Summary:

- Nvidia Corporation’s shares soared 25% on Thursday, in extended trading, after the chipmaker reported better-than-expected FQ1’24 results.

- The first quarter saw a reacceleration of Nvidia’s topline growth, due to soaring AI chip demand.

- Nvidia submitted a strong outlook for FQ2’24.

- However, given the strong increase in Nvidia’s share price this year, investors may want to consider selling into the strength as shares are expensive on a P/S.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) shares soared after the chipmaker presented a better-than-expected Q1 FY2024 earnings card for the first fiscal quarter yesterday and submitted a very strong outlook for the second fiscal quarter. While Nvidia sees continual challenges in the Gaming segment, the company saw a reacceleration of topline growth in its Data Center business in FQ1’24 due to strong demand for artificial intelligence chips following the release of the AI chatbot ChatGPT. Nvidia’s shares soared 25% in extended trading yesterday, and while the outlook for FQ2’24 is solid, investors may want to think about selling, as NVDA shares are now quite expensive and investors appear greedy again!

Nvidia is seeing a re-acceleration of topline growth

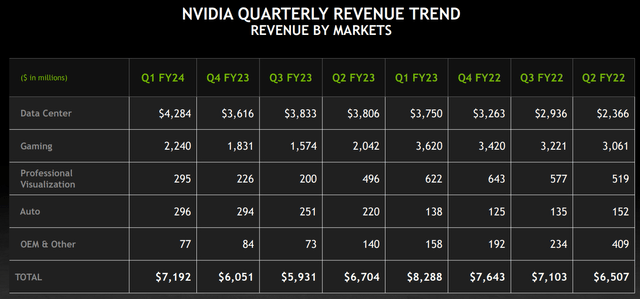

In the first fiscal quarter of FY 2023, Nvidia’s Data Center segment overtook the Gaming segment regarding revenue contribution due to more workloads shifting to the Cloud as companies invested more money into their IT capabilities. Nvidia’s revenue growth started to taper off in the second half of 2023, largely because of a brutal downturn in the consumer-driven PC market. Consumers upgraded their IT equipment during the pandemic to prepare for remote working and studying… which resulted in a normalization of device sales (workstations, laptops, tablets). This post-pandemic adjustment has negatively impacted Nvidia’s performance in the Gaming segment.

However, in the most recent quarter, FQ1’24, Nvidia saw a re-acceleration of topline growth. Nvidia generated $7.19B in revenues for the first fiscal quarter of FY 2024, showing 19% quarter-over-quarter growth. In FQ4’22, Nvidia’s revenue growth slowed to just 2% quarter over quarter.

The re-acceleration of Nvidia’s growth was primarily driven by the company’s Data Center business, which benefits from soaring demand for artificial intelligence chips. The Data Center segment saw 18% quarter-over-quarter revenue growth in FQ1’24 as opposed to a 6% decline in FQ4’22. While Nvidia also experienced a rebound in the Gaming business (revenue growth of 22% Q/Q), Nvidia’s Data Center performance weighs more heavily because the segment is 1.9 times larger, regarding revenues, than the Gaming business.

In the Gaming business, Nvidia continues to face challenges, chiefly due to weak demand for consumer electronics products. However, a continual re-acceleration of growth is also possible for the firm’s Gaming segment going forward, as Nvidia has recently launched a new series of graphics cards, the GeForce RTX 4060… which appeals to performance-driven gamers.

