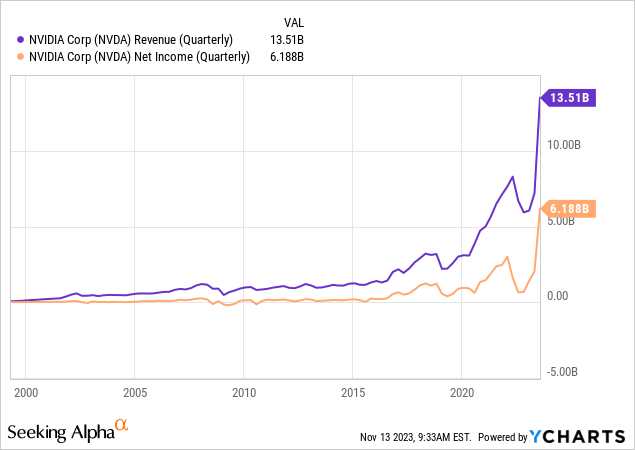

These optimistic earnings forecasts are founded on the robust financial performance during the previous earnings report. The company’s revenue for Q2 2024 reached an impressive $13.51 billion. This represents a remarkable increase of 101% compared to Q2 2023 and an 88% rise from Q1 2024. Additionally, net income soared to $6.188 billion, demonstrating exponential growth as illustrated in the following chart. Such an exponential growth rate underscores Nvidia’s dominant market position and the increasing demand for its products and services, particularly in AI and computing technologies.

Moreover, GAAP earnings per diluted share stood at $2.48, an increase of 854% from Q2 2023 and a 202% jump from Q1 2024. The non-GAAP earnings per diluted share were reported at $2.70, showing a 429% increase year-over-year and a 148% rise from Q1 2024. These figures highlight Nvidia’s successful strategies in increasing revenue and maintaining operational efficiency and cost management.

A significant portion of Nvidia’s growth is attributed to its focus on accelerated computing and generative AI, as noted by Jensen Huang, the founder and CEO. The company’s GPUs and Mellanox networking and switch technologies supported by the CUDA AI software stack have become central to the computing infrastructure required for generative AI. This emphasis is evident in the company’s data center revenue, which hit a record $10.32 billion, marking a substantial quarterly and annual increase.

Nvidia’s strategic investments and partnerships played a crucial role in this growth. For instance, the collaborations with major cloud service providers and enterprise IT system and software providers have expanded Nvidia’s AI capabilities across various industries. Additionally, the company’s share repurchase program and consistent dividend payments demonstrate a strong balance sheet and commitment to returning value to shareholders. As per previous quarter earnings, Nvidia returned $3.38 billion to shareholders, including 7.5 million shares repurchased for $3.28 billion, and also announced an additional $25.00 billion in share repurchases.

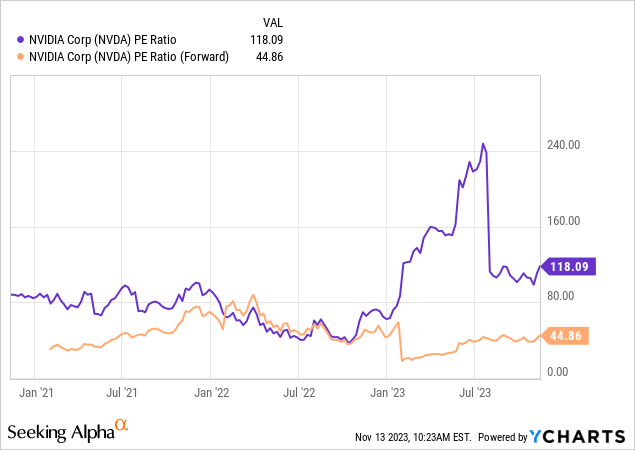

The company’s other segments, like gaming and professional visualization, also showed positive trends with varied growth rates. Gaming revenue increased modestly, whereas professional visualization experienced a slight decrease from the previous year, indicating a more complex market dynamic in these areas. Additionally, Nvidia’s stock is trading at 118.09 times trailing earnings but only 44.86 times forward earnings, signals to investors a strong expectation of substantial earnings growth in the future.

Moreover, the pre-emptive purchase of Nvidia GPUs by the Chinese AI startup 01.AI, led by Kai-Fu Lee, highlights Nvidia’s technology’s critical role in the rapidly evolving AI industry. This move directly responds to U.S. export restrictions and underscores the demand for Nvidia’s advanced semiconductors and the geopolitical complexities impacting the global tech landscape. As companies like 01.AI stockpile these essential components for AI development, Nvidia’s influence and the strategic importance of its products in international markets are further emphasized, even as geopolitical tensions create new challenges and market dynamics for tech companies worldwide.

