Summary:

- Nvidia’s fundamental growth, driven by AI and data center demand, will likely slow in 2026 due to market saturation, including the completion of initial AI build-outs and double-ordering by customers.

- A potential price correction is likely in H2 2025 or H1 2026; competition and tech advancements may impact NVDA’s long-term dominance.

- High valuation compared to peers; current Hold rating with potential Strong Buy opportunity in 2026-2027 as undervaluation emerges, opening up high long-term growth potential in robotics and automation.

David Tran

I’ve covered Nvidia (NASDAQ:NVDA) twice before, and in my first analysis of the company, I was skeptical about the valuation—albeit, at that time, I arguably should have been bullish. In April 2024, I provided follow-up coverage, and I rated the stock a Buy. Since then, the investment has gained ~60% in price. Now, I think the investment is certainly overvalued in the near term, and I think there is some potential for the stock to contract significantly in price in late fiscal 2025/early fiscal 2026. It is important for investors to begin to ascertain how the market is going to react once the company begins to report slower YoY growth, which Wall Street analysts have forecasted is likely to truly begin in 2026. It is somewhat speculative to ascertain whether the market will sustain the high valuation, but my own perspective is that NVDA is in for somewhat of a correction, and I think this could be relatively steep and could begin somewhere in H2 2025.

Please note that throughout this analysis, years always refer to fiscal periods, not calendar years.

Operational Analysis

Nvidia’s surge over the last 12 months has largely been driven by its leadership in AI and data center technologies. The growth is anticipated by Wall Street and independent analysts to continue through 2025, but the consensus is a slowdown is likely in 2026. For fiscal year 2024, NVDA reported 126% YoY revenue growth. Furthermore, in fiscal 2025 Q1, the company reported 262% YoY revenue growth. This was largely driven by exponential demand for AI chips and data center solutions. For example, its data center revenue saw a 409% increase in 2023 and continued to grow exponentially into 2024. The company has secured major partnerships with Amazon (AMZN), Google (GOOGL) (GOOG), Meta (META), Microsoft (MSFT), and Apple (AAPL), who have collectively pledged to invest $200B in AI chips and data centers in 2024. This build-out, AI arms race and total attention on the field of AI has positioned Nvidia as one of the undoubtable lynchpins in the semiconductor supply chain, alongside TSMC (TSM). I don’t see this changing, but in my estimation, there is likely to be a momentary slowdown circa 2026 as major tech companies complete phase 1 of the AI build-out. I think this is going to open up a significant moment of lowered sentiment in the market for NVDA. I also think this will be one of the best times to buy NVDA shares because I think over the next 5-10 years, big tech companies in the United States and the Western world could begin phase 2 of the AI build-out, which I think could involve tax incentives and federal spending support from the United States government among other leading public institutions.

In the near term, continued growth is set to resume for NVDA throughout 2025, with new products being launched, including the Blackwell platform, which supports generative AI at a trillion-parameter scale, and Spectrum-X technology for Ethernet-only data centers. Management has also committed to expanding its presence in autonomous vehicles and edge computing, which are expected to drive further revenue growth.

However, come 2026 the growth prospects could look less appealing as the firm achieves potential market saturation in the AI training market. As I mentioned, as companies complete their initial AI infrastructure setups, the demand for AI training hardware may start to reduce. There is also evidence that some of Nvidia’s top customers have double-ordered to secure their near-term needs—once these infrastructure setups are complete, this double-ordering could lead to a significant cyclical downturn that the market has not anticipated fully yet. Furthermore, as I mentioned in my last thesis on Nvidia, while its moat is unlikely to be challenged significantly, emerging competitors like Groq, Cerebras and SambaNova continue to vie for market share through more efficient chip designs, and Amazon and Google are also developing in-house chips. In other words, the market is evolving and becoming more diverse, and I think it is worth remembering that these last few years have been notably lucky for Nvidia—it was largely in the right place at the right time with the right GPUs and infrastructure to support the largely unimaginable AI boom. Moving forward, new players and established tech giants will be trying to consolidate their positions, which further emphasizes why, over the next few years, the fundamental growth story for Nvidia is likely to change forever as phase 1, the AI infrastructure build-out, culminates.

Financial & Valuation Analysis

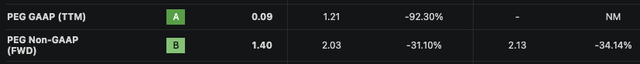

Nvidia has been nothing short of extraordinary on the financial front over the past couple of years:

However, analyst estimates for 2025 are already lower than the growth delivered in 2024. As we can also see from the following table, 2026 is a significant drop from 2025 in normalized EPS YoY growth if forecasts prove to be accurate. As it has been covered by almost 50 analysts for both years, I’m convinced that the forecasts are likely to come to fruition.

