Summary:

- Nvidia Corporation’s Q2 FY25 results showed robust growth, driven by strong demand for AI chips.

- However, I think Nvidia’s software ecosystem is an aspect underappreciated by the bulls.

- Its Inference Microservices offer scalable, high-value AI solutions and are gaining traction among major partners.

- History has taught me that a software ecosystem can form a more durable — and also more lucrative moat — than hardware eventually.

troyek

NVDA stock: Previous thesis and Q2 recap

My last article on NVIDIA Corporation (NASDAQ:NVDA) was titled “Nvidia Q2 Preview: Blackwell And Liquid Cooling Could Form Killer Combination.” As the title suggests, it was published shortly before the release of the Q2 earnings report and was meant to be my preview of the report. As you can guess from the title, the preview emphasized the hardware side of the business, in particular, the potential of its Blackwell chips. Quote:

Nvidia’s key partner, Super Micro Computer, recently reported the delivery of direct liquid cooling (DLC) systems for NVDA chips. NVDA’s Blackwell AI chips, when combined with DLC, could fundamentally shift the cost structure for AI developers and end users. I expect to see this catalyst reflected in NVDA’s upcoming Q2 earnings report. The potential energy saving and performance boost are so significant and thus will materially widen NVDA’s long-term competitive moat in my view.

Since that writing, the company released 2nd quarter FY25 financial results on August 28, and I thought it would be helpful to review the earnings report. More than a dozen SA authors have written review articles on the stock in the past few days. Like my preview article, most of these articles focused on its hardware. Therefore, my goal in this earning review is to concentrate on the development of its software ecosystem. A key lesson I learned from other established companies (such as Microsoft, Adobe, Oracle, etc.) is that the software ecosystem can form a more durable moat than hardware. Judging by the results it reported in Q2, I think the NVDA is progressing well in this direction too.

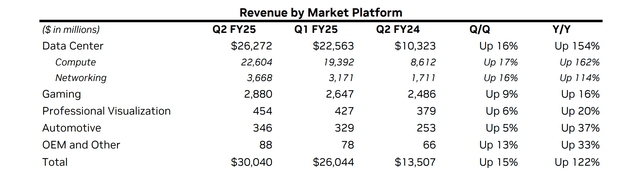

Before I dig in, let me first recap the Q2 financial statements to better prime the remainder of the discussion. The company reported another quarter of robust growth (see the next chart below) with results beating consensus expectations. As seen, its revenue grew 122% YOY and surpassed $30B for Q2. The growth was led by the Data center segment, with YOY growth of 154% thanks to the strong demand for its AI chips. Looking ahead, the anticipation for its next-gen Blackwell chips is incredible, as the CEO and CFO commented in the release.

Nvidia Inference Microservices (NIM)

Against that background, let’s move on to the software side now. With its hardware dominance well-known and a key anchor for most bullish theses, I will argue that its software should be a key factor too – but often underappreciated by many bulls.

As just mentioned, a key lesson I learned from the IT industry is that the software ecosystem can form a more durable moat than hardware. Microsoft’s history is an excellent example. Its enduring success is largely attributed to its robust software ecosystem, in my view. This ecosystem, built around its Windows operating system and various productivity tools, has proven to be a far more durable moat than any of its hardware-based initiatives and most of the technology companies that are hard-oriented.

The underlying reasons are also elementary and powerful. First, software products enjoy superb scalability (or the so-called Network Effects). Microsoft Corporation (MSFT) selling Windows to 100 million people does not cost much more than selling it to 10 million people. Yet, the more people use Windows, the more software developers create applications for it. This creates a virtuous cycle where the platform becomes more valuable over time. As a direct result of such scaling and network effects, a well-established software ecosystem is highly sticky, and the switching costs can be very high. Take Microsoft as an example again. Once users and businesses are deeply invested in the Microsoft ecosystem, it becomes difficult and costly to switch to competing platforms. The interconnectedness of Microsoft’s products, coupled with the time and resources required to migrate data and retrain employees, creates a significant barrier to entry.