Generative AI opportunity

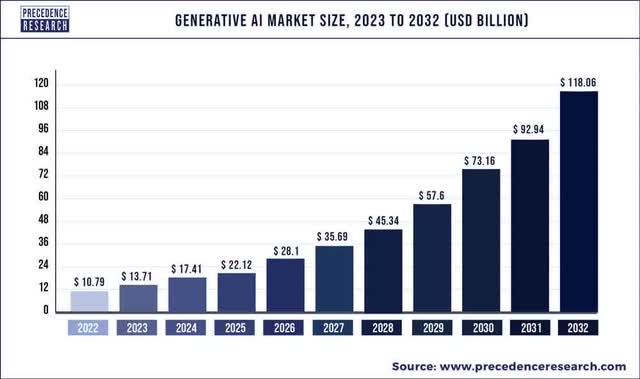

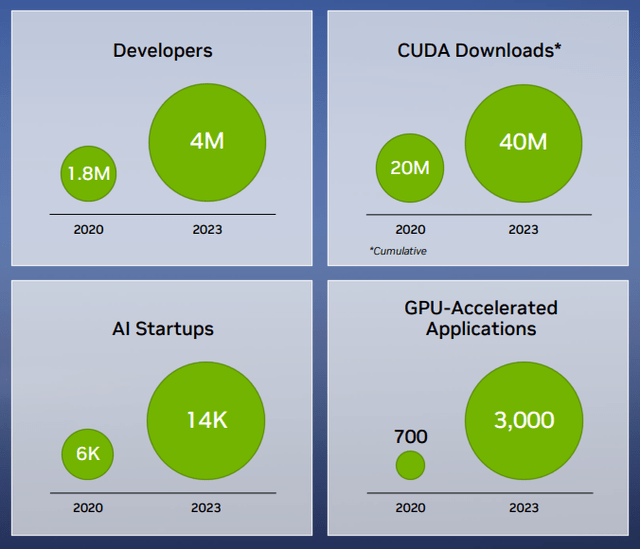

Nvidia and Advanced Micro Devices, Inc. (AMD) have a huge opportunity to capitalize on the growing demand for artificial intelligence chips as more companies are rolling out their own chatbot rivals in order to cash in on the generative AI hype. According to Precedence Research, the generative artificial intelligence market is set to increase by a factor of 11X to $118.1B within the next decade.

Nvidia has a huge opportunity to capitalize on the expected explosion in the size of the generative AI market in the next ten years. The market for AI applications is booming (and so is the number of start-ups in the industry) and Nvidia is filling this demand through the offering of dedicated AI chips and development of its AI platform which facilities the production and support of artificial intelligence applications. The platform is geared specifically toward the enterprise market and helps companies accelerate their growth.

Nvidia’s outlook for FQ2’24

Nvidia submitted a blowout outlook for the second fiscal quarter as the chipmaker sees $11.0B in consolidated revenues, implying 53% quarter-over-quarter topline growth. Nvidia expects to continue to see soaring demand for its AI chips in the second quarter, which are sold through its Data Center platform. Nvidia’s FQ2’24 guidance was also significantly better than the consensus expectation of $7.2B in second quarter revenues.

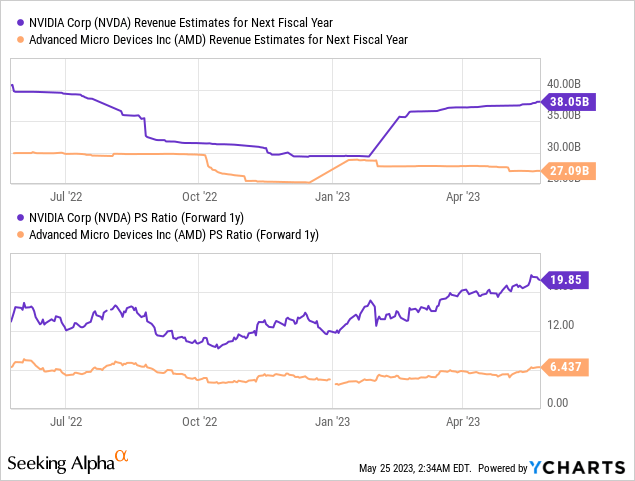

Nvidia’s valuation was already expensive before Wednesday’s 25% pop

Nvidia’s shares were expensive before the firm submitted its first quarter earnings sheet, and the 25% increase in pricing on Wednesday has made the firm’s revenue and earnings prospects even more expensive. Nvidia is currently valued at a very rich P/S of 19.9X compared to AMD’s 6.4X P/S ratio… so Nvidia is about 3 times more expensive than AMD right now. AMD is set to also profit from the artificial intelligence trend in the corporate sector, and I don’t believe that Nvidia deserves that much of a higher multiplier factor.

Risks with Nvidia

The biggest risk for Nvidia, as I see it, is a potential slowdown in topline growth as the current rate of revenue growth is likely not sustainable. ChatGPT has fueled interest and demand for artificial intelligence chips as more companies jump into their own generative AI products, which has led to a strong forecast for Nvidia’s FQ2’24. However, the already very high valuation of Nvidia’s revenue prospects makes it likely that investors jumping into Nvidia after FQ2’24 earnings are overpaying. The PC market also remains in less than ideal shape with PC shipments dropping 30% in the first quarter and the market may not have yet bottomed. Unless the PC market recovers, I would expect a continued challenged picture for Nvidia’s graphics cards going forward.

Final thoughts

I believe, considering Nvidia Corporation’s very high valuation based off of revenues (P/S), that investors are now heavily leaning towards excessive optimism… which may not be a bad time to consider selling shares of the chipmaker.

Nvidia Corporation delivered a strong earnings sheet for the first fiscal quarter and the outlook for the second quarter was impressive, especially as it related to strong expectations for AI chip demand. Therefore, Nvidia is set to report a second consecutive quarter of topline reacceleration in FQ2’24. This doesn’t change the fact, however, that Nvidia Corporation shares are very expensive. While Nvidia is certainly well-positioned to ride growing AI chip demand related to the generated AI market opportunity, I believe Nvidia’s growth prospects are more than fully reflected in its valuation of 20X forward sales!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.