Based on Nvidia’s impressive performance in previous quarters and strategic advancements, the expectations for the Q3 2024 earnings are highly positive, signaling continued growth and profitability. The company’s substantial revenue and net income trends, particularly in areas like AI and computing technologies, underscore its market dominance and innovative edge. With solid operational planning and financial discipline, Nvidia is poised to deliver robust results in the upcoming quarter and maintain its trajectory of growth and market leadership into the future.

A Thorough Exploration of Technical Price Patterns

Previous Discussion

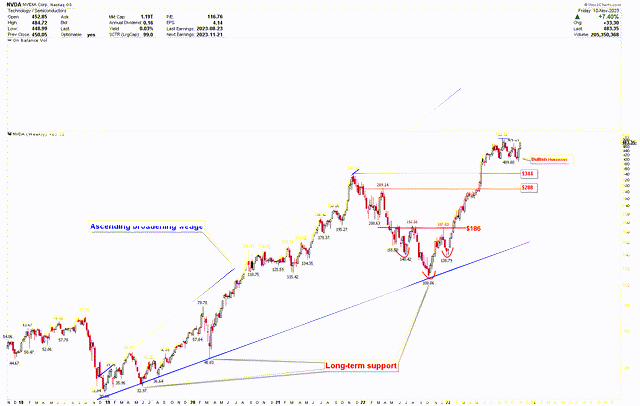

The previous article discussed the robust demand for Nvidia, driven by advances in AI technology and a significant partnership with Microsoft Corporation (MSFT). This collaboration involved utilizing Nvidia’s GPUs for AI supercomputing and integration with Azure services, enhancing Nvidia’s market standing and financial results. Technically, the stock displayed a strongly bullish trend. Its price movement formed an inverted head and shoulders pattern within an ascending broadening wedge at a crucial long-term support level. At the time of these bullish predictions, the stock was trading around $260, with anticipated targets of $344, marking the initial milestones of this bullish trajectory. A breakout above $225 was also identified as a continuation of upward momentum. The stock’s performance aligned perfectly with these expectations, surging sharply thereafter.

An update followed when the stock was trading at approximately $438, forecasting a long-term bullish trend based on the evolving price patterns. The article also discussed the long-term price bottom observed on the monthly chart, with the stock’s movement again aligning with the projected expectations.

The Next Move In NVIDIA

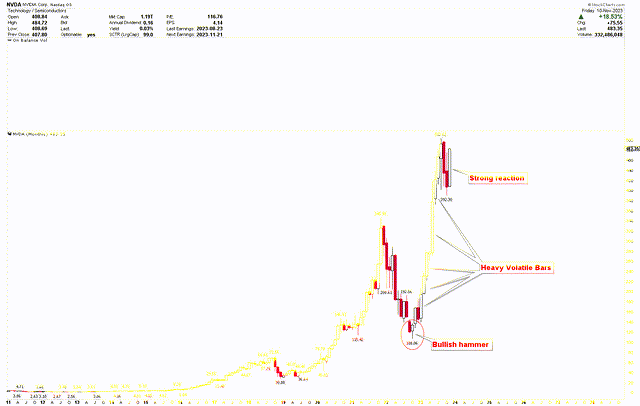

The stock price has gained significant upside as per the expectations. The revised monthly chart update from the previous article indicates a robust bullish trend. The notable price surge from the October 2022 lows at $108.06 signifies a bullish hammer on the chart, marking the most significant rally in Nvidia’s history. This remarkable increase in Nvidia’s stock value has been primarily propelled by the expansion in large language models (LLMs) and AI technologies, especially following the launch of OpenAI’s ChatGPT. Nvidia emerged as a primary beneficiary in this AI surge. The company’s performance throughout 2023 mirrors this shift. Nvidia recorded substantial revenue growth, driven by its leadership in key sectors essential for accelerated computing and generative AI applications. This untapped potential, combined with Nvidia’s established market leadership and cutting-edge technology, forms the foundation of the significant upswing in Nvidia’s stock price in 2023.

NVIDIA Monthly Chart (StockCharts.com)

The 2023 rally led to significant volatility, as evidenced by heavy volatility bars on the monthly chart, and technical indicators suggested an overbought scenario, hinting at a potential consolidation phase. This consolidation phase took place in August, September, and October 2023, during which the stock price retraced to its support levels. However, as of November 2023, there are signs of recovery, with the stock surpassing its October highs. This suggests that the stock likely established its lowest point at $392.30 in October and is poised for an upward trajectory.