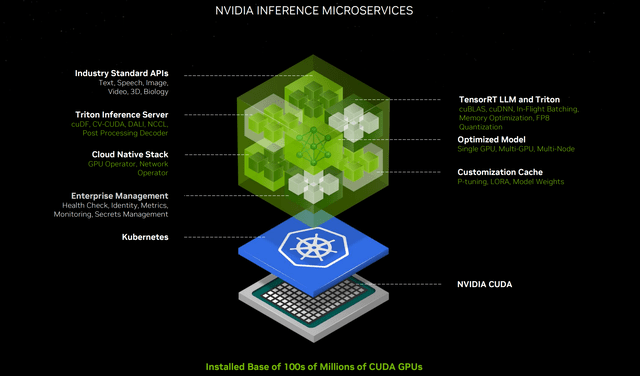

Back to NVDA, judging by its recent developments, I am impressed by its capability to help customers quickly scale and deploy their services, often AI-related and highly synergistic to its hardware chips. I anticipate such recurring software services to be the next growth bright spot for NVDA in the years to come. Specifically, NVDA’s NIMs (Inference Microservices) are a highlight on this front. These NIM software containers offer a range of crucial capabilities (see the next chart below), and they can tremendously shorten NVDA’s enterprise customers’ development time and speed up their AI application deployment. Furthermore, NVDA has already developed a good pricing model as quoted below:

Nvidia’s pricing ladder: A lower barrier to the adoption and deployment of AI inferencing has upsides for both software licensing and hardware sales. On the software side of things, the AI Enterprise license necessary to deploy NIMs in production will set you back $4,500 per GPU per year, or $1 per GPU per hour.

The features and pricing model have made the NIM highly attractive to many well-known names. More than 200 technology partners are integrating NIMs for their domain-specific AI applications. These patterns are full of sector leaders spanning manufacturing, healthcare, financial services, retail, customer service, etc., as illustrated by the examples quoted below:

Foxconn – the world’s largest electronics manufacturer – is using NIM in the development of domain-specific LLMs embedded into a variety of internal systems and processes in its AI factories for smart manufacturing, smart cities and smart electric vehicles.

Lowe’s – a FORTUNE® 50 home improvement company – is using generative AI for a variety of use cases. For example, the retailer is leveraging NVIDIA NIM inference microservices to elevate experiences for associates and customers.

Siemens – a global technology company focused on industry, infrastructure, transport and healthcare – is integrating its operational technology with NIM microservices for shop floor AI workloads. It is also building an on-premises version of its Industrial Copilot for Machine Operators using NIM.

Other risks and final thoughts

In terms of downside risks, Nvidia faces several risks that are common to its AI-related peers. These risks include high valuation multiples (42x FWD P/E as of this writing), intense competition from other AI chip manufacturers (such as AMD and Intel), sensitivity to global supply chain disruptions due to the specialized components required for advanced chips, sensitivity to geopolitical risks (e.g., due to the trade-tension between the U.S. and China), etc. These risks have been thoroughly discussed in many other SA articles (and my own past articles too). So I won’t further elaborate on any of them here anymore.

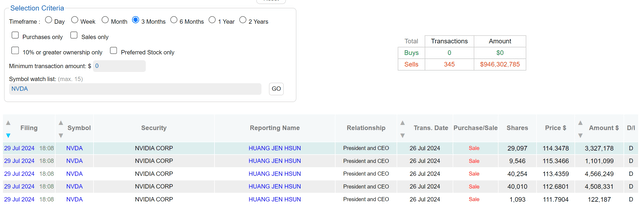

Instead, I will point out a risk that is less often mentioned: insider selling. The chart shows insider selling activity on NVDA stock over the past three months. As seen, the recent insider transactions were completely dominated by selling. To wit, a total of 397 selling transactions were disclosed by the insiders in the past 3 months and these sales resulted in a total transaction value of over $1 billion. Notably, the CEO, Jen-Hsun Huang, has reported a series of selling transactions recently. As seen, his recent sales in August 2024 were largely made around an average price of $105 per share. Such significant insider selling activity could add to the selling pressure, create resistance to the upside movement of the stock prices (especially in the near term), and signal a valuation concern from the insiders.

All told, NVDA is certainly not suitable for all investors. I see large uncertainties on both the upside and downside and expect large price volatilities to persist. However, for investors with the risk tolerance to stomach these volatilities, I see an attractive reward/risk curve. Besides the dominance of AI chips (the focus of my last article), I see nonlinear growth potential on the software front, too. Notably, Nvidia Corporation’s NIMs are progressing quickly, judging by recent financials and customer acquisition. I anticipate the synergies between its hardware and software to form an even wider and more formidable moat in the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.