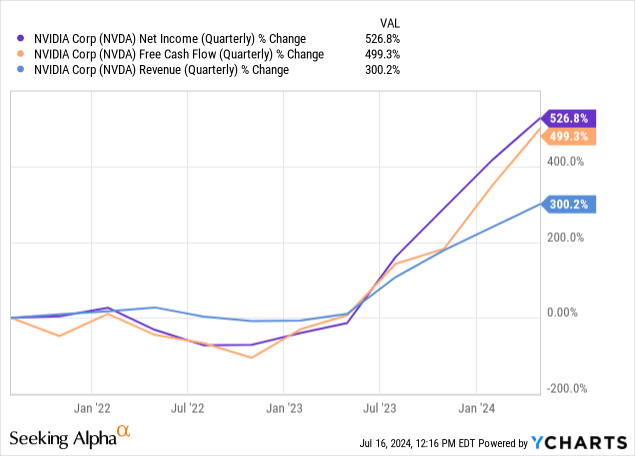

What Nvidia shareholders need to remember is that the valuation is much higher than other big tech companies at the moment. This makes the investment notably more prone to volatility. For example, compare NVDA to the rest of the magnificent seven on normalized PE ratio:

Arguably, NVDA deserves this rich valuation, but it is also worth remembering that the stock is much more prone to volatility if it fails to deliver such high fundamental growth as it has in the past moving forward. I think because the normalized PE ratio is so high, even on a forward basis, where it reduces to 47, the likelihood of a correction is likely in H2 2025 in anticipation by the market of lower fundamental growth for NVDA for fiscal 2026, which is when Wall Street is forecasting much lower YoY EPS growth. While I understand the argument that NVDA has an immense amount of cash and ST investments and masses of free cash flow, giving it the capability to buy back shares aggressively, I think this will not be enough to keep investor sentiment high throughout 2026. However, share buybacks are a worthy strategy to please investors and bolster shareholder value until the next phase of AI spending begins, which I believe will be heavily oriented toward robotics and automation.

A lot of semiconductor companies are cyclical, and NVDA is proving to be no different as it continues to position itself at the epicenter of advanced computational capabilities. I think that the end of the first semiconductor upcycle related to AI and data centers will be in late 2025 and early 2026, and skepticism about high levels of AI spending is already apparent, for example, in a report from Goldman Sachs titled ‘Gen AI: too much spend, too little benefit?‘. Doubt is starting to surface about whether AI is worth the amount big tech companies and other industries are spending to develop and deploy its capabilities. This argument is warranted in the near term, but I think that once the spending settles, industries will begin to notice new potentials in the technologies, and I believe the focus will shift much more aggressively from LLMs, which are largely information-based tools, to robotics through AI-assisted automation. In my opinion, this is likely to be phase 2 of the AI build-out and NVDA shareholders who buy during the correction that I predict circa 2026 will be able to profit very well when new enthusiasm for intelligent technologies begins. In the interim, if buying at a low valuation, NVDA is likely to continue to keep growing amid support for information-based AI primarily, but I think the current valuation is too high to warrant an investment at this time. This is why my rating for NVDA is a Hold rather than a Buy, but I can see it becoming a Strong Buy at some point in 2026 or 2027.

By H2 2025 or H1 2026, I think the non-GAAP PE ratio could contract to around 40 on a TTM basis as the market reacts to lower growth prospects in the near future. If normalized EPS is $3.67 in January 2026 (in line with the Wall Street consensus), this would make the stock worth $146.80 in July 2026 if the market prices this into the stock approximately 6 months early. That indicates a 12-month CAGR of 16.17%. However, there is also the possibility that the market overreacts and opens up a more significant undervaluation, which I think is not unlikely considering how richly valued NVDA currently is. If the normalized PE ratio contracts to 35 on a TTM basis, the stock would be worth $128.45, meaning a 12-month CAGR of 1.65%. I think in both of these instances; the investment becomes a Strong Buy with a long-term horizon strategy hinged on the thesis of high growth coming in the future related to automation, robotics, and AI demand surging both domestically and potentially internationally through a re-globalized world order in conjunction with China. Please refer to my recent Palantir and S&P 500 analyses for why I think the West could continue to lead the global economy.

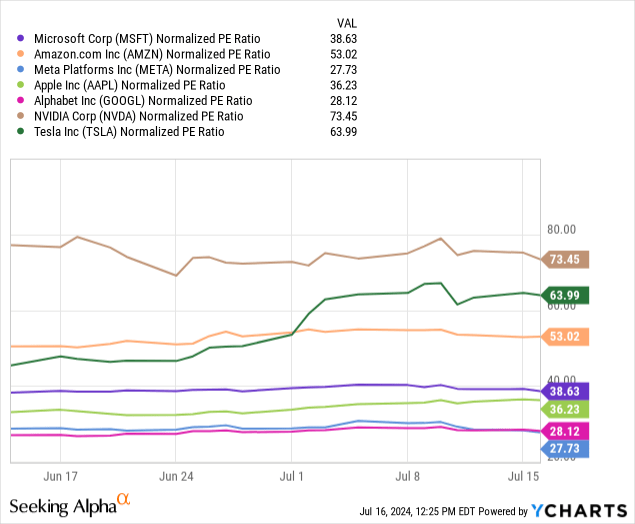

NVDA has a notably strong PEG ratio at the moment—currently just 0.09; but this is likely to come under pressure, and this is already evident in the discrepancy between the PEG GAAP TTM ratio and the PEG non-GAAP FWD ratio. I think that as this metric begins to indicate poorer growth performance on a forward basis, institutional investors are going to begin questioning the near-term valuation, and it could trigger heavy selling action down to the retail investor level. As a result of my analysis, I would be looking to hold off from investing until circa 2026, when hopefully the TTM normalized PE ratio is nearer to 40 or 35. Alternatively, if one is already an NVDA investor, I would certainly not sell, and I would hold this stock for the long term.

Risk Analysis

It is prudent to consider that the sentiment toward AI could shift toward the negative over the long term. The result of this shift would be very bad for NVDA. Although I think this is unlikely, what is perhaps more likely is that the infrastructure build-out for AI, automation, and robotics becomes much slower and elongated. I do not think this is the wisest strategy for Western companies to take, especially due to how bullish China’s CCP is in supporting AI at the moment (I think it is paramount that the West hold the lead in technology during this time of geopolitical tension). However, it is conceivable that due to high costs and not enough near-term profits from these infrastructure expenses related to AI, companies stop investing in them heavily, at least for some time.

The enormous power requirements of AI data centers are currently straining existing grids. ClearBridge Investments notes that “The path of least resistance is one of higher power prices in markets with outsized AI infrastructure builds”. This could slow down expansion plans, especially as we are concerned about net-zero policies and are yet to have a stable renewable energy infrastructure to meet such high demands.

Furthermore, Sam Altman, OpenAI’s CEO, has mentioned that the industry might need as much as $7T in investment to build the necessary AI infrastructure. I think some caution around how the money is being spent and why is paramount, and I think there are likely to be delays in spending affecting NVDA’s revenues due to a more prudent and measured allocation strategy related to intelligent technology moving forward. This point is also further reinforced by growing regulatory constraints, which I believe are likely to compound as the technologies become more proficient.

There are also long-term risks that could compound related to China that have already made themselves present. For example, Nvidia’s business has already been affected by U.S. export controls on advanced AI chips to China. Huawei’s Ascend chip is being positioned as a long-term solution for Chinese enterprises, and Nvidia is losing a big portion of the market if it is further inhibited from selling to China. There is both geographic and company diversification related to AI and semiconductors at the moment, as well as a growing notion of isolationism that is hinged on the geopolitical debate. In my opinion, both are somewhat bad for Nvidia over the long term as more companies begin to become viable alternatives to Nvidia, potentially at lower costs for specific workloads, and certain international markets become less accessible. In my opinion, these inhibitions are likely to get somewhat worse in the short term until the West has solidified a dominant lead and moat in AI infrastructure and capabilities, at which point I believe China is likely to be more dependent on the West for such capabilities and cross-border trade will have less friction and be more tenable. These are core reasons why I think bearish sentiment surrounding AI companies is going to build in the near term, but this will open up a significant buying opportunity for investors who capitalize on the lower valuations with a long-term horizon strategy.

Conclusion

In my opinion, NVDA is currently overvalued when taking into consideration the contraction in YoY growth rates expected in 2026. I think the market is likely to begin pricing this contraction in YoY growth into the stock in H2 2025. Therefore, I think investing at the present valuation is not wise, and I think it would be much better to allocate to NVDA during 2026/2027 when I think there will be a more bearish stance on AI as the infrastructure expenses do not prove as profitable in the near term as initially assumed. That being said, I think this sentiment will be transitory, and the potential undervaluation that evolves in 2026/2027 could make for a Strong Buy opportunity. I think over the next 5-10 years, NVDA will likely continue to be one of the biggest beneficiaries of AI growth and be a lynchpin in the advanced semiconductor supply chain, particularly related to robotics and automation capabilities. For these reasons, my rating for NVDA is a Hold for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, TSLA, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.