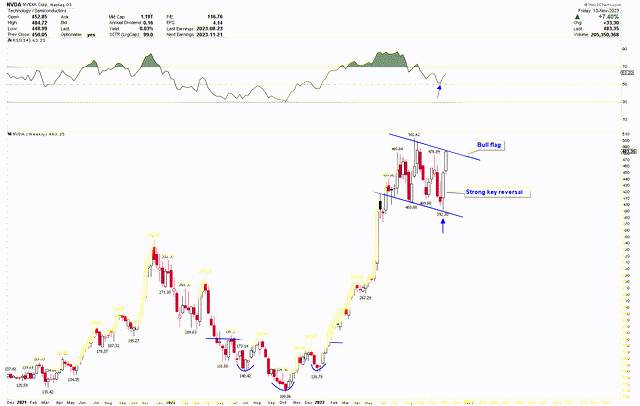

The strength in price momentum is evident in the weekly log chart, which overlooks the more volatile fluctuations. This chart reveals the development of an ascending broadening wedge pattern, suggesting a potential increase in volatility. The stock price has established a robust base supporting this pattern, forming an inverted head and shoulders configuration, with the head at $108.06 and shoulders at $140.42 and $138.79. These bullish patterns were confirmed following the neckline break at $186, and the price has surpassed the $344 mark, signaling a likely continued upward trajectory. High volatility bars in the monthly chart further bolsters these bullish indicators.

NVIDIA Weekly Chart (StockCharts.com)

Given the strongly bullish price structure, the anticipated market correction following overbought conditions has already set a low point, as evidenced by a bullish hammer on the weekly chart. The subsequent candle following this hammer is also robust, indicating a likely continuation of the bullish trend. Surpassing the all-time high of $502.62 could trigger another upward movement in the market, potentially elevating prices significantly. The growing demand for AI is expected to fuel this robust uptrend further.

The recent surge in stock prices demonstrates a significant reversal pattern on the weekly chart following the formation of a bull flag. This pattern, which developed after a notable inverted head and shoulders and a monthly bullish hammer, suggests an upward trajectory for the stock. Consolidating prices in August, September, and October 2023, resulting in a bull flag, implies that breaking above $502.62 could lead to substantial gains, despite overbought technical signals. Additionally, this robust rally in the past two weeks, occurring just before the Q3 2024 earnings release, hints at potential large swings in value following the earnings announcement, likely driving NVIDIA’s value higher.

NVIDIA Weekly Chart (StockCharts.com)

Thus, investors may consider buying NVIDIA shares at the current price levels, anticipating gains based on the historically bullish chart patterns and recent strong weekly trends.

Market Risk

Nvidia’s anticipated revenues of around $16.00 billion for Q3 2024, with strong gross margins, sets a high bar. Any failure to meet these expectations could negatively impact investor confidence and stock prices, particularly given the stock’s recent strong performance. Moreover, Nvidia’s significant growth is largely attributed to its focus on accelerated computing and generative AI. Any slowdown in these sectors, or unexpected challenges in maintaining its technological edge, could adversely affect its market position and financial performance.

Broader economic conditions can influence Nvidia’s performance. Factors such as trade tensions, changes in technology spending due to economic downturns, or shifts in consumer demand can impact its financial performance. The rapid pace of technological innovation means that Nvidia faces constant competition. Advancements by competitors in key areas like GPUs, AI, and cloud computing could erode Nvidia’s market share.

From the technical perspective, Nvidia experienced significant volatility, as indicated by the heavy volatile bars on the monthly chart and the emergence of an ascending broadening wedge. This volatility can result in potential sharp price movements in both directions. A monthly close below $108 may negate the bullish perspective in Nvidia stock.

Final Thoughts

In conclusion, Nvidia Corporation is poised for a potentially transformative period as it approaches its Q3 2024 earnings announcement. Building on a strong financial showing in Q2 2024, with a significant increase in revenues and net income, the company is well positioned to maintain its momentum in the market. The anticipation of continued robust growth, especially in the AI and computing sectors, coupled with efficient operational management and financial discipline, positions Nvidia favorably for the upcoming quarter and beyond.

From a technical analysis standpoint, Nvidia’s stock price demonstrates a compelling bullish trend. The emergence of inverted head and shoulders and the ascending broadening wedge indicate a high likelihood of continued upward momentum. The stock’s impressive rally through 2023, driven partly by the expansion in AI technologies and large language models, has set a solid foundation for further growth. The recent bullish hammer and bull flag patterns on the weekly chart reinforce this optimistic outlook, suggesting a potential surge beyond current highs, especially in light of the upcoming earnings release. A break above $502.62 could trigger another robust surge upward. Investors may consider purchasing Nvidia stock at the current prices before the earnings announcement in expectation of this potential strong rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.