Summary:

- Nvidia Corporation has once again reported a monster beat and guidance.

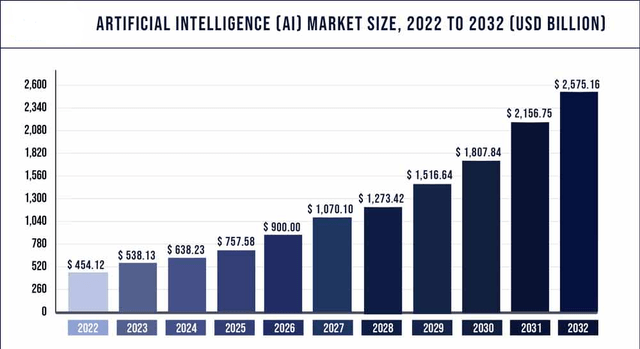

- AI’s total addressable market still remains largely unknown, with Nvidia being the shovel seller to the gold-diggers.

- But when the going seems easy, danger maybe lurking in plain view.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) Stock Price Today, Quote & News) has just released its FY 2024 Q2 results as Seeking Alpha has covered here. This was one of the most highly anticipated earnings report that I recall, so much that this Seeking Alpha news item linked Nvidia’s earnings to global markets being higher (not cause and effect per se but just the two events being linked in the same headline conveys the point).

I recently previewed Nvidia’s Q2, calling this earnings report a “market direction decider”. While these are early hours, the market direction is likely to be up in the short-term as Nvidia’s stock was up nearly 10% after hours, breaching the historical $500 mark for the first time. Let us review The Good, The Bad, and The Ugly from this report, while acknowledging that the Bad and Ugly section will challenge me as a writer given what appears like a blowout result and guidance. Let us get into the details.

The Good

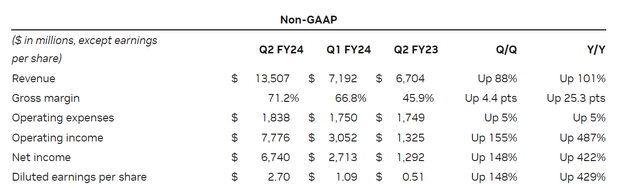

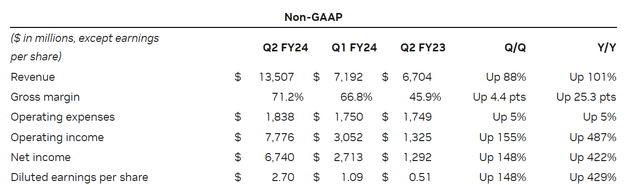

- EPS of $2.70 beat by 30% and in this frenzy, it may be easy to forget that about a year ago, analysts were expecting just $1.07/share in this quarter. Nvidia shattered those expectations by guiding for $2.07. And has now topped off the monstrous guidance with a big beat. Revenue, not to be left behind, beat by 22%, coming in at $13.51 billion when the expectation was for about $11.1 billion.

- Such monstrous beats and guidance over two consecutive quarters means that the stock is not so expensive all of a sudden from a valuation perspective either. For example, going into earnings, the FY 2024 EPS expectation was $8.18. Let’s just add the 61 cents that Nvidia beat by to that number, ignoring the Q3 guidance. We get about $8.80 in FY 2024 EPS. That means, despite the 10% run-up after hours, Nvidia’s stock is still trading at the same forward multiple of 55 now as it did going into the earnings report. It wasn’t long ago that the forward multiple was in three digits. All these numbers back what I wrote in my Q2 preview about the stock’s valuation

“I admit here, too, that it is hard to value a trend setter. Nvidia is not just the trend-setter, but the one who sells shovels (chips) when everyone is digging the AI gold rush. Irrespective of who finds the gold first or how many companies share the gold mine, Nvidia appears like the undeniable leader in selling the shovels.”

- To top things off with a cherry, Nvidia has also guided Q3 revenue up by almost 30%. The new guidance is of $16 billion in Q3 against consensus of $12.42 billion. Bear in mind, the consensus for Q3 and FY 2024 have been on the rise ever since Nvidia surprised with its Q1 result and guidance. And despite that, the company has upped revenue expectations by a further 30%. I am running out of words here.

- When companies are in the middle of a purple patch like the one Nvidia seems to be in now, indulging in expansions and self-gratifying expenses is all too easy. However, for now, Nvidia is resisting this urge as operating expenses went up just 5% in a quarter where revenue went up 88% YoY.

NVDA Q2 Expenses (/nvidianews.nvidia.com)

- Flush with money, Nvidia also has announced a $25 billion buyback program. Beyond the fact that this is enough to retire about 2% of the shares outstanding, a buyback from one of the conservative CEOs in my view on the back of the stock gaining almost 5X in less than a year signals there is way more magic to come from the company.

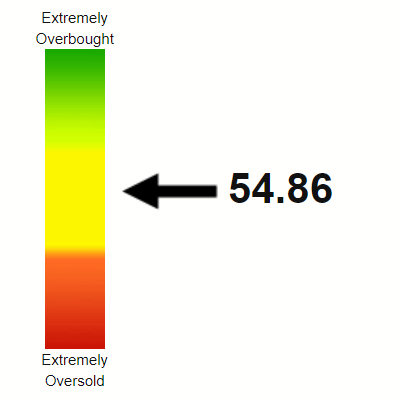

- From a technical perspective, the recent pull back to low $400s is now appearing like a blessing in disguise. It may have shaken off the “weak-hands” and also allowed the stock to fill some gaps that it left on its quick run-up from $200s to $480. The recent sell-off means the stock’s Relative Strength Index [RSI] going into Q3 earnings was a moderate 55, which is around my sweet-spot as the stock has enough momentum while also having enormous room to run before getting overbought technically (RSI >80).

NVDA RSI (Stockrsi.com)

The Bad and The Ugly

Given the monster report and guidance, all three points below may seem overly critical, but they are worth considering.

- I wrote in my Q2 preview that I will be paying attention to the gross margin and this is finally one area where the company did not beat by a wide margin. While the guidance was for 70%, Nvidia managed “just” 71%. I know this may sound like a stretch at this point but perhaps, margin maybe under pressure if and when competitors start pressurizing Nvidia’s pricing power and/or when suppliers raise their prices to get a higher share of Nvidia’s pie.

Q2 Margin (nvidianews.nvidia.com)

- Could Nvidia be drinking its own cool aid when it comes to the buyback? Sure, it could be a sign of confidence as I noted above but the adage “pride comes before fall” comes to mind. Could the company not invest in anything more meaningful than buying its stock after the run-up to $500? Recent history suggests that mega-caps are not exempt from overestimating their prowess when it comes to buying back at the wrong time.

- This is once again going to sound like a stretch but while Nvidia is producing the results so far, I cannot help but notice the “fanboyism” building around the stock. Tags like “4th revolution” and “Godfather of AI” make me believe the bandwagon is almost full, if not entirely. Nvidia may continue growing as a company but at some point, the adulation and multiple may not keep up.

Conclusion

Nvidia is in the middle of a purple patch undoubtedly and deserves all the accolades it is receiving right now. With Nvidia being the primary shovel-seller for everyone digging up what is expected to be a $2.5 trillion goldmine by 2032, even the long-term story in the stock remains compelling.

AI TAM (precedenceresearch.com)

My only peeve against the stock was its valuation, which I admitted was hard for a trend-setter. And the company keeps delivering on top of sky-high expectations. So everything appears in the company and stock’s favor. Could we all be overlooking something though? When the going seems so easy, there could be danger lurking.

No one thought the Cisco Systems, Inc. (CSCO) would ever slow down. The company still makes a lot of money but the stock stopped returning money to its investors long time ago. Nvidia is nowhere near Cisco’s bubble territory in terms of valuation but expectations need to be tempered. Not many times will a company double its immediate next quarter’s EPS guidance and then beat that by 30%. Enjoy the purple patch and as much as some of you may not like this, pocket some gains (at least your original investment) and let your gains garner further gains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.