Summary:

- I view Nvidia Corporation currently as a textbook example of a momentum stock after its Q1 earnings report.

- However, for investors who are not momentum traders, this article’s goal is to examine some of the arguments against the ongoing market hype.

- In particular, I will analyze the insider selling activities and explain my interpretation of these activities.

- Its current valuation multiple implies not only perfect growth.

- It also implies a substantially expanded margin (more than double its past average). A very unplausible assumption to me either by vertical or horizontal comparison.

Ethan Miller/Getty Images News

Thesis

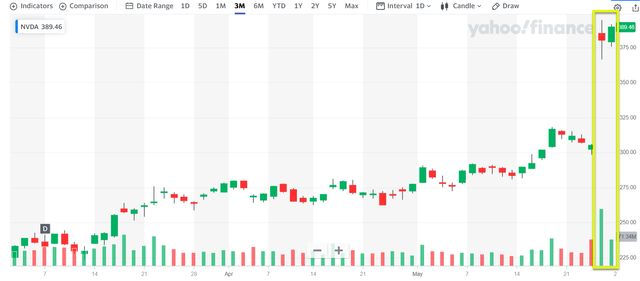

After reporting a strong Q1, Nvidia Corporation (NASDAQ:NVDA) stock prices rallied sharply, as seen in the chart below. To wit, the company reported Q1 total revenue of $7.19 billion, translating into an annual growth rate of 19%. Its EPS dialed in at $1.09, beating market consensus by $0.17 (or ~16%). More importantly, the company also announced an upbearing full-year outlook.

Also note that the sharp price rally is combined with large trading volume (as highlighted in the yellow box), commonly considered a strong bullish sign within the technical analysis community. This is because it indicates that there is a lot of buying pressure in the market (enough to push the price of the stock up significantly). Additionally, a large trading volume indicates that a lot of money is being invested in the stock, which further supports the bullish trend.

On the fundamental side, there are also plenty of reasons to be bullish. The success of ChatGPT triggered the market’s enthusiasm about the AI future, and NVDA is well-positioned to capitalize on this enthusiasm. As commented by Jensen Huang, CEO of Nvidia Corporation:

The computer industry is going through two simultaneous transitions — accelerated computing and generative AI. A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.

NVDA’s entire data center family of products (e.g., H100, Grace CPU, NVLink, et al) is poised to meet surging demand in this area. In particular, its DGX GH200, an AI supercomputer platform, has attracted the attention of heavyweights like Alphabet Inc. (GOOG) aka Google, Meta Platforms, Inc. (META), and Microsoft Corporation (MSFT). All are anticipated to be the first large buyers of the DGX GH200.

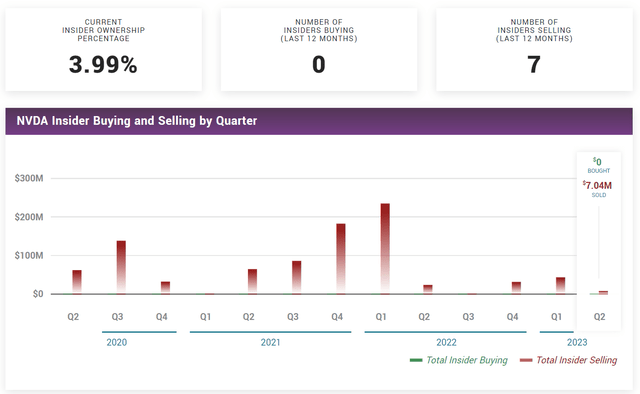

Combining strong technical signs and fundamentals, I have no doubt that the stock is a dream case for momentum investors. However, for long-term buy-and-holder investors, the goal of this article is to examine some of the arguments against the ongoing market hype. In particular, I will analyze the insider activities (which have been all selling activities).

In the end, insiders are typically more knowledgeable about the true value of their own company than the general public in the market. In the following sections, I will first examine the selling activities in detail, and then explain why I concur with the insiders’ selling decisions.

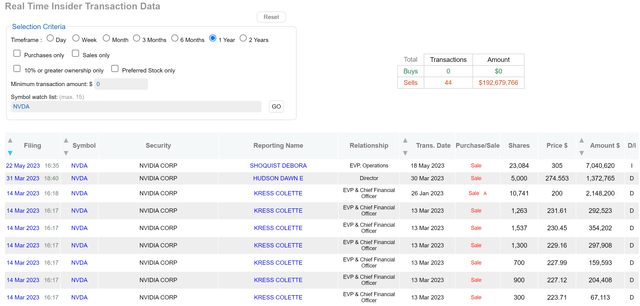

NVDA’s insider selling activities

In the past 12 months, there have been a total of 44 Nvidia Corporation insider transactions, and all of them have been selling activities as seen in the two charts below. The cumulative amount from these 44 selling transactions was about $193 million. The latest selling activities were filed on May 23, 2023, a few days ahead of its Q1 earnings report. As seen in the second chart, one of its EVPs (Debora Shoquist) sold more than 23k shares at a price of $305. Rolling back a bit further to Mar 2023, two of its EVPs sold multiple batches mostly in the $225 to $275 price range.

Insider selling (especially when all the transactions are selling like in this case) is usually interpreted as a sign that insiders are not confident in the company’s future prospects.

Given NVDA stock’s current situation, I highly doubt this is the case. First, it is important to note that insider selling does not always mean a lack of confidence. Insiders could sell stock to raise money for a variety of reasons unrelated to business fundamentals (diversify their portfolios, buy a new house, divorce, et al). Second, I see little reason to be bearish about its fundamentals given its strong product line and market demand.

My interpretation of the insiders’ activities involves valuation risks and the market’s overestimation of its profitability, as detailed next.

Source: MarketBeat Source: DataRoma.com

Valuation is too ahead of growth

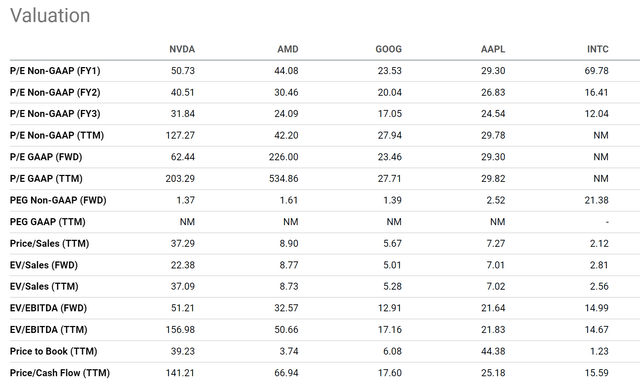

In a nutshell, I view NVDA’s current risk as dominated by valuation risks. As seen in the chart below, compared to other peers, NVDA’s valuation multiples are at an unjustifiable level in my view. To cite a few examples, its FY1 P/E ratio is currently at 50.7x, which is substantially higher than its immediate peers such as Advanced Micro Devices, Inc. (AMD) (at 44x) and other players in the AI race (e.g., Apple Inc. (AAPL) and GOOG). As detailed in my earlier article, I view all of them as viable contenders in the AI race.

For example, AMD is a major competitor to NVDA both in the GPU and CPU markets. AMD’s chips are also widely used in a variety of applications, including gaming, artificial intelligence, and data centers. I also consider Google (or even AAPL) as a major competitor to NVDA in the AI market. Google’s AI chips are used in a variety of applications, including machine learning, natural language processing, and computer vision.

Due to capital structure differences, NVDA’s valuation premium is even more extreme in terms of top-line multiples. For example, its FWD EV/sales ratio currently stands at 22.38x, higher than its peers by a whopping factor of about 240% to almost 800%.

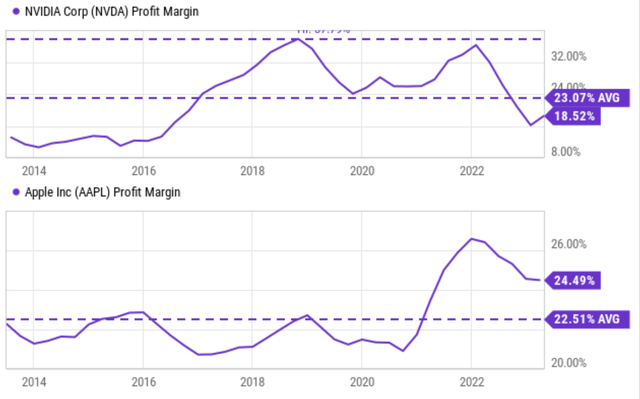

Market is overestimating its profitability

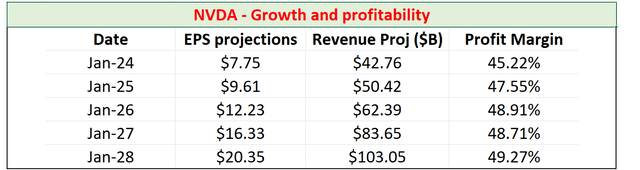

To further compound the valuation risk analyzed above, I also anticipate the possibilities that its future EPS would not match up with consensus estimates. Because consensus estimates overestimated its margins.

The following chart was made based on consensus estimates of its projected EPS and revenues in the next 5 years. Needless to say, consensus estimates expect robust growth both in the top and bottom line as seen. Digging a bit further, consensus estimates also imply a consistent profit margin in the range of 45% to 49%. Note that to translate consensus estimates of EPS and revenues into the profit margin, I assumed that its outstanding shares remain fixed at the current level of 2.495 billion shares.

Such an expected profit margin is too optimistic in my view both by vertical and horizontal comparison. Historically, its profit margin has been in a range of a few percent to a peak of 38% with an average of 23% only – which is a remarkable margin already. As seen, AAPL’s profit margin has been averaging around the same level in the past. And somehow, the market expects NVDA’s margin to double in the next 5 years, which seems unplausible to me, especially considering the intensifying competition as mentioned above.

Source: Author based on Seeking Alpha data Source: Seeking Alpha data

Other Risks and Final Thoughts

To recap, there are certainly upside risks. As aforementioned, I view Nvidia Corporation as a textbook example of a momentum stock in the near term. Its current situation is an ideal combination of strong technical signs and a rosy fundamental outlook. Market enthusiasm can always push its prices higher. However, for long-term buy-and-holder investors, the risks become heightened, not reduced, at higher prices. And there are indeed plenty of downside risks both in the near term and long term.

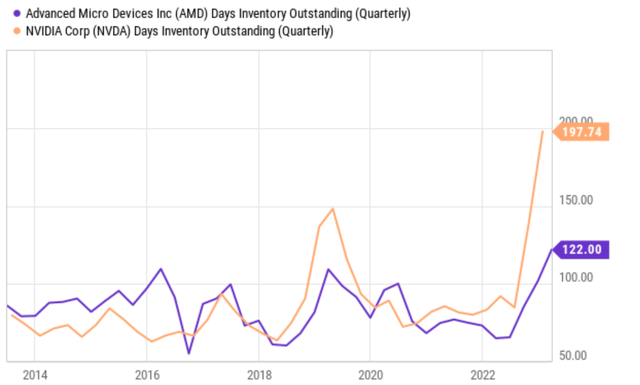

In the near term, as I recently analyzed in my AMD article, the chip industry (especially NVDA) is still in the process of clearing up the large inventory they hoarded during the COVID (see the chart below). Such a large inventory is likely to pose balance sheet risks (e.g., obsolescence or even write-off) and profit risks (e.g., increased storage cost, increased management costs, reduced selling price). NVDA also faces geopolitical and regulatory risks such as those caused by the trade tensions between the U.S. and China, particularly in the area of advanced CPU and GPU segment.

In the longer term (say 3~5 years out), the Nvidia Corporation valuation risk seems too high to me. The current multiple requires years of perfect growth to catch up. To further compound the risk, even such a rosy growth projection is not enough. A substantially expanded Nvidia Corporation margin is also required at the same time (more than double its past average), which seems very unplausible in my eyes either by vertical or horizontal comparison